31 March 2023

Global Market Outlook

Global Market Outlook

Staying SAFE

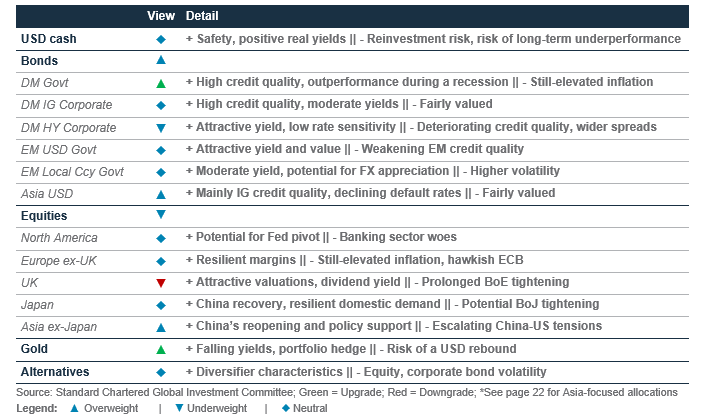

We believe the core approach of our SAFE strategy – Securing yield, Allocating to Asian assets, Fortifying against further surprises and Expanding beyond the traditional – remains intact as we start Q2 23.

Our increased expectation of a US recession this year leads us to prefer bonds over equities. We continue to see multi-asset income strategies as an attractive and diversified way to navigate a slowing global growth outlook.

Within bonds, we raise our exposure to high-quality government bonds and reduce exposure to high-yield debt. Within equities, we continue to prefer Asia ex-Japan and adopt a defensive sector stance in the US and Europe.

What to expect once the Fed stops hiking?

What are the key macroeconomic signposts to watch?

What are your preferred equity sectors in China?

Strategy

Investment strategy and key themes

|

|

||||

|

Our top preferences

(12-month outlook)

Foundation overweights

- Government Bonds, gold

- In equities: Asia ex-Japan

- In bonds: Developed Market IG government, Asia USD

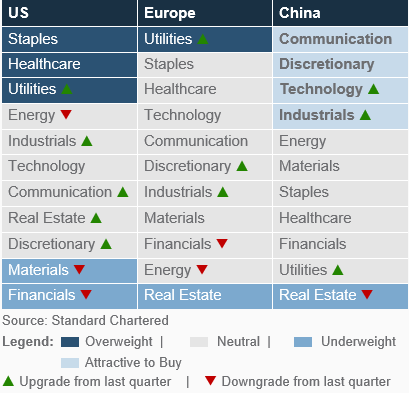

Sector overweights

- US: Healthcare, Staples, Utilities

- Europe: Utilities

- China: Comms. Services, Consumer Discretionary, Technology, Industrials

FX views

- Modestly weaker USD

Structural macro trends*

- A digital tomorrow

- Preparing for an aging world

- From unipolarity to multipolarity

- Investing in a climate-constrained world

*Individual reports available

Staying SAFE

- We believe the core approach of our SAFE strategy – Securing yield, Allocating to Asian assets, Fortifying against further surprises and Expanding beyond the traditional – remains intact as we start Q2 23.

- Our increased expectation of a US recession this year leads us to prefer bonds over equities. We continue to see multi-asset income (MAI) strategies as an attractive and diversified way to navigate a slowing global growth outlook.

- Within bonds, we raise our exposure to high-quality government bonds and reduce exposure to high-yield debt. Within equities, we continue to prefer Asia ex-Japan and adopt a defensive sector stance in the US and Europe.

Should I worry?

One of the cornerstones of our Investment Philosophy is to examine the signal from ‘Outside views’ – in other words, perspectives from historical data, quantitative models and other similar sources. While volatility in bonds and most recently in financial sector equities and subordinated debt has remained high, risk assets more broadly have arguably not been as vulnerable as one might expect given continued warnings from our US recession indicator checklist. This is where a perspective from our quantitative models, which take an approximately 3-6-month view, may help as an ‘Outside view’.

Our inflation-growth framework, which uses signals from macro and market variables such as the Leading Economic Indicator, M2 growth and 10-year bond yields, argues growth and inflation are both likely to move significantly lower from the current levels. Based on this assessment, the model is bearish on risky assets and bullish on bonds.

Our US Equity-Bond Market Risk model, which relies more on asset class signals instead of macro data, is similarly bearish equities and bullish bonds. Having said that, the model attaches about a two-thirds probability that the economy moves out of this stage by mid-year into one that is more constructive for both bonds and equities.

Our stocks vs bonds model, which relies on several fundamental, valuation and technical indicators, is only mildly bullish equities. The signal from fundamentals and technicals remains weak, with only valuations being more supportive.

Fig.1 Money supply contracting in the US and accelerating in China, illustrating differing policy goals

M2 money supply growth (%y/y)

Putting this together – we prefer bonds

Each model comes with its strengths and weaknesses, but on balance we remain cautious. We see an 80% chance of a US recession in the next 12 months and expect the Fed to start cutting rates before year-end. It has become almost clichéd to say the Fed keeps hiking until something breaks, but recent banking stress illustrates things are indeed starting to ‘break’.

From an asset class perspective, we believe this means the core approach of our SAFE strategy (Securing your yield, Allocating to Asian assets offering long-term value, Fortifying against further surprises and Expanding beyond the traditional) remains intact.

Overall, we prefer bonds over equities. However, our positioning within bonds has become incrementally more cautious. We are Overweight Developed Market Investment Grade government bonds and Underweight High Yield bonds. This is consistent with a US recessionary cycle wherein government bonds typically benefit from a fall in bond yields (as markets price slower growth and eventual rate cuts) and corporate bond yield premiums over US government bonds widen on expectations of worsening credit quality.

We also raise gold to Overweight. While bullish positioning could be a near-term headwind, we expect gold to benefit both from falling bond yields and its track record of usually delivering positive returns during economic recessions.

Prefer Asia ex-Japan, defensive sectors

Our regional equity views remain relatively unchanged from Outlook 2023. We continue to see an attractive risk/reward in Asia ex-Japan equities. Within that, we prefer China as valuations remain inexpensive even after the rebound from Oct 2022 and policymakers continue to support growth, as evidenced by the most recent cut in bank reserve ratios. Our expectation of further USD weakness should support Asia ex-Japan’s outperformance. We remain comfortable with this view – while it has been argued that the USD should rise

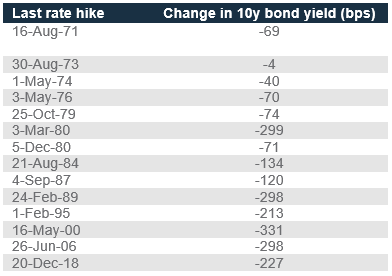

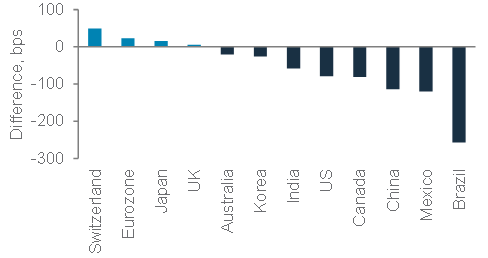

Fig.2 Bond yields have generally fallen significantly after the last Fed rate hike of a monetary policy cycle

Change in 10-year yield, last Fed hike to yield trough

during US recessions, this track record is mixed. We believe the US’s eroding yield advantage is likely to dominate.

We have also updated our sector views. In the US, we favour the relatively defensive sectors – utilities, healthcare and consumer staples – given our recession outlook. In Europe, we prefer utilities. In China, we prefer the communication services, consumer discretionary, technology and industrials sectors that are likely to benefit from a cyclical upturn.

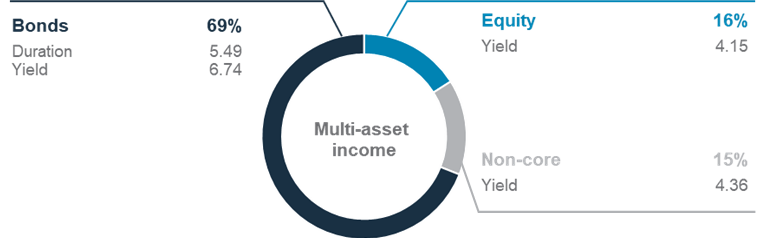

Income generation remains a major focus

We continue to see multi-asset income strategies as attractive. Besides still-attractive yields, the strategy’s relatively muted volatility in recent months demonstrates the value of a diversified income basket – the volatility in junior financial debt being offset by gains in government bonds, for example. We continue to see this approach as attractive in navigating the range of scenarios our ‘Outside views’ lay out.

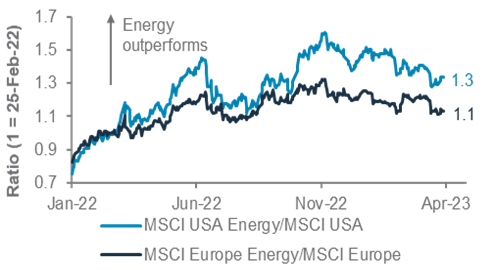

Fig.3 Energy sector equities – taking profit

Energy sector equities relative to regional equity benchmarks

Moderating our energy price outlook

Oil faced an unexpectedly large surplus in recent months on strong production and the US’s reluctance to restock strategic reserves. We close our energy sector Overweight given our view that these are likely to weaken the oil price outlook.

