Important Note:

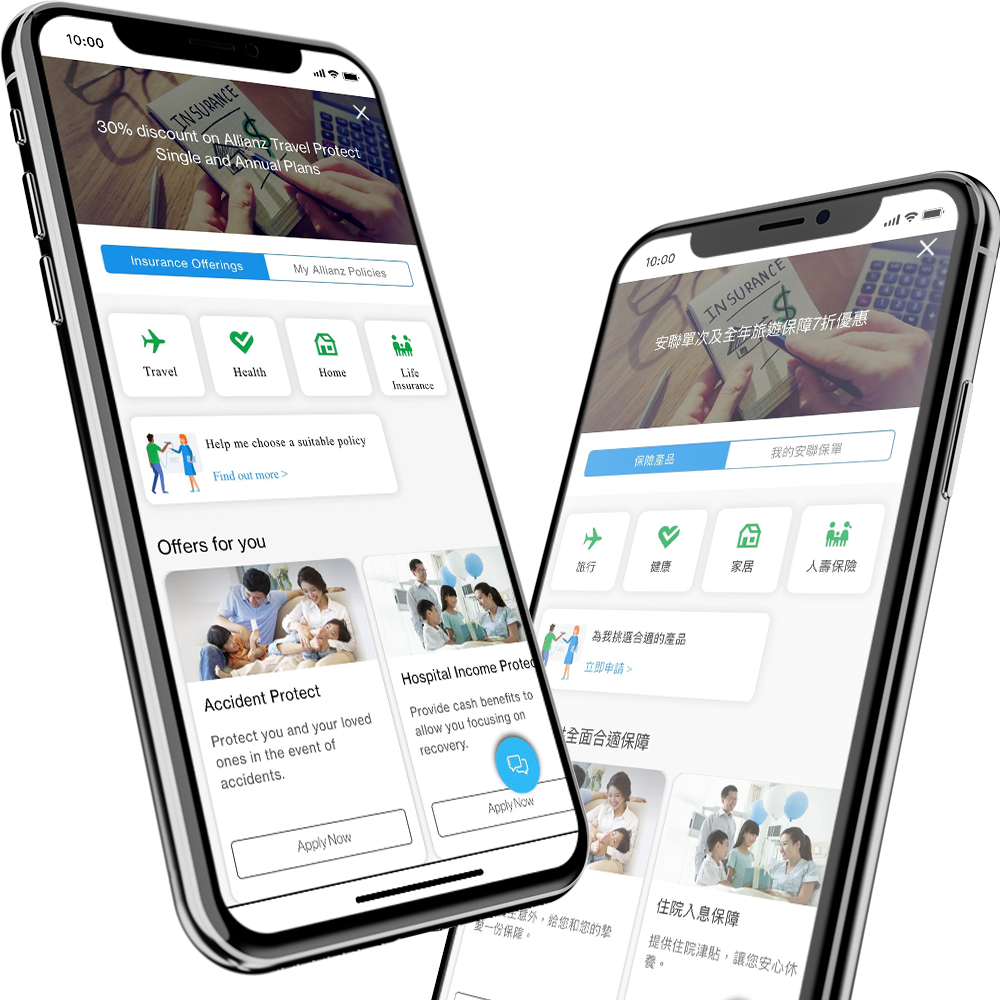

• The above General Insurance plans are underwritten by Allianz Global Corporate & Specialty SE (incorporated in the Federal Republic of Germany with limited liabilities) Hong Kong Branch (“Allianz”) which is a general insurer authorized and regulated by the Insurance Authority of Hong Kong. The Bank is an insurance agent appointed by Allianz. To the extent permissible by law, the Bank shall not be liable to any person for the use of any of the above information.

• All General Insurance plans offered by Allianz are only available for subscription by residents of Hong Kong, subject to the relevant Terms and Conditions. For details, please refer to the Bank’s website sc.com/hk/insurance/general-insurance/.

