27 January 2023

Weekly Market View

Complacent markets?

Resurgent markets are about to collide with central bank policy as the Fed and the ECB meet next week for the first time this year. It promises to be a sequel to the saga which unfolded a year ago, but with a discernible twist.

A year ago, central banks sought to stamp their authority on markets as they took on then-raging inflation, embarking on one of the sharpest rate hikes in history. Most asset classes suffered.

This year, central banks appear to have gained the upper hand, with headline inflation peaking across economies. While some central banks such as the Bank of Canada have signalled a pause in rate hikes, we believe it is too early for the Fed and ECB to declare victory.

Hence, we believe our SAFE portfolio is still a good way to balance the risks with the emerging opportunities until we get further clarity on central bank policy.

How is the US earnings season shaping up?

What is the near-term outlook for US government bond yields?

What is the outlook for the USD and gold after the sharp moves in recent months?

Charts of the week: Complacent markets into Fed, ECB meetings

Narrowing breadth suggests stretched positioning in some assets; hawkish Fed and ECB policies could trigger a reversal

US Greed/Fear indicator shows narrowing breadth/rising greed

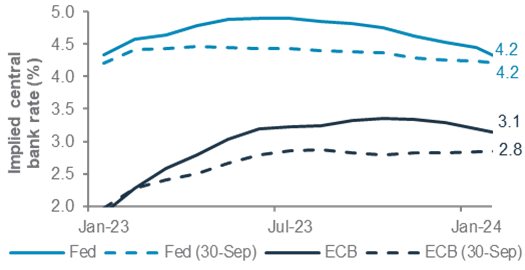

Fed, ECB forward rate expectations curves: today vs Sep 22

Source: Bloomberg, Standard Chartered

Editorial

Time to fade the rally in Europe

Resurgent markets are about to collide with central bank policy as the Fed and the ECB meet next week for the first time this year. It promises to be a sequel to the saga which unfolded a year ago, but with a discernible twist. A year ago, central banks, led by the Fed, sought to stamp their authority on markets as they took on then-raging inflation, embarking on one of the sharpest set of rate hikes in history. Most asset classes suffered. This year, central banks seem to be gaining the upper hand, with headline inflation peaking. As a result, some have started to call truce – the latest being the Bank of Canada, which signalled a pause after hiking rates 425bps since March.

We believe it’s too soon for the Fed and the ECB to declare victory as their job markets remain hot. The two central banks are worried about easing financial conditions too soon and letting underlying wage inflation pressures accelerate. Given this backdrop, it would be prudent to fade the rally in some asset classes where investor positioning particularly look stretched. We believe our SAFE portfolio, which has performed strongly since we issued our 2023 Outlook in mid-December, is still a good way to balance the risks with the emerging opportunities until we get further clarity on central bank policy.

In our view, three broad themes have driven the rally in some assets this year: a) Europe’s record warm winter removing the tail risk of an energy crisis; b) further signs of weakness in US economic activity and easing inflation, raising the odds of an early pause in Fed hikes; and c) China’s early lifting of mobility restrictions. However, our proprietary indicator shows investor positioning has become crowded in most assets that have led the rally, raising the odds of at least some consolidation. These assets include European and Asia ex-Japan equities, Asia local currency and Europe HY bonds, industrial metals, gold and the AUD. Next week’s Fed and ECB policy meetings could be the catalysts for a near-term reversal, with expectations of a dovish shift in Fed policy raising the risk of a disappointment.

Markets have pared back expectations of the terminal Fed Funds rate by 10bps, expecting 25bps rate hikes in Feb and March before a pause. However, Fed officials have thus far remained resolutely hawkish until they see clearer signs of the job market and service sector wages easing. In Europe, the better-than-expected weather, which helped revive consumer and business confidence, raises the odds of a more hawkish ECB. A hawkish ECB, against the backdrop of stretched technicals, would challenge the Euro area equity rally.

