- Get Started

- Subscribe Reports

- Subscribe Alerts

- MT103 Copy

Overview of Reporting & Inquiry Services

Reporting & Inquiry services on Straight2Bank are offered as Standard Editable Reports. These are simple and ready to use reports offering the latest and up to date information of your financial transactions with the Bank.

An array of reports ranging from summaries to details, intra-day or prior-day is available to you for online viewing and scheduled generation. Transactions in accounts held with Standard Chartered locally or in other locations (multi-countries), across multiple currencies, and multiple entities will be available in these reports. Furthermore, you will be able to define the criteria for each of these reports to easily narrow down to the information you are looking for.

All reports in Straight2Bank NextGen Web that are not downloaded or accessed by users for 90 days from the date of report generation will be automatically purged. Hence, we strongly encourage users to download and save the reports within the 90-day period for their future reference.

Reports Available on Straight2Bank

Straight2Bank offers an array of reports to provide clients with enhanced visibility. Listed below are the available report categories and are available in standard and editable versions and/or formats

All reports in Straight2Bank NextGen Web that are not downloaded or accessed by users for 90 days from the date of report generation will be automatically purged. Hence, we strongly encourage users to download and save the reports within the 90-day period for their future reference.

Payables - Payment Transactions

RFQ Deals Report

This report will provide you with information on ‘Standalone FX Deals’ booked using Straight2Bank.

The report will include information of the deal amount, utilised, available amount and tenor. This report is available only in Singapore and Hong Kong currently.

Consolidated Payments Items

This report will include a consolidated payment items with payment instructions status such as “Sent to Bank”, (e.g.) “Under Processing”, “Debit in Progress”, etc.

Deleted Transaction

List of all payment transactions that are deleted in a date range.

Debit / Credit Advice

A summary of debit and credit transactions on operating accounts held with us will be available in this report. The report is available only for account held out of US and UK

Debit / Credit Detail

Details of the debit and credit transactions will be available in this report. The report is available only for account held out of US and UK.

Outstanding Payment Items

Payments initiated through Straight2Bank but are not yet “Sent to Bank” will be available in this report (e.g.) “Under Processing”, “Cheque Ready for Pickup” and other statuses.

Processed Payments Items

Electronic payment instructions initiated through Straight2Bank and in their final status (based on the transaction type) will be included in this report (i.e.) fully processed.

Payment Authorization Report

List of all payments authorized by an authorizer in a date range.

Payment Reconciliation

All electronic payments created on Straight2Bank with their latest statuses will be available in this report.

This report will be useful for reconciliation purposes to know the status of payments as of a particular date and the report will include payments that have been sent to bank for processing as well as those that have not been submitted to the bank as yet.

Working Capital - Deposit Accounts

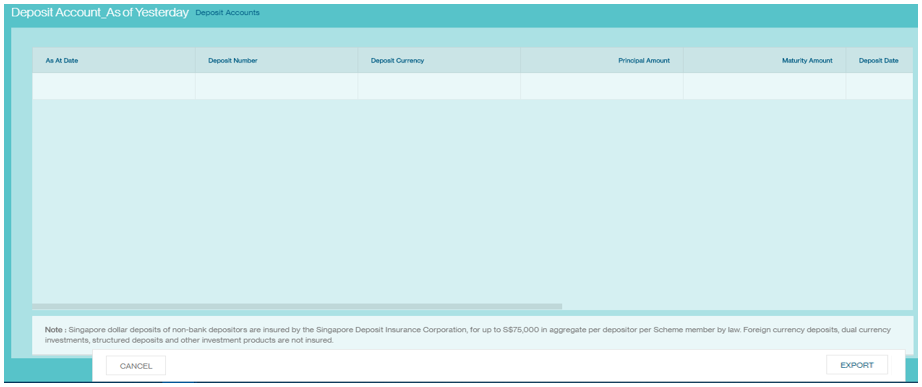

Deposit Account

Key information on term deposits such as deposit period, currency, account number, principal amount, maturity amount and interest rate maintained with us are available in this report.

This report will provide information on the term deposits as of a specific date.

This report will carry information as of previous (prior) day.

Deposit Account and Balance History

Historical balances of the term deposits maintained with us will be available in this report.

The latest information available in this report will be as of previous (prior) day.

Working Capital - Loan Accounts

Loan Account Balance History

Historical balances of loan account(s) maintained with us will be available in this report. The latest information available in this report will be as of previous (prior) day.

Loan Account

Information on loan account(s) held with us as of a particular date will be available in this report.

This report will carry information as of previous (prior) day and include principal amount, loan account number, branch details, last repayment’, next repayment and other information.

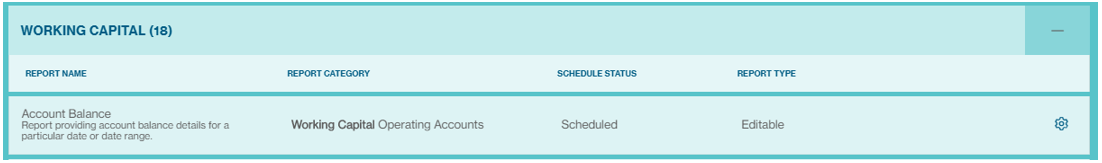

Working Capital - Operating Accounts

Account Balance

A consolidated report that provides information about your Operating, Deposit and Loan account(s) for a specified reporting period.

The report shows the available balance (for the specified dates) for the accounts held with us locally and across other locations. It includes account number, account name, currencies, entities and account classes (‘Operating’, ‘Deposit’ and ‘Loan ‘).

Information is grouped by account type, entity, bank / location and currency.

Facility Lines Report

This report provides information on the facility account (overdraft) maintained with us.

Information provided in this report includes limit amount, available amount, limit number, limit type and account class.

The latest information available in this report will be as of previous (prior) day.

Intra-day Transaction Details Report

This report will provide details of all intra-day transactions on accounts maintained with us and third party banks as setup on Straight2Bank.

Details in this report will include transaction type, date, amount, description and other information

Intra-day Transaction Summary Report

This report will provide a summary of all intra-day transactions in accounts maintained with us or third party banks as setup on Straight2Bank.

Information available in this report includes transaction amount, transaction details and transaction type are some of the information available in this report.

Multibank Account

This report provides you with transaction information on accounts held with other banks as configured for access through Straight2Bank

Operating Account Balance History

This report provides the historical account balance information of the operating account(s) maintained with us and third party banks as configured on Straight2Bank.

The latest information available in this report will be as of previous (prior) day.

Operating Account Details

Comprehensive operating account related information such as company name, bank branch, country, currency and account number will be available in this report.

Other information in this report include opening, closing balance, float details, accrued interest (if any) and last transaction date.

The latest information available in this report will be as of previous (prior) day.

Operating Account Statement

The Operating Account statement report provides you with previous (prior) day and intra-day transaction information on accounts held with us in any location. Information in this report will include opening, closing ledger balances, transaction details and transaction amount.

Operating Account Transaction Details

This report will provide details of historical transactions on accounts maintained with us and third party banks as setup on Straight2Bank.

Details in this report will include transaction type, date, amount, description and other information.

Operating Account

This report will provide end of day (prior day) balance information of the ‘Operating Account(s)’ maintained with us and third party banks as of a particular date.

Information in this report will include opening, closing ledger balance and available balances.

The latest information available in this report will be as of previous (prior) day.

Report Category

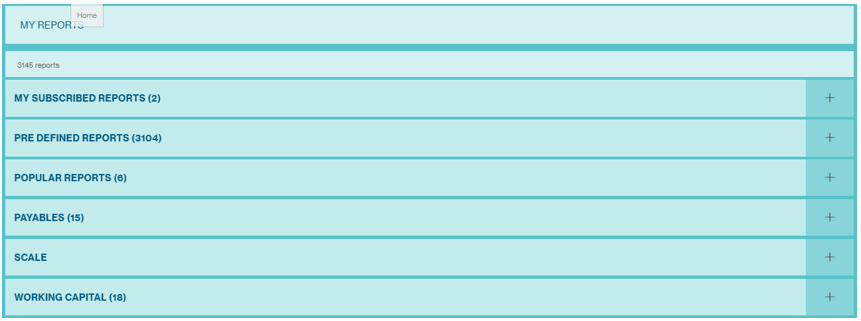

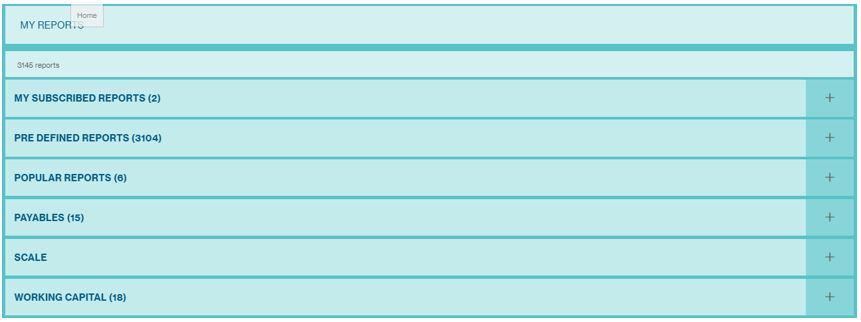

The new Straight2Bank reporting provides you with an array of reports to assist you. Access to these reports are based on your service entitlement and have been categorized for navigation ease.

