21 Jul 2025

This article is for informational purposes only.

🚨 HIBOR has hit a two-year low, putting further pressure on cash holdings. Constantly comparing cash yields can ultimately be time-consuming and counterproductive.🤔 Whether your goal is to earn interest or to park funds temporarily before making a move, consider looking into money market funds.

💰 Money market funds typically invest in highly liquid instruments such as time deposits⏲️, certificates of deposit, short-term government bonds, and short-term corporate bonds📜. They aim to achieve yields higher than cash while reducing risks related to market and interest rate fluctuations.

Money Market Fund is a Low Risk Investment

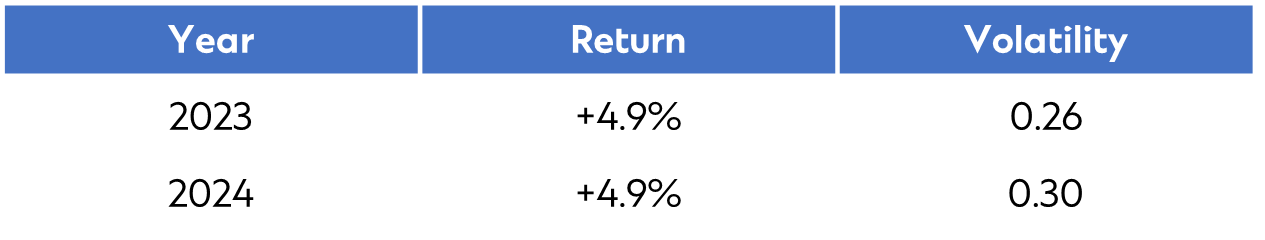

Money market funds have lower volatility than other funds and are highly liquid. The table below shows that over the past two years (2023-2024), the cumulative return of money market funds is +10.0% with 1-year volatility less than 0.30%.

Source: MorningStar. Refer to EAA USD Money Market Fund

💡 Want to search or invest in money market funds?

You’re one click away! Our online fund trading platform now offers a selection of HKD and USD money market funds. You can start with just HKD 1,000 and subscribe to or transfer into a money market fund with 0% fees. Search for money market funds on our platform now!