- PayNow

- Proxy Registration

- Payees with Proxies

- PayNow Transfers

- Alerts

- PayNow FAQs

Overview

Pay Now is an enhanced funds transfer service to allow customers to send and receive Singapore Dollar funds from one bank to another in Singapore through various payment modes by using a ‘Proxy’

The sender does not require the recipient’s bank and account number when transferring funds via Pay Now

Corporate Proxy & How it works?

Proxy: Company Unique Entity Number

How it works?

| Creating a proxy | Transferring funds using PayNow |

|---|---|

|

|

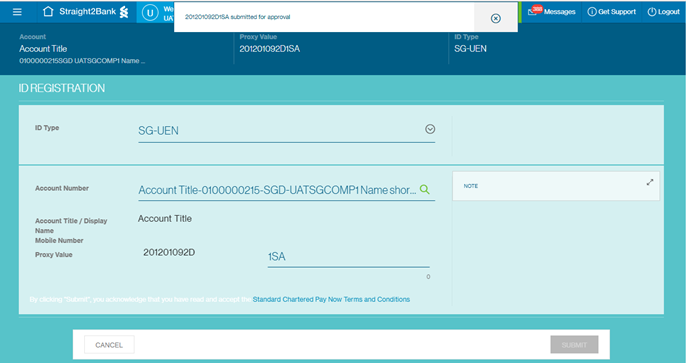

Register New Proxy

One of the ways to register your new proxy is by manually keying in the detail on Straight2Bank screen.

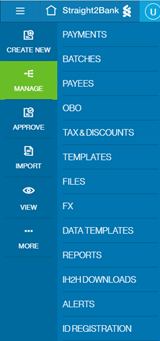

Start from the options on the left. Go to “Create New” and click “ID Registration”

On this page, choose :