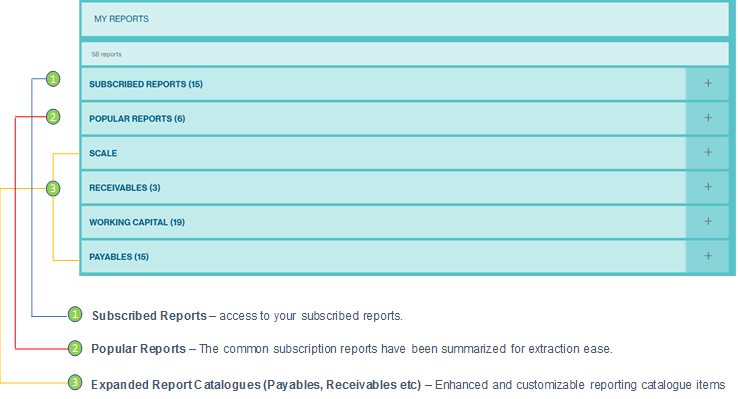

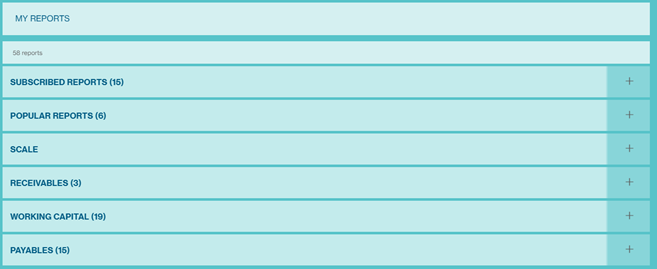

First, reports have been catgeorized for ease in navigation :

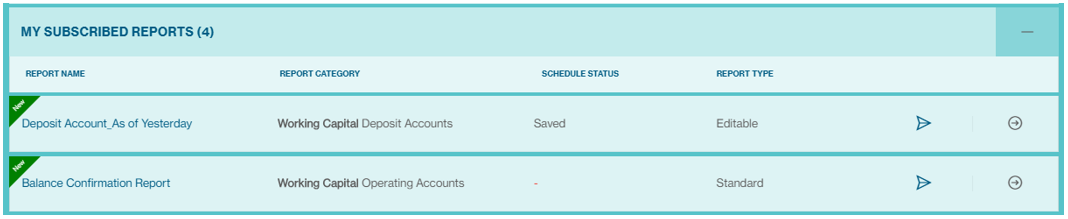

- MY Reports – access to your current report subscription

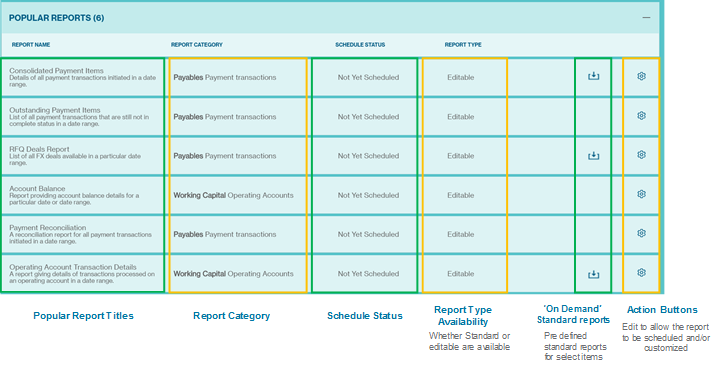

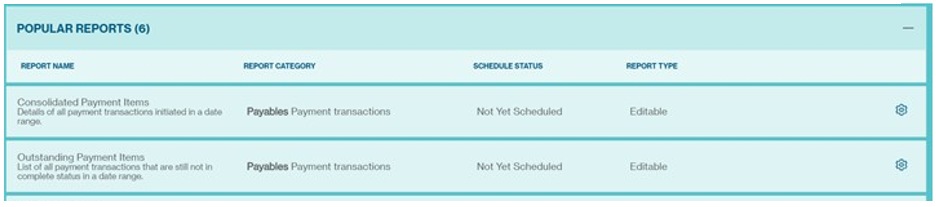

- Popular Reports – The common subscribed reports have been summarized for extraction ease

- Expanded Report Catalogues (Payables, Working Capital, & Receivables)) – Enhanced and customizable reporting catalogue items based on services

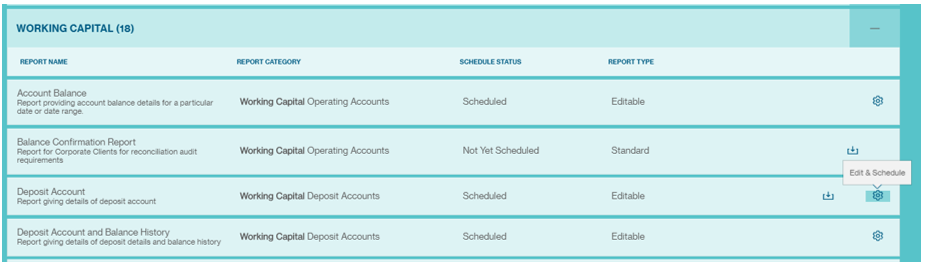

The report category is expandable and would reveal detailed reports you are entitled to and the available options (standard format and editable feature availability)

The “Function” level control is to enable users to access the various types of Reports such as “Operating Account Statement”, “Operating Account Details”, “Loan Account”, etc.

The “Data” level control is to allow a user to access one or more accounts linked to each of the Reports. It will be possible to configure a user, “User A” with access to “Operating Account Balance” only for “Account 1” while another user, “User B” may have access to “Operating Account Balance” and “Operating Account Details” for “Account 1” and “Account 2”.

Availability & Control

Standard and Editable Report versions are default service for all Straight2Bank clients. Each of the individual reports is available for user entitlement control at two levels

Function level

Data level

The “Function” level control is to enable users to access the various types of Reports such as “Operating Account Statement”, “Operating Account Details”, “Loan Account”, etc.

The “Data” level control is to allow a user to access one or more accounts linked to each of the Reports. It will be possible to configure a user, “User A” with access to “Operating Account Balance” only for “Account 1” while another user, “User B” may have access to “Operating Account Balance” and “Operating Account Details” for “Account 1” and “Account 2”.

All reports in Straight2Bank NextGen Web that are not downloaded or accessed by users for 90 days from the date of report generation will be automatically purged. Hence, we strongly encourage users to download and save the reports within the 90-day period for their future reference.

Standard Reports

Overview

Standard reports are based on the Bank’s prescribed standard formats.

Refer to ‘Report Type’ to identify if the report is Standard or Editable.

All reports in Straight2Bank NextGen Web that are not downloaded or accessed by users for 90 days from the date of report generation will be automatically purged. Hence, we strongly encourage users to download and save the reports within the 90-day period for their future reference.

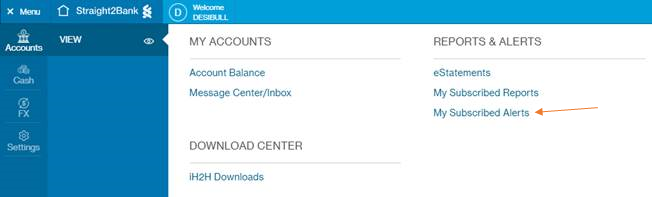

Downloading Standard Reports

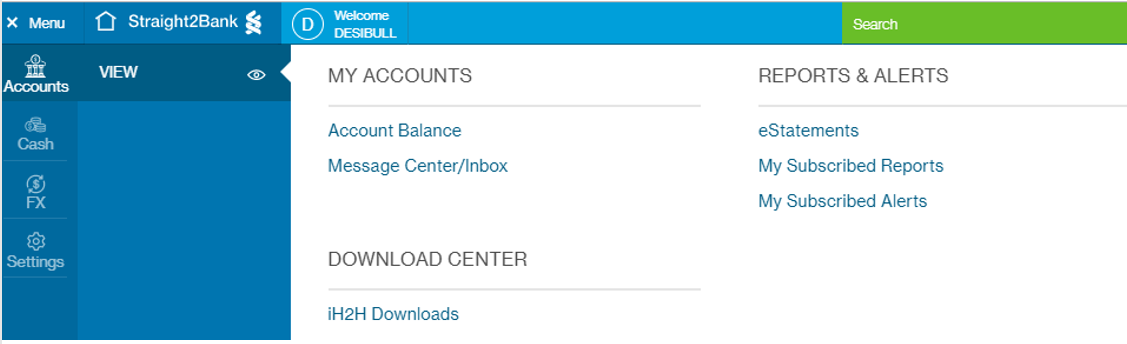

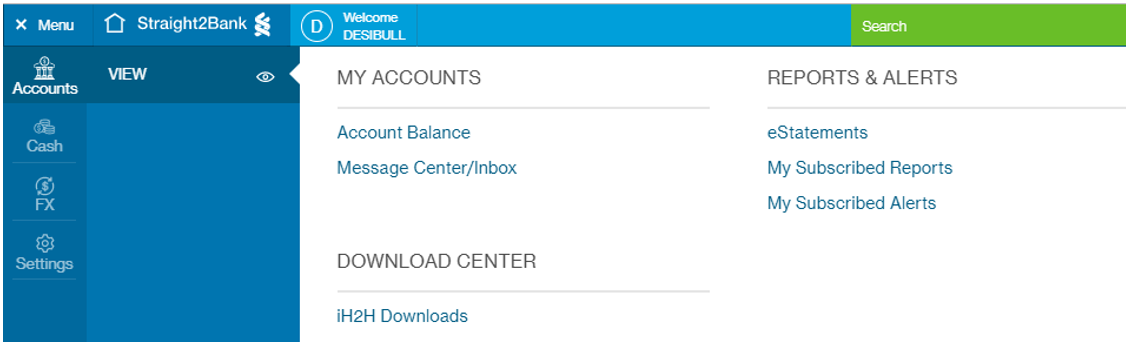

Go to Menu > Accounts > View > My Subscribed Reports

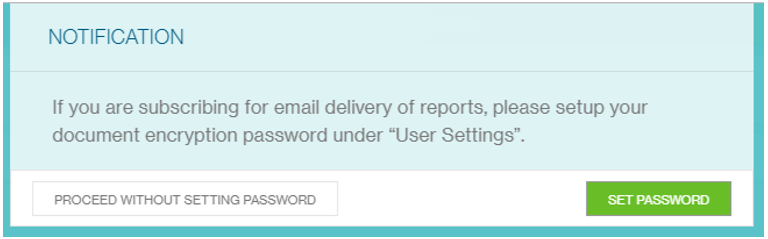

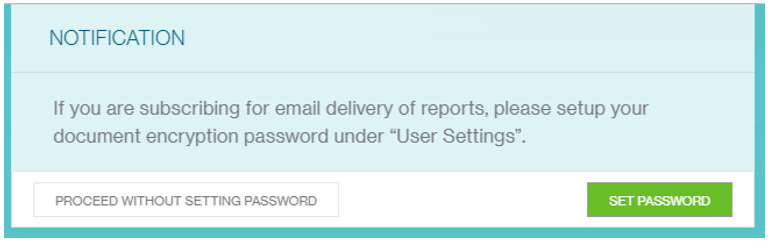

Select ‘Proceed Without Setting Password’ if you do not wish to encrypt your report.

