-

Corporate & Investment bankingHelping your business and our world prosper

Asia, Africa and the Middle East are home to the world’s most dynamic markets. And with a 170-year history in these regions, we can help you thrive.

Our services

Bringing you solutions for your global business needs, from transaction banking to financial markets and advisory services

Transaction banking

Whatever business challenges come your way, your need for smooth, successful transactions will be constant. Alongside continuing operational requirements, you’ll need to balance enduring targets with emerging ones – including sustainability and digitialisation aspirations.

By combining international-bank stability with local-market knowledge, we can support your transaction banking needs across the world. From cash management solutions to bolster your treasury to financing solutions to sustainably fund your supply chain, we have the solutions to help you prepare for future opportunities.

Financial markets

Access and thrive in high-barrier markets with us. We provide on-the-ground research into Asia, Africa and the Middle East, and proprietary pricing and trade execution across multiple asset classes – including FX, rates, and commodities.

And for more complex packaging needs, we offer bespoke structuring solutions. For financing needs, we offer a full spectrum across our dynamic footprint – from traditional credit and debt market products, to specialised financing and beyond. And with custody, clearing and securities lending also available, we can support all your financial market needs.

Discover your digital potential

Digital connectivity is a catalyst for business growth. Explore our digital touch points, and find new trading and transaction opportunities.

Straight2Bank Pay

Consolidate your customers’ payment options, without complicating your collections. Discover our one-stop global platform – and be at ease knowing their payments are visible, stable, and secure.

Standard Chartered Markets

Trade on our multi-product platform and centralise your digital FX trades. Access a unique mix of G10 and emerging market currencies from across Asia, Africa and the Middle East, all in one place.

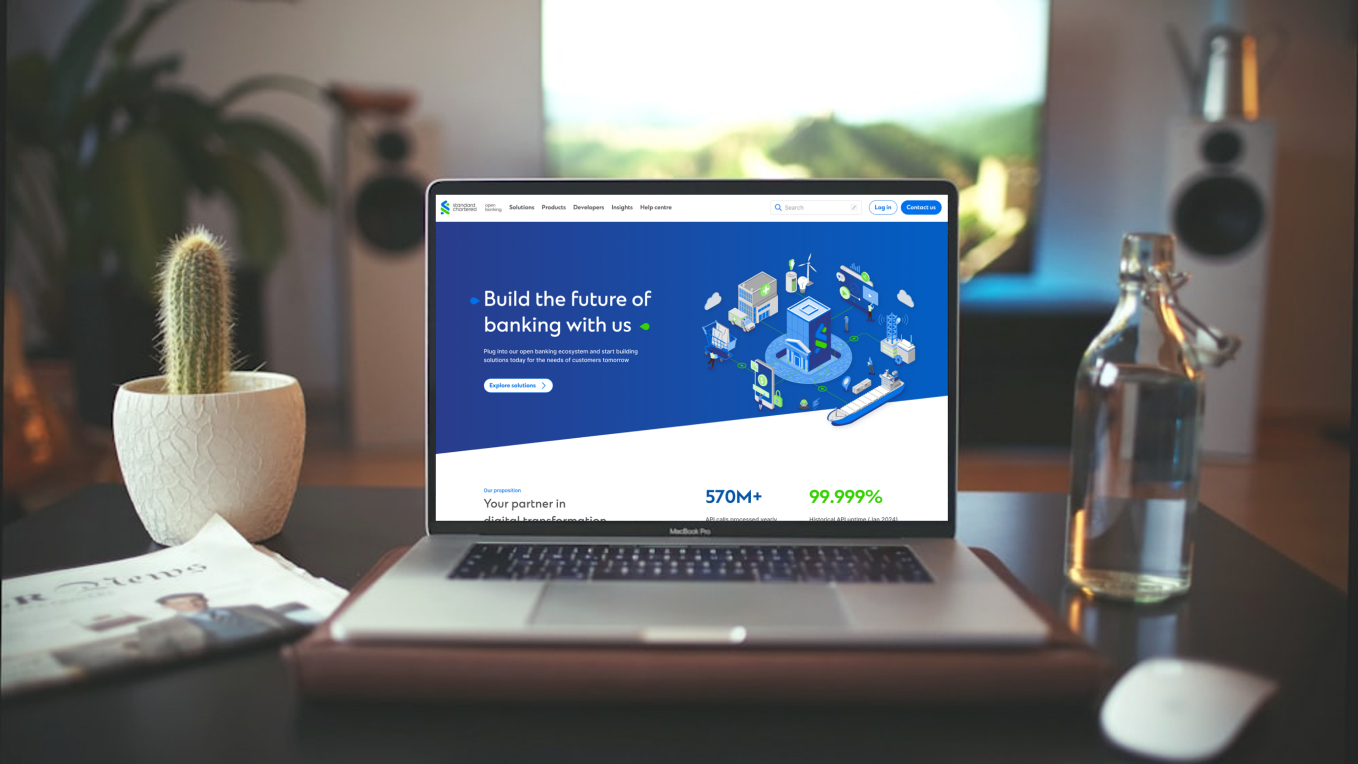

Open Banking Marketplace

Build the future of banking with us. Explore innovative solutions, shortlist APIs that meet your business needs and test in a sandbox — all on one platform.

Why choose us?

As a leading international cross-border bank with deep local expertise, we can be your guide to a world of opportunity

Rely on one global partner

Consolidate your corporate banking needs with us across emerging and developed markets

Make our world more sustainable

We’re channelling capital to where the impact will be greatest, via our solutions for businesses

Unique markets, bespoke solutions

Tailored solutions catered to local demands and individual market needs

News and views

Our insights can help you uncover new opportunities for your business. Explore case studies, articles, videos, podcasts and more now.

Industries in transition

With topics around urban transformation, energy transition, the future of transport and critical infrastructure across Asia, Africa and the Middle East, this content series will unearth fresh trends and showcase how we are supporting clients in the transition towards a more sustainable and inclusive future.

Sustainable trade financing

Sustainability is important to you and to us. It’s why we’re bringing you sustainability-linked financing solutions.

Financial markets insights

Turning expertise to actionable insights. Explore our views on what to watch out for in today’s financial markets.

Fintech

We partner with fintechs to help them grow in the world’s most dynamic markets.

Our latest thinking

Explore our perspectives on global trends, in-market nuances, and so much more

Dawn of a new era: The story behind Bangladesh’s first green…

Bangladesh’s maiden sustainability-linked bond issuance is a rallying call for corporates and investors in the d…

Bankable insights e-magazines

Bringing you the latest trends, insights and best practices, so you can turn them into business opportunities

Webinars and events

Learn about what’s influencing the world of finance by attending our physical and virtual events