23 June 2023

Global Market Outlook

Global Market Outlook

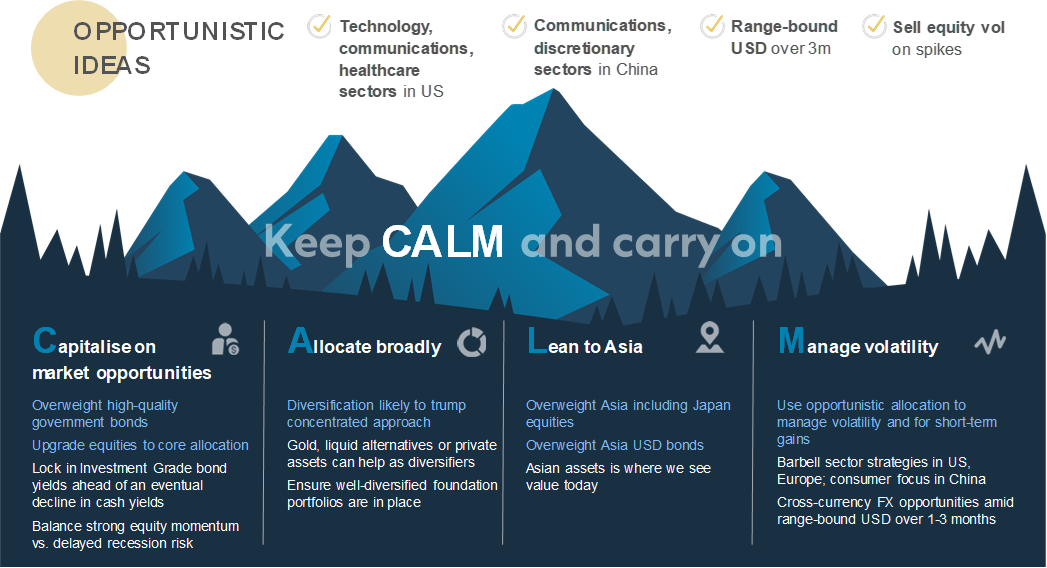

Keep CALM and carry on

As we enter H2 2023, two extreme narratives are jostling for investors’ attention. First, a ‘no-landing’ scenario which argues for chasing equities higher as the US avoids a recession altogether. Second, a scenario where risky assets are not worth holding at all as a deep recession awaits.

We believe a CALM strategy that takes a more balanced approach to Foundation portfolios and opportunistic allocations is more appropriate.

We propose four ways to do this: Capitalise on market opportunities, Allocate broadly, Lean to Asia and Manage volatility.

What would extend the uptrend in equities?

Will the US economy experience a recession

at all?

How has the multi-asset income strategy performed?

Strategy

Investment strategy and key themes

|

|

||||

|

Our top preferences

(12-month outlook)

Foundation Overweights

- Government bonds

- In equities: Asia ex-Japan, Japan

- In bonds: Developed Market IG government, Asia USD

Sector Overweights

- US: Healthcare, Technology, Communication Services

- Europe: Technology, Financial, Consumer discretionary

- China: Consumer discretionary & Communication services

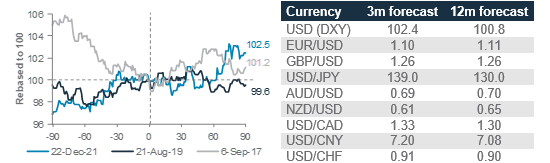

FX views

- Modestly weaker USD

Structural macro trends*

- A digital tomorrow

- Preparing for an ageing world

- From unipolarity to multipolarity

- Investing in a climate-constrained world

*Individual reports available

Keep CALM and carry on

- As we enter H2 2023, two extreme narratives are jostling for investors’ attention. First, a ‘no-landing’ scenario which argues for chasing equities higher as the US avoids a recession altogether. Second, a scenario where risky assets are not worth holding at all as a deep recession awaits.

- We believe a CALM strategy that takes a more balanced approach to Foundation portfolios and opportunistic allocations is more appropriate.

- We propose four ways to do this: Capitalise on market opportunities, Allocate broadly, Lean to Asia and Manage volatility.