Select the ‘+’ sign to view the dropdown list for each report category.

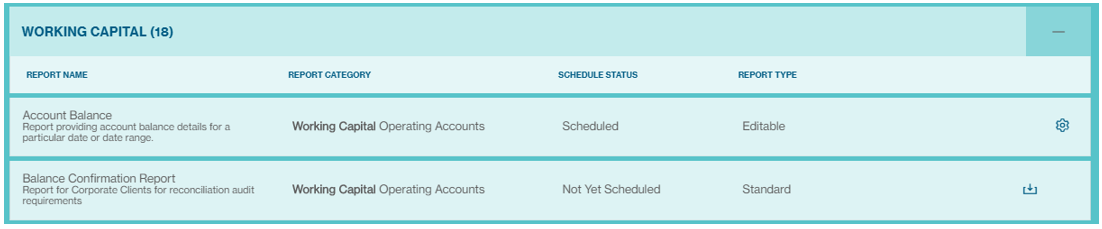

Download the report by selecting the file download icon

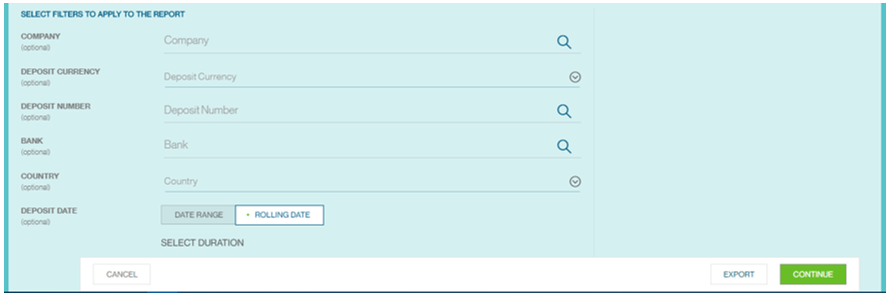

Select the filters to be applied for the report, then select ‘Continue’.

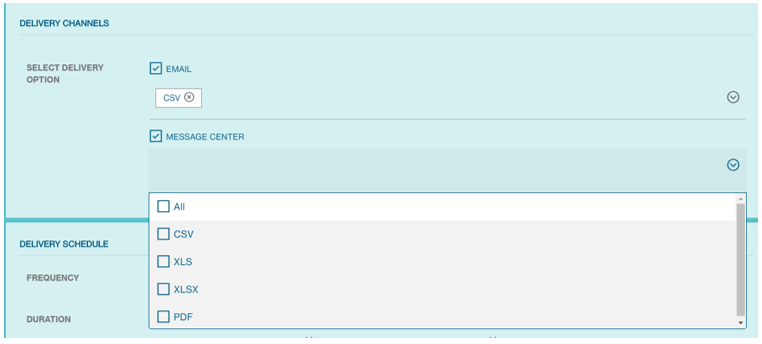

Select the delivery channel and report format.

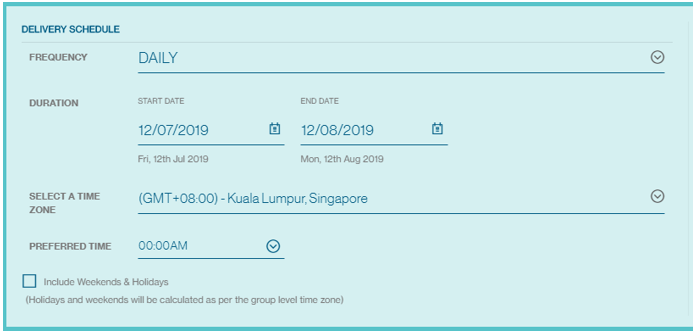

Fill up the fields below

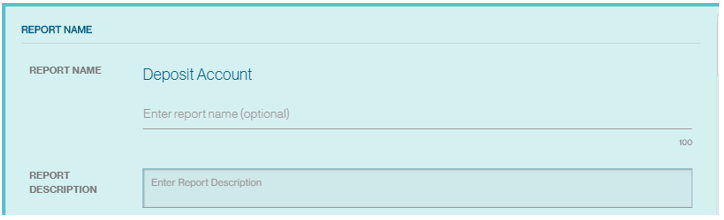

Customise the name of this report and select ‘Submit’. After which, this report will appear in My Reports as a subscribed report.

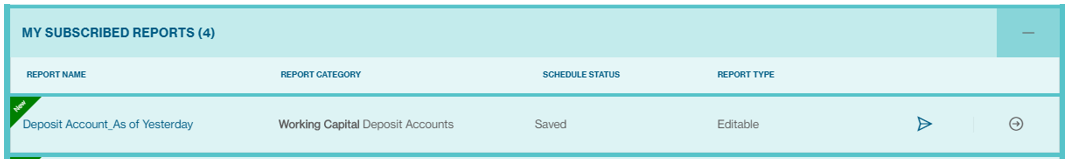

To download a subscribed report, select the arrow icon to first run the report.

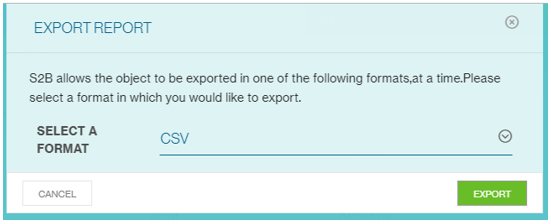

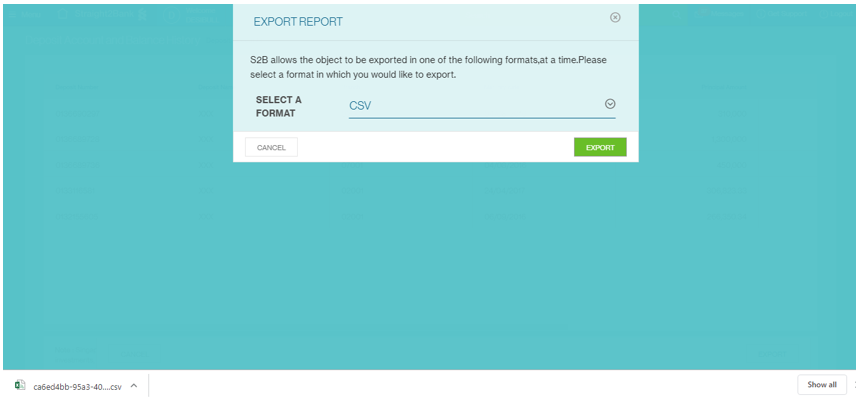

A preview of the report will be shown. Select ‘Export’ to continue.

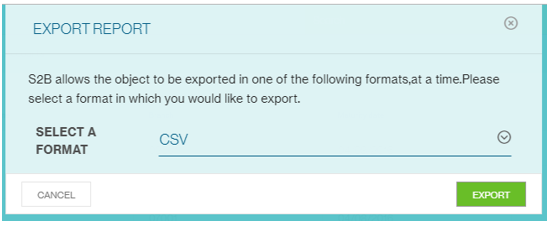

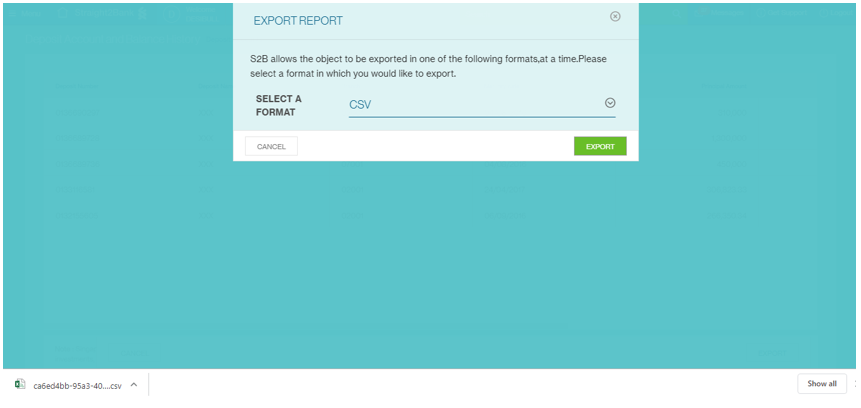

Select the Report Format and select ‘Export’ to trigger the report extraction. Please ensure your popup blocker is disabled.

Editable Reports

Overview

Users can customize their reports to suit their needs – these are indicated as ‘Editable’ under the ‘Report Type’ column. Select the gear icon to edit the report output.

All reports in Straight2Bank NextGen Web that are not downloaded or accessed by users for 90 days from the date of report generation will be automatically purged. Hence, we strongly encourage users to download and save the reports within the 90-day period for their future reference.

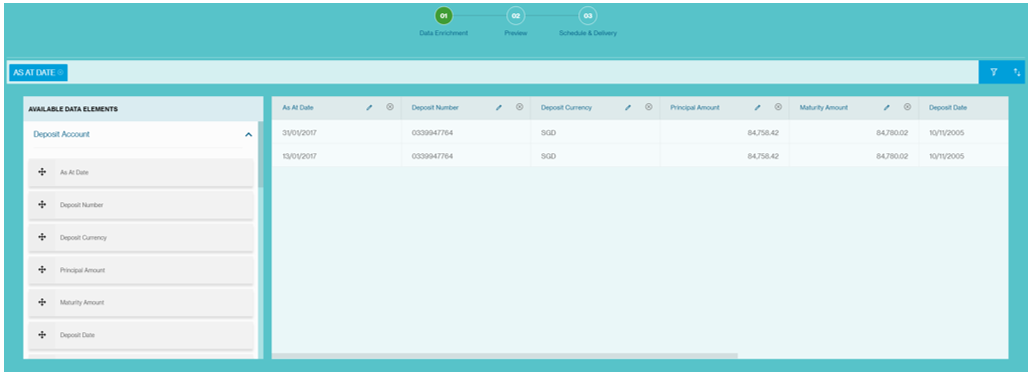

Configuration of Editable Reports

Go to Menu > Accounts > View > My Subscribed Reports

Select ‘Proceed Without Setting Password’ if you do not wish to encrypt your report.