- ID Type as always SG-UEN for PayNow

- the Account Number for which you would like to register your proxy and

- you can opt to key in a 3 character suffix to your UEN and submit for approval

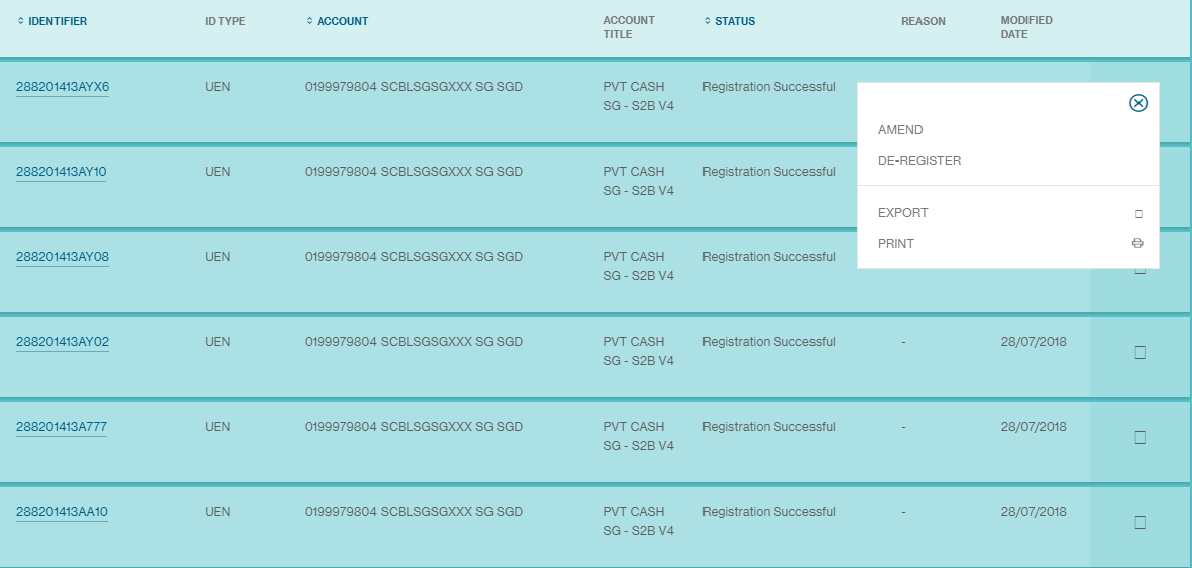

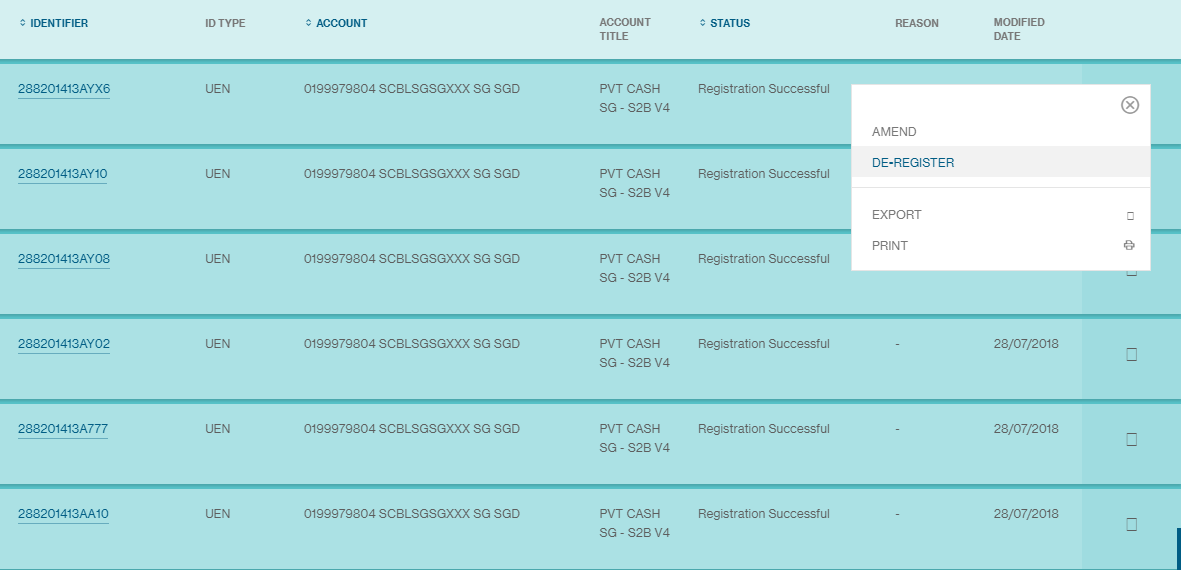

Amend Registered Proxy

You can opt to amend your registered proxy. You can either amend your account number or the suffix of the UEN for same account number.

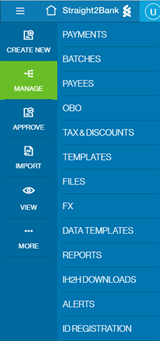

Start from the options on the left. Go to “Manage” and click “ID Registration”

On this page, :

- Choose the Proxy that you would like to amend and click on the action button

- Click amend option

On the resultant screen,

- You can either amend the account number or

- You can amend the 3 character suffix for the same account number

De-Register Registered Proxy

You can opt to de-register your registered proxy.

Start from the options on the left. Go to “Manage” and click “ID Registration”

On this page, :

- Choose the Proxy that you would like to De-Register and click on the action button

- Click De-Register option

On the resultant screen, you can confirm de-registration and can also key in the reason for your reference

