Welcome to the SC Mobile experience. Explore and enjoy banking at your fingertips, anytime, anywhere.

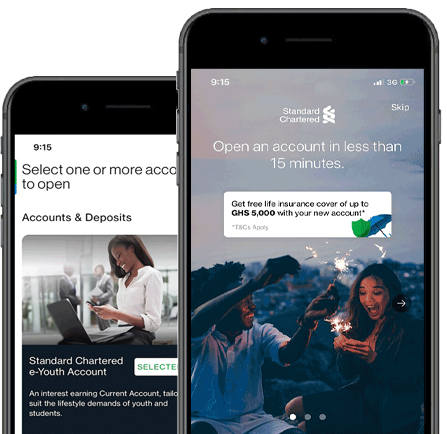

How to open an account on the SC Mobile App for Ghana

At Standard Chartered, we understand that we all live busy lives so we are designing and developing an even faster account opening solution where you can open an account in lightning speed.

The SC Mobile app gives you the freedom and time to apply for new bank accounts from the comfort of your home, office or on the go. We’re helping you Bank anytime, anywhere with our iPhone and Android mobile banking apps.

For our Mobile Banking Account Opening application, all we need is you and your mobile. We will ask you for uploads of your Identity Documents that you can prepare before you start. Then with your mobile, simply capture, attach and even upload from your preferred cloud storage.

Forget long queues in the branch. You can complete over 70 services right from your smart mobile device in your own time, at your own convenience. For example, you can apply for your Visa debit or credit card, update your personal details, transfer locally and internationally across various currencies, transfer funds through various platforms and more.

We’re excited to announce the first fully digital bank in Ghana, offering you unparalleled experience. Open an account today and be unstoppable.

Amazing offers await your when you start your digital banking experience with Standard Chartered Bank.

With our SC Mobile App, you can open an account and start transacting on-the-go seamlessly and in a secured environment.

Track your money and stay in control of your finances, with quick and easy access to your accounts.

Log in using the same credentials you use for Online Banking. You can also log in using your finger print if your smart device has the fingerprint functionality.

You may save and resume your application and you will have within 30 days to complete your application counting from the day you start the account opening journey.

You can open an account and track the process through to the end. You can request for a service and monitor the progress of your service

You can confirm a cheque you’ve issued right on SC Mobile App. You don’t have to wait for a call from the Bank to authorize payment.

DIGITAL BANKING

HELP CENTRE

AVAILABLE ON IOS & ANDROID

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/gh and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/gh

Download SC Mobile using QR Code