Select the ‘+’ sign to view the dropdown list for each report category.

Download the report by selecting the file download icon

To configure a report, select the gear icon.

Drag and drop additional data columns and use the filter to set the parameters for the report. Select ‘Continue’ once you are done configuring your report.

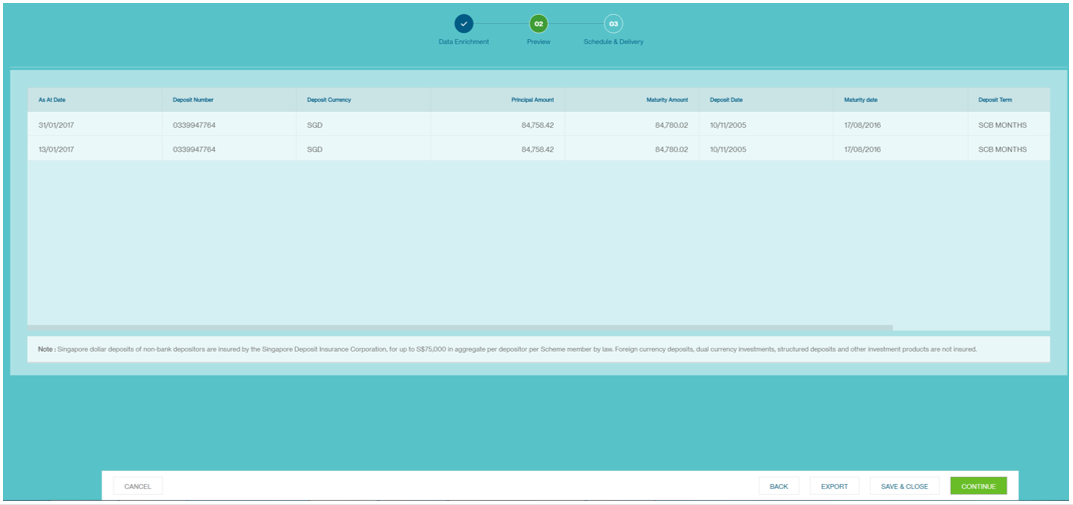

Preview your report based on your configuration and select ‘Save and Close’ to save this customization.

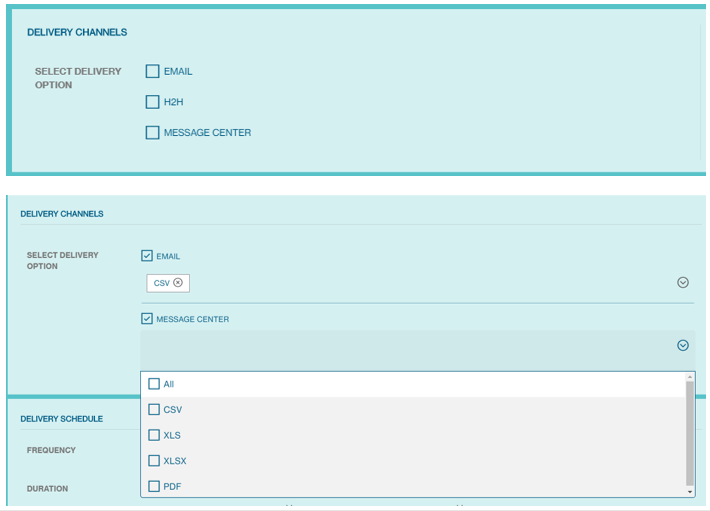

Select the delivery channel and report format.

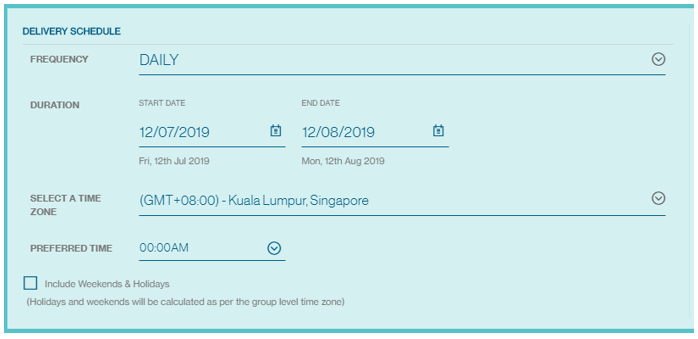

Fill up the fields below

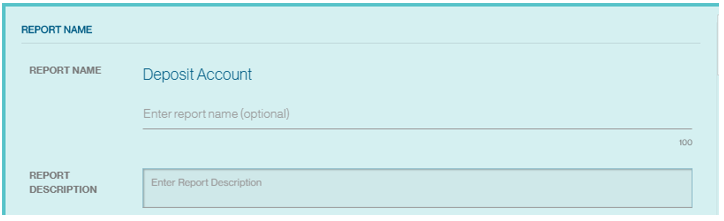

Customise the name of this report and select ‘Submit’. After which, this report will appear in My Reports as a subscribed report.

To download a subscribed report, select the arrow icon to first run the report.

A preview of the report will be shown. Select ‘Export’ to continue.

Select the Report Format and select ‘Export’ to trigger the report extraction. Please ensure your popup blocker is disabled.

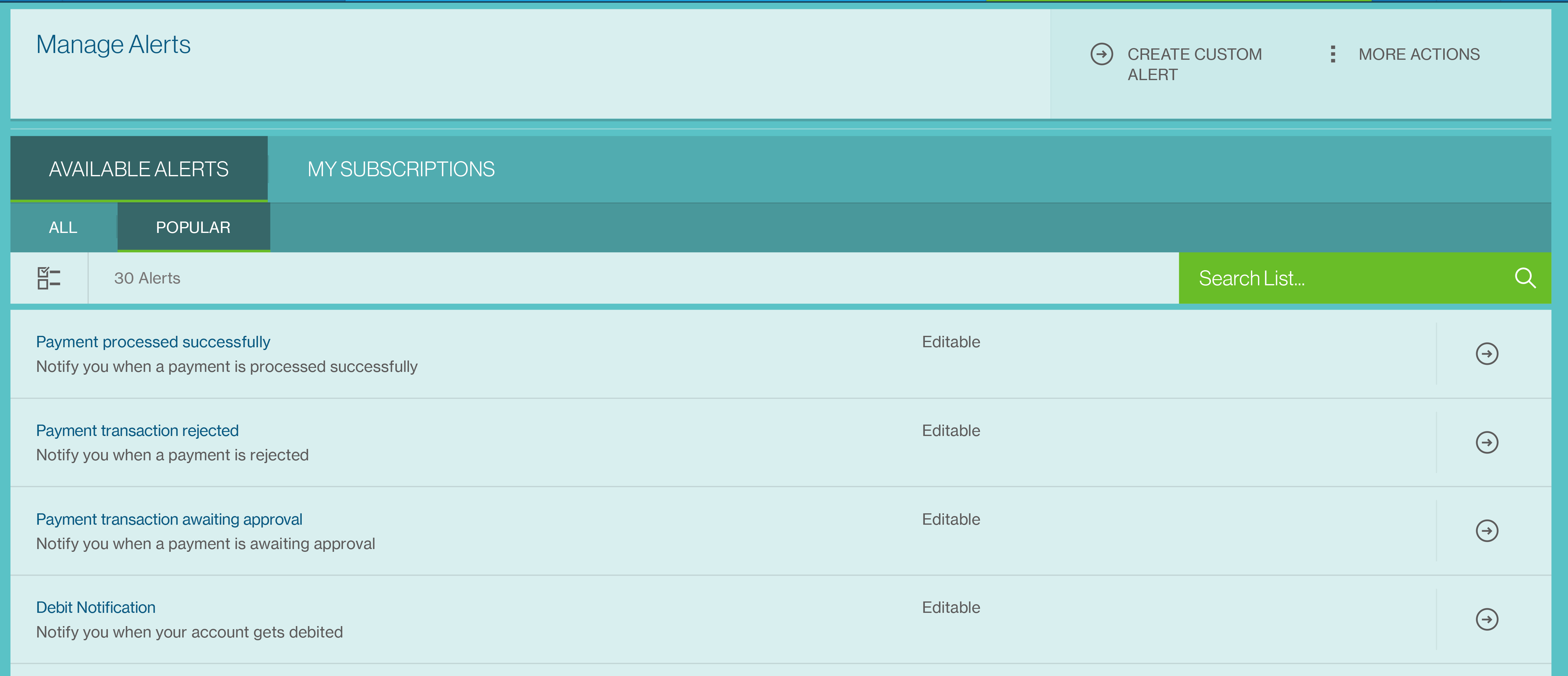

Alerts Available on Straight2Bank

The below list provides a summary of the various alert activities available on Straight2Bank across the different products and their bene fits. Please contact the Bank if y ou need more information on any of these alerts.

Payables - Payments

Payment processed successfully

Alert will be generated when the payments submitted to the Bank have been processed successfully.

This will be useful to be aware of payments have been processed successfully by the bank and inform the beneficiary of the same for next steps.

Payment transaction rejected

Alert will be generated when the payments submitted to the Bank have been rejected by the beneficiary bank for various reasons such as in valid account number, invalid beneficiary, etc.

This will be us eful to be aware of payments have been rejected by the beneficiary bank and inform the beneficiary of the same for next steps.

Payment transaction returned

Alert will be generated when the payments submitted to the Bank have been “Returned” for various reasons such as insufficien t funds, invalid FX, etc.

You will be no tified if the pa yments submitted have been “Returned” by the Bank t o contact and inform the beneficiary of any delays as a result or make alternative arrangements for the payment.

