Today, Tomorrow and Forever

Grow, manage and protect your wealth for yourself, your family and beyond

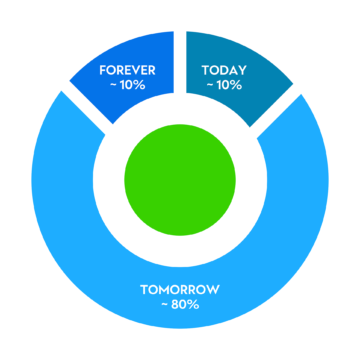

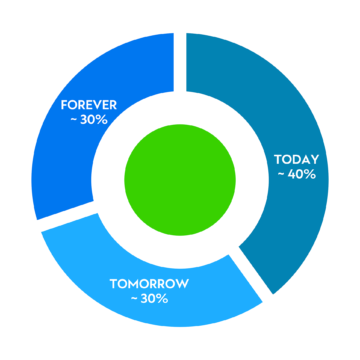

Our approach to wealth

Planning for ‘Today‘

Ensuring you have the liquidity and stable cash flow to meet your near term needs and lifestyle, by matching your current assets and resources against expenditure.

Primary financial needs

• Meeting near term spending needs

• Savings for emergencies

• Protection

Investment solutions

• Cash & cash equivalents

• Fixed income instruments

• Mutual Funds paying distributions

• High dividend equities and REITS

• Life/medical/disability/property/car insurance

Securing ‘Tomorrow‘

Having a clear view of your financial goals and future needs, and ensuring your wealth portfolio grows to meet them over your lifetime.

Primary financial needs

• Wealth accumulation

• Hedging against inflation

• Saving for an investment property

• Retirement planning

• Planning for children’s education

Investment solutions

• Growth portfolio – mutual funds, equities, bonds, private assets, hedge funds

• Insurance

• Endowment plan

• Real Estate / Property

Building for ‘Forever‘

Focusing on a longer term view of investment planning to improve the lives of family members and the generations to come.

Primary financial needs

• Wealth transfer

• Life cover (to manage estate tax)

• Unlocking the value of property assets

• Orderly transition of Business interests

Investment solutions

• Private Equity

• Trusts

• Estate planning structures

• Growth portfolio – mutual funds, equities

How it works

Our wealth planning considers your situation, background and needs. Here are some examples.

Dual-income family with two children in school

Investor’s goals: Children’s education and retirement planning

Business owner with spouse and two grown up-children

This investor reinvests profits into the business, and owns investment properties.

Investor’s goals: Wealth transfer to their children and supporting their philanthropic interests.

Our approach to managing wealth

Our approach to wealth

SC Wealth Select

Grow, manage and protect your wealth

Principles

Guiding principles to manage, grow and protect your wealth

Portfolio approach

Our portfolio approach improves your potential of achieving your wealth goals

Get our latest market insights and reports

Explore our breadth of leading unbiased investment insights designed to help you navigate today’s complex investment landscape