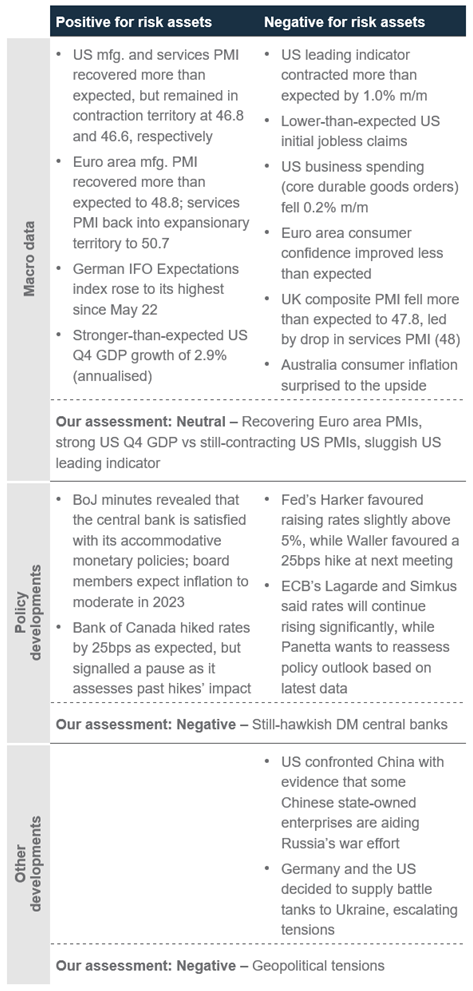

There is a window for risk assets to continue rallying, after perhaps a near-term consolidation. Essentially, markets would need a confirmation that the US and Europe are heading for a soft-landing, followed by an economic revival, to justify the rally in risk assets so far. On this front, this week’s US Q4 GDP data (2.9% growth) was stronger than expected, boosted mainly by private inventory, although personal consumption slowed. A hot job market, seen in high job openings and near-record low jobless claims, point to a resilient services sector (Jan jobs data due on 3 Feb). However, contracting US PMIs and sustained negative reading of the leading index suggest activity is slowing significantly after a robust Q4 22. The contrast in the forward- and backward-looking data poses a quandary for the Fed. Meanwhile, Euro area’s outlook continued to improve, with services PMI returning to positive territory for the first time since July 22, providing further ammunition for hawkish ECB policymakers to propose a 50bps rate hike next week.

Investment implications: We would a) Refrain from chasing the rallies, given crowded positioning; b) Ensure portfolios are diversified and in line with your risk tolerance; c) Remain watchful for signs of the Fed preparing to cut rates before turning more constructive on risk assets (we expect the Fed to cut rates only in H2); d) Favour income: A diversified income portfolio remains a good way to play the current situation – earning income, while awaiting clarity on central bank policies.

— Rajat Bhattacharya

The weekly macro balance sheet

Our weekly net assessment: On balance, we see the past week’s data and policy as negative for risk assets in the near term.

(+) factor: Recovering Euro area PMIs, strong US Q4 GDP

(-) factor: Still-hawkish DM central banks, sluggish US leading indicator

US business confidence indices remained in contraction territory, while Euro area indicators continued to recover

US and Euro area manufacturing and services PMIs

The US leading index continued to contract, raising the risk of a recession in the coming quarters

US leading index

Euro area consumer confidence and economic expectations continued to improve as a warm winter reduced the risk of energy shocks

Euro area consumer confidence; German IFO Expectations index

Top client questions

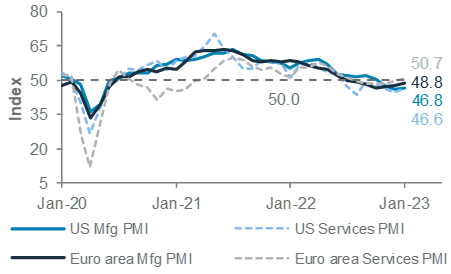

What is the near-term outlook for US 10-year yields?

US government bond yields continued to trade in range, with the 10-year yield hovering around 3.5%. We attribute the recent moves to:

- Dovish global policy developments, such as the Bank of Japan reiterating its support for its accommodative policy and the Bank of Canada signalling a “pause” in rate hikes, have bolstered investors’ expectation for the Fed to signal an imminent pause in its rate hiking cycle. Money markets are pricing in two 25bps Fed rate hikes by the end of Q1 followed by a pause until mid-2023.

- Economic data was mixed. Although manufacturing data was weaker, the US labour market appeared strong as initial jobless claims hit the lowest since March 2022.

- Short-term technical indicators are still looking bearish and point to a strong support for the US 10-year yield at 3.408%.

Against this backdrop, we expect US government bond yields to rebound in the coming weeks. First, we believe markets have significantly priced in the dovishness of the Fed. The surprisingly hawkish shift of the BoJ last December was a one-off event, in our view, at least until BoJ Governor Kuroda retires in April. We also expect the ECB and BoE to stay on their rate-hiking course. We would use any rebound in US government bond yields to add to quality income assets, such as Asia USD bonds.