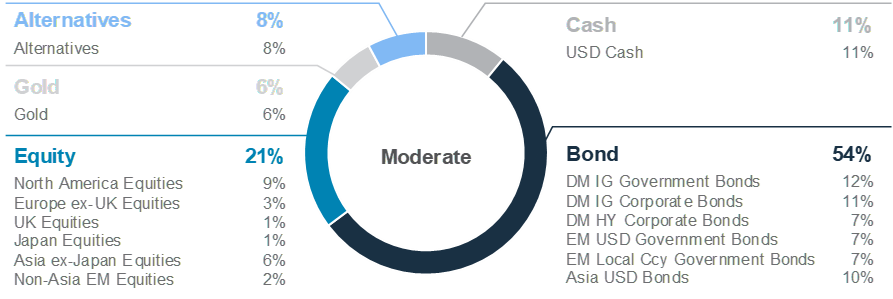

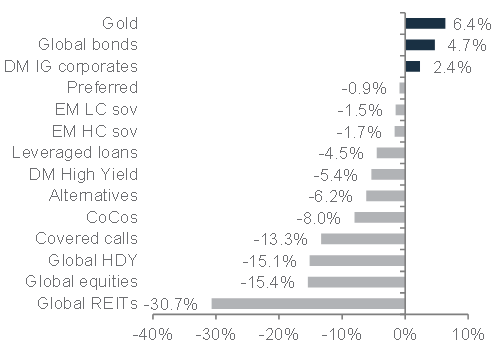

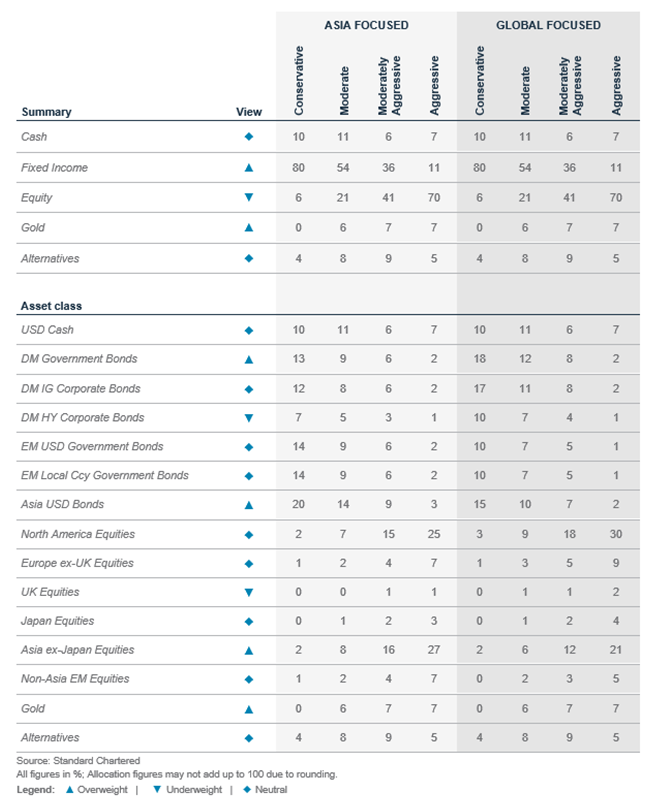

Foundation: Our tactical asset allocation

Global* allocation for a moderate risk profile

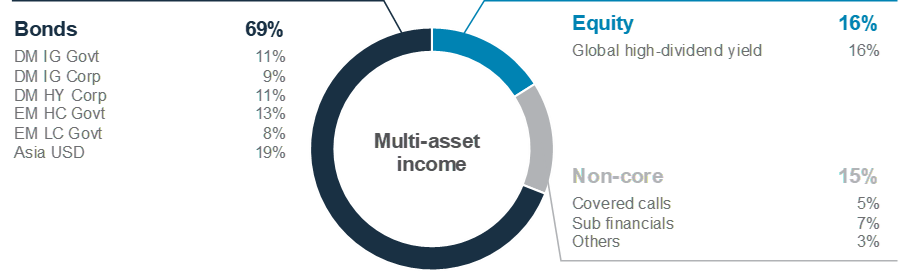

Multi-asset income allocation for a moderate risk profile

Foundation: Multi-asset income strategies

|

|

||||

Key themes

Income-generating assets remain attractive, with our multi-asset income (MAI) allocation offering a yield of almost 6%. We believe investors have a window to lock in an attractive yield given the Fed is likely to approach the peak of its hiking cycle in the next few months before taking a pause, with yields likely falling ahead of it.

Within our MAI allocation, we have further increased our allocation towards fixed income assets. The recent upheaval in the banking sector is likely to lead to a pullback in lending by banks and herald a slowdown in economic growth. Our quantitative models and recession checklists continue to signal a high risk of a recession over the next 6-12 months, a key factor behind our DM IG government bonds upgrade this quarter. While the 10-year US government bond yield has declined recently, yields of other income assets are still near the top of their historical range. Historically, high-quality fixed income assets have tended to trough around the last Fed hike, as markets start to price an economic slowdown and eventual rate cut.

We have pared back our allocation to high dividend equities given our US recession view and financial sector stress. While dividend income can provide some buffer against price declines, we believe high dividend yield equities are not immune to a broader decline in equity markets given dividend income contributed about a third of total returns over the past three years. We also closed our relative preference for subordinated financial debt (or junior debt) vs DM HY bonds this month.

Key chart

We maintain a strong conviction in income strategies, given the attractive yields on offer and income being key from a total returns’ perspective

Fig. 4 Yields on our income strategy increasingly anchored by the bonds component

Yields, duration and allocations to bonds, equity and non-core within our multi-asset portfolio

Fig. 5 Despite the fall in government bond yields, yields on most income assets remain near multi-year highs

Yield to worst/dividend yield (%); yield range of various income assets since 2014

Contingent Convertibles are complex financial instruments. (Refer to Important Information on page 26 for further details)

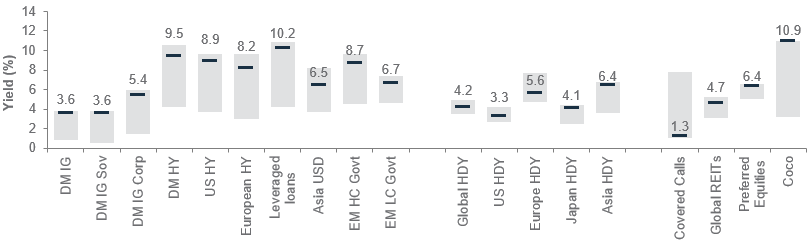

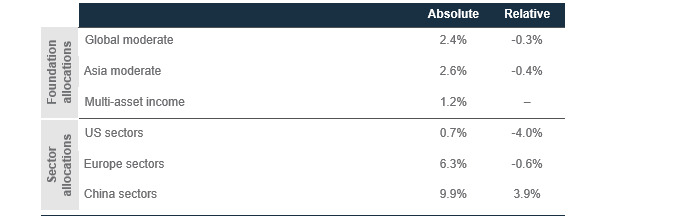

Muted start for diversified income

Our income allocation has had a muted start to the year. While our sizeable Overweight to bonds did well, the allocation was dragged lower by the underperformance of non-core assets and high dividend equities. As a result, the MAI allocation delivered a 2.1% vs 3.3% for our global balanced allocation.

Nevertheless, we continue to expect a diversified MAI allocation to deliver an attractive income and outperform a balanced allocation. Attractive yields, moderating growth and an elevated risk of economic recession should support strategies with a greater allocation to fixed income assets that have relatively stable cash flows.

Fig. 6 DM sovereign bonds have been resilient during the past US recessions, but dividend equities have fallen

Performance during past recessions (2001, 2008, 2020)*

CoCos and preferred securities for 2020 recession, while Global REITs, Asia USD bonds and EM LC Sov for 2008 and 2020 recessions

Add to bonds for diversification benefits

We continue to add to fixed income assets within our MAI allocation this quarter. While the recent bank failures may not have morphed into a broader crisis, they will likely lead to tighter lending standards, thereby creating a headwind for economic growth and corporate earnings. As the peak in the current Fed hiking cycle draws closer, the diversification benefits of fixed income could reassert themselves in 2023, making IG bonds an important diversifier to consider. With the sharp fall in US 10y government bond yields from this year’s high of over 4.0% to c.3.5% currently, credit spreads have expanded, keeping yields on credit assets near the highs of their historical range. DM IG government bonds are now yielding c.3.6%, an attractive level, in our view.

While there is still a wide gap between market expectations of Fed policy (75bps of cuts by year end) and the Fed’s own projections (no rate cut in 2023), we expect the Fed to pivot towards cutting rates in H2 23 once the cumulative effects of 475bps of rate hikes (the second fastest pace of rate hikes in history) start to bite. We have upgraded DM IG government bonds to Overweight, given heightened US recession risks.

Historically, in addition to gold, DM IG government bonds have been one of the best hedges against a decline in risky assets during recessionary periods. To quantify the potential gains, every 100bps decline in US Treasury yields would translate to c.7% in capital gains, which, together with a c.4% yield on offer, is something we see as attractive from both an income and capital appreciation perspective. The risk to this view is, the Fed will tighten further if inflation proves to be stickier than expected or US growth remains resilient.

Paring back dividend equities

The increased allocation to fixed income was at the cost of reduced allocation to dividend equities. While yields on global dividend equities at 4.2% are modestly higher than the 3.6% provided by DM IG government bonds, its significant exposure to the financial, industrial and material sectors poses potential downside risks in a recessionary scenario. While the dividend component could provide some cushion against price declines, dividends have contributed c.30% of total returns since 2020, with the bulk of returns still coming from capital appreciation. The latter could be at risk from a recessionary downturn in equities.

Fig. 7 Concerns about the banking sector have led to a decline in contingent convertible bonds and high dividend equities

Performance of relevant indices rebased to 100 from 1 January 2020

We have closed our preference for subordinated financial debt (or junior debt) relative to DM HY bonds. The recent upheaval in the banking sector is likely to result in a higher cost of capital for the sector as investors reassess risks to this asset class.

With the macroeconomic outlook remaining uncertain, we believe a diversified income-generating portfolio offers a prudent way to maintain an equity allocation. Additionally, income strategies present attractive opportunities given the high yields on offer, allowing investors to be paid while riding out what we see as an impending US recession.