Payment transaction awaiting approval

Alert will be generated when the status of the payment changes to "Completed" (i.e.) after the initiator have created the payments instruction.

The alert is s end to the authoriser. This will be us eful to receive notifications when the payments instruction is awaiting approval.

Credit Successful

Alert will be generated when the payments submitted to the Bank have been credited successfully by the beneficiary bank.

This will be us eful to be aware of payments have been credited successfully by the beneficiary bank and inform the beneficiary of the same for next steps.

Transaction Status Change

Alert will be generated when there is a change in the status of a transaction.

This will be useful to be aware of the change in the status of a transaction.

Approver Alert

Alert will be generated when a transaction is approved by the selected approver.

This will be useful to be aware of payments have been approved successfully by the selected approver, and the status of the payment changes to "fully authorised" / "partially authorised".

Payment Transaction Approved

Alert will be generated when all authorisers have successfully authorised the Payment and is pending to be Sent to the Bank.

This will be useful to be aware of payments have been fully authorised.

Transaction Sent to Bank

Alert will be generated when all authorisers have successfully authorised the Payment and is pending to be Sent to the Bank.

This will be useful to be aware of payments have been fully authorised.

Payables - Batches

Batch Fully Signed

Alert will be generated when the status of the payment batch changes to "Fully Signed" (i.e.) after all the authorisers have authorised the batch.

The alert is send to the “Releaser” (or the user who has “Send to Bank” function). This will be useful to receive notifications when the pa yment batches(es) are ready to be released to the Bank for processing.

Payables - Payee

New Payee Creation and Awaiting Approval

Alert will be generated when a new payee is created and is awaiting approval.

The alert is s end to the authoriser. This will be us eful to receive notifications when the new payee is awaiting approval.

Working Capital - Operating Accounts

Debit Amount

Alerts will be generated based on debit transactions on your account and the criteria configured.

This will be us eful to receive notifications on high-value payments, payments out of certain designated accounts, entities, payment reference and various other parameters.

Credit Amount

Alerts will be generated based on inward credits to your account and the crit eria configured.

This will be us eful to receive notifications on high-value inward receipts, inwards to certain designated accounts, entities, transaction reference and various other parameters.

Closing Ledger Balance

Alerts will be generated based on the threshold of the “Closing Ledger Balance”.

Several parameters are available to define the filter criteria and receive alert notification.

Closing Available Balance

Alerts will be generated based on the threshold of the “Closing Available Balance”.

Several parameters are available to define the filter criteria and receive alert notification.