— Cedric Lam, Senior Investment Strategist

The US 10-year government bond yield is testing near-term technical support

US 10-year Treasury yield and 200-day moving average

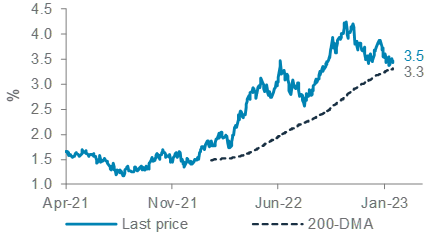

What is the outlook for the USD and gold after the sharp moves in recent months?

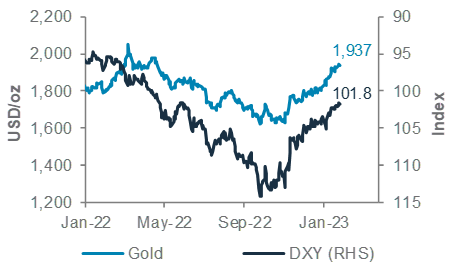

Since November 2022, we have seen a sharp decline in the USD index (DXY), driven by markets pricing fewer Fed rate hikes and a more hawkish ECB stance, eroding the USD’s expected interest rate advantage. Elevated recession concerns have also pulled long-term bond yields in the US lower. However, ahead of the Fed meeting next week, we see the risk of complacency in markets. With multiple Fed members still sticking to their hawkish stance, there is a risk that any hawkish surprise from the Fed could lead to a short-term bounce in the USD, especially the light positioning and stretched technicals. However, given the large weight of the EUR in DXY, we see a hawkish ECB capping any near-term bounce in DXY around 103.

Gold prices have rallied sharply, driven by lower US government bond yields and the recent decline in the USD, given the relatively high correlation. Our proprietary indicator, fractals, is signalling that the recent rally has led to stretched technicals for gold, which has shot past our end-2023 price target of 1,890. Hence, we see elevated risk of a consolidation or even a pullback in the safe-haven metal over the next few weeks. We would prefer to wait for a pullback towards the 1,840 area before adding further exposure to gold.

— Abhilash Narayan, Senior Investment Strategist

The gold rally appears stretched after strong gains on the back of lower government bond yields and a weaker USD, raising the risk of a pullback

Gold and USD index (DXY, inverted)

Top client questions (cont’d)

How is the US earnings season shaping up?

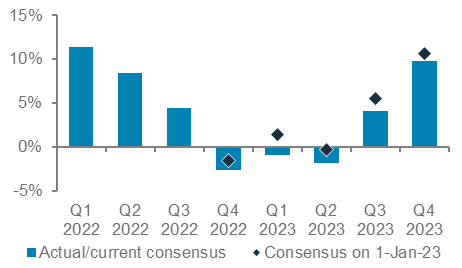

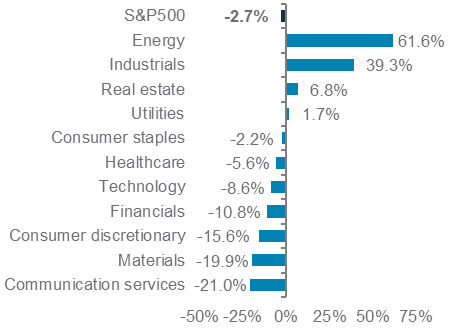

About 25% of companies in the S&P500 index have reported so far with mixed results. According to Refinitiv, 69% of these companies have “beaten” expectations (compares with the long-term average of 66%), delivering a positive earnings surprise of 2.4%. However, earnings growth for Q4 FY22 is still expected to be negative at -2.7% and this estimate is revised down from the -1.6% expected at the start of the year. In fact, earnings estimates for every quarter in 2023 have been trimmed since the start of the year, as analysts reassess the likelihood of a growth slowdown and companies provide softer guidance. For FY23, consensus expectation stands at 3.1%, revised down from 4.4% at the start of the year. While earnings expectations are being revised down, revenue expectations have been stable since the start of the year, at 4.1% growth for Q4 FY22. This points to a weakening in margin expectations as the earnings season is progressing.

Sector wise, the US financial sector is most advanced in reporting, with over 50% of companies having reported, delivering a slight 1.0% positive earnings surprise. Q4 FY22 earnings growth is negative for the sector as credit provisions increased and the “provision releases” witnessed in 2021 were not repeated. The credit provisions, however, have been largely within expectations and the sector is expected to benefit from rising interest rates driving 12% earnings growth in 2023.