Perspectives on key client questions

|

|

||||

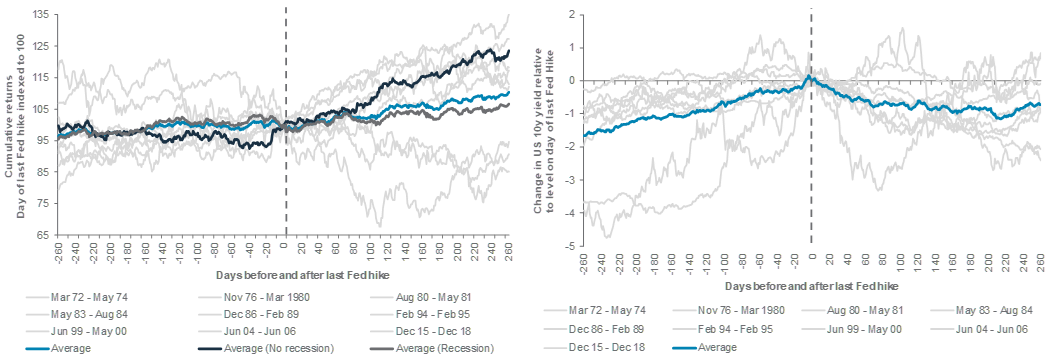

The Fed is nearly done. What is next?

“Don’t Fight the Fed” is an old Wall Street adage. The phrase centres around the concept of staying aligned with the Fed. In the years when monetary policy was loose and liquidity abound, this meant keeping the foot on the gas pedal and staying risk-on. Investors understood this dynamic in the aftermath of the global financial crisis, when near-zero interest rates and quantitative easing propelled a 400% bull run in the S&P500 index that only ended with the arrival of COVID-19.

Today, after 475bps in rate hikes over the span of a year, the Fed is once again signalling that it is near the end of its hiking cycle. The old mantra of “Don’t Fight the Fed” would suggest that investors start turning more constructive on risk. But with a recession looming, especially given the recent stress in the banking sector, should investors also be concerned about weaker economic conditions ahead?

We found that while an end to the Fed hiking cycle and a subsequent easing of policy could be bullish for equities, this only holds true if there was no ensuing recession. In most cases, only a trough in economic conditions would instead constitute a sufficient condition to produce an equity rally.

Past policy reversals did not consistently lead to equity rallies in the near term

In our analysis of past hiking cycles, we found that while equities on average saw positive returns 12 months after the last Fed hike or first Fed cut, the variance of outcomes was large, with equities benefiting in some years and suffering substantial losses in others. For instance, during the 2000-02 and 2007-08 equity bear markets, equities fell despite aggressive Fed rate cuts. In contrast, the end of the Fed hiking cycles in 1983 and 1994 propelled strong returns for equities.

The difference in stock market performance highlights the finding that monetary policy shifts are an insufficient condition for equity investors to turn bullish. While declining interest rates should theoretically lead to higher stock valuations, the positive impact to valuation can be outweighed by the prospect of weakening economic conditions.

Fig. 8 Stocks can benefit from a pause in Fed hikes, but only if economic conditions remain resilient

Cumulative returns of the S&P500 index and change in the US 10y govt bond yield following the last Fed hike

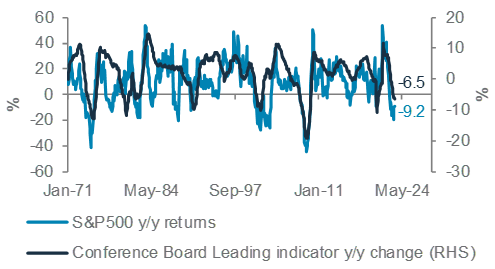

The distinction is clear when comparing the equity performance of hiking cycles that resulted in a recession against those that did not, with returns in the former clearly lagging those in the latter. In contrast, a trough in economic conditions would instead constitute a sufficient condition for investors to turn bullish. In recent decades, the bottom in equities has typically coincided with the trough in the US Conference Board Leading indicator.

Unlike equities, government bond yields have typically behaved more predictably towards the end of the Fed hiking cycle. Historically, the peak in 10-year government bond yields have almost always occurred around the last rate hike, before falling by an average of 70bps over the next 12 months as slower growth and lower inflation weigh on yields.

Fig. 9 Economic conditions are a more prominent driver of market performance

S&P500 index and Conference Board Leading indicator

The labour market remains too tight

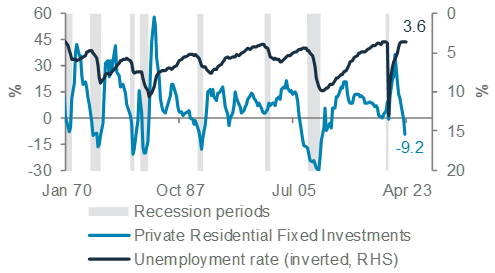

For investors, identifying when the trough in economic conditions might be, rather than the timing of a Fed policy reversal, could thus prove to be a more important gauge of an investable bottom in equities. A historical sequencing of the economy as it headed into a recession can serve as a useful guide to timing the trough in economic conditions.

Historically, the housing market typically softens ahead of the start of a recession, while the annual growth rate of GDP usually turns negative around the middle of the recession, just ahead of a peak in the unemployment rate. On the other hand, banking crises are rare. There have only been two episodes of severe banking crises, defined as a substantial spike in bank failures since the Great Depression: The Savings and Loan Crisis in 1989 and the Global Financial Crisis in 2008.

Currently, while the housing market has already contracted and the annual growth rate of GDP has slowed, the labour market remains tight to indicate a start, much less a bottom, in economic conditions (although early job market indicators are starting to flash warning signals – see the Macro section). This suggests that even after the Fed pauses rate hikes in May, there could still be some runway before a discernible trough in economic conditions emerges. There is, thus, a considerable risk that equities have yet to see its bottom.

Fig. 10 Unemployment historically rises around the start of a recession and peaks only towards the end

Historical sequencing of economic variables leading into a recession

Bonds to reclaim the role of portfolio diversifiers

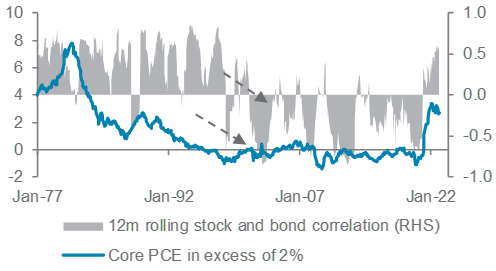

The anticipation of a recession, which historically weighs on stock market performance and leads to a decline in bond yields, is the basis for our Overweight stance on government bonds and Underweight allocation to equities. The contrast in performance between the two asset classes, particularly after they lost value in 2022, also affirms our view that the correlation between stock and bond returns is expected to turn negative once inflation subsides.

Since the late 1990s, the correlation between stock and bond returns has typically been negative. Even though rising bond yields can inflict a negative impact on equity valuation when they are also associated with better growth prospects, it is good news for stocks, especially when deflation is the main economic threat and monetary restraint is rarely necessary. When inflation is the main economic threat, however, as was the case in 2022, rising bond yields instead signalled economic overheating and the need for monetary restraint. In this environment, stock and bond returns correlation can turn positive. Consequently, since we expect inflation to eventually subside, bonds are expected to reclaim their role as portfolio diversifiers – a particularly useful outcome ahead of an anticipated period of stock market underperformance.

Fig. 11 Stock and bond returns correlation is expected to turn negative as inflation subsides

12m rolling stock and bond returns correlation and core PCE more than 2%

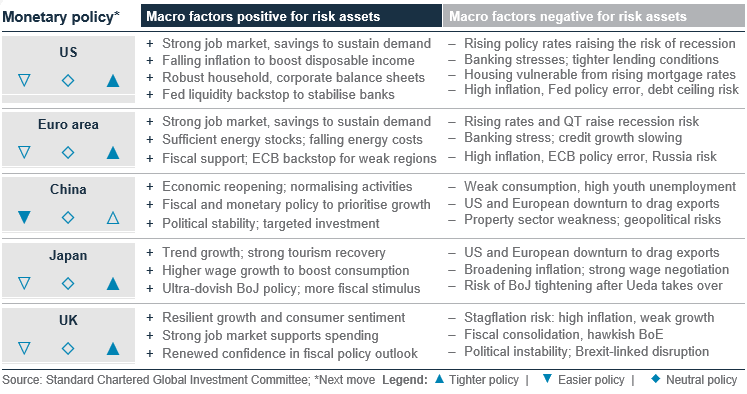

Macro overview – at a glance

Summary

|

|

||||

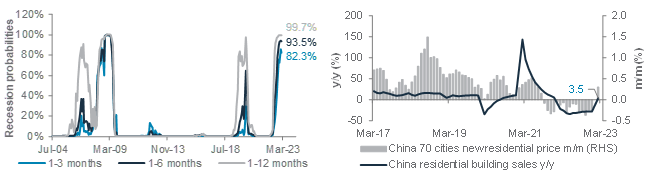

Key themes

We started the year anticipating an increased risk of a recession in the US and Europe and a turnaround in China. As we enter Q2, we believe the risk of a US recession has risen as the outlook has been clouded by a likely further tightening of lending conditions following liquidity stresses faced by smaller US banks. Our Global Investment Committee assigns an 80% probability of a US recession over the next 12 months. Given this, we expect the Fed to end its aggressive rate hiking cycle after another 25bps hike in Q2, then cut rates by 50bps in H2 as it shifts its focus from subduing inflation to supporting growth.

The Euro area economy has fared better than anticipated due to an unusually mild winter. Hence, we see a more modest 60% probability of a Euro area recession in the next 12 months. The region faces a more persistent inflation problem than the US. Hence, we see the ECB delivering another 50bps of rate hikes to take the deposit rate to 3.5% and holding it for the rest of the year. China is at the other end of the global economic cycle – consumption, fixed asset investment and the distressed property sector are showing increased signs of a recovery as economic activity gradually normalises following late last year’s reopening. We expect policymakers to sustain monetary and modest fiscal measures to revive growth above 5% this year.

Key chart

Our quant model estimates more than 90% probability of a US recession in the next six months, while our subjective probability is 80% over the next 12 months. Meanwhile, China property sector upturn is signalling a turnaround in the broader economy

Fig. 12 While China recovers, we see increased risk of a US recession this year

Our quant-based 3-12m US recession probabilities; China residential sales and prices

US, Europe, China economies diverge further

The outlooks for the US, Europe and China have diverged. In this section, we look at the various indicators that point to a rising risk of a US recession, a challenging inflation outlook for Europe and increased signs of a recovery in China.