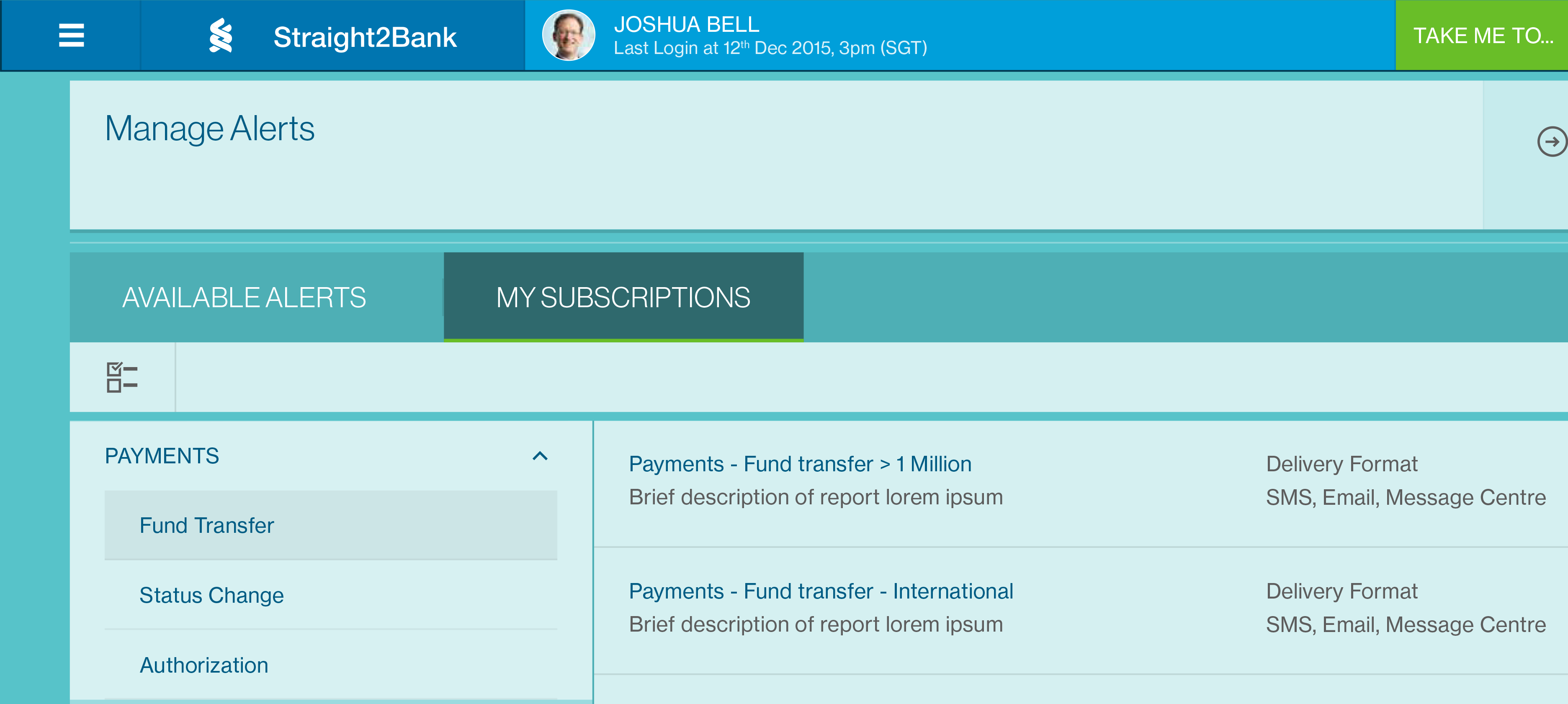

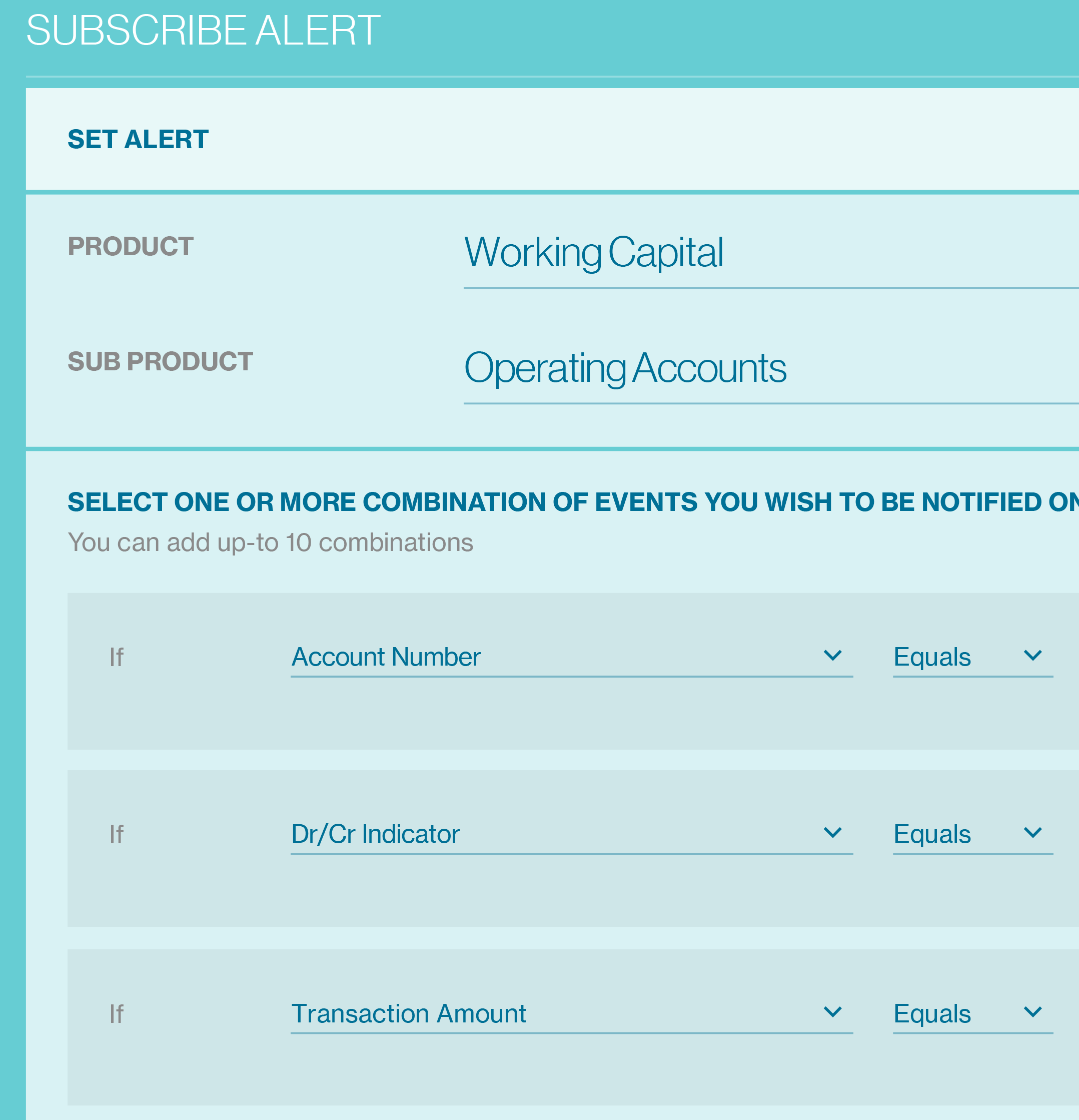

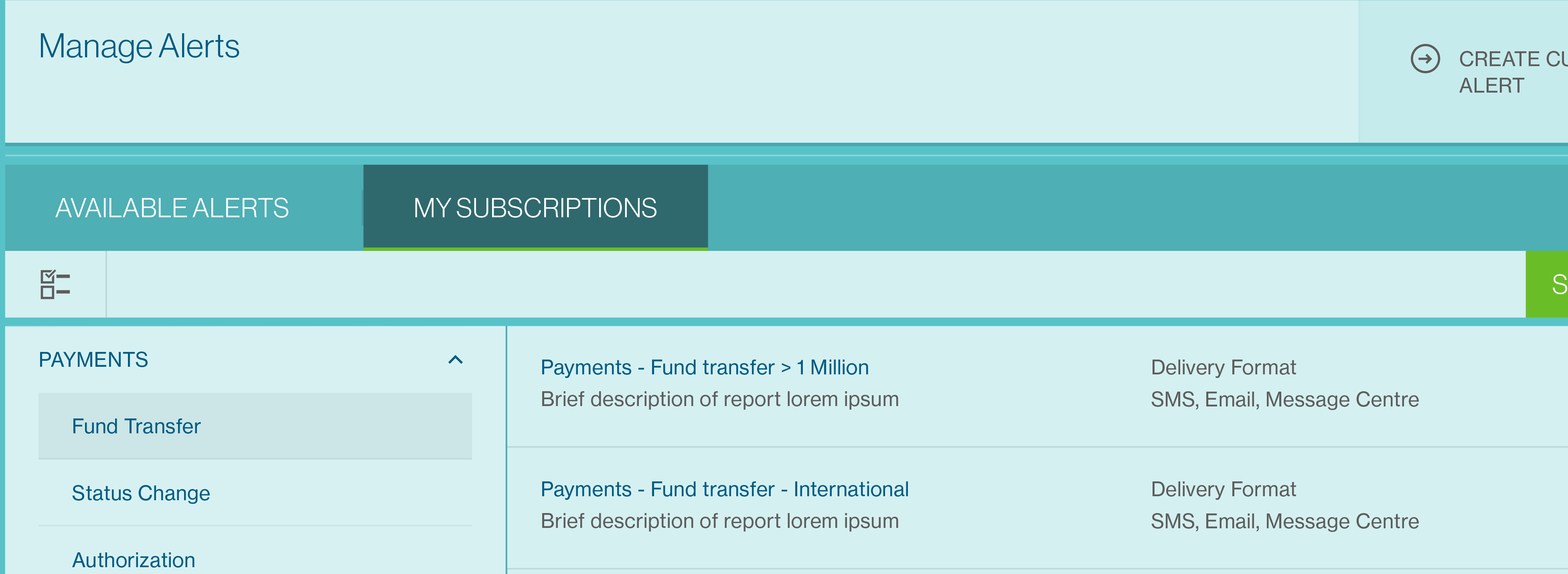

Subscribe Alerts

Setting up of alert notifications across the various products on Straight2Bank is a simple 3 s teps process like the “Subscribe Report”.

Subscribe Alert

- Choose the alert activity based on the “Product”

Set Alert

- Customise Content and Delivery Options

Save Alert

- Define Criteria & Save Alert

The steps involved for the “Working Capital - Operating Account - Debit No tification Alert” are used for illustration purposes in this section. Same steps will be relevant to other products and sub-products and hence have not been described in detail.

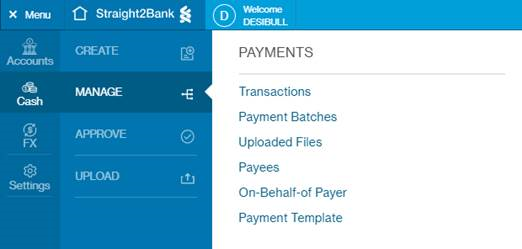

Under the Manage menu, choose the "Alert"

You will be presented with a s creen to select the most popular alerts t o configure. Please refer to ‘Alerts available on Straight2Banks’ for more details.

Click on subscribe to configure the debit notification alert.

Debit account number selection is mandatory for debit nofication and other combinations will be prefilled with appropriate values.

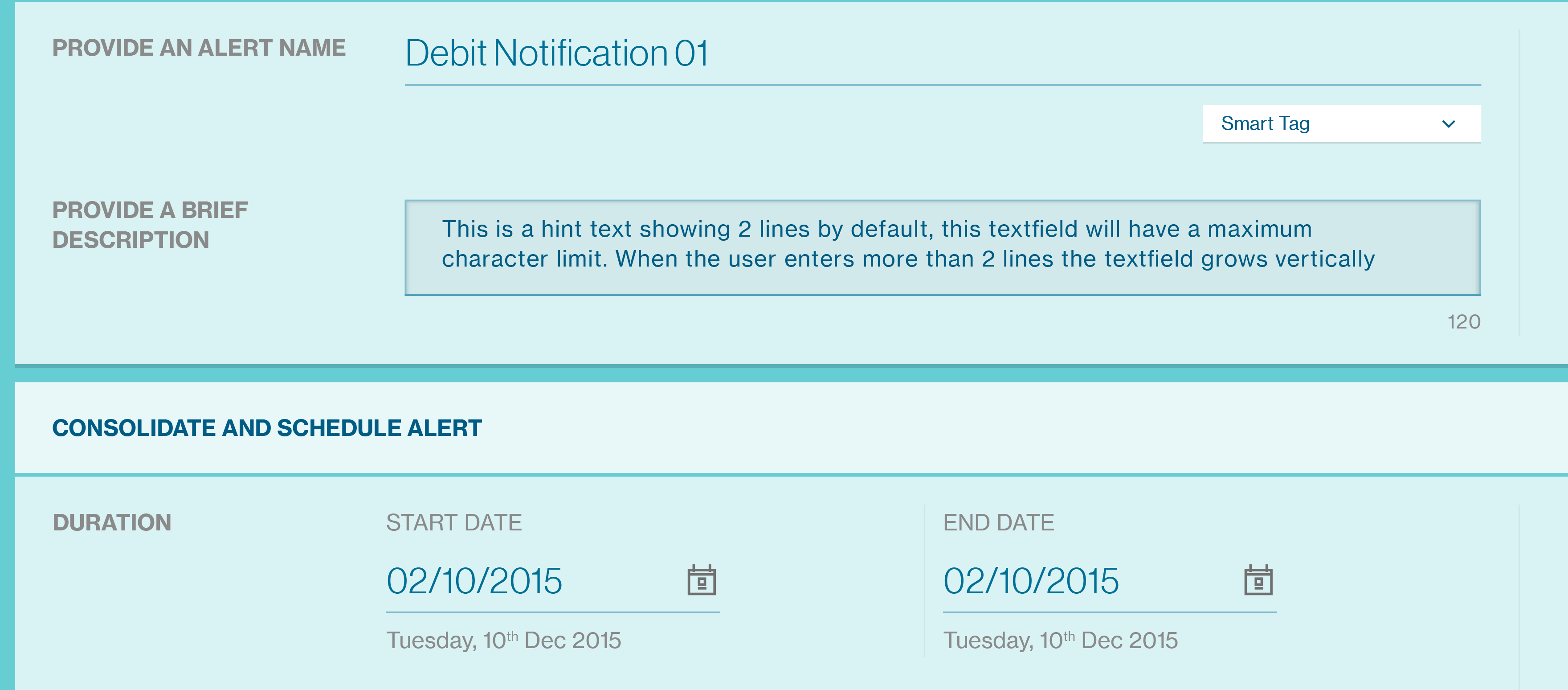

Please provide the Alert Name for tracking under my subscriptions. And also End date is optional for schedule duration.