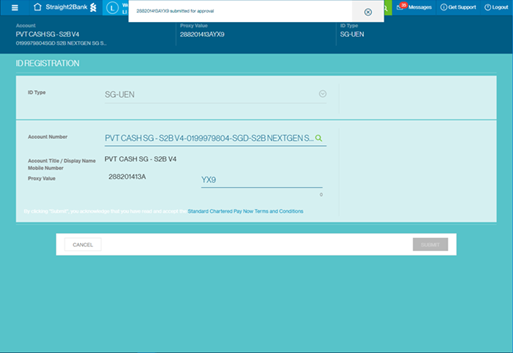

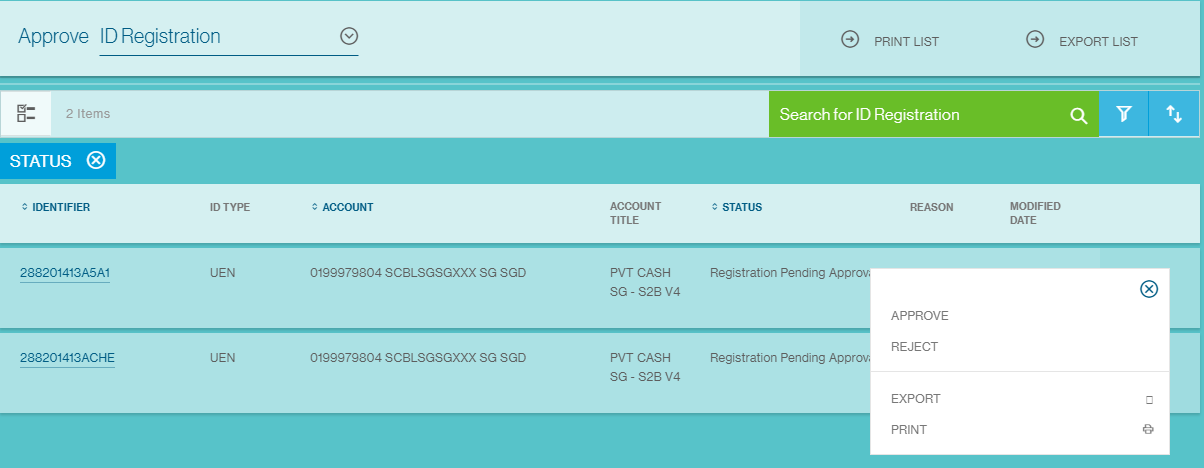

Approve Proxy

If you are an approver, you can approve a New Proxy , Amended proxy and a de-registered proxy that was created by an operator. You will need a physical token to approve. Refer to “Use a Vasco Token for Approval” on how to approve using physical token.

Start from the options on the left. Go to “Approve” and click “ID Registration”

On this page, :

- Choose the Proxy that you would like to approve and click on the action button

- Click approve option

On the resultant screen, you can provide your comments and approve the proxy. You will be prompted to key in the challenge response which you can get by using the physical token that you hold. Refer to “Use a Vasco Token for Approval” for detail on how to approve using physical token.

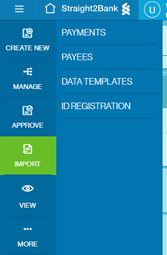

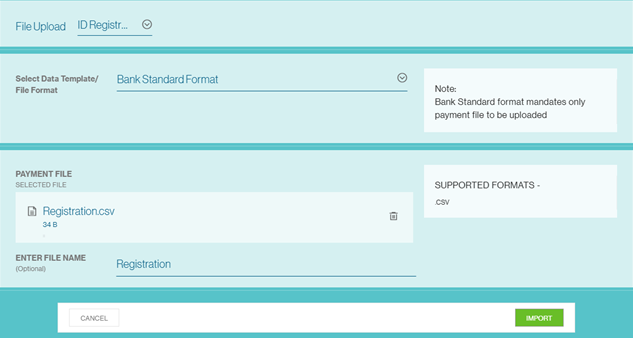

Import Proxy

If you want to register, amend or de-register more than 1 proxies, you can opt to import a file with proxy details

Start from the options on the left. Go to “Import” and click “ID Registration”

On this page, :

- Choose the File Upload option to be ‘ID Registration’