US recession monitor: The US economic outlook has deteriorated since we published our Outlook 2023 in December. Most of our US recession indicators, except for the two market-based gauges (equity and credit markets), are now flashing warning signals that a recession is coming. The latest to turn bearish are the two early job market indicators: payrolls for temporary workers and initial jobless claims have both started to contract y/y. Companies first stop hiring temporary workers as the outlook deteriorates, making this an early warning signal. Meanwhile, a y/y rise in initial jobless claims shows the employment cycle is turning decisively. The US unemployment rate is still below the level a year ago, but this is a lagging indicator, which is likely to rise in the coming months as hiring slows and job cuts, so far concentrated in the technology and financial services sectors, broaden. The level of job openings is the other indicator to watch closely – they have come off the record high levels hit last year but remain elevated, compared with the pre-pandemic levels.

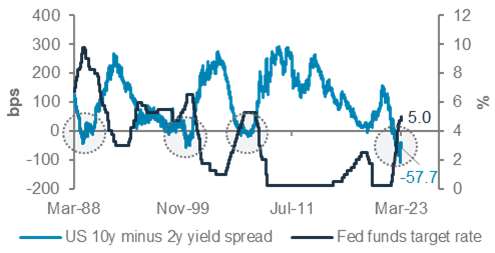

Other leading indicators, such as for the manufacturing sector and consumer confidence, the new orders-to-inventories ratio and the spread between long- and short-term interest rates, have been signalling a recession since last year. A segment of the US bond yield curve that Fed Chair Powell believes is the best indicator of a coming recession (spread between 3m T-bill yield in 18 months and the current 3m T-bill yield) has fallen to a record low (below the levels before the 2000 and 2008 recessions). Meanwhile, US money supply is contracting y/y for the first time on record as banks tightened lending conditions even before the current turmoil hit small banks.

All these recessionary signals notwithstanding, the Fed faces a policy dilemma as inflation, running above 5%, remains significantly above its 2% target. Service sector inflation is the main driver of the latest bout of inflation as demand for services remains robust as consumers, bolstered by a still-resilient job market and over USD 1tn of excess savings from the pandemic, continue to spend. Given this, we expect the

Fed to hike rates by 25bps one more time to a peak rate of 5.25% to cool the job market and reduce service sector wage pressures. With US rates already restrictive, we expect the job market to tip over along with consumption as the ongoing liquidity crunch among small banks leads to a further tightening of lending conditions in the coming months. As the unemployment rate rises in H2, we expect Fed policy to pivot. We estimate 50bps of rate cuts in H2 to end the year at 4.75%.

ECB’s inflation challenge: The Euro area faces a more persistent inflation problem compared with the US. Euro area core inflation, at 5.6%, has been accelerating, unlike in the US, where inflation peaked last year. While gas prices are likely to significantly fall y/y in the coming months as the base effect from the Ukraine war fades, Europe’s industries and households face structurally higher energy costs as long as Russian gas supplies remain cut off. Meanwhile, like the US, Euro area service sector activity and inflation remain robust as the job market remains strong, even though the manufacturing sector has been contracting since last year. Given the ECB’s sole mandate of keeping inflation within its 2% target, we expect the central bank to continue hiking rates to a peak of 3.5% by June and keep it there till the end of the year. The broader impact of the turmoil at Credit Suisse, leading to the government-managed takeover by UBS, needs to be closely watched – further tightening of bank lending conditions would raise the chance of an ECB rate pause.

China’s recovery taking hold: Unlike the US and Europe, China’s economy has been showing signs of acceleration this year as economic activity normalises. Infrastructure investments beat expectations in the first two months of the year, retail sales are turning around and even the distressed property sector is showing signs of recovery, with residential property sales rising y/y for the first time since 2021. China’s incoming government, elected at the recent National People’s Congress, has set a conservative 5% growth target for the year. We expect growth to exceed that target with the help of a modest fiscal boost from some of last year’s spillover funds. Meanwhile, the PBoC’s latest cut to bank reserve requirements is likely to be followed by more targeted lending towards strategic sectors of the economy to promote domestic technology and support China’s drive towards self-sufficiency.

Fig. 13 US yield curve steepening, signalling rate cuts

US yield curve (10y minus 2y yields), Fed funds rate (RHS)

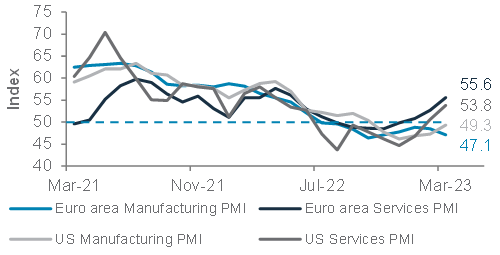

Fig. 14 US and Euro area services sector still strong

US and Euro area manufacturing and services PMI

Asset Classes

Bonds – at a glance

|

|

||||

Key themes

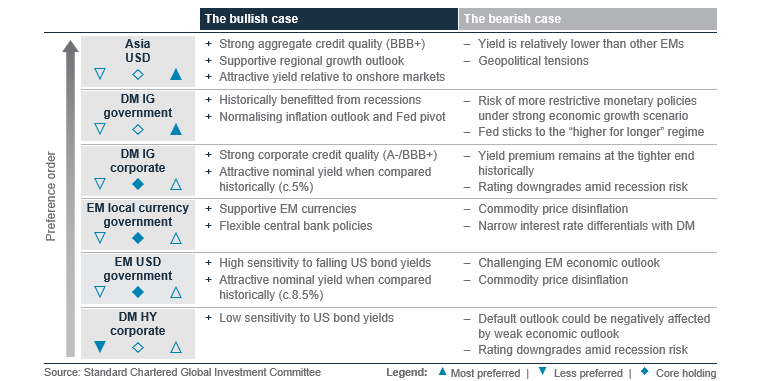

We expect the Fed to hike 25bps before end-June and follow it with rate cuts going into H2 23. However, softening economic indicators and tightening financial conditions lead us to believe that the second-steepest Fed rate hiking cycle is drawing to an end. We see the 10-year US government bond yield moving lower to 3.25-3.50% by end-June and 2.75-3.00% by year-end.

Against this backdrop, we upgrade Developed Markets (DM) Investment Grade (IG) government bonds to Overweight. We remain Overweight Asia USD bonds as the predominantly IG asset class benefits from both falling US bond yields and supportive regional economic activity, led by China’s reopening and India’s growth outlook.

For DM corporate bonds, we are Neutral IG and Underweight High Yield (HY) debt. We believe yield premiums are still insufficient to compensate for a likely forthcoming recession. In Emerging Markets (EM), we are Neutral local currency (LCY) and USD government bonds. A US recession is likely to be a drag on EM fundamentals, but EM central banks are well positioned to pivot in need. EM USD bonds benefit from a high sensitivity to US bond yields, but credit quality remains a risk.

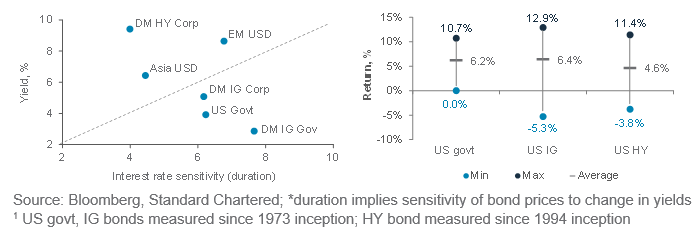

Key chart

DM IG bonds should benefit from their high rate sensitivity; historically, US IG government and corporate bonds deliver relatively better returns than US HY corporate bonds around Fed pivots

Fig. 15 DM IG bonds and EM USD bonds are sensitive to interest rate changes; when Fed pivots, US government bonds have offered an attractive risk-reward trade-off

Current yields vs duration*; US bond asset class returns from last rate hike to first rate cut1

Why upgrade DM IG government bonds and keep DM IG corporate bonds Neutral?

In a recessionary environment, where the Fed rate hiking cycle is getting closer to the end and the prospect of a policy pivot is rising, we believe risk/reward favours adding exposure to risk-averse assets, such as DM government bonds. Historically, this asset class benefits from falling yields around the peak in Fed rates. In addition, we believe the recent US regional bank turmoil has exerted additional pressure on the fragile economic outlook, as banks are likely to tighten their lending conditions to preserve capital. We also expect demand for risk-averse investment positioning to push DM government bond yields lower. Hence, we upgrade DM IG government bonds to Overweight this month.

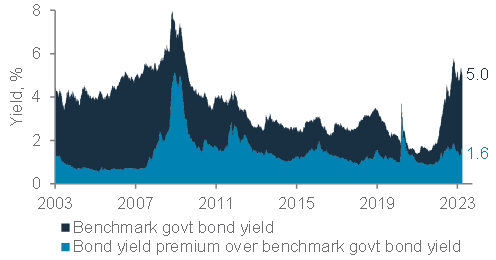

Although DM IG corporate bonds should also benefit from lower government bond yields and an attractive yield of c.5%, we maintain our Neutral view due to the following key risks:

- Current yield premiums appear tight and insufficient to compensate for recession risk

- While DM IG corporate fundamentals remain strong, in our assessment, we see rising risk of rating downgrades as corporate funding costs climb with higher Fed rates and global banks tighten their lending conditions

Fig. 16 DM IG corporate bonds yield premium is tight despite an attractive nominal yield of c.5%

Bloomberg Global Aggregate Corporate Bond Index nominal yield and yield premium

Why do you remain Neutral EM USD and local currency government bonds?

Commodity prices have gradually normalised as supply chain concerns appear to have eased to some degree. This challenges the fiscal strength of net commodity exporter countries. Although a US recession is likely to impact EM growth as well, we are optimistic given EM central banks have room for policy flexibility. In addition, money markets currently expect EM central banks to take a more active role in cutting policy rates in the next 12 months when compared with their DM counterparts. While lower rates from monetary easing should support the performance of EM LCY bonds, the narrow rate differentials to DM could weigh on EM FX. For EM USD government bonds, their relatively long duration (sensitivity to bond yields) means they should benefit from a lower US rate

environment, though the pressure on their credit quality is likely to offset this to some degree.