The coming weeks will see several mega cap technology and internet heavyweights reporting earnings. Technology, the largest sector in US equities (weighing over 25%), is expected to see 8.6% y/y decline in Q4 FY22 earnings. We have already seen warnings of a slowdown in cloud computing as growth rates normalise from the acceleration witnessed during the COVID-19 pandemic. There are also signs of weaker corporate spending on software and other technology products. Tech companies have been reacting with job cuts, a rare move after years of robust growth enjoyed by the sector. The technology sector is expected to grow its 2023 earnings by 2.6%, just below the broader market.

We have a neutral view on the financial and technology sectors, which we expect to perform in line with the broader US equities over the next 6-12 months. As we see a high likelihood of a recession in the US, we prefer defensive sectors such as healthcare and consumer staples. We are also Overweight the US energy sector, where we see strong cashflows and attractive valuation.

— Fook Hien Yap, Senior Investment Strategist

US earnings growth expectations for Q4 FY22 and every quarter in 2023 have been revised down since the start of the year

S&P500 index earnings growth (y/y) by quarters

Most US equity sectors are expected to see earnings decline in Q4 FY22, with expectations for weaker profit margins overall

US Q4 FY22 earnings growth (y/y) by sector

Top client questions (cont’d)

Do you expect the crude oil rally to sustain?

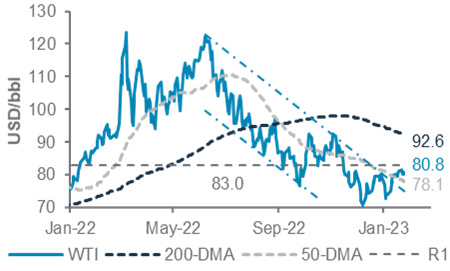

Oil prices declined sharply in the first two trading days of 2023 before recovering steadily in the past few weeks. The gradual, but steady, climb in oil prices can be attributed to:

- A rebound in energy demand in China, the world’s largest crude importer, following the government’s rapid relaxation of mobility restrictions. China’s growth spillovers to Asia are also helping to boost oil demand from the region.

- An improvement in global economic growth sentiment on positive economic data surprises in Europe and China.

- Signs of falling crude exports from Russia due to existing sanctions. Seaborne crude exports slumped to 22% to 3.0mb/d last week, according to Bloomberg ship tracking data.

We believe the crude rally can continue to grind higher in the short term. The additional cap on the price of Russia’s fuel exports, effective from 5 February, is likely to take away about 600kd/d of diesel supply. The upcoming OPEC+ meeting on 1 February is unlikely to see any tweaks to the current policy. On the demand side, China’s reopening will remain supportive of oil prices. From a technical perspective, WTI crude oil’s breakout from a seven-month long downtrend that started on 8 June 2022 could see prices move higher towards 83.

— Zhong Liang Han, CFA, Investment Strategist

Crude oil rally can continue to grind higher in the near term after breaking out from a seven-month long downtrend

