The USD80 bn opportunity: why working capital management is vital to future-proofing FMCG

As the global recovery edges forward, the gap between industry leaders and laggards has widened, and with new threats on the horizon, putting trapped cash to work will be key to success.

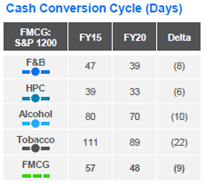

Compared to other sectors, FMCG as a whole emerged from the worst of the pandemic largely unscathed, with cash conversion cycles reaching a five year low in 2020 in spite of a challenging physical environment, supply chain disruptions, and unprecedented volatility in demand.

However, the past 18 months have been far from plain sailing for firms in the sector, and behind the strong headline figures, the cracks have begun to show.

Although the disruption boosted demand for product lines that were categorised as essential when lockdowns began, discretionary goods sales struggled as incomes shrank – particularly in Asia, where government stimulus was limited.

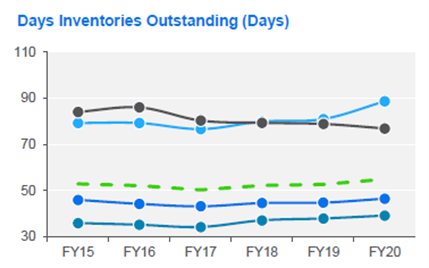

Battling the impact of supply chain disruption while seeking to predict and meet changing consumer demand and adapt their business models drove companies to invest in safety stock (‘just in case’ inventory) to hedge against uncertainty, leading to a material increase in days inventories outstanding (DIO) across the board. This jump was notable in the household and personal care (HPC) and food and beverage (F&B) sub-sectors.

While companies are implementing inventory management enhancements, such as optimising inventory levels per stock taking unit and improving batch sizes in production processes, unlocking trapped working capital using tools such as distributor financing will be crucial to offset balance sheet stress.

Source: SCB analysis, company reports and presentations

Regional differences have also been magnified, with comparatively longer payment terms in the Asia Pacific region driving an increase in days sales outstanding (DSO), while in Europe, despite increased use of supply chain financing to drive days payables outstanding (DPO) improvement, the positive trajectory has tapered.

“As disruptions continue, many companies will still be in the realm of ‘just in case’ for some time, focusing on the resilience of their supply chains and their inventory,” says Kai Fehr, global head of trade and working capital at Standard Chartered.

Closing the DSO gap by implementing best practices on receivables collection as well as by automating processes will enable some companies to improve their performance on this metric, while solutions such as factoring can not only accelerate the availability of funds but also help mitigate buyer and country risk at a time where uncertainty remains high.

“Wherever companies are in terms of their working capital performance, the focus now needs to be on how can they move to the next quartile. That is how they can unlock trapped cash, and if done right, it can become free cash that can then be put into strategic priorities,” says Fehr.

But pressure on FMCG companies extends further than the Covid-19 pandemic. Gaining headroom for investment into strategic priorities such as sustainability improvements, innovation and shareholder dividends has become an urgent objective.

“To give one example, while companies within FMCG have continued to pay dividends, this has plateaued in order to support free cash flow and free up debt capacity. By unlocking cash from their working capital, this can be rebalanced,” says Shoaib Yaqub, global head of capital structure advisory at Standard Chartered.

In the wake of the COP26 climate conference, major FMCG companies all have ESG goals in mind, and pressure on the sector to step up to its social and environmental responsibilities is mounting.

“Environmental impacts have become a greater regulatory and consumer concern, and supplier and retailer statements have created a domino effect around the world,” says Fehr. He adds that the main ESG challenges for the sector are now around achieving net zero and portfolio reshaping around health and wellbeing, and while this will require serious levels of investment, it can be achieved with limited funding constraints via working capital efficiencies.

“Companies have several levers that they can pull in order to achieve this,” says Fehr. “One strategy is to push more inventory to their distributors, which brings two benefits: it positions their products closer to their customers, thus mitigating some of the supply chain risk, and also allows them to bring down their days inventory outstanding. Companies can manage this by working with their banks to finance the working capital aspects of the distributors.”

By harnessing working capital management tools, from distributor financing to receivables services and supply chain finance, FMCG companies can unlock sizeable amounts of trapped cash. Indeed, Standard Chartered research shows that if they can boost overall cash conversion performance in line with the 80th percentile of companies within each sector – a feasible target – the amount released would be as much as USD80 bn1.

To put that into perspective, for 20 of the largest corporates, this would be enough to meet 80% of the costs needed to achieve net zero2.

For the FMCG sector, closing the working capital management gap between industry leaders and laggards offers an important opportunity to free up cash that can be directed towards the sustainability agenda, delivering shareholder value, and innovating to get ahead of upcoming consumption trends – enabling the sector to cement a strong recovery from the Covid crisis and build the foundations for future success.

Notes:

1 Improvement aligns peers to the 80th percentile of top CCC performers in each sub-sector, calculated based on 2020 sales

2 Estimated cost of abatement of c.US$45 bn based on 2020 emissions per SCB analysis. Please contact a member of the CSA team listed below for further details.

For more information, contact us:

| Capital Structure Advisory Shoaib Yaqub Raza Piracha | Working Capital Solutions Kai Fehr |