Given the relatively mixed outlook, we remain Neutral on EM bonds.

Fig. 17 Money markets expect more room for rate cuts in EM countries than DM countries in the next 12 months

Difference of current policy rates and futures implied 1y policy rate

What is the rationale behind your DM HY corporate bonds Underweight and Asia USD bonds Overweight?

We see DM HY bonds at risk from our view of a rising probability of a US recession. Although nominal yields look attractive, particularly after their recent rise, we hesitate to add further to this bond sub-asset class as default risks (and, hence, yield premiums) usually surge when an economy suffers from a recession.

On the contrary, we see more attractive risk/reward in Asia USD bonds. The asset class, with its significant weight to Chinese issuers, appears supported by the region’s stronger economic prospects, led by China’s reopening and India’s growth outlook. In addition, the vast majority of Asia USD bonds are IG-rated, which we believe provides a strong shelter in terms of credit fundamentals to weather a DM-led recession, besides benefiting from a fall in US bond yields.

Although this sub-asset class has relatively low sensitivity to changes in interest rates, which means it is less likely to enjoy the capital appreciation prospects from falling bond yields, we find its yield premium of over 300bps attractive and offering value. Hence, we are Overweight Asia USD bonds.

Within Asia USD bonds, we have a preference for IG bonds over HY bonds. Our Underweight rating on Asia HY bonds is mainly driven by our view that slowing global growth and rising financing costs put additional pressure on corporate leverage ratios. The ripple effect from the unprecedented pandemic support measures has also been fading. Also, commodity prices have normalised, and easing supply chain disruption is likely to limit firms’ pricing power. Asia IG bonds, on the other hand, should benefit from investors’ demand for quality and their relatively higher sensitivity to falling US bond yields.

Equity – at a glance

|

|

||||

|

Key themes

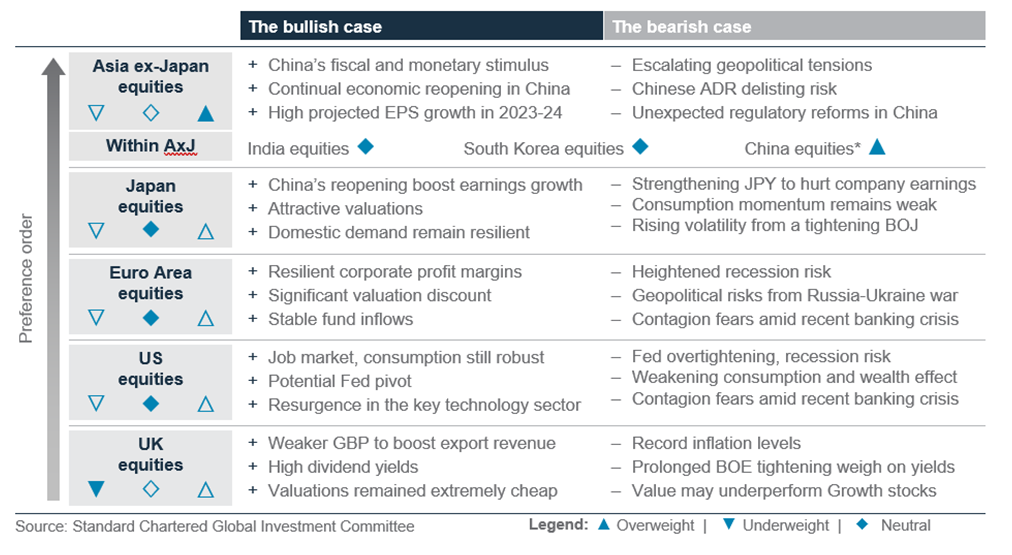

We remain Underweight equities given our central scenario of a recession in the US and Europe. Troubles in the financial sector are complicating the Fed’s and the ECB’s fight against inflation, which may lead to tighter lending standards, slowing growth, weakening consumption patterns and downside risks to earnings estimates on a 12-month horizon.

We are Overweight Asia ex-Japan. China’s economic recovery is likely to support an improved earnings growth profile. A potential pause in Fed rate hikes and a weaker USD may lead to fund inflows. Within the region, we are Overweight China equities due to the increasingly pro-business stance from the new government. We have an equal preference for onshore vs offshore markets. We are Neutral Indian equities given the trade-off between relatively strong earnings and high valuations.

We upgraded Japan to Neutral – potentially tightening BoJ policy is counteracted by the recovery in the Chinese economy. We are Neutral Euro area equities – significant valuation discount offsets the aggressive ECB rates hikes. We are Neutral US equities due to relatively expensive valuations and the risk of further earnings downgrades. We downgraded UK equities to Underweight – despite its cheap valuation and high dividends, we believe slowing growth would hurt Value equities.

Key chart

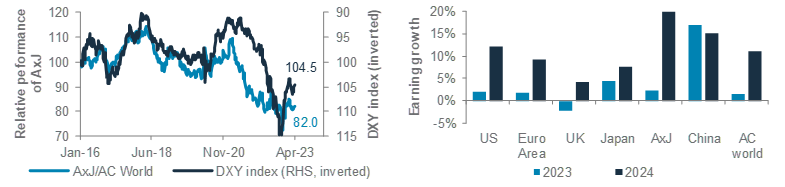

Economic uncertainties in the US should lead to a weaker USD, which may trigger fund inflows into Asia ex-Japan, which is likely to see stronger economic growth and corporate earnings

Fig. 18 Weaker USD and stronger China earnings prospects are tailwind for Asia ex-Japan

MSCI Asia ex-Japan vs AC World relative performance vs DXY index; regional earnings growth

Underweight global equities

We remain Underweight global equities given our expectation of a US and Euro area recession over the next 12 months. Still-elevated inflation in the US and the Euro area imply that policymakers have some more tightening left, which could hinder growth and corporate earnings in the coming quarters. Historically, equities bottomed only well into a recession. The recent banking sector turmoil, in addition to weakening consumption patterns, are likely to further pressure global earnings growth into 2023.

Overweight Asia ex-Japan equities

We remain Overweight Asia ex-Japan equities. A potential pause in Fed rate hikes and rising recession risks in Developed Markets (DMs) are expected t

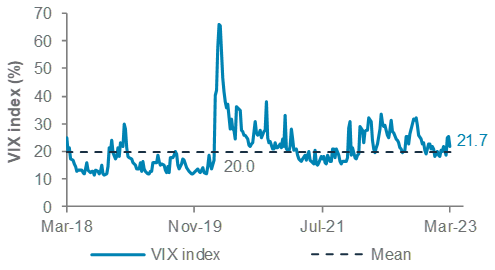

Fig. 19 Market volatility rebounded following banking sector woes, dampening investor sentiment

S&P500 volatility index (VIX)

o support fund flows into Asia ex-Japan in 2023. Historically, a weaker USD has also been correlated with the outperformance of Asian equity markets. The region is reasonably valued, in our view. The 12-month forward P/E of 13x is in line with its historical average. We expect China’s further economic growth and large-scale stimulus to support further EPS growth.

Within Asia ex-Japan, we are Overweight China equities. The National People’s Congress held in early March stressed on high-quality growth and economic stability. Following China’s reopening, the outline of business-friendly policies and property sector stimulus has further lifted investor sentiment, boosting earnings growth expectations in the region. China’s valuations remained attractive, with equities currently trading at a 20% discount in terms of P/E to Asia ex-Japan equities, below its long-term average of 8% discount. The country’s expected earnings growth in 2023 has also been revised higher to 17% compared to 15% at the start of 2023.

We are Neutral China onshore vs offshore, with the caveat that rising China-US tensions, including the recent Chinese spy balloon episode and the US visit of Taiwan leaders, and heightened delisting risk of China’s ADRs, could hurt performances in the offshore market.

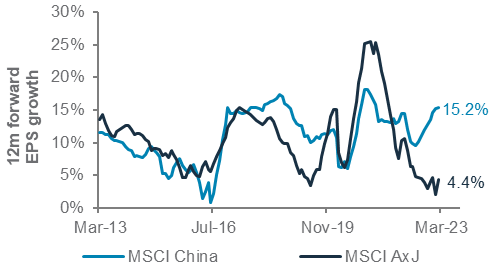

Fig. 20 China equities are expected to outperform Asia ex-Japan equities on a 6-12 month horizon

12-month forward EPS growth estimates of MSCI China vs MSCI Asia ex-Japan

We are Neutral India equities within the region. Valuations (12-month forward P/E at 20x) remain elevated vs historical averages despite strong earnings growth.

Neutral Japan equities

We upgraded Japan equities to Neutral. Riding on both China and Japan’s economic reopening, the previous supply chain disruption has been subsiding. Valuations remain attractive on both an absolute and relative basis. Domestic demand remains robust, although a strengthening JPY could hinder Japan’s economic recovery and dampen corporate earnings. Potential termination in the BoJ’s Yield Curve Control policy is also headwind to a heightening market volatility.

Neutral Euro Area equities

We are Neutral Euro area equities. The region is currently trading at a significant valuation discount, which is likely to offset negative impacts from aggressive ECB interest rate hikes. Meanwhile, we see potential recession, concerns about liquidity risks in the banking sector and elevated inflation as near-term headwinds.

Neutral US equities

We are Neutral US equities. The recent financial sector instability triggered a widespread risk-off sentiment. Amid still-elevated inflation and the Fed’s policy tightening regime, we expect a heightened risk of a US recession in the coming 6-12 months. We remain cautious over the regions’ relatively expensive valuations and see potential downside risks to earnings estimates

Underweight UK equities

We downgraded UK equities to Underweight. Previously, UK equities outperformed global equities due to its Value-tilted nature amid prolonged BoE tightening. Yet, the recent moderation in both inflation and oil prices is likely to lead to a pause in BoE rate hikes. Nevertheless, a weakening GBP is likely to lead to higher translation of foreign revenue. Valuations remain extremely cheap, with a 12m forward P/E at 10x, significantly below its long-term average of 12x.