WTI crude oil

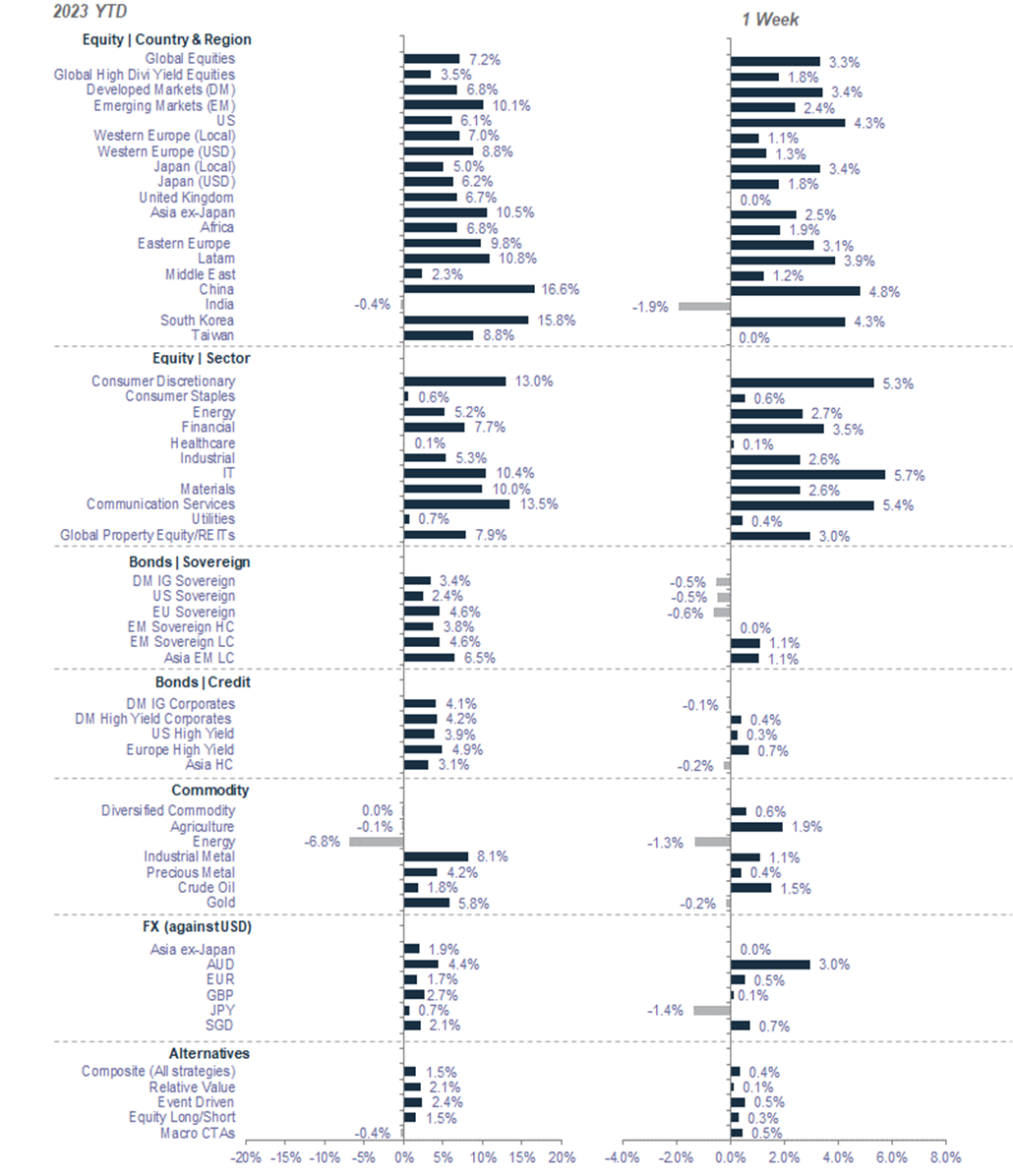

Market performance summary*

*Performance in USD terms unless otherwise stated, 2023 YTD performance from 31 December 2022 to 26 January 2023; 1-week period: 19 January 2023 to 26 January 2023

