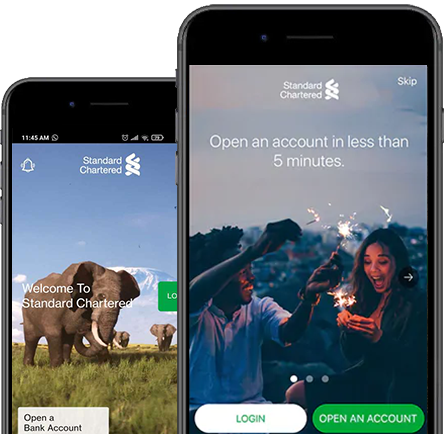

Welcome to Standard Chartered Employee Banking

An all-in-one company registration process for efficient salary processing through our secure Straight2Bank platform. Transfer salaries directly from your corporate account with Standard Chartered Bank (Uganda) Limited to your employees’ accounts.

Enjoy superior service with a Relationship Manager that understands the financial needs of your employees and always at your service.

Through our expert staff, we offer free advisory services to your employees.

Our comprehensive and flexible reporting tools provide visibility on your accounts and facilities, allowing you to better manage your working capital and risk.

An international banking network to meet your employees’ needs across our footprint around the globe.

Your salary will be transferred to your Standard Chartered Bank account same day, so you never have to wait.

Boost your career with an accredited Bachelors or Masters degree from UNICAF at a discount of up to 80% and 50% off professional short courses.

We care about your health. Access health and wellness care, ground and air evacuation services all at a discount.

We help you save, protect, and grow your wealth, both locally and internationally.

We help you plan for unforeseen circumstances for you and your family

We give you exclusive discounts and rewards through our various partnerships.

Available now

Call our hotline for any assistance.

Number: (+256)200524100, (+256)313294100

Email Us

Please send us a message and we will be in touch as soon as possible.

Email UsLocate Us

Visit the branch that is nearest to you.

Find a BranchThis is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/ug and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/ug