Equity sector views

|

Stay defensive in DM

Buy ongoing recovery in China

• We continue to position defensively in US and Europe sectors, in line with our cautious view on global equities.

• Meanwhile, we see a consumption rebound in China, supporting the case to buy the communication services and consumer discretionary sectors. With policy tailwinds, we would also buy the technology and industrials sectors.

US

We see three sectors that are likely to outperform the broader US market. Consumer Staples has historically delivered positive EPS growth even in a recession and is seen as a reliable outperformer in a downturn. Healthcare provides defensive exposure with reasonable valuation and resilient profit margins amid cost pressures. Utilities is upgraded to Overweight as it also provides defensive exposure.

Other views: We downgrade financials to Underweight as concerns with the less regulated regional banks could weigh on the broader sector and higher funding costs are likely to squeeze margins. We are Underweight materials as it is vulnerable in a cyclical slowdown. We downgrade energy to Neutral as recession concerns could weigh on the sector, as would our more moderate outlook for oil prices.

Europe

We expect the utilities sector to outperform the broader market in Europe. It offers resilience amid slowing growth whilst the valuation of the sector is reasonable.

Other views: We are Underweight real estate as price momentum remains poor. Rising rates are an ongoing

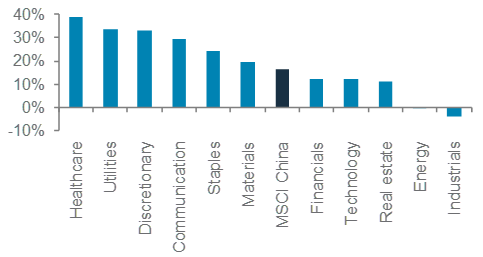

Fig. 21 We expect China’s consumption rebound to benefit communication and discretionary sectors; technology and industrials have weaker earnings growth but attractive valuation and policy support

Consensus 12m forward EPS growth by sectors in China

headwind, and credit defaults have occurred in the sector. We downgrade financials to Neutral as news flow around EPS upgrades may fade with a likely rise in funding costs.

China

We see value in the four China sectors we consider a Buy. Communication services is dominated by media and entertainment companies that we believe will benefit from greater consumer spending, a recovery in advertising and policy support for internet platforms’ development. We also see consumer discretionary as a beneficiary of ongoing reopening and policymakers’ priority in boosting domestic consumption. We upgrade technology to a Buy as we see the government’s goal of digital transformation as a tailwind for the sector, while valuation remains attractive. Hardware sales volume growth could resume in H2 23 and ongoing localisation of semiconductor businesses also offers support. Industrials is upgraded to a Buy, with policymakers calling for technological upgrade of key manufacturing sectors and expansion of domestic production capacity. A recovery in express delivery and transportation volumes also benefits the sector, which is still at a deep valuation discount to the market.

Other views: We downgrade real estate to Underweight as we expect it to lag a rebound in China equities. The house price-to-wage ratio looks high by global standards, making us cautious about the sector.

Fig. 22 Our sector views by region

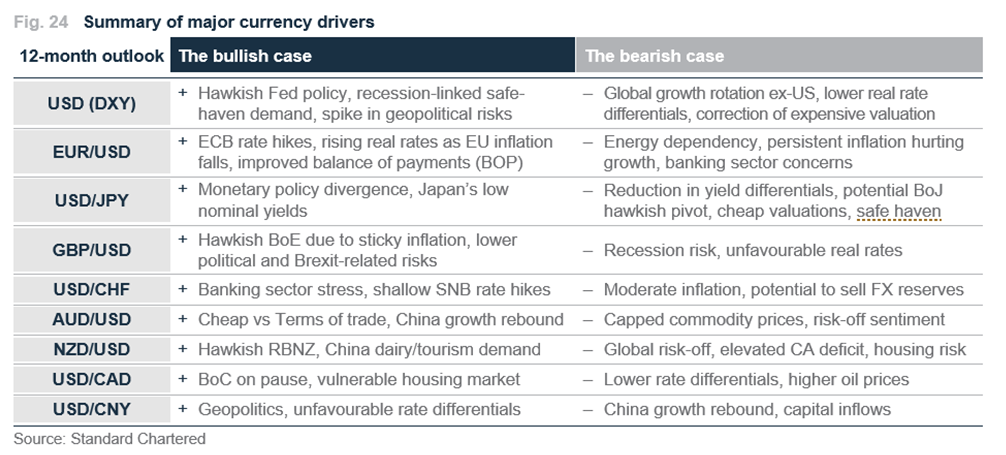

FX – at a glance

|

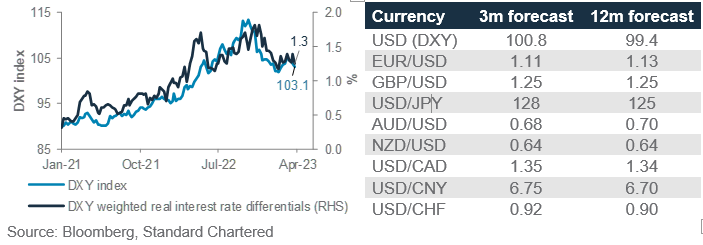

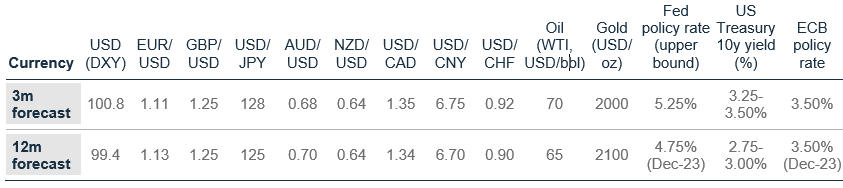

Key themes

We maintain our bearish stance towards the USD over the next 3-month and 12-month horizons. The recent stress in the banking sector means that the Fed funds rate is likely to peak at 5.25% and be cut before the year-end on rising recession risk. We also expect 2-year and 10-year US government bond yields to decline over the next 6-12 months, eroding USD’s interest rate advantage. Additionally, the rebound in China’s economic growth should filter through to improved Asian and European growth prospects, which should reinforce the USD ‘Smile’ framework that argues the USD strengthens in times of US exceptionalism and market stress but declines in periods where global growth is in line or better than US growth. Lastly, despite the nearly 10% decline from October 2022 highs, the USD still screens as expensive relative to its fundamentals. Persistent US inflation or a sharper-than-expected US growth slowdown are key risks to our bearish USD view as they may spark safe-haven demand leading to USD resilience, or even USD strength.

Still-hawkish guidance from the ECB due to elevated inflation could lead to further upside for the EUR compared with the start of the year. Easing of political concerns in the UK and progress in the Northern Ireland trade agreement makes us more optimistic on GBP/USD over the next three months. Swift action by Swiss authorities to tackle the banking sector stress and a more hawkish stance from the SNB have increased the likelihood of further CHF strength. However, heightened recession concerns have increased downside risks for commodities, causing us to lower our 12-month expectations for the AUD, the NZD and the CAD.

Key chart

Reduction in real (net of inflation) interest rate differentials, our expectation of Fed rate cuts before year-end and decline in US government bond yields to push the USD lower over the next 12 months

Fig. 23 Fed rate cuts and lower US bond yields to drive the USD lower

USD index (DXY) and DXY-weighted real interest rate differential; table of forecasts

Looking for further upside in EUR

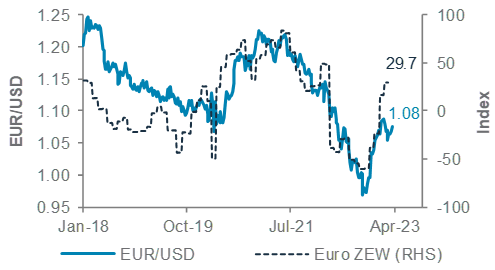

The EUR is likely to be the main beneficiary of a weaker USD in the next 3 and 12 months. Given still-elevated inflation, the ECB could hike rates by another 50bps to 3.5% and keep rates on hold at least till end-2023. Meanwhile, lower energy prices are likely to lead to lower European inflation, resulting in more favourable real (net of inflation) interest rate differentials. Lower energy import costs could cause a current account surplus over the next 12-18 months, which along with improved portfolio flows should result in favourable technicals for the EUR. EUR/USD should break above the 1.10 resistance over the next 3 months before gradually trending higher towards 1.13-1.15 on a 12-month horizon.

Fig. 25 Improved sentiment and favourable interest rate differentials should drive EUR/USD higher

EUR/USD and ZEW Eurozone growth expectation

We turn more optimistic on GBP/USD over the next three months, expecting it to appreciate towards 1.24-1.25, as the relative resilience of the UK banking system and progress in the Northern Ireland agreement are likely to buoy sentiment. However, the pair could trade in the 1.24-1.27 range thereafter as the BoE is likely to pause rate hikes soon due to the still challenging domestic growth backdrop.

Over the next three months, we see USD/CHF being largely rangebound around 0.9200, with 0.9040 acting as a key support as near-term risk-on sentiment reduces safe-haven demand. However, as recession risks come into focus in H2 23, USD/CHF is likely to decline towards 0.9000 on safe-haven demand, supported by SNB’s willingness to sell FX reserves to maintain strong CHF to manage imported inflation.

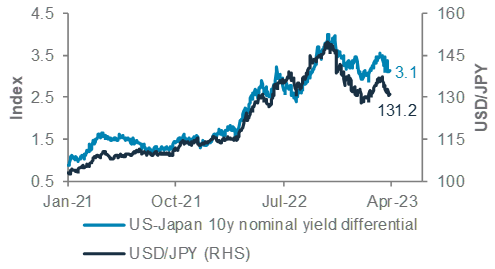

While we expect the BoJ to gradually normalise the monetary policy, the recent banking sector turmoil and Governor Ueda’s comments increase the risk of a slower-than-anticipated normalisation. Hence, USD/JPY is likely to trade in the 128-132 range with a downside bias over the next 3 months, with the pair pushing towards the 120-125 range over the next 12 months due to favourable yield differentials and a potential increase in safe-haven demand.