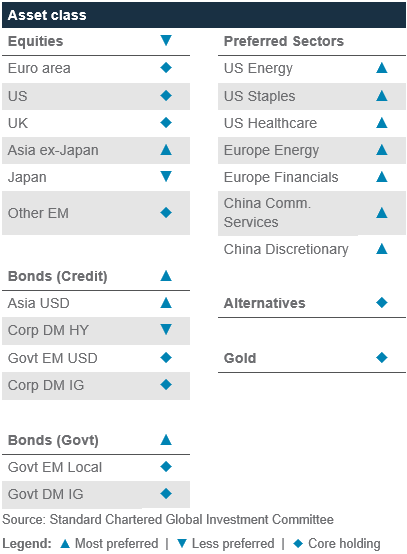

Our 12-month asset class views at a glance

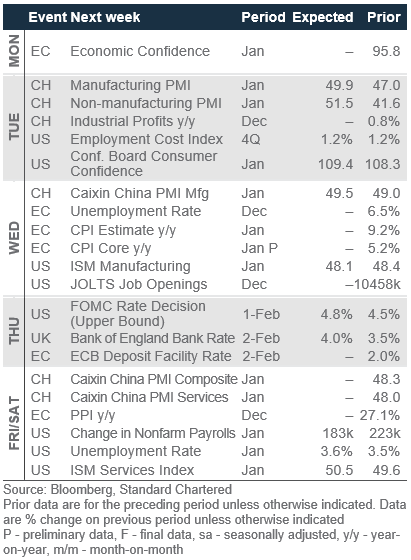

Economic and market calendar

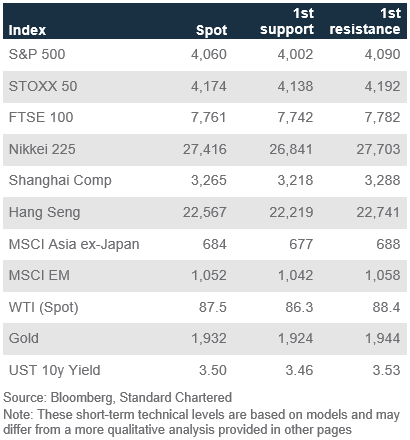

The S&P500 index faces next resistance at 4,090

Technical indicators for key markets as of 26 January close

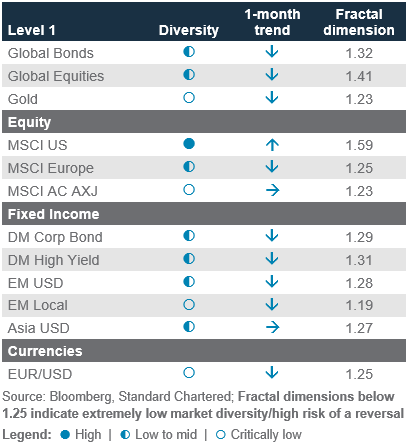

Investor diversity has deteriorated in Asia ex-Japan stocks

Our proprietary market diversity indicators as of 26 January

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2026, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘ESG Intentional Investments – Overall’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures

Bahrain: This document is being distributed in Bahrain by Standard Chartered Bank, Bahrain Branch, having its address at P.O. 29, Manama, Kingdom of Bahrain, is a branch of Standard Chartered Bank and is licensed by the Central Bank of Bahrain as a conventional retail bank. Botswana: This document is being distributed in Botswana by, and is attributable to, Standard Chartered Bank Botswana Limited which is a financial institution licensed under the Section 6 of the Banking Act CAP 46.04 and is listed in the Botswana Stock Exchange. Brunei Darussalam: This document is being distributed in Brunei Darussalam by, and is attributable to, Standard Chartered Bank (Brunei Branch) | Registration Number RFC/61 and Standard Chartered Securities (B) Sdn Bhd | Registration Number RC20001003. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. Standard Chartered Securities (B) Sdn Bhd is a limited liability company registered with the Registry of Companies with Registration Number RC20001003 and licensed by Brunei Darussalam Central Bank as a Capital Markets Service License Holder with License Number BDCB/R/CMU/S3-CL and it is authorised to conduct Islamic investment business through an Islamic window. China Mainland: This document is being distributed in China by, and is attributable to, Standard Chartered Bank (China) Limited which is mainly regulated by National Financial Regulatory Administration (NFRA), State Administration of Foreign Exchange (SAFE), and People’s Bank of China (PBOC). Hong Kong: In Hong Kong, this document, except for any portion advising on or facilitating any decision on futures contracts trading, is distributed by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), a subsidiary of Standard Chartered PLC. SCBHK has its registered address at 32/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong and is regulated by the Hong Kong Monetary Authority and registered with the Securities and Futures Commission (“SFC”) to carry on Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activity under the Securities and Futures Ordinance (Cap. 571) (“SFO”) (CE No. AJI614). The contents of this document have not been reviewed by any regulatory authority in Hong Kong and you are advised to exercise caution in relation to any offer set out herein. If you are in doubt about any of the contents of this document, you should obtain independent professional advice. Any product named herein may not be offered or sold in Hong Kong by means of any document at any time other than to “professional investors” as defined in the SFO and any rules made under that ordinance. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and any interests may not be disposed of, to any person unless such person is outside Hong Kong or is a “professional investor” as defined in the SFO and any rules made under that ordinance, or as otherwise may be permitted by that ordinance. In Hong Kong, Standard Chartered Private Bank is the private banking division of SCBHK, a subsidiary of Standard Chartered PLC. Ghana: Standard Chartered Bank Ghana Limited accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to feedback.ghana@sc.com. Please do not reply to this email. Call our Priority Banking on 0302610750 for any questions or service queries. You are advised not to send any confidential and/or important information to Standard Chartered via e-mail, as Standard Chartered makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Standard Chartered shall not be responsible for any loss or damage suffered by you arising from your decision to use e-mail to communicate with the Bank. India: This document is being distributed in India by Standard Chartered in its capacity as a distributor of mutual funds and referrer of any other third party financial products. Standard Chartered does not offer any ‘Investment Advice’ as defined in the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 or otherwise. Services/products related securities business offered by Standard Charted are not intended for any person, who is a resident of any jurisdiction, the laws of which imposes prohibition on soliciting the securities business in that jurisdiction without going through the registration requirements and/or prohibit the use of any information contained in this document. Indonesia: This document is being distributed in Indonesia by Standard Chartered Bank, Indonesia branch, which is a financial institution licensed and supervised by Otoritas Jasa Keuangan (Financial Service Authority) and Bank Indonesia. Jersey: In Jersey, Standard Chartered Private Bank is the Registered Business Name of the Jersey Branch of Standard Chartered Bank. The Jersey Branch of Standard Chartered Bank is regulated by the Jersey Financial Services Commission. Copies of the latest audited accounts of Standard Chartered Bank are available from its principal place of business in Jersey: PO Box 80, 15 Castle Street, St Helier, Jersey JE4 8PT. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter in 1853 Reference Number ZC 18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. The Jersey Branch of Standard Chartered Bank is also an authorised financial services provider under license number 44946 issued by the Financial Sector Conduct Authority of the Republic of South Africa. Jersey is not part of the United Kingdom and all business transacted with Standard Chartered Bank, Jersey Branch and other SC Group Entity outside of the United Kingdom, are not subject to some or any of the investor protection and compensation schemes available under United Kingdom law. Kenya: This document is being distributed in Kenya by and is attributable to Standard Chartered Bank Kenya Limited. Investment Products and Services are distributed by Standard Chartered Investment Services Limited, a wholly owned subsidiary of Standard Chartered Bank Kenya Limited that is licensed by the Capital Markets Authority in Kenya, as a Fund Manager. Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya. Malaysia: This document is being distributed in Malaysia by Standard Chartered Bank Malaysia Berhad (“SCBMB”). Recipients in Malaysia should contact SCBMB in relation to any matters arising from, or in connection with, this document. This document has not been reviewed by the Securities Commission Malaysia. The product lodgement, registration, submission or approval by the Securities Commission of Malaysia does not amount to nor indicate recommendation or endorsement of the product, service or promotional activity. Investment products are not deposits and are not obligations of, not guaranteed by, and not protected by SCBMB or any of the affiliates or subsidiaries, or by Perbadanan Insurans Deposit Malaysia, any government or insurance agency. Investment products are subject to investment risks, including the possible loss of the principal amount invested. SCBMB expressly disclaim any liability and responsibility for any loss arising directly or indirectly (including special, incidental or consequential loss or damage) arising from the financial losses of the Investment Products due to market condition. Nigeria: This document is being distributed in Nigeria by Standard Chartered Bank Nigeria Limited (SCB Nigeria), a bank duly licensed and regulated by the Central Bank of Nigeria. SCB Nigeria accepts no liability for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to clientcare.ng@sc.com requesting to be removed from our mailing list. Please do not reply to this email. Call our Priority Banking on 02 012772514 for any questions or service queries. SCB Nigeria shall not be responsible for any loss or damage arising from your decision to send confidential and/or important information to Standard Chartered via e-mail. SCB