- Browse the file from your computer to upload and click ‘Import’ button

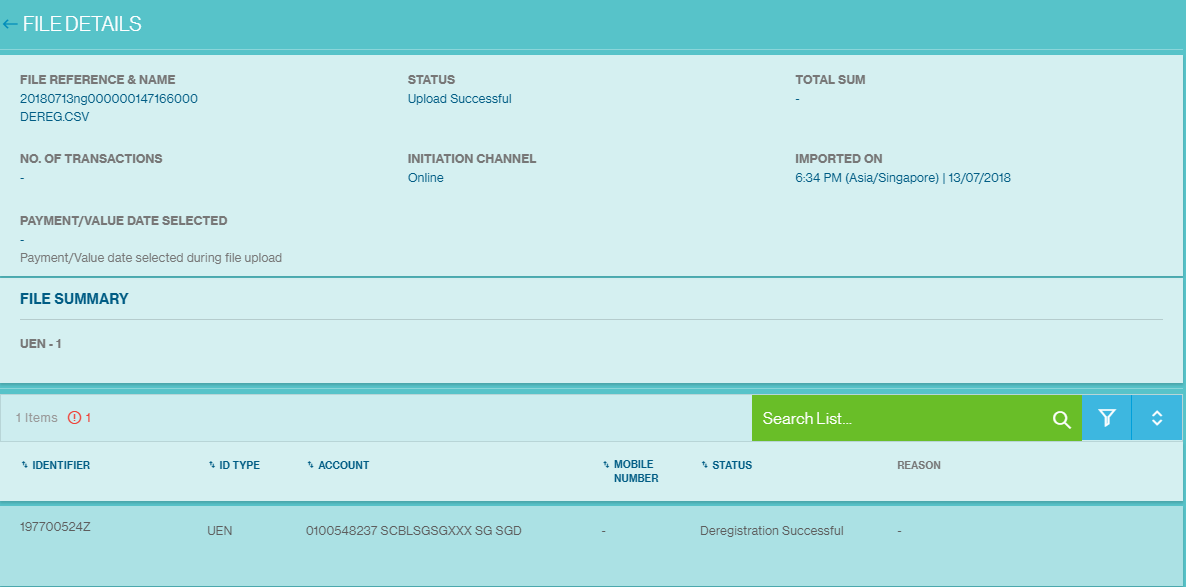

To check if your file was imported successfully,

Start from the options on the left. Go to “Manage” and click “Files”

On this page, :

- You can view the status of the file

From this page you can click on the file reference & name of the file that you imported to view the summary of the file with detail on the number of proxies that you have successfully imported with their status. The errors, if any will be also summarised here.

Below is the file format that you should use to import proxies

* If you would like to amend a proxy, please de-register and then register it back

| No | Field Name | Length | List of Possible Values | Mandatory (Yes/No) | Remarks |

|---|---|---|---|---|---|

| 1 | Operation* | X(1) | A / D | Yes | A - New D - De-Register |

| 2 | Country | X(2) | IN / SG | Yes | For Singapore, this should be SG |

| 3 | Account Number | X(34) | Yes | For Singapore, only SGD account supported | |

| 4 | Currency Code | X(3) | No | For Singapore, account currency should be SGD and hence value of this place holder should be SGD | |

| 5 | Mobile Number | X(10) | Conditional | Not applicable for Singapore | |

| 6 | Identifier Value | X(140) | Mandatory | For Singapore, UEN should be provided in this field | |

| 7 | Identifier Type | X(12) | MMID / VPA / UEN | No | For Singapore, only UEN is supported. |

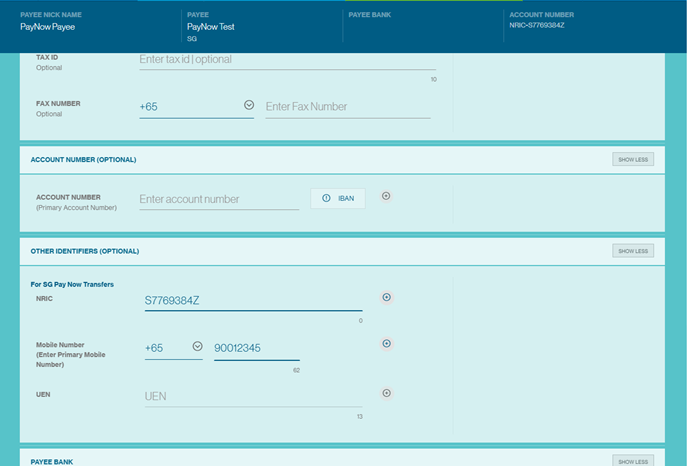

Create Payee with Proxies

You can have payee/beneficiary maintained with proxy detail for you to do PayNow Transfers