The contrast between fundamentals and market momentum

As we enter H2 2023, financial markets are presenting a challenge to investors. Equity markets have surged, at least at a headline index level, and our view is that they may rise further, at least in the short term. However, leading indicators of economic growth (particularly in the US) continue to paint a less optimistic picture and most major central banks remain much more concerned about elevated inflation than about weak growth indicators.

Against this context, it is tempting to either wholeheartedly chase the surge in equities, or retreat to a very conservative portfolio. Instead, we believe investors should keep CALM and maintain a steady hand in relation to their portfolios in four ways:

- Capitalise on market opportunities (via an Overweight in high-quality government bonds and a core allocation to equities).

- Allocate broadly (on the view that diversification is likely to trump a concentrated approach in foundation portfolios).

- Lean to Asia (where we see greater relative value across equities and bonds).

- Manage volatility (in opportunistic allocations, via barbell-like equity sector strategies and cross-currency trades amid a range-bound USD over 1-3 months).

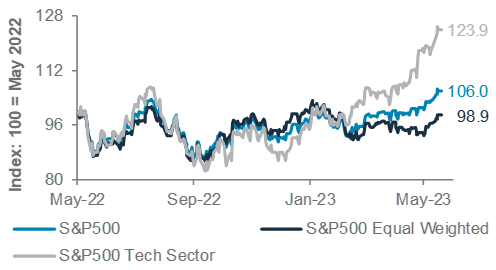

Fig.1 The technology sector has played a disproportionate role in US market strength

S&P500, S&P500 Tech, S&P500 equal-weighted indices

Capitalise on market opportunities

We are Overweight high-quality government bonds. We have also upgraded equities to a core allocation.

In H2 2023, we expect two extreme narratives to jostle for investors’ attention – first, the ‘no-landing’ scenario in which the avoidance of a US recession argues for chasing equities and risky bonds higher. Second, we are on the cusp of a deep recession and risky assets are not worth holding. We believe the best portfolio strategy sits in the middle.

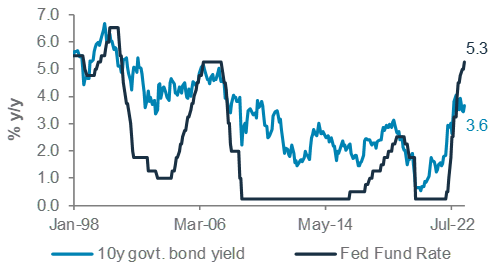

We prefer high-quality bonds because, here, we see a clearer risk/reward relative to other assets: (i) they offer an attractive yield, (ii) bond yields are likely to fall (prices are likely to rise) as economic growth slows, and (iii) their returns are likely to be less impacted by a slightly higher Fed peak rate, given the cushion from the already high current yields on offer.

More importantly, we believe market conditions today favour locking in the yield on high-quality Investment Grade (IG) bonds before slowing growth eventually pushes yields lower. This is a key advantage high-quality bonds hold over cash.

Meanwhile, we close our earlier Underweight in equities and upgrade the asset class to a core allocation. In our view, an Overweight view on Developed Market (DM) IG government bonds and a core allocation to global equities allow us to balance strong equity momentum today against the delayed, but still real, US recession risk.

Allocate Broadly

An environment of strongly competing narratives is one where we expect diversification to trump a concentrated approach. We advocate core allocations to gold, liquid alternatives or private assets, asset classes that have historically played the role of portfolio diversifiers (see page 6 for our suggested allocations to each asset class).

We close our earlier Overweight to gold given relatively elevated prices and the likelihood of a headwind from rising real (net-of-inflation) bond yields. However, we continue to see a core allocation to gold as an attractive portfolio diversifier. Still-robust demand from Emerging Market central banks is likely to place a floor under prices. Also, exposure to gold can be attractive during any short-term risk-off events.

Fig.2 Long-term US bond yields tend to peak around the same time as Fed policy rates peak

US Fed policy rate, 10y US government bond yield

Where accessible, the addition of alternative strategies (that include both liquid alternatives [‘hedge funds’] and private assets) typically leads to better risk-adjusted returns. During 2022’s cross-asset drawdown, these strategies demonstrated their value by exhibiting much more muted volatility than most other major asset classes.