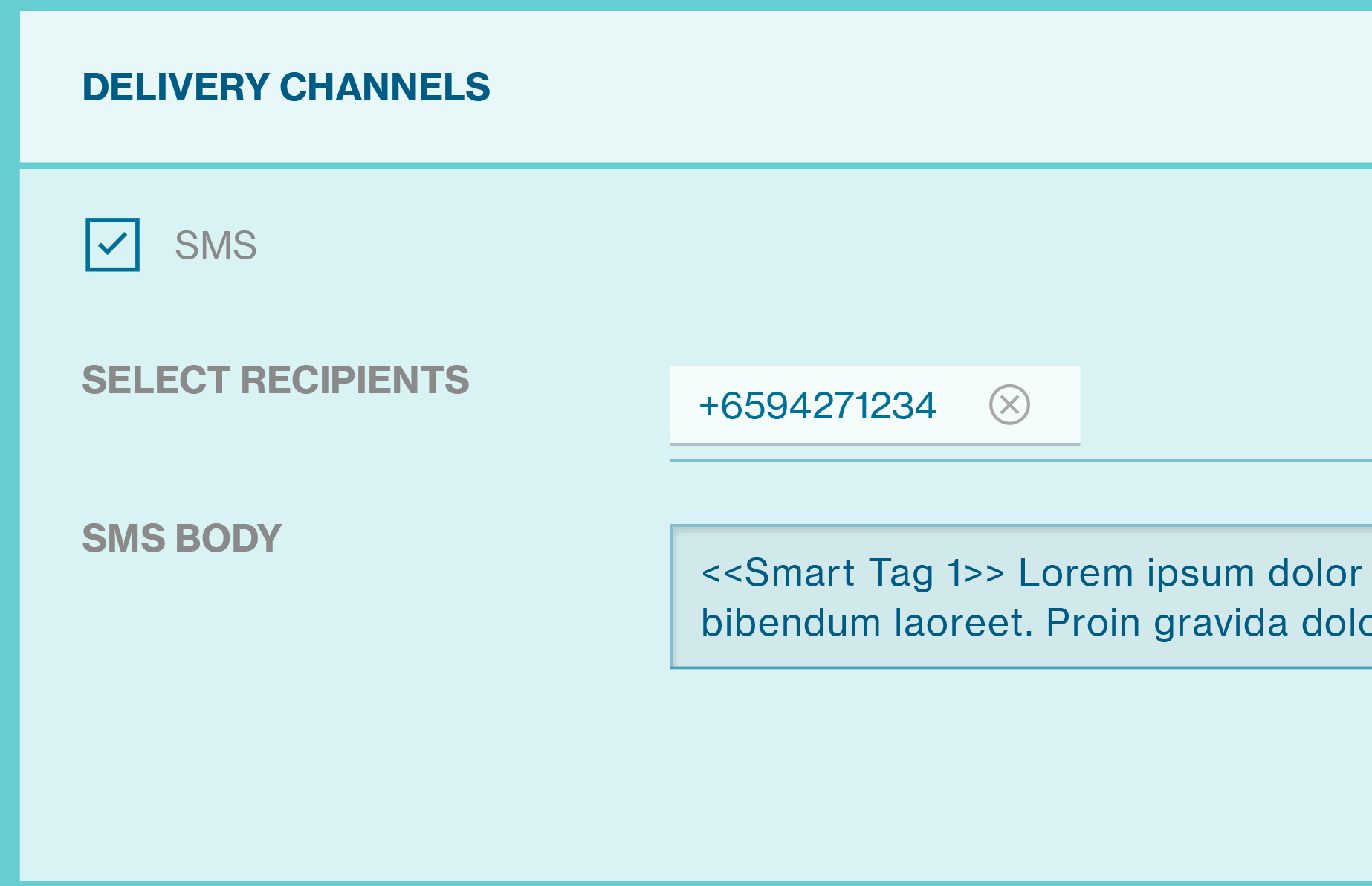

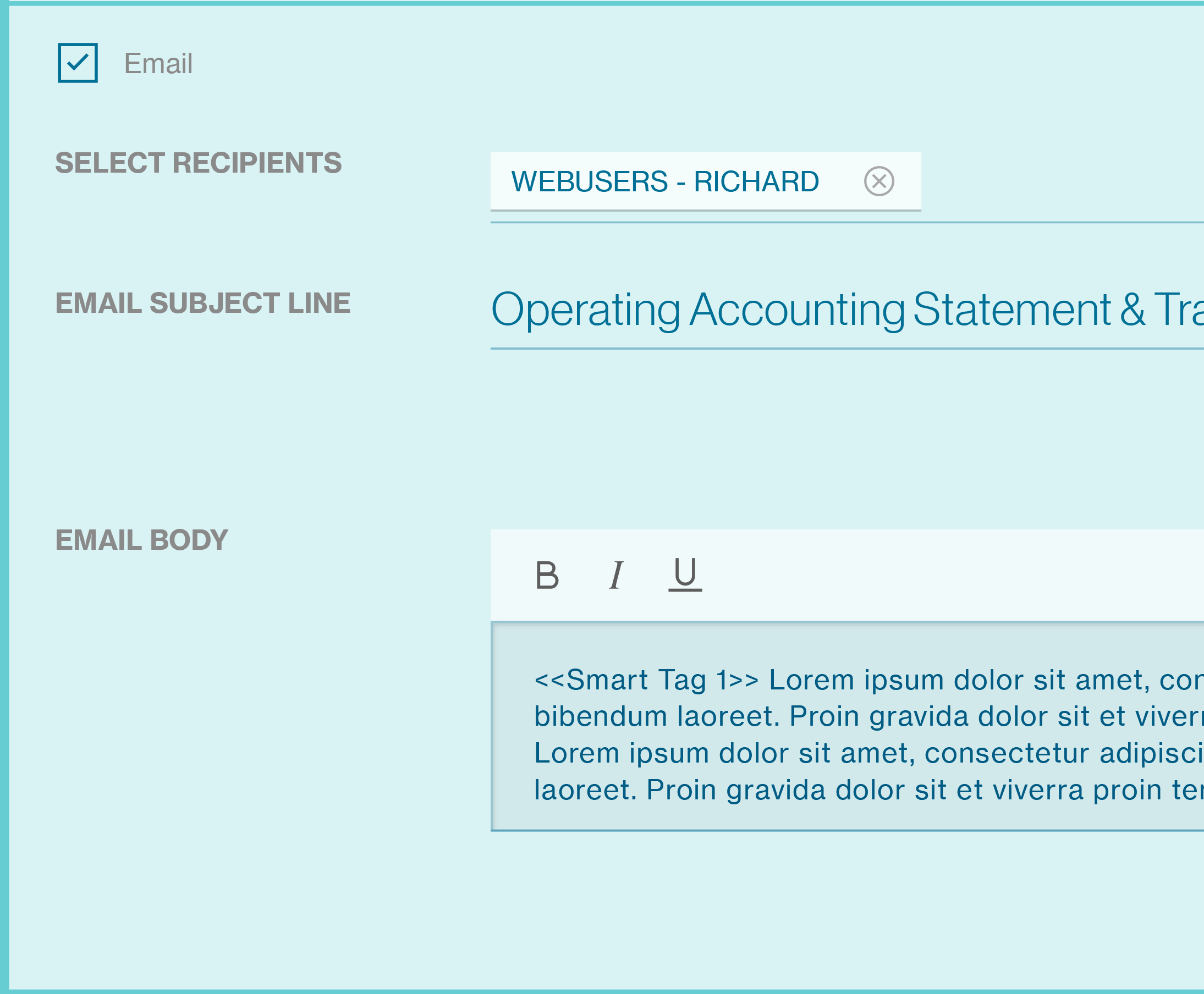

For SMS configurations please provide the mobile number with country code prefix. You can configure multiple recipients with comma s eparator.

For Email configurations please provide the whitelisted Email ID. Client can configure multiple recipients with comma separator

The list of fields available as the crit eria may vary for each of the alerts. All or s ome of the below fields would be available to define the alerts crit eria.

| Data Field / Parameter | Usage Description |

|---|---|

| Set Alert | Select the activity from the drop-down list based on which the alert needs to be triggered. This varies based on the “Product” and “Sub-Product” chosen for the alert. |

| Combinations | List of data fields available to customise the content of the alert. Each of these fields will be r eplaced with the v alue from the transaction (e.g.) Account Number will be replaced with the actual account number. |

| Alert Name | Mandatory field for the alert t o be saved. This should be unique t o other alerts. |

| Description | Description of the alert f or easy identification and retrieval. |

| SMS Delivery | Provide the mobile number with coun try code prefix to generate the alert notifications and deliver through SMS. Multiple mobile number may be provided with comma separator. |

| Email Delivery | Provide email addresses to generate the alert no tifications and deliver through email. Multiple email addresses may be provided with comma separator but the domain of the email address must match the domain information provided during setup of Straight2Bank. (whitelisted email) |

| Subject | This is the subject title o f the email alert no tification. |

| Body Content | The content of the email ma y be customised here and the da ta-fields can be replaced as Smart Tag appropriately. |

| Alert Schedule | Start Date, End Date and Frequency at which the report schedule needs to run. |

| Consolidated Alerts | Select “Yes” for a consolidated notification (instead of individual) to be generated and delivered based on your preferred delivery time. Select “No” to send individual alerts. |

Once Alert is submitted, you can track/modify alert from My Subscriptions.

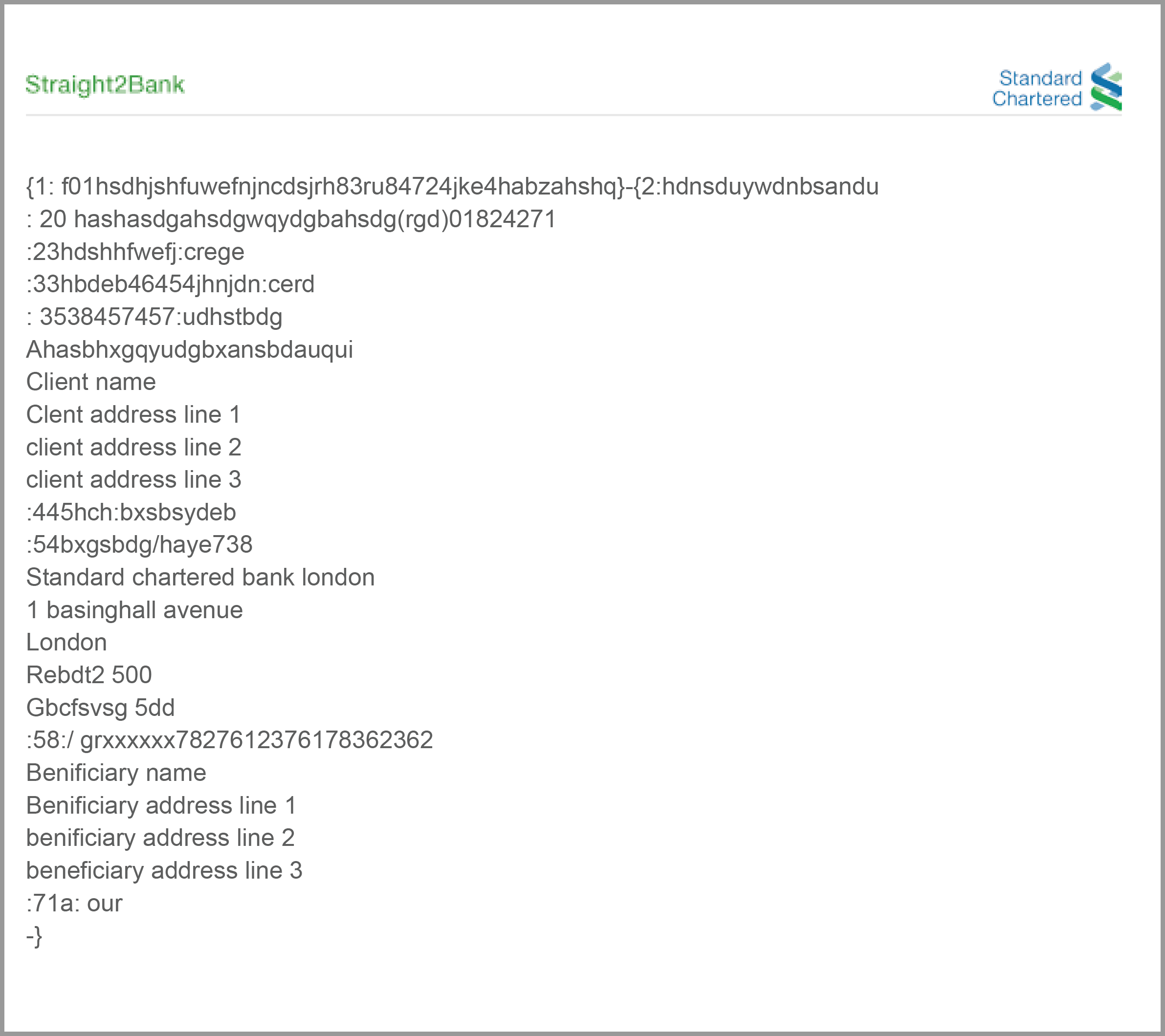

MT103 Copy

This feature allows you to generate a copy of the MT103 con firmation message for Outward Telegraphic Transfers (OTT’s) made on Straight2Bank.