Start from the options on the left. Go to “Manage” and click “Payees”

On this page, :

- You can provide the proxy (NRIC or Mobile Number or UEN)

- For complete detail on how to create a payee refer to “Create Payee”

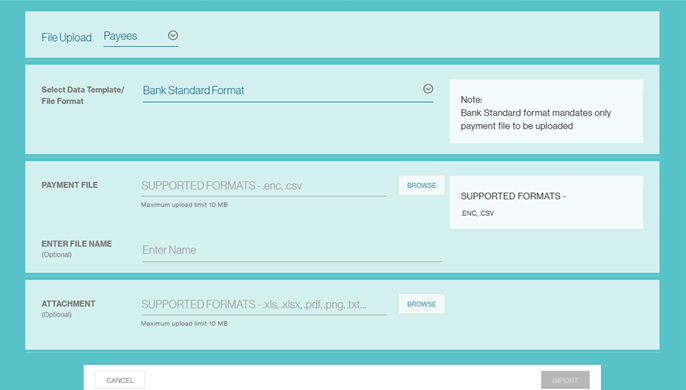

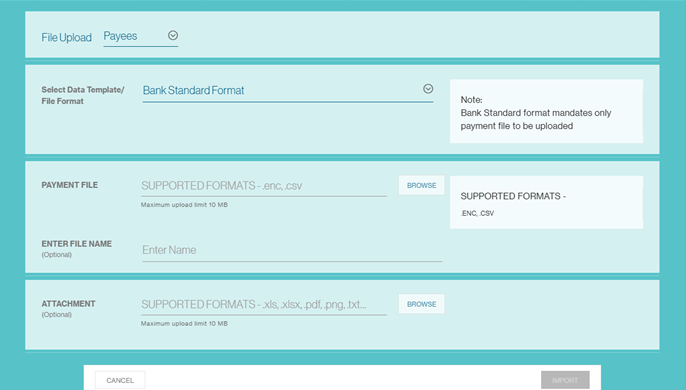

Import Payee with Proxies

If you have more than one payees to be created or maintained with proxies, you can opt to import a file of payees.

Start from the options on the left. Go to “Import” and click “Payees”

On this page, :

- Choose the File Upload to be ‘Payees’

- Browse the file from your computer to upload and click ‘Import’ button

- For further details on how Bulk Import for Payee works, refer “Bulk Import Payees”

File Format

- Refer to “Payee Bulk Import Format” for the file format specification

- Provide the Proxy Type in the field – ‘Beneficiary Identification Type’

- The possible values for Proxy Type are MOB (for mobile number), NID (for NRIC) & CID(for UEN)

- Provide the Proxy value in the field – ‘Beneficiary Account Number’

