21 Jul 2025

This article is for informational purposes only.

💭 Returns on cash are declining rapidly

The return on cash has been declining rapidly📉since the Fed cut interest rates in Q4 2024. The Secured Overnight Financing Rate (SOFR) fell from 5.2% in September 2024 to 4.3% in March 2025.

💡 Short Duration Bond Funds outperform cash on average in rate-cutting cycles

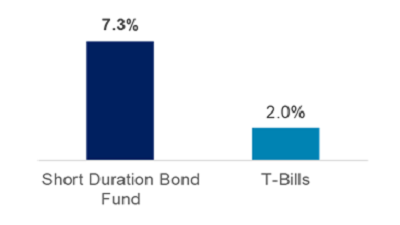

The chart below shows the average 24-month returns of 💡 Short Duration Bond Funds and T-Bills after the first rate cut in the past 2 rate cut cycles. Among them, the average return of 💡 Short Duration Bond Funds in the past 2 interest rate cut cycles was 7.3%, exceeding the 2.0% of T-Bills.

Source: Bloomberg, Morningstar. Refer to the 24-month average performance of funds following the first rate cut in the past two interest rate cycles. Date of first rate cut: August 1, 2019; September 18, 2007. Short Duration Bond Fund: EAA Fund USD Diversified Bond – Short Term; T-Bills: SPDR® Blmbg 1-3 Mth T-Bill ETF.

📣 Make good use of your idle cash and invest in Short Duration Bond Funds to lock in gains

Short Duration Bond Funds allow investors to capture the upside in bond prices when interest rates fall. They have low volatility compared to other Bond Funds. The chart below shows that after the Fed rate cut in September 2024, U.S. Short-term Bonds were less volatile than U.S. Aggregate Bonds.

US Short-term bonds refer to the Bloomberg U.S. Aggregate 1-3 Year Total Return Index. U.S. Aggregate Bond refers to the Bloomberg U.S. Aggregate Bond Total Return Index.

💡 Want to search or invest in Short Duration Bond Funds?

Browse Short Duration Bond Funds on our platform now. Standard Chartered combines comprehensive wealth solutions to make your financial management simple.