Fig. 26 Expected decline in US yields and normalisation of the BoJ policy to lead to lower USD/JPY

Consensus 12m forward EPS growth by sectors in China

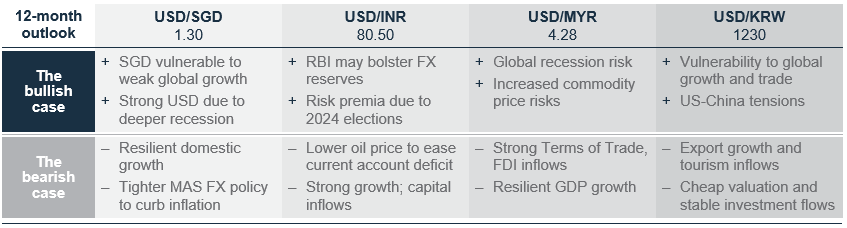

The increased probability of a recession in the US and China’s focus on driving a consumption recovery raise downside risk for commodity prices. Commodity currencies (AUD, NZD and CAD) should appreciate versus USD, but we see limited upside potential. Additionally, vulnerabilities in domestic housing markets in Canada and Australia are likely to cap investor enthusiasm towards the respective currencies.

A faster-than-expected economic reopening makes us optimistic on the CNH. Near term, we expect optimism around a rebound in GDP growth and capital flows to drive USD/CNY towards 6.75. Over the next 12 months, decline in US yields should result in more favourable interest rate differentials and USD/CNH trading within 6.65-6.72 band.

We expect USD/INR to decline modestly towards 80-81 over the next 12 months. The INR could benefit from a broad USD weakness, strong domestic growth and declining current account deficit. However, greater risk premium ahead of 2024 elections and RBI’s rebuild of FX reserves may cap gains.

Fig. 27 Summary of Asian currency drivers

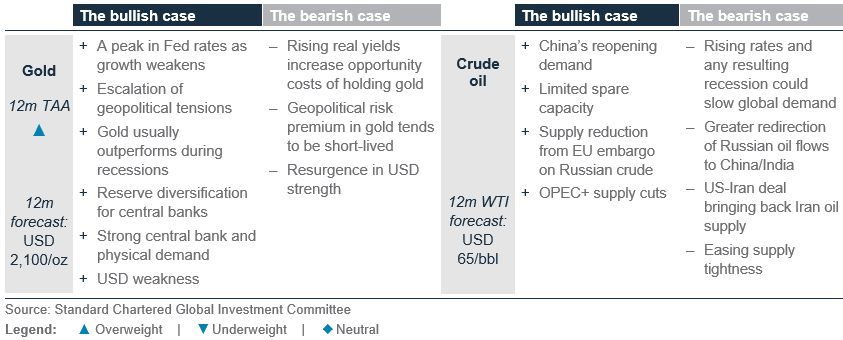

Gold, crude oil – at a glance

|

Key themes

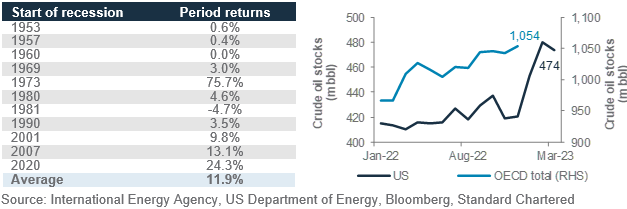

We are Overweight gold vs other major asset classes, viewing it as a hedge against tail risk scenarios, with a 12-month forecast of USD 2,100. We see gold being well-supported as the Fed rate-hiking cycle pauses and the focus shifts to rate cuts amid rising recession risks from the banking crisis. Gold has delivered positive returns in 10 of the last 11 recessions, and it arguably retains its safe-haven properties during times of crisis. These increase the appeal of gold as a diversifier against a backdrop of elevated macro uncertainty, especially with the low investor allocation. A weaker USD and increased demand from central banks, households and investors are other key drivers behind our constructive view.

We turned less optimistic on oil given the weaker-than-expected demand-supply balance. On a 12-month horizon, we expect WTI oil to trend lower towards USD 65/bbl on (1) weaker oil demand from a slowing global economy, (2) resilience of Russia’s exports from redirection of flows, and (3) the gradual build-up of inventories from warmer weather. The OPEC+ group is likely to regulate supply to prevent a drastic fall in oil prices should demand contract more than expected. However, over the next three months, prices are likely to remain rangebound. The US could start replenishing the Strategic Petroleum Reserve (SPR), while China’s reopening demand still has some legs, which would offset some of the slowdown in global demand. The EU embargo on Russian oil, Russia’s yet-unknown response and low producer elasticity present risks to supply.

Key chart

Gold shines through periods of recession

The crude oil stock is accumulating gradually, especially in the US

Fig. 28 On average, gold gained c.12% during the last 11 US recessions; Crude oil inventory is gradually building up, especially in the US

LHS chart: Price performance of gold during the last 11 US recessions

RHS chart: Global and US crude oil inventory

Quant perspective

US market risk model remains bearish

|

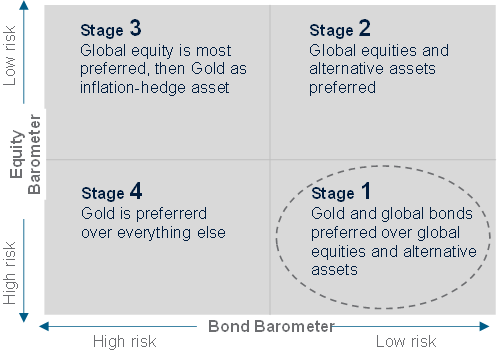

Bearish equity but bullish bond market risks

Our US Equity-Bond Market Risk (EBMR) models the downside risks in US equities and the US 10-year government bonds. It uses 11 economic and market factors to create equity and bond risk barometers. If the value of a barometer falls below 50, it signals higher downside risks and vice versa.

The model has remained in Stage 1 of the US financial market cycle, where high downside risks are expected for US equities but low for US government bonds. The model, however, has been bearish US equity market risks since January 2022 when it was in Stage 4 (bearish equity and bond market risks). It accurately captured elevated equity market volatility in 2022 when the volatility index VIX averaged 26pts versus its long-term average of 18 pts. The S&P 500 today remains 14% below its level in Jan-22. The model has reacted early by turning bullish US government bonds in Jun-22 after capturing a 2.2% rise in US government bond yields previously.

Fig. 29 EBMR bearish on equities, bullish on bonds

US equity and bond market risk barometers

The equity barometer consists of 11 equity indicators. In March, the barometer remained at 27, which is bearish as it was below the cut-off of 50. The previous improvement in the barometer was solely driven by stronger equity market momentum, which has worsened recently (but not captured in our monthly model yet) due to the recent banking crisis. Higher interest rates, still-elevated inflation, slower housing starts and a contracting monetary base remain the running factors to be bearish on equity risks. The recent correction in the S&P 500 after the c.16% rally since mid-October is a reminder that the current economic backdrop remains fragile.

Meanwhile, our bond barometer has improved further to 86 from 71. The improvement is driven by a more neutral signal from jobless claims as it has remained flat. However, this factor has a bearish bias towards our bond barometer as it is currently low, which means that any rate hike decision is unlikely to be hindered by concerns of a severe effect on employment (bond price falls when interest rate rises). Still contracting factor activity as indicated by US PMI, slowing US housing starts and declining US capacity utilisation are key factors supporting the bond view as a defensive asset class.

Our model currently projects that the US will remain in Stage 1 till Jun-23. For bonds, we have previously cautioned against taking excessive duration risks despite the model’s view, but the recent banking crisis could provide an opportunity to cap rate hike risks.

Implications on global assets

Data since 1999 suggest gold and bonds are the most preferred in Stage 1. The model’s preference for the assets is based on its long-term relationship with the market cycle, which favours defensive assets in Stage 1.

Fig. 30 Scenarios over the coming months till June 2023 vs September 2022 projections

Probability of the evolution of financial market risk cycle from the current Stage 1 and preferred assets

Model’s estimated probabilities in September 2022

| Stage | Sep-22 | Oct-22 | Nov-22 | Dec-22 |

|---|---|---|---|---|

| 1 | 100% | 100% | 98% | 85% |

| 2 | 0% | 0% | 1% | 15% |

| 3 | 0% | 0% | 0% | 0% |

| 4 | 0% | 0% | 1% | 0% |

Model’s estimated probabilities in March 2023

| Stage | Feb-23 | Mar-23 | Apr-23 | May-23 |

|---|---|---|---|---|

| 1 | 100% | 97% | 96% | 68% |

| 2 | 0% | 0% | 3% | 27% |

| 3 | 0% | 0% | 0% | 3% |

| 4 | 0% | 2% | 1% | 3% |

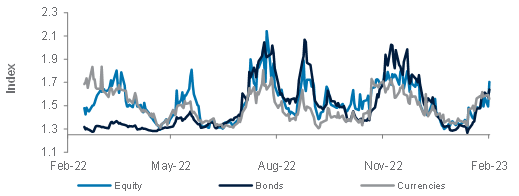

Tracking market diversity

|

About our market diversity indicators

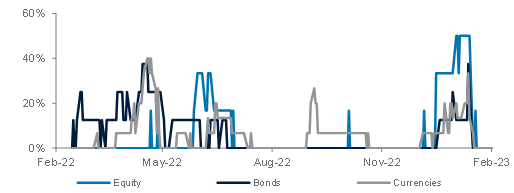

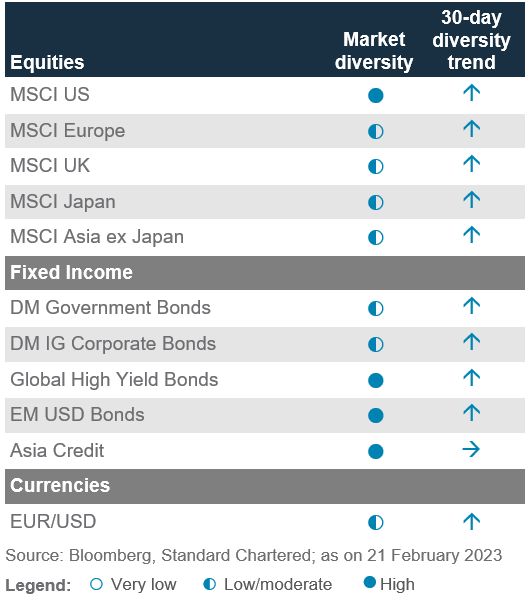

Our market diversity indicators help to identify a potential change in short-term trends due to a fall in market breadth across equities, credit, FX and commodities. When market diversity falls, it implies either buyers or sellers are dominating, leading to a rapid rise or fall in asset prices. This is usually unsustainable and is likely to be followed by a consolidation or a reversal. Our diversity indicator is based on a statistical index called fractal dimension; a value below 1.25 serves as a guideline that prices are rising or falling too fast.