Nigeria makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Pakistan: This document is being distributed in Pakistan by, and attributable to Standard Chartered Bank (Pakistan) Limited having its registered office at PO Box 5556, I.I Chundrigar Road Karachi, which is a banking company registered with State Bank of Pakistan under Banking Companies Ordinance 1962 and is also having licensed issued by Securities & Exchange Commission of Pakistan for Security Advisors. Standard Chartered Bank (Pakistan) Limited acts as a distributor of mutual funds and referrer of other third-party financial products. Singapore: This document is being distributed in Singapore by, and is attributable to, Standard Chartered Bank (Singapore) Limited (Registration No. 201224747C/ GST Group Registration No. MR-8500053-0, “SCBSL”). Recipients in Singapore should contact SCBSL in relation to any matters arising from, or in connection with, this document. SCBSL is an indirect wholly owned subsidiary of Standard Chartered Bank and is licensed to conduct banking business in Singapore under the Singapore Banking Act, 1970. Standard Chartered Private Bank is the private banking division of SCBSL. IN RELATION TO ANY SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT REFERRED TO IN THIS DOCUMENT, THIS DOCUMENT, TOGETHER WITH THE ISSUER DOCUMENTATION, SHALL BE DEEMED AN INFORMATION MEMORANDUM (AS DEFINED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT, 2001 (“SFA”)). THIS DOCUMENT IS INTENDED FOR DISTRIBUTION TO ACCREDITED INVESTORS, AS DEFINED IN SECTION 4A(1)(a) OF THE SFA, OR ON THE BASIS THAT THE SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT MAY ONLY BE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION. Further, in relation to any security or securities-based derivatives contract, neither this document nor the Issuer Documentation has been registered as a prospectus with the Monetary Authority of Singapore under the SFA. Accordingly, this document and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the product may not be circulated or distributed, nor may the product be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons other than a relevant person pursuant to section 275(1) of the SFA, or any person pursuant to section 275(1A) of the SFA, and in accordance with the conditions specified in section 275 of the SFA, or pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. In relation to any collective investment schemes referred to in this document, this document is for general information purposes only and is not an offering document or prospectus (as defined in the SFA). This document is not, nor is it intended to be (i) an offer or solicitation of an offer to buy or sell any capital markets product; or (ii) an advertisement of an offer or intended offer of any capital markets product. Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. This advertisement has not been reviewed by the Monetary Authority of Singapore. Taiwan: SC Group Entity or Standard Chartered Bank (Taiwan) Limited (“SCB (Taiwan)”) may be involved in the financial instruments contained herein or other related financial instruments. The author of this document may have discussed the information contained herein with other employees or agents of SC or SCB (Taiwan). The author and the above-mentioned employees of SC or SCB (Taiwan) may have taken related actions in respect of the information involved (including communication with customers of SC or SCB (Taiwan) as to the information contained herein). The opinions contained in this document may change, or differ from the opinions of employees of SC or SCB (Taiwan). SC and SCB (Taiwan) will not provide any notice of any changes to or differences between the above-mentioned opinions. This document may cover companies with which SC or SCB (Taiwan) seeks to do business at times and issuers of financial instruments. Therefore, investors should understand that the information contained herein may serve as specific purposes as a result of conflict of interests of SC or SCB (Taiwan). SC, SCB (Taiwan), the employees (including those who have discussions with the author) or customers of SC or SCB (Taiwan) may have an interest in the products, related financial instruments or related derivative financial products contained herein; invest in those products at various prices and on different market conditions; have different or conflicting interests in those products. The potential impacts include market makers’ related activities, such as dealing, investment, acting as agents, or performing financial or consulting services in relation to any of the products referred to in this document. UAE: DIFC – Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18.The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered Bank, Dubai International Financial Centre having its offices at Dubai International Financial Centre, Building 1, Gate Precinct, P.O. Box 999, Dubai, UAE is a branch of Standard Chartered Bank and is regulated by the Dubai Financial Services Authority (“DFSA”). This document is intended for use only by Professional Clients and is not directed at Retail Clients as defined by the DFSA Rulebook. In the DIFC we are authorised to provide financial services only to clients who qualify as Professional Clients and Market Counterparties and not to Retail Clients. As a Professional Client you will not be given the higher retail client protection and compensation rights and if you use your right to be classified as a Retail Client we will be unable to provide financial services and products to you as we do not hold the required license to undertake such activities. For Islamic transactions, we are acting under the supervision of our Shariah Supervisory Committee. Relevant information on our Shariah Supervisory Committee is currently available on the Standard Chartered Bank website in the Islamic banking section. For residents of the UAE – Standard Chartered UAE (“SC UAE”) is licensed by the Central Bank of the U.A.E. SC UAE is licensed by Securities and Commodities Authority to practice Promotion Activity. SC UAE does not provide financial analysis or consultation services in or into the UAE within the meaning of UAE Securities and Commodities Authority Decision No. 48/r of 2008 concerning financial consultation and financial analysis. Uganda: Our Investment products and services are distributed by Standard Chartered Bank Uganda Limited, which is licensed by the Capital Markets Authority as an investment adviser. United Kingdom: In the UK, Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. This communication has been approved by Standard Chartered Bank for the purposes of Section 21 (2) (b) of the United Kingdom’s Financial Services and Markets Act 2000 (“FSMA”) as amended in 2010 and 2012 only. Standard Chartered Bank (trading as Standard Chartered Private Bank) is also an authorised financial services provider (license number 45747) in terms of the South African Financial Advisory and Intermediary Services Act, 2002. The Materials have not been prepared in accordance with UK legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Vietnam: This document is being distributed in Vietnam by, and is attributable to, Standard Chartered Bank (Vietnam) Limited which is mainly regulated by State Bank of Vietnam (SBV). Recipients in Vietnam should contact Standard Chartered Bank (Vietnam) Limited for any queries regarding any content of this document. Zambia: This document is distributed by Standard Chartered Bank Zambia Plc, a company incorporated in Zambia and registered as a commercial bank and licensed by the Bank of Zambia under the Banking and Financial Services Act Chapter 387 of the Laws of Zambia.