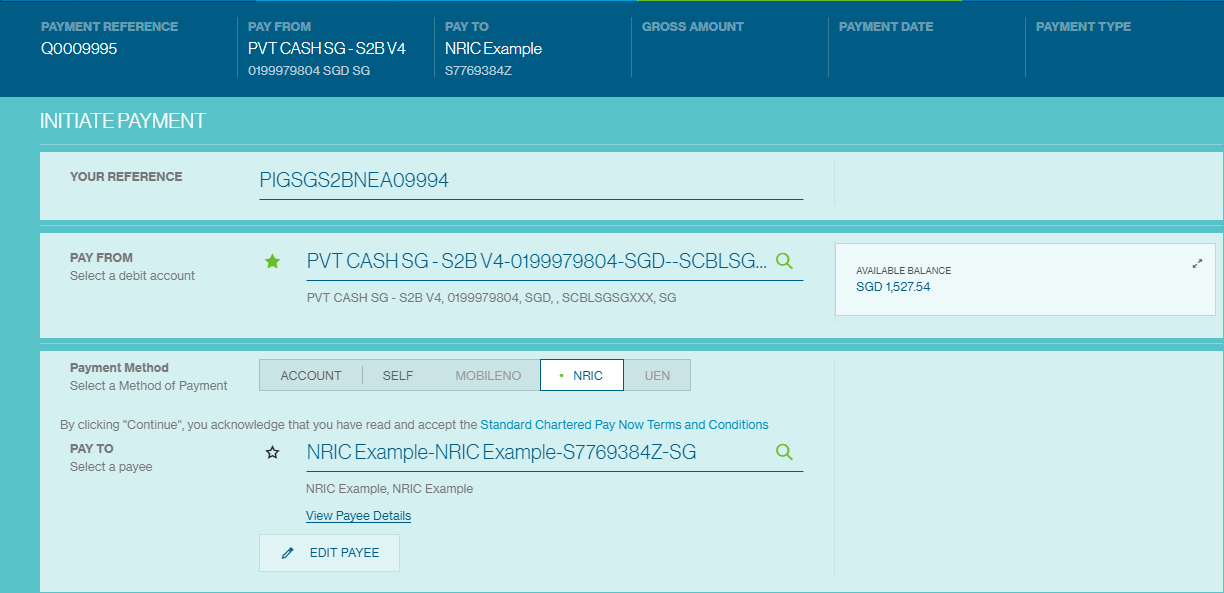

Create Payment with Payee identified by a proxy (NRIC, Mobile Number, UEN)

Straight2Bank will allow you to make a payment (RTGS or ACH or Payroll or IBFT/FAST) with payment to a NRIC or a Mobile or a UEN

Start from the options on the left. Go to “Create” and click “Payment”

On this page, :

- Choose the payment method as ‘MOBILENO’ or NRIC or UEN as appropriate

- Choose a Payee/Beneficiary to make payment to

- Provide all other mandatory information to make a payment.

Click validate button

You can verify the Nick Name/Display Name of the beneficiary displayed and continue to complete the payment

- Refer “Create Payments” for further detail on how to make a payment

- Payment to a Proxy can be done for all local transfers. This includes Inter Bank GIRO (ACH)/Payroll, RTGS & Instant Bank Fund Transfer(IBFT)/ FAST

Import Payments with Proxies

If you have more than one payment to be created, you can opt to import a file of payments.

Start from the options on the left. Go to “Import” and click “Payments”

On this page, :

- Choose the File Upload to be ‘Payments’

- Browse the file from your computer to upload and client ‘Import’ button

- For further details on how Bulk Import for Payment works, refer “Bulk Import Payments”

File Format

- Refer to “Payments Bulk Import File Format” for the file format specification

- Provide the Proxy Type in the field – ‘Pay Sub Product Type’ (P172)

- The possible values for Proxy Type are PTM (Pay to Mobile), PTN (Pay to NRIC) & PTU(Pay to UEN)

- Provide the Proxy value in the field – ‘Beneficiary Account Number’ (P20)