The option will be available on the Manage Payments List Screen - from the "Menu" > "Manage" > "Payment".

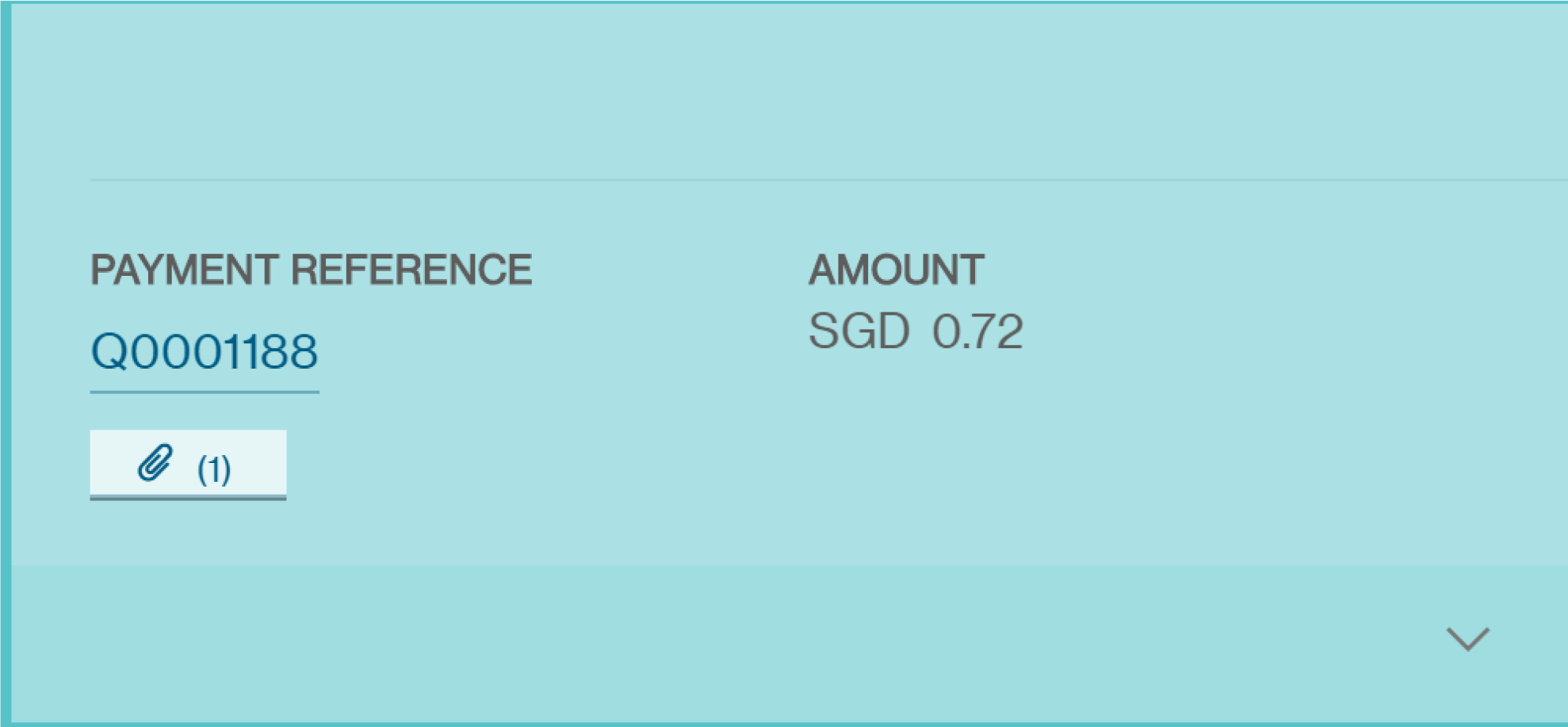

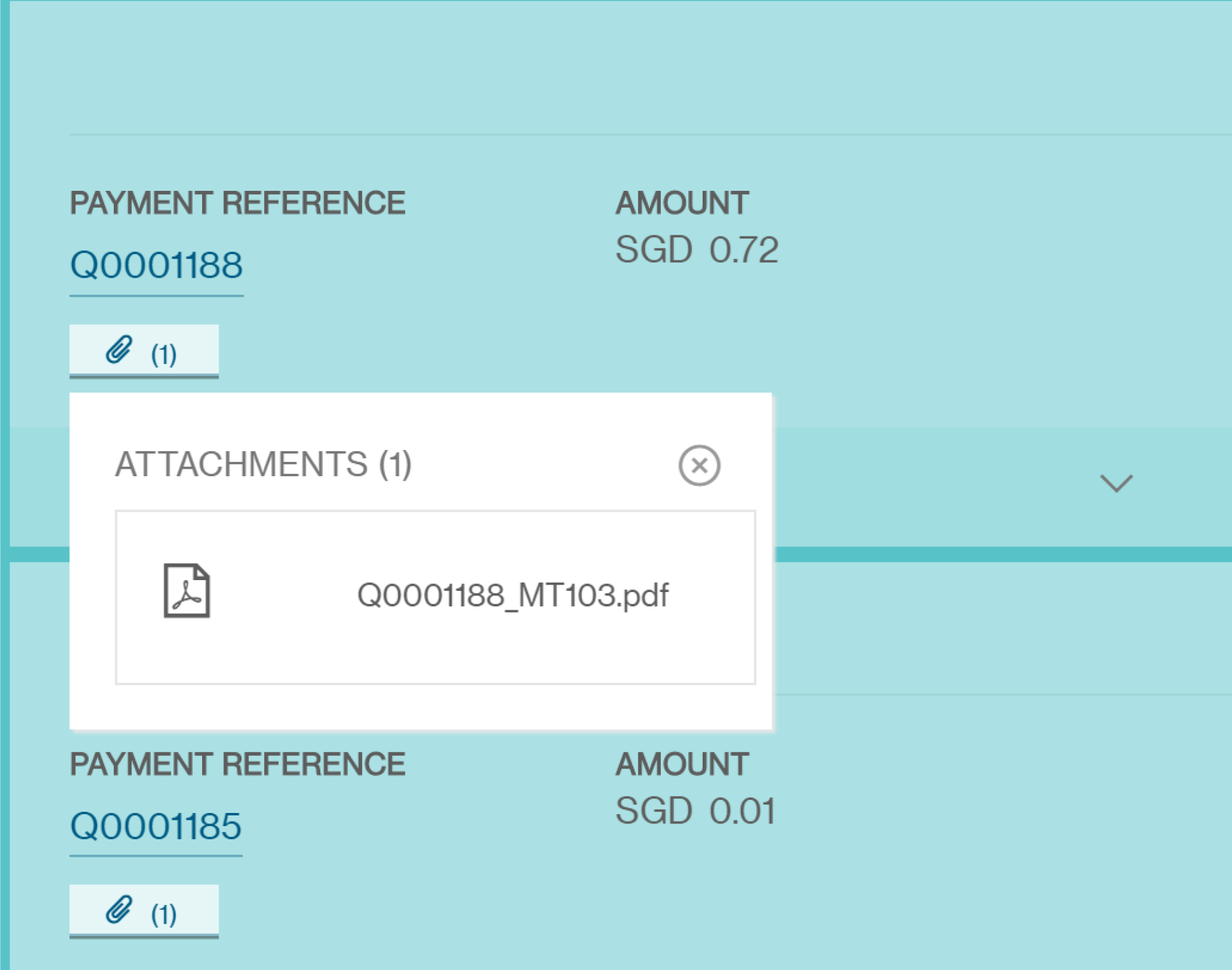

You should be able to access MT103 copy from Transactions List view on Manage List.

Copy of the MT103 message can be downloaded any number of times till the payment gets purged in Straight2Bank, via the attachment icon found beneath Payment Reference.

There will be no audit trail maintained when you click on the MT103 Swift Message Link to download the copy of MT103 PDF message.

Data / contents present in the MT103 pdf will no t be modified and will be displa yed the same as the one in column according to the mapping table.

MT103 Advice Fields for Main Information:

Mandatory Data Field & Description:

20: If left blank, the system will default the customer referenceas < P > < I > < GroupID > < Sequence Number >

32A: Calculated based on float. Allow client to overwrite the date.

33B: Currency , Gross Amount

53B: List of account set up for the client

33B: Currency , Gross Amount

50K: Defaulted to debit account name. Allow client overwrite. 57A: Beneficiary Bank name + Code

59: Name/Account/Address of Beneficiary

70: Payment details

71A: The codes for the above options are OUR,BEN,SHA and will be in SWIFT Message.

Optional Data Field & Description:

56A: Intermediary Bank Name + Code

54A: Receiver Correspondent Bank + Bank code

71F,71G: Default to 0.00 with currency the same as the currency of the debit account.

23E: Instruction Codes eg.

-------

SDVA: Payment must be executed with same day value to the beneficiary

INTC: Intra-Company Payment

REPA: Related E-Payments Reference

CORT: Settlement of a Trade

HOLD: Beneficiary Customer/Claimant will call

CHQB: Pay Only by Cheque

PHOB: Advise Beneficiary/Claimant by Phone

TELB: Advise Beneficiary/Claimant by the most efficient means of telecommunication

PHON: Advise Account with Institution by Phone

TELE: Advise Account with Institution by the most efficient means of telecommunication

PHOI: Advise Intermediary by Phone

TELI: Advise Intermediary by the most efficient means of telecommunication