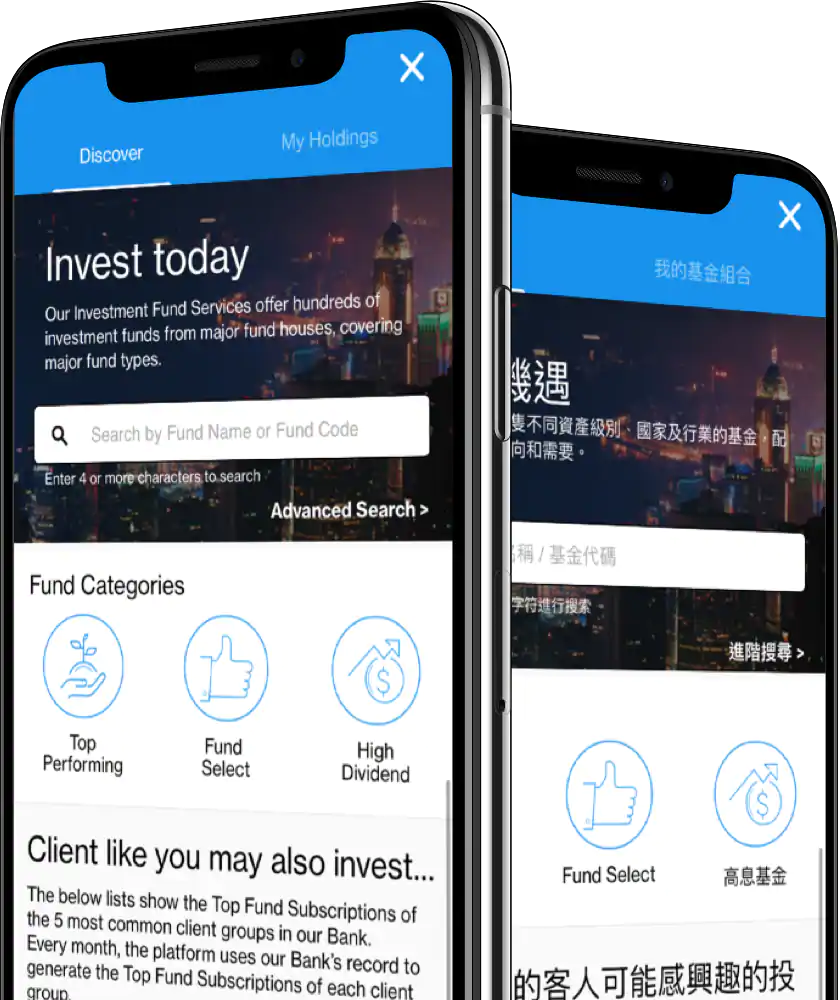

• Investment Fund is an investment product and some Investment Funds would involve derivatives. The investment decision is yours, but you should not invest in Investment Fund unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Important Notes of Online Securities Trading and SC Equities:

• The Bank will not be liable for any loss or damage to you as a result of making the Online Securities Trading Services available to you, unless the loss or damage is directly caused by our negligence or our wilful default.

• For more details and the risks involved, please refer to the Securities Services Terms and Conditions or contact our branch staff.

Important Notes for Qualifying Deferred Annuity Plan and Voluntary Health Insurance Scheme Series:

• You can always choose to take out the above-mentioned plan(s) as a standalone plan without enrolling with other type(s) of insurance product at the same time, unless such plan(s) is/are only available as a supplementary benefit which needs to be attached to a basic plan.

• The life insurance plans are life insurance products and are not bank deposit. They are underwritten by Prudential Hong Kong Limited (A member of Prudential plc group) (“Prudential”). Some of these plans may have a savings element and are not an alternative to ordinary savings or time deposits. Part of the premium pays for the insurance and related costs.

• If you are not happy with your policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premiums and levy(ies) paid, less any withdrawals (if applicable), provided that no claim has been made under the policy. A written notice signed by you should be received directly by the Prudential’s Hong Kong Office at 8/F Prudential Tower, The Gateway Harbour City, 21 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong within the cooling-off period (that is, within 21 days for face-to-face distribution (including webpage and mobile app) or 30 days for non-face-to-face distribution, after the delivery of the policy or issue of a notice (informing you or your representative about the availability of the policy and expiry date of the cooling-off period), whichever is the earlier). After the expiration of the cooling-off period, if you cancel the policy before the end of the term, the projected total cash value (if applicable) may be less than the total premium you have paid. You should check with Prudential if you have any doubt regarding your cooling-off right.

• Standard Chartered Bank (Hong Kong) Limited (“Standard Chartered”) is an insurance agent of Prudential.

• As the issuer of the life insurance plans, Prudential will be responsible for all protection and claims issues. Prudential is not an associate or subsidiary company of Standard Chartered. The material and information contained on this webpage should be read in conjunction with the relevant product brochure and for the risk discloure, please refer to the product brochure. Standard Chartered does not accept any responsibilities regarding any statements provided by Prudential or any discrepancies or omissions in the contract of insurance nor shall Standard Chartered be held liable in any manner whatsoever in relation to your contract of insurance.

• This webpage is intended to be valid in Hong Kong only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Hong Kong. Prudential and Standard Chartered do not offer or sell any insurance product in any jurisdictions outside Hong Kong in which such offering or sale of the insurance product is illegal under the laws of such jurisdictions. This webpage does not constitute a contract of insurance or an offer, invitations or recommendation to any person to enter into any contract of insurance or any transaction described therein or any similar transaction.

• Whether to apply for insurance coverage is your own individual decision. During the sales process, this document should be read in conjunction with the relevant product brochure. For full terms and conditions, and risk disclosures of the relevant insurance plan, please refer to relevant product brochure and policy document and read carefully.

• Please note that the tax law, regulations or interpretations are subject to change and may affect related tax benefits including the eligibility criteria for tax deduction. We do not take any responsibility to inform you about any changes in the laws and regulations or interpretations, and how they may affect you. Policyholders must meet all the eligibility requirements set out under the Inland Revenue Ordinance and any guidance issued by the Inland Revenue Department of the Hong Kong Special Administrative Region before they can claim the relevant tax relief. All of the above general tax information provided is for reference only. You should always consult with a professional tax advisor if you have any doubts. For further information on tax concessions applicable to PRURetirement Deferred Annuity Plan / VHIS plans, please refer to www.ia.org.hk/en or www.vhis.gov.hk/en/.

• In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Standard Chartered and the client out of the selling process or processing of the related transaction, Standard Chartered is required to enter into a Financial Dispute Resolution Scheme process with the client; however any dispute over the contractual terms of the product should be resolved directly between Prudential and the client.

Important Note for Customer Investment Profile

• Having a Customer Investment Profile will be a prerequisite for investors and for us to assess suitability of all investment subscriptions/switch-in transactions#. Therefore, please remember to complete the questionnaire before investing to avoid any inconvenience.

• “Customer Investment Profile” is valid for two (2) years from the last updated date. Client should complete a new questionnaire regularly, and whenever there is any change in circumstances that may impact on her/ his risk appetite.

# excluding securities trading.