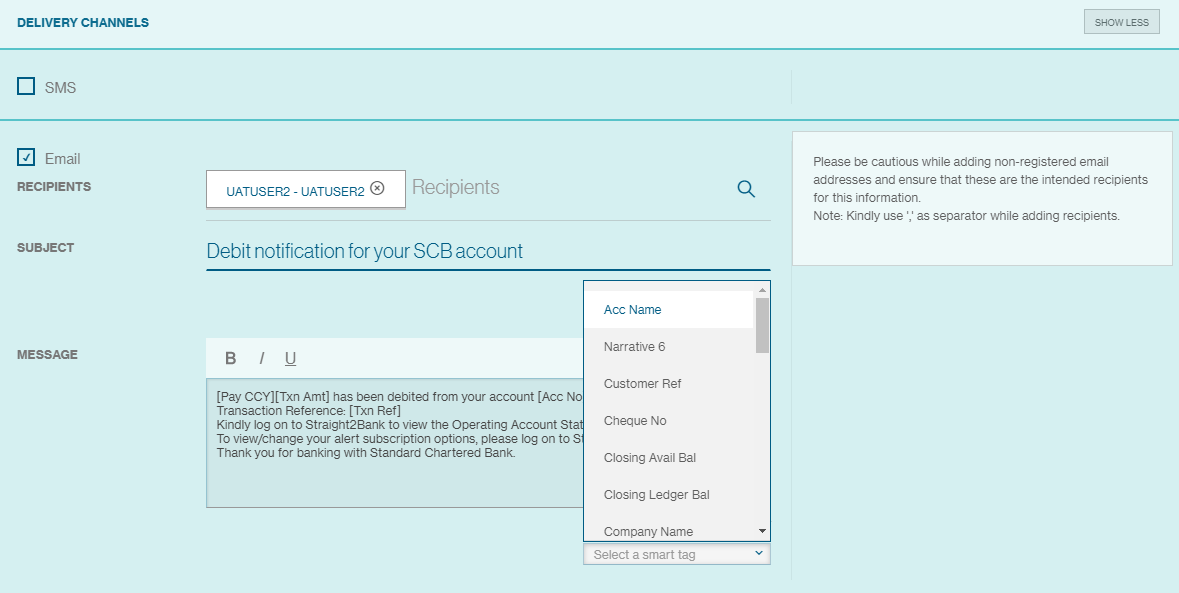

Debit/Credit notification

You can set up an alert to get notified of any incoming debit or credit transfers which will include PayNow transfers.

The smart tags of these alerts have been enhanced to include all the 6 lines of narration. This will help you to add them into the subject of the email alert or in the body. The text ‘PayNow’ in these narration will help you identify PayNow debit and credits.

For more details on how to create alerts, refer to “Subscribe Alerts”

Frequently Asked Questions

PayNow

- What is PayNow Corporate?

PayNow Corporate will enable businesses/corporates and the Singapore Government to pay Singapore Dollar funds instantaneously to eligible retail and corporate customer’s bank accounts held with SCB and other PayNow participating banks via the use of such customer’s registered PayNow proxy. PayNow Corporate will also enable businesses/corporates and the Singapore Government to receive Singapore Dollar funds instantaneously from eligible retail and corporate customers of PayNow participating banks by linking their Singapore bank account a unique identifier (i.e. a “proxy”) (see “PayNow - Registration” below). - Will my SCB bank account number be affected?

No. Your account number remains the same. - What benefits does new PayNow corporate offers to me?

- Fast – Make and receive payments almost instantly

- Easy – Enjoy ease of cash flow with reduced paperwork and better customer experience

- Secure – No need to provide your bank account details (i.e. bank and account number) to the payer

PayNow – Registration

- Are all my accounts eligible for proxy registration?

No. Only Singapore dollar accounts are eligible for PayNow Registration. In addition, please note that certain accounts (e.g. Time deposit / fixed deposit accounts) are also not eligible. - What can I register as a proxy for my corporate bank account? Can I register my NRIC or mobile number for PayNow Corporate account?

No you cannot register an NRIC or mobile number as a proxy for PayNow Corporate. PayNow Corporate currently only allows proxies comprising of:- Your registered Unique Entity Number (“UEN”) (please refer to https://www.uen.gov.sg/ for more information on UEN)

- Your registered UEN together with a three alphanumeric character suffix. Each registered proxy can only be linked to one account. However, different proxies may be registered with different bank accounts (whether with the same bank or with different banks).