Where is diversity falling or rising this month?

General market diversity has improved significantly over the past few weeks as reversals took place in some equity, bond and currency markets. This can be seen in Fig. 10 and 11 where average diversity within each asset class has risen significantly above 1.25, and the percentage of assets by asset class with diversity below 1.25 fell to 0. These changes came on the back of the recent risk-off environment.

In equities, Asia ex-Japan and European equities have the lowest diversity due to their strong rebound since Oct-22. Our indicators flagged the risk of a reversal or slowdown in both markets in early February. This has worked well for the MSCI Asia ex Japan Index as there was a correction (-4.5% MTD), but not yet for the MSCI Europe Index (+2.1% MTD). Meanwhile, the US and Japan have the highest market diversity currently. This is partly due to the recent reversal in US equities (-1.6% MTD for S&P 500), and the lack of clear trends in Japan equities (in USD terms).

Fig. 31 Average market diversity score by asset class

General diversity has risen post reversals

Fig. 32 Percentage of assets with diversity score <1.25

No assets are currently flagged

For bonds, we are seeing a rise in market diversity for individual markets. Many of these bond markets have previously been flagged for their corrections around January- February. After the recent equity market sell-off, however, they have performed well, with DM government bonds leading with a 3.5% return, followed by EM government bonds at 2.4%. Despite the jump in bond returns, our indicators are not flagging a reversal anytime soon. DM government bonds currently have the lowest diversity, but its level is well above our diversity threshold.

For currencies, the USD weakness has resumed after a brief respite in February, and this has helped to elevate its market diversity further. This means any reversal to the USD weakness seen since September 2022 (DXY Index down 10%) is unlikely to be coming from the stretched market positioning. USD/IDR currently has the lowest diversity at 1.46. Other USD pairs have diversity levels well above the threshold as well.

Fig. 33 Diversity across key assets

Performance Review

Foundation: Asset allocation summary

Performance of our calls

Summary of performance since Outlook 2023

Fig. 34 Summary of our 2023 calls year-to-date

Performance measured from 15 December 2022 or when the call was opened, to 30 March 2023 or when the view was closed.

Past performance is not an indication of future performance. There is no assurance, representation or prediction given as to any results or returns that would actually be achieved in a transaction based on any historical data.

‘Absolute’ represents the simple absolute return. ‘Relative’ tracks our Tactical Asset Allocations vs. our Strategic Asset Allocation, or if a relative measure was specified in individual themes.

Global moderate and Asia moderate comprise our Tactical Asset Allocations as described in the Global Market Outlook publications. Broad asset class allocations are represented by MSCI AC World, FTSE Non-MBS WorldBIG Index, Bloomberg commodities ex-agriculture & livestock, HFRX total return and Bloomberg U.S. Treasury Bills: 1-3 Months Index. Equity allocations are represented by MSCI USA, EMU, UK, Japan, Asia ex-Japan and Other EM total return indices. Bond allocations are represented by FTSE WorldBig Government Index, FTSE WorldBig Corp Index, J.P. Morgan EMBI Global Diversified, EM Local, Asia Credit Index and Bloomberg Global High Yield indices.

Equity sector allocations are represented by MSCI USA sector indices, MSCI Europe sector indices and MSCI China sector indices, based on total returns. In our Multi-Asset Income allocation, bond allocations are represented by Bloomberg Global High Yield Index, S&P Global Leveraged Loan Index, J.P. Morgan EMBI Global Diversified, EM Local, Asia Credit and Asia Credit Index Non- Investment Grade, FTSE WorldBig Corp Index and FTSE WorldBig Government Index. Equity allocations are represented by MSCI AC World and AC Europe High Dividend Yield Index. Non-core allocations are represented by Chicago Board Options Exchange S&P 500 BuyWrite Index, Barclays Global Contingent Capital Index Value Unhedged USD, SPDR ICE Preferred Securities ETF, FTSE EPRA/NAREIT Asia Pacific Index and FTSE EPRA/NAREIT Global Index.

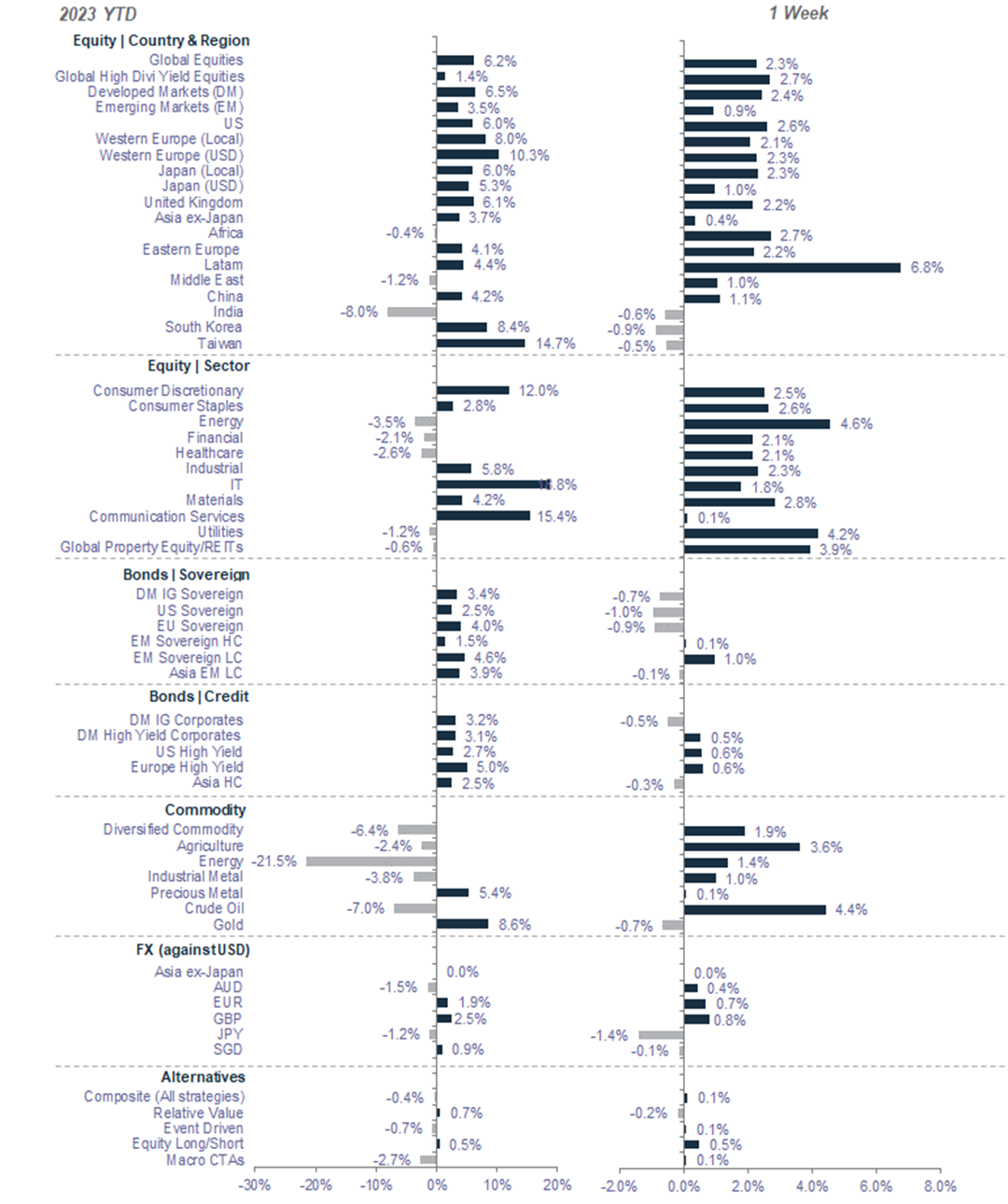

Market performance summary

*All performance shown in USD terms, unless otherwise stated

*YTD performance data from 31 December 2022 to 30 March 2023 and 1 week-performance from 23 March 2023 to 30 March 2023

Key events

Explanatory notes

1. The figures on page 5 show allocations for a moderate risk profile only – different risk profiles may produce significantly different asset allocation results. Page 5 is only an example, provided for general information only and they do not constitute investment advice, an offer, recommendation or solicitation. They do not take into account the specific investment objectives, needs or risk tolerances of a particular person or class of persons and they have not been prepared for any particular person or class of persons.

2. Contingent Convertibles are complex financial instruments and are not a suitable or appropriate investment for all investors. This document is not an offer to sell or an invitation to buy any securities or any beneficial interests therein. Contingent convertible securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (EEA) (each as defined in the Policy Statement on the Restrictions on the Retail Distribution of Regulatory Capital Instruments (Feedback to CP14/23 and Final Rules) (“Policy Statement”), read together with the Product Intervention (Contingent Convertible Instruments and Mutual Society Shares) Instrument 2015 (“Instrument”, and together with the Policy Statement, the “Permanent Marketing Restrictions”), which were published by the United Kingdom’s Financial Conduct Authority in June 2015), other than in circumstances that do not give rise to a contravention of the Permanent Marketing Restrictions.

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2025, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘Sustainable Investments’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures