8 August 2025

Weekly Market View

The Fed to the rescue?

The case for Fed rate cuts from September has strengthened after a significantly weak US jobs report. Higher US tariffs that started to go into effect this week are likely to hurt growth further.

However, Fed rate cuts, combined with tax incentives in the US budget and strong AI-driven corporate earnings growth, should enable an economic soft-landing, ultimately supporting US risk assets.

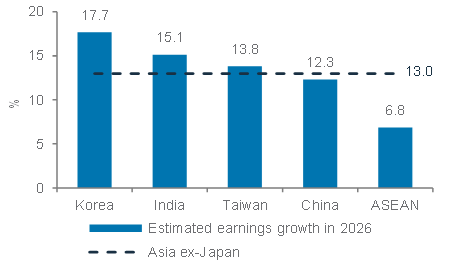

We prefer Asia ex-Japan equities and Emerging Market (EM) local bonds as Fed rate cuts weaken the USD, driving investor flows into EMs.

In Asia ex-Japan, we like equities in China and South Korea, where policymakers are focussed on boosting shareholder returns. Fed rate cuts and solid credit fundamentals are also positive for shorter duration US high yield bonds.

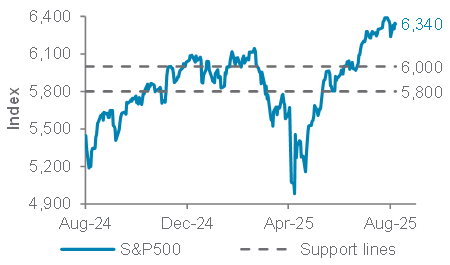

Add US equities on dips: next technical support at 6,000, followed by 5,800

Add shorter duration high yield bonds: benefit from rate cuts and sound credit fundamentals

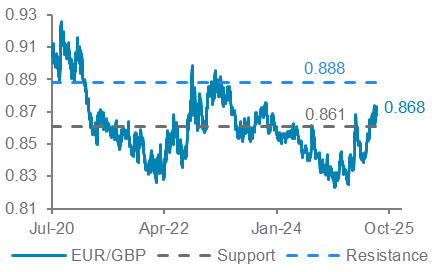

Rangebound EUR/GBP with bullish bias: BoE to cut rates more than ECB

Charts of the week: Fed rate cuts and earnings upgrades

Fed rate cuts and corporate earnings upgrades should ultimately support risk assets, despite near-term consolidation

Money market estimates of Fed rate cuts by end ’25, end ’26

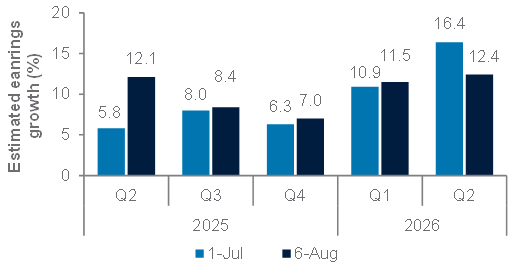

Consensus earnings growth estimates for S&P500 index

Source: LSEG I/B/E/S, Bloomberg, Standard Chartered

Editorial

The Fed to the rescue?

Investment Strategy: The case for Fed rate cuts from September has strengthened after a significantly weak US jobs report. Higher US tariffs that started to go into effect this week are likely to hurt growth further. However, Fed rate cuts, combined with tax incentives in the next fiscal year’s US budget and strong AI-driven corporate earnings growth, should enable an economic soft-landing, ultimately supporting US risk assets. We prefer Asia ex-Japan equities and EM local bonds, though, as Fed rate cuts weaken the USD, driving fund flows into EMs. In Asia ex-Japan, we like equities in China and South Korea, where policymakers are focussed on boosting shareholder returns. Fed rate cuts and solid credit fundamentals are also positive for shorter duration US high yield bonds.

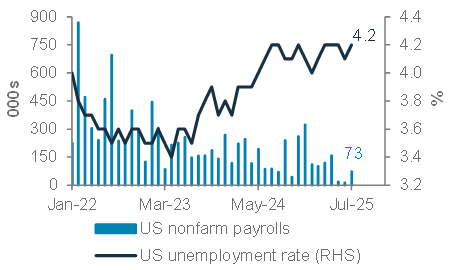

US job market cools. The US job market has been slowing significantly, new data revealed last week. Weaker-than-expected net new payrolls for July (73,000) and a 258,000 downward revision to prior two months’ payrolls means US monthly job creation has been averaging only 35,000 in the past three months vs. prior estimates of 150,000. The revised monthly rate of job creation is well below the rate (estimated around 100,000) required to keep the jobless rate stable.

Higher tariffs still to take effect. A sharp slowdown in supply of workers due to immigration curbs is partly responsible for the slowdown in jobs growth this year, but increasingly a slower pace of hiring is responsible, with most jobs created in healthcare. Higher US tariffs that took effect from 7 August are estimated to cut US growth by 0.5% in 2025 and 2026, as per the Yale Budget Lab. This is likely to impact domestic consumption and/or corporate margins, curtailing hiring further.

Fed rate cuts back in play: With the job market slowing decisively, the Fed is likely to resume rate cuts from September. Fed Chair Powell sounded relatively hawkish after last week’s policy meeting where the Fed held rates for the fifth straight meeting, citing caution against expected tariff-driven inflation. However, since then, at least three Fed policymakers

have voiced increasing concerns about the deteriorating job market after the July jobs report. This adds to the two Fed policymakers who had unsuccessfully voted for a rate cut last month, the first such double-dissent in over three decades. Trump’s nominee for a vacant Fed Governor post, economic adviser Stephen Miran, will add another dovish member to the Fed Board.

Inflation data in focus. July’s inflation data on 12 August will be closely watched. The consensus estimates US core consumer inflation rose marginally in July to 0.3% m/m and 3.0% y/y, from 0.2% m/m and 2.9% y/y, respectively. The chance of a 50bps cut will rise if inflation data for July and August miss expectations and the job market slows further.

US equities face near-term headwind. US stocks, especially the technology and communications services sectors, face near-term headwinds from overly bullish investor positioning amid tariff-driven growth headwinds. However, Fed rate cuts should ultimately lift sentiment, while corporate earnings outlook has been revised higher, driven by AI-led growth. The budget for the fiscal year starting in October (“One Big Beautiful Bill”) is another potential driver of earnings thanks to the tax incentives to manufacturers to invest in the US. Given these positive drivers, we would average into US equities on any pullback in the S&P500 index towards 6,000, followed by 5,800.

USD faces downside risk. After a brief rebound, the USD has come under renewed pressure as Fed rate cut expectations build. In the next few weeks, we see the USD rangebound, with a bearish bias, as US tariffs impacts global growth. However, President Trump’s repeated attacks on the Fed and plans to nominate a dovish candidate for the Fed Chair are likely to undermine the USD further over a 12-month horizon.

We like Emerging Market (EM) local currency bonds as Fed rate cuts open the door to further EM central bank rate cuts amid slowing growth, while a weak USD supports EM inflows. Indian government bonds look attractive on a currency-hedged basis, given elevated inflation-adjusted yields and chance of further rate cuts as US tariffs impact near-term growth.

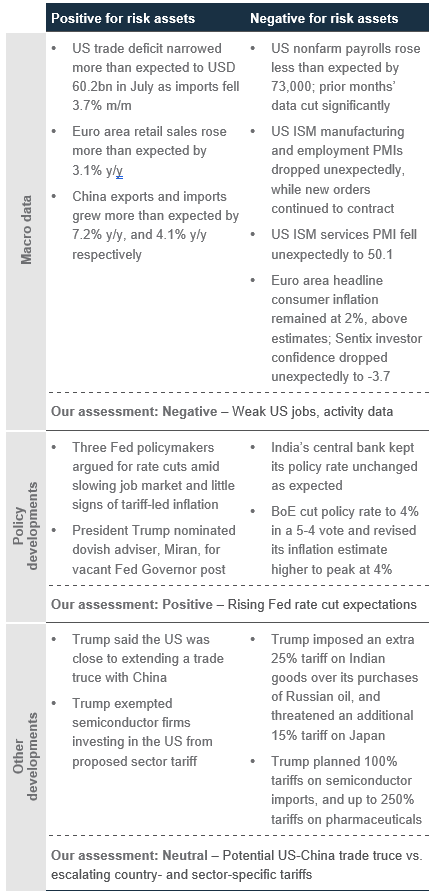

The weekly macro balance sheet

Our weekly net assessment: On balance, we see the past week’s data and policy as neutral for risk assets in the near-term

(+) factors: Fed rate cut expectations, US-China trade truce extension

(-) factors: Weak US data, escalating country- and sector-specific tariffs

US net new jobs created in May to July were well below estimates, while the jobless rate rose to a cycle high of 4.25%

US nonfarm payrolls and unemployment rate

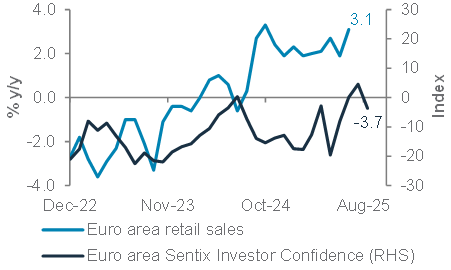

Euro area retail sales in June rose to the highest level since September 2024, but investor sentiment weakened in August

Euro area retail sales growth and Sentix investor confidence

China exports and imports grew more than expected in July, although a soft PMI reflected weak business confidence

S&P Global China composite PMI; China exports and imports growth

Top client questions

What is the outlook for US equities in light of the weak US jobs data and potential sector-specific tariffs?

Our view: US equities are poised for consolidation in the near term. We see support for the S&P500 at 6,000; any pullback would be an opportunity to add exposure, particularly in the technology sector.

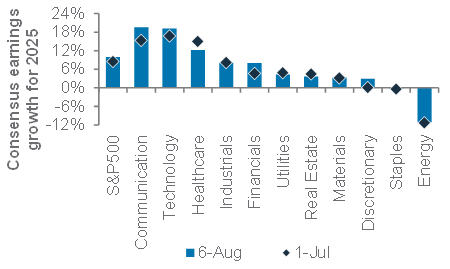

Rationale: We expect weakness in the US job market to lead to the Fed cutting rates by 25bps in September, followed by another 50bps of cuts by mid-2026. These rate cuts would support a soft landing for the US economy and ongoing earnings growth. The Q2 earnings season shows robust corporate earnings. Consensus 2025 earnings growth estimates moved up to 10% versus 8.5% at the start of the season, while growth in 2026 is expected to accelerate to 13.4% (nudged down from 14.0% at the start of the season). Earnings growth supports our overweight call on global equities; within that, US equities are a core holding.

However, our technical indicators point to stretched positioning for US equities in the near term, particularly the technology and communication services sectors. Tariff uncertainty also remains, with the Trump administration flagging its intention to announce tariffs on the pharmaceutical and semiconductor industries. In the former, tariffs would reportedly be small initially, rising up to 250% over time, while the latter could face 100% tariffs. The healthcare sector accounts for 8.8% of the S&P500 index, while semiconductor counts for 13.6%, a sizeable impact overall. However, there may be various exemptions and the initial impact could be limited, as Trump seeks a balance between incentivising strategic industries to bring manufacturing back to the US versus raising costs for companies and consumers.

These headwinds point to a likely consolidation for US equities in the near term. We see support for the S&P500 at 6,000 and 5,800. We would view a pullback as an opportunity to add exposure, particularly in the technology sector. Although semiconductor tariffs may create some uncertainty, we expect the net impact from strong AI demand to drive the technology sector to outperform over 6-12 months.

— Fook Hien Yap, Senior Investment Strategist

We see near term headwinds for the S&P500 index, with support at 6,000 and 5,800. We remain positive on a 6-12-month horizon

S&P500 index with support levels

Consensus 2025 earnings growth estimates are moving higher for US equities, including for our preferred technology, communication and financial sectors

Consensus 2025 earnings growth estimates for S&P500 sectors as of 6 August vs. 1 July*

80% of companies in the S&P 500 have reported their Q2’ 25 earnings.

Top client questions (cont’d)

Where are the opportunities in bonds as yields decline?

Our view: Add US TIPS; Switch from very long maturity bonds to more moderate maturities (we prefer 5-7 years); Add short duration US HY bonds.