Sample Customer UEN Suffix (Alpha, Numeric) Proxy Acceptability 201812345X - 201812345X Acceptable 201812345X 0A1 201812345X 0A1 Acceptable 201812345X $$$ 201812345X $$$ Not Acceptable 201812345X _5_ 201812345X _5_ Not Acceptable

PayNow – Registration

- What information is required for proxy registrations?

The following information will be required as part of your proxy registration:- Your registered name

- Your bank account number

- Your bank account name

- Your proposed proxy

- Can I amend my registered proxy?

Yes. If your proxy is registered to an SCB account, you can amend the following details relating to your proxy:- Your bank account number

- the suffix relating to such proxy (if your proxy comprises both UEN and a suffix. You cannot amend the UEN portion of your proxy) If your UEN changes or is no longer valid, you will need to inform us and deregister all your existing proxies containing such UEN.

- Can I deregister proxy?

Yes. If your proxy is registered to a SCB account, you can deregister. - What are the currencies supported by PayNow Corporate?

Only SGD dollar accounts are supported. - Can I register the same PayNow Corporate proxy to different account?

No, the same proxy cannot be linked to multiple accounts. If the proxy has already been registered and linked to a bank account, the same proxy cannot be linked to another account. 1 unique proxy can only be linked to 1 account. If you wish to link an already registered proxy to another account, you will need to first de-register the proxy and re-register it with the other account as the linked account. - Can I register multiple PayNow Corporate proxies to the same bank account?

Yes. As long as the proxy proposed to be registered and linked to the bank account is unique (i.e. not currently registered and linked to another bank account), it can be registered and linked to that bank account. - If I have already registered for PayNow corporate with another participating bank, can I register for PayNow with SCB using the same UEN?

Yes. The same UEN can be used but the proxy created should be unique as the system does not allow duplication. In such scenario, if the first proxy registered comprises only your UEN, any subsequent proxy should be a combination of UEN + unique 3 character (alphanumeric) suffix.

UEN Suffix (Alpha, Numeric) Bank X 201812345X - SCB 201812345X 0A1

PayNow - Payments

- Do I need my beneficiary’s bank account details when making a PayNow transfer?

No. You require only the beneficiary’s proxy information. - How do I know if the proxy is accurate?

When you make a payment by keying in one transaction at a time via Straight2Bank NextGen, you will get to see a “Nickname” of the proxy holder. You should check whether the displayed “Nickname” belongs to the beneficiary before transferring the funds out. If you are making a payment via bulk import option on Straight2Bank, then the payment will get rejected if the proxy is invalid with an appropriate reason. - Will I be able to transfer to a PayNow proxy if I have not registered for PayNow corporate?

Yes. As long as the beneficiary has registered with PayNow, you can make a PayNow transfer - As a corporate, can I make payment to individual beneficiary?

Yes. As long as the beneficiary has a proxy registered, you can make a PayNow transfer. - What are the different payment types for PayNow transaction?

FAST / Instant Bank Fund Transfer(IBFT)

Inter Bank GIRO (ACH) / Payroll

RTGS - On Straight2Bank, can I batch PayNow payments with other payments (eg: Telegraphic Transfers or ACH/FAST/RTGS that is made to a beneficiary account rather than a proxy)?

Yes. However, note that if you have opted for consolidated debit, please be aware that there will be 2 debits. One for PayNow transfers and another for non-PayNow transfers. Hence, we suggest you group all PayNow transfers in one batch.

PayNow – Collections

- Can I receive funds without a registering my proxy (UEN) set up via PayNow?

No. You will need to register your proxy(UEN) to collect funds via PayNow. - Can my retail clients make payment to my corporate account?

Yes. As long as you have valid registered proxy that is linked to your corporate account, you will be able to receive funds from retail clients via PayNow.

PayNow – Alerts

- Do I get alerts on payment transfer?

Yes. You can set up alert in Straight2Bank NextGen and receive notifications via email or download/receive reports. - Will there be any Payee advices?

Yes. We do have Payee advices that will be sent to the beneficiaries.