What is Money Mule?

Money mules are used to transfer illegally acquired money, thereby helping criminals to launder their illegal proceeds.

Scenario 1: Scammers may pose as lonely individuals seeking companionship and love online. They befriend victims on social media sites and after gaining their trust, ask the victims to open a new bank or use an existing one to receive money.

When the money is deposited into account, the victim is asked to pass or send the money to another person or company, usually based overseas.

Scenario 2: scammers post job advertisements on online job portals or social media platforms for the position of ‘agent’. The ‘agents’ will be asked to transfer large sums of money between different bank accounts after which they are to pass or send the money to another person or company.

Sample of life case:

In September 2021, a total of 71 people suspected of being involved in job scams were arrested during a four-day enforcement operation. Click here to read more.

How do I spot the signs?

Be wary of easy jobs with high pay

– Job offers: Recruiters looking for ‘agents’ to transfer money, paying good commission for a simple job or the job promises significant earning potential for very little effort. The communication from the recruiter is often awkward and the written communication includes poor sentence structure and grammatical errors.

– Employer details: Employers are usually without street address and the email addresses associated with the offers use web-based services (Gmail, Yahoo!, Windows Live, Hotmail etc.) instead of an organisation-based domain.

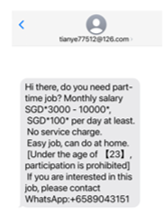

Sample of recruitment SMS

How do I stay safe?

Tip #1:

Keep your personal particulars or bank account details confidential. Never give it out to people you have never met

Tip #2:

Ensure that your bank account is used only for your personal banking needs. If you suspect that you have received money in your account in the above circumstances, report it to the bank and the Police immediately. If the money is still in your account, do not deal with it

Tip #3:

Decline all requests by an online acquaintance for money transfers. You might be unwittingly committing a crime by laundering money for another party

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Hotline at 1800-722-6688. Anyone with information on such scams may call the Police hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness.

Learn to avoid becoming a victim by taking the anti-scam quiz by the National Crime Prevention Council.

Sources:

https://www.scamalert.sg/scam-details/money-mule-scam

https://www.channelnewsasia.com/singapore/71-arrested-job-scam-29-charged-money-mule-activities-police-2197946

https://www.police.gov.sg/media-room/news/20210410_police_investigate_scammers_and_money_mules