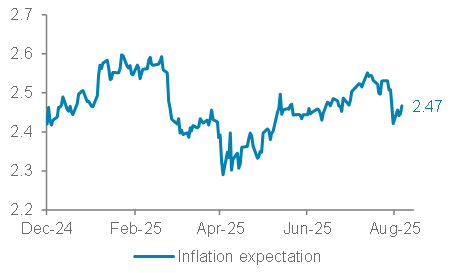

Rationale: The bond market priced in a higher chance of a Fed rate cut in September following weaker-than-expected US July jobs data. In the Market Watch published on August 4, 2025, we identified two opportunities that we believe are still valid today: (i) a pullback in inflation expectations has created an opportunity to add US inflation-protected government bonds (TIPS) as an inflation hedge, and (ii) recent yield curve steepening (i.e. the widening gap between short- and long-term bond yields) has room to extend further in the short term as markets price higher odds of Fed cuts at shorter maturities, while inflation risks lift longer maturity yields. We remain cautious on very long maturity bonds given higher vulnerability to inflation risk compared to shorter maturity bonds.

Short-duration US High Yield bonds are an additional opportunity that benefits from Fed rate cuts and still-solid credit fundamentals in a soft-landing environment. Our 12-month target for the US 10-year bond yield remains 4-4.25%. Technical indicators suggest near-term support at 4.20% and resistance at 4.35%.

— Cedric Lam, Senior Investment Strategist

US inflation expectations have eased lately amid slowing job market and activity data

US 5Y5Y inflation swap

What is the outlook for India and Korea equities?

Our view: Retain core holding on India and an overweight on Korea. Near-term pressures present an opportunity to increase exposure to Korea equities; accumulate India for long-term.

Rationale: The unexpected 25% US tariff on Indian goods and an extra 25% levy tied to Russian oil imports introduce near-term risks. Any potential restrictions on India’s services exports could amplify pressures, given that services exports to the US are significantly larger than goods exports. That said, the impact is likely to be contained as India’s merchandise exports to the US represent only about 2% of Indian GDP. Within India equities, we maintain our preference for domestic cyclicals, which stand to benefit from resilient fundamentals and sustained domestic inflows.

For Korea, proposed tax reforms weighed on market sentiment, though the draft remains fluid and subject to revision. While these are initially disruptive, the proposals align with the ongoing capital market reform efforts. The ruling Democratic Party has signalled a possible rollback of the capital gains tax proposal. Meanwhile, (i) the US-Korea trade deal cut the tariff rate to 15%, from an expected 25%, and (ii) exemptions for tech giants from the proposed 100% semiconductor tariffs are expected to support the market.

— Jason Wong, Equity Analyst

Korea and India are projected to have higher 2026 earnings growth within the Asia ex-Japan

Consensus 2026 earnings growth estimates for Asia ex-Japan markets

Top client questions (cont’d)

What is the GBP/USD outlook after the latest BoE meeting?

Our View: We expect the BoE to cut rates more than the ECB over the next 12 months. Play a 0.8610-0.8880 range on EUR/GBP, with a bullish bias.

Rationale: The Bank of England cut rates by 25bps to 4%, the fifth cut in the last 12 months. The Monetary Policy Committee remained divided; some favoured deeper easing to support the slowing job market, while others focused on high inflation. Markets expect the BoE to deliver two more rate cuts over the next 12 months, leading us to hold a rangebound view (with a bearish bias) on GBP/USD.

Meanwhile, markets anticipate the ECB will hold rates steady at 2% as Euro area inflation remains aligned with its 2% target and growth remains resilient. President Lagarde signalled the easing cycle is nearly done, and the market is pricing in only one more rate cut in the next 12 months to 1.75%, which aligns with our own ECB rate outlook. The diverging monetary policies mean we expect EUR/GBP to remain rangebound with a bullish bias.

— Iris Yuen, Investment Strategist

Looking for gradual upside in EUR/GBP

EUR/GBP and technical levels

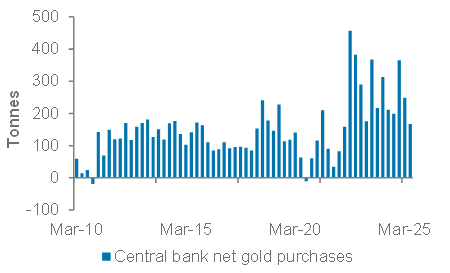

Do you expect the gold rally to continue?

Our View: We expect gold to trade around USD 3,400/oz in the near term, with a rise to USD 3,500 over 12 months. Add on dips.

Rationale: With fading tariff fears, the next catalyst for gold hinges on signs of US economic weakness. Recent downward revisions to non-farm payrolls raises the chance of a Fed rate cut in September. If the August jobs report confirms the trend of labour market softening, we expect gold to push above its recent range toward our 6-12-month price target of USD 3,500/oz. Until then, we expect gold to remain rangebound around USD 3,400 and prefer to build positions opportunistically on weakness.

Recent data from the World Gold Council shows central bank net gold purchases fell to 166.5 tonnes in Q2, the lowest since Q2 2022. This puts 2025 on track to mark the first sub-1,000 tonne year since 2021. While central banks are strategic, long-term buyers, they are partially price sensitive. As such, the 29% YTD rally in gold prices has likely contributed to the slowdown in buying and allowed some banks to reach allocation targets.

Despite the current lull, we remain constructive on central bank gold purchases in the coming years and expect purchases to pick up again should prices moderate, especially with the steep depreciation in the USD this year further reinforcing the need to diversify reserves.

— Tay Qi Xiu, Portfolio Strategist

Global central bank net gold purchases have slowed amid a record rally in gold prices

Global central bank quarterly net gold purchases (tonnes) as of Q2 2025

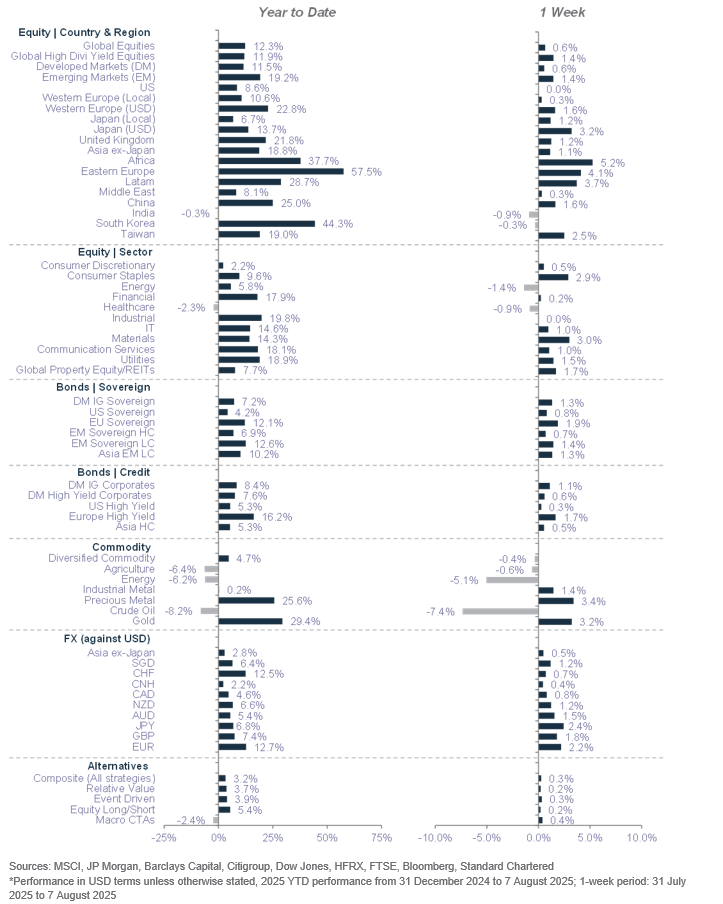

Market performance summary*

Our 12-month asset class views at a glance

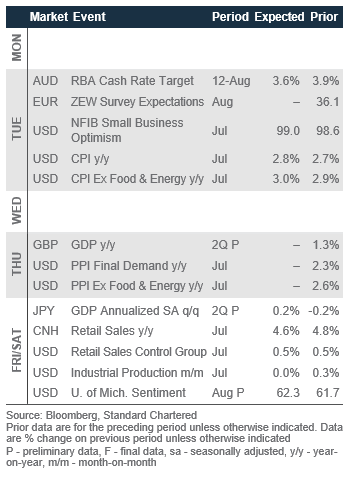

Economic and market calendar

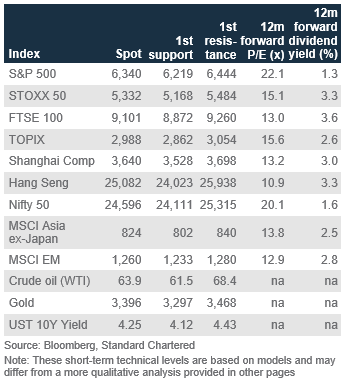

The S&P500 has next interim resistance at 6,444

Technical indicators for key markets as of 7 Aug close

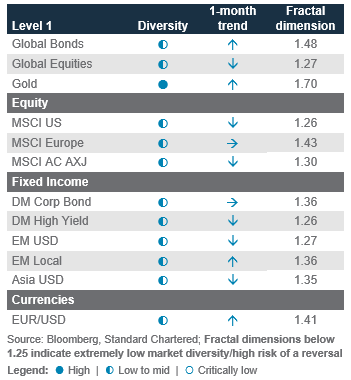

Investor diversity has normalised across asset classes

Our proprietary market diversity indicators as of 7 Aug close

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2025, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘Sustainable Investments’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures

Botswana: This document is being distributed in Botswana by, and is attributable to, Standard Chartered Bank Botswana Limited which is a financial institution licensed under the Section 6 of the Banking Act CAP 46.04 and is listed in the Botswana Stock Exchange. Brunei Darussalam: This document is being distributed in Brunei Darussalam by, and is attributable to, Standard Chartered Bank (Brunei Branch) | Registration Number RFC/61 and Standard Chartered Securities (B) Sdn Bhd | Registration Number RC20001003. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. Standard Chartered Securities (B) Sdn Bhd is a limited liability company registered with the Registry of Companies with Registration Number RC20001003 and licensed by Brunei Darussalam Central Bank as a Capital Markets Service License Holder with License Number BDCB/R/CMU/S3-CL and it is authorised to conduct Islamic investment business through an Islamic window. China Mainland: This document is being distributed in China by, and is attributable to, Standard Chartered Bank (China) Limited which is mainly regulated by National Financial Regulatory Administration (NFRA), State Administration of Foreign Exchange (SAFE), and People’s Bank of China (PBOC). Hong Kong: In Hong Kong, this document, except for any portion advising on or facilitating any decision on futures contracts trading, is distributed by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), a subsidiary of Standard Chartered PLC. SCBHK has its registered address at 32/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong and is regulated by the Hong Kong Monetary Authority and registered with the Securities and Futures Commission (“SFC”) to carry on Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activity under the Securities and Futures Ordinance (Cap. 571) (“SFO”) (CE No. AJI614). The contents of this document have not been reviewed by any regulatory authority in Hong Kong and you are advised to exercise caution in relation to any offer set out herein. If you are in doubt about any of the contents of this document, you should obtain independent professional advice. Any product named herein may not be offered or sold in Hong Kong by means of any document at any time other than to “professional investors” as defined in the SFO and any rules made under that ordinance. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and any interests may not be disposed of, to any person unless such person is outside Hong Kong or is a “professional investor” as defined in the SFO and any rules made under that ordinance, or as otherwise may be permitted by that ordinance. In Hong Kong, Standard Chartered Private Bank is the private banking division of SCBHK, a subsidiary of Standard Chartered PLC. Ghana: Standard Chartered Bank Ghana Limited accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to feedback.ghana@sc.com. Please do not reply to this email. Call our Priority Banking on 0302610750 for any questions or service queries. You are advised not to send any confidential and/or important information to Standard Chartered via e-mail, as Standard Chartered makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Standard Chartered shall not be responsible for any loss or damage suffered by you arising from your decision to use e-mail to communicate with the Bank. India: This document is being distributed in India by Standard Chartered in its capacity as a distributor of mutual funds and referrer of any other third party financial products. Standard Chartered does not offer any ‘Investment Advice’ as defined in the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 or otherwise. Services/products related securities business offered by Standard Charted are not intended for any person, who is a resident of any jurisdiction, the laws of which imposes prohibition on soliciting the securities business in that jurisdiction without going through the registration requirements and/or prohibit the use of any information contained in this document. Indonesia: This document is being distributed in Indonesia by Standard Chartered Bank, Indonesia branch, which is a financial institution licensed and supervised by Otoritas Jasa Keuangan (Financial Service Authority) and Bank Indonesia. Jersey: In Jersey, Standard Chartered Private Bank is the Registered Business Name of the Jersey Branch of Standard Chartered Bank. The Jersey Branch of Standard Chartered Bank is regulated by the Jersey Financial Services Commission. Copies of the latest audited accounts of Standard Chartered Bank are available from its principal place of business in Jersey: PO Box 80, 15 Castle Street, St Helier, Jersey JE4 8PT. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter in 1853 Reference Number ZC 18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. The Jersey Branch of Standard Chartered Bank is also an authorised financial services provider under license number 44946 issued by the Financial Sector Conduct Authority of the Republic of South Africa. Jersey is not part of the United Kingdom and all business transacted with Standard Chartered Bank, Jersey Branch and other SC Group Entity outside of the United Kingdom, are not subject to some or any of the investor protection and compensation schemes available under United Kingdom law. Kenya: This document is being distributed in Kenya by and is attributable to Standard Chartered Bank Kenya Limited. Investment Products and Services are distributed by Standard Chartered Investment Services Limited, a wholly owned subsidiary of Standard Chartered Bank Kenya Limited that is licensed by the Capital Markets Authority in Kenya, as a Fund Manager. Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya. Malaysia: This document is being distributed in Malaysia by Standard Chartered Bank Malaysia Berhad (“SCBMB”). Recipients in Malaysia should contact SCBMB in relation to any matters arising from, or in connection with, this document. This document has not been reviewed by the Securities Commission Malaysia. The product lodgement, registration, submission or approval by the Securities Commission of Malaysia does not amount to nor indicate recommendation or endorsement of the product, service or promotional activity. Investment products are not deposits and are not obligations of, not guaranteed by, and not protected by SCBMB or any of the affiliates or subsidiaries, or by Perbadanan Insurans Deposit Malaysia, any government or insurance agency. Investment products are subject to investment risks, including the possible loss of the principal amount invested. SCBMB expressly disclaim any liability and responsibility for any loss arising directly or indirectly (including special, incidental or consequential loss or damage) arising from the financial losses of the Investment Products due to market condition. Nigeria: This document is being distributed in Nigeria by Standard Chartered Bank Nigeria Limited (SCB Nigeria), a bank duly licensed and regulated by the Central Bank of Nigeria. SCB Nigeria accepts no liability for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to clientcare.ng@sc.com requesting to be removed from our mailing list. Please do not reply to this email. Call our Priority Banking on 02 012772514 for any questions or service queries. SCB Nigeria shall not be responsible for any loss or damage arising from your decision to send confidential and/or important information to Standard Chartered via e-mail. SCB Nigeria makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Pakistan: This document is being distributed in Pakistan by, and attributable to Standard Chartered Bank (Pakistan) Limited having its registered office at PO Box 5556, I.I Chundrigar Road Karachi, which is a banking company registered with State Bank of Pakistan under Banking Companies Ordinance 1962 and is also having licensed issued by Securities & Exchange Commission of Pakistan for Security Advisors. Standard Chartered Bank (Pakistan) Limited acts as a distributor of mutual funds and referrer of other third-party financial products. Singapore: This document is being distributed in Singapore by, and is attributable to, Standard Chartered Bank (Singapore) Limited (Registration No. 201224747C/ GST Group Registration No. MR-8500053-0, “SCBSL”). Recipients in Singapore should contact SCBSL in relation to any matters arising from, or in connection with, this document. SCBSL is an indirect wholly owned subsidiary of Standard Chartered Bank and is licensed to conduct banking business in Singapore under the Singapore Banking Act, 1970. Standard Chartered Private Bank is the private banking division of SCBSL. IN RELATION TO ANY SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT REFERRED TO IN THIS DOCUMENT, THIS DOCUMENT, TOGETHER WITH THE ISSUER DOCUMENTATION, SHALL BE DEEMED AN INFORMATION MEMORANDUM (AS DEFINED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT, 2001 (“SFA”)). THIS DOCUMENT IS INTENDED FOR DISTRIBUTION TO ACCREDITED INVESTORS, AS DEFINED IN SECTION 4A(1)(a) OF THE SFA, OR ON THE BASIS THAT THE SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT MAY ONLY BE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION. Further, in relation to any security or securities-based derivatives contract, neither this document nor the Issuer Documentation has been registered as a prospectus with the Monetary Authority of Singapore under the SFA. Accordingly, this document and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the product may not be circulated or distributed, nor may the product be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons other than a relevant person pursuant to section 275(1) of the SFA, or any person pursuant to section 275(1A) of the SFA, and in accordance with the conditions specified in section 275 of the SFA, or pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. In relation to any collective investment schemes referred to in this document, this document is for general information purposes only and is not an offering document or prospectus (as defined in the SFA). This document is not, nor is it intended to be (i) an offer or solicitation of an offer to buy or sell any capital markets product; or (ii) an advertisement of an offer or intended offer of any capital markets product. Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. This advertisement has not been reviewed by the Monetary Authority of Singapore. Taiwan: SC Group Entity or Standard Chartered Bank (Taiwan) Limited (“SCB (Taiwan)”) may be involved in the financial instruments contained herein or other related financial instruments. The author of this document may have discussed the information contained herein with other employees or agents of SC or SCB (Taiwan). The author and the above-mentioned employees of SC or SCB (Taiwan) may have taken related actions in respect of the information involved (including communication with customers of SC or SCB (Taiwan) as to the information contained herein). The opinions contained in this document may change, or differ from the opinions of employees of SC or SCB (Taiwan). SC and SCB (Taiwan) will not provide any notice of any changes to or differences between the above-mentioned opinions. This document may cover companies with which SC or SCB (Taiwan) seeks to do business at times and issuers of financial instruments. Therefore, investors should understand that the information contained herein may serve as specific purposes as a result of conflict of interests of SC or SCB (Taiwan). SC, SCB (Taiwan), the employees (including those who have discussions with the author) or customers of SC or SCB (Taiwan) may have an interest in the products, related financial instruments or related derivative financial products contained herein; invest in those products at various prices and on different market conditions; have different or conflicting interests in those products. The potential impacts include market makers’ related activities, such as dealing, investment, acting as agents, or performing financial or consulting services in relation to any of the products referred to in this document. UAE: DIFC – Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18.The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered Bank, Dubai International Financial Centre having its offices at Dubai International Financial Centre, Building 1, Gate Precinct, P.O. Box 999, Dubai, UAE is a branch of Standard Chartered Bank and is regulated by the Dubai Financial Services Authority (“DFSA”). This document is intended for use only by Professional Clients and is not directed at Retail Clients as defined by the DFSA Rulebook. In the DIFC we are authorised to provide financial services only to clients who qualify as Professional Clients and Market Counterparties and not to Retail Clients. As a Professional Client you will not be given the higher retail client protection and compensation rights and if you use your right to be classified as a Retail Client we will be unable to provide financial services and products to you as we do not hold the required license to undertake such activities. For Islamic transactions, we are acting under the supervision of our Shariah Supervisory Committee. Relevant information on our Shariah Supervisory Committee is currently available on the Standard Chartered Bank website in the Islamic banking section. For residents of the UAE – Standard Chartered Bank UAE does not provide financial analysis or consultation services in or into the UAE within the meaning of UAE Securities and Commodities Authority Decision No. 48/r of 2008 concerning financial consultation and financial analysis. Uganda: Our Investment products and services are distributed by Standard Chartered Bank Uganda Limited, which is licensed by the Capital Markets Authority as an investment adviser. United Kingdom: In the UK, Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. This communication has been approved by Standard Chartered Bank for the purposes of Section 21 (2) (b) of the United Kingdom’s Financial Services and Markets Act 2000 (“FSMA”) as amended in 2010 and 2012 only. Standard Chartered Bank (trading as Standard Chartered Private Bank) is also an authorised financial services provider (license number 45747) in terms of the South African Financial Advisory and Intermediary Services Act, 2002. The Materials have not been prepared in accordance with UK legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Vietnam: This document is being distributed in Vietnam by, and is attributable to, Standard Chartered Bank (Vietnam) Limited which is mainly regulated by State Bank of Vietnam (SBV). Recipients in Vietnam should contact Standard Chartered Bank (Vietnam) Limited for any queries regarding any content of this document. Zambia: This document is distributed by Standard Chartered Bank Zambia Plc, a company incorporated in Zambia and registered as a commercial bank and licensed by the Bank of Zambia under the Banking and Financial Services Act Chapter 387 of the Laws of Zambia.