Among liquid alternative assets, long/short equity strategies are a good example since they offer more muted downside volatility in return for relatively muted upside. Meanwhile, a small allocation to private assets can also add diversification benefits. In our assessment, a 27-32% allocation to alternative strategies can lead to 49-61bps of annualised outperformance relative to portfolios that exclude these (see 360 Perspectives – Alternative Assets and the role they play in portfolios for more)

Lean to Asia

We are Overweight Asia, including Japan, equities and Asia USD bonds.

One driver behind our view is to prefer markets where we see value. We see such value in Asia ex-Japan equities as a region. Chinese equities disappointed in H1 – while the economic reopening boom was indeed visible in the economic data, it failed to translate to equity market gains as US-China geopolitical tensions kept investors away. Nevertheless, this has resulted in Chinese equities turning even more inexpensive. We expect this value to be unlocked as domestic policy turns increasingly stimulative as policymakers become concerned about deflationary headwinds and US-China geopolitical tensions cool. Meanwhile, valuations of Indian equities have continued to ease from their highs, creating better value, especially for investors looking to benefit from what we see as the market’s positive structural outlook.

We believe Japan equities also offer value. Two factors that are likely to drive the outperformance of Japan equities over global equities are: (i) strong momentum in stock buybacks and (ii) earnings growth, supported by higher nominal economic growth as inflation stays elevated at least for now.

Within bonds, we like Asia USD corporate bonds, both for their credit quality – which remains higher than DM IG-rated peers – and still-reasonable value relative to history. While it is tempting to see this as a view on Chinese USD bonds given their significant weight in the asset class, we prefer to view it through our lens of preferring IG bonds. This means the asset class should eventually benefit from lower US bond yields and its attractive current yield.

Manage volatility

We would use opportunistic allocations in three ways in H2 2023: (i) adopt barbell-like sector strategies in the US and Euro area, while focusing on consumer-oriented sectors in China, (ii) capitalise on cross-currency opportunities amid a range-bound USD over the next 1-3 months, and (iii) look for opportunities to sell equity market volatility on spikes.

A starting point characterised by low volatility, combined with two strongly competing market narratives, means investors should be prepared for episodes of heightened volatility. Opportunistic ideas can be an additional source of returns in this context.

In the US, our sector preferences have turned a little more barbell-like. We view healthcare, communication services and technology as Buys. Healthcare sits at one end of the barbell, offering a relatively defensive exposure given the weaker macroeconomic backdrop. Technology and Communication services, on the other hand, offer an attractive hedge if the ongoing sector rally extends.

In the Euro area, we like Technology given its strong YTD price momentum. We also upgrade Consumer discretionary on strong earnings and Financial services on rising rates.

In China, our Buy views on the Communications services and Consumer discretionary sectors offer a route to take a more focused exposure to the market. We see attractive opportunities in these sectors, given the support from earnings, policy direction and consumer spending, which contrasts with poor sentiment on the broader market, driven to a large degree by worries related to the real estate sector.

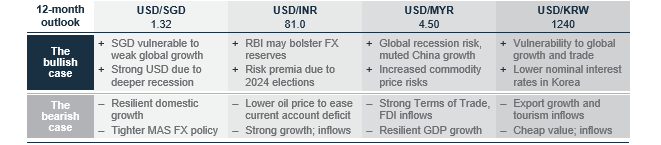

In FX markets, we continue to expect modest USD weakness on a 12-month horizon as US bond yields gradually move lower to price in weaker growth. On a more opportunistic 1-3- month horizon, though, we expect a more range-bound USD. This, in our view, is likely to open the door to cross-currency opportunities. The CNY is likely to be an exception to this as falling bond yields in China weigh on the currency. A relatively stable CNY versus major trade partners means policymakers are unlikely to lean against further CNY weakness.

Finally, equity volatility itself is likely to create opportunities. The level of volatility today remains at the lower end of the recent ranges and we are of the view that it has room to move higher, including short-lived spikes, when data or events surprise markets. We continue to believe a strategy to conservatively sell volatility during such opportunities

remains attractive.

Fig.3 Our H2 2023 Outlook: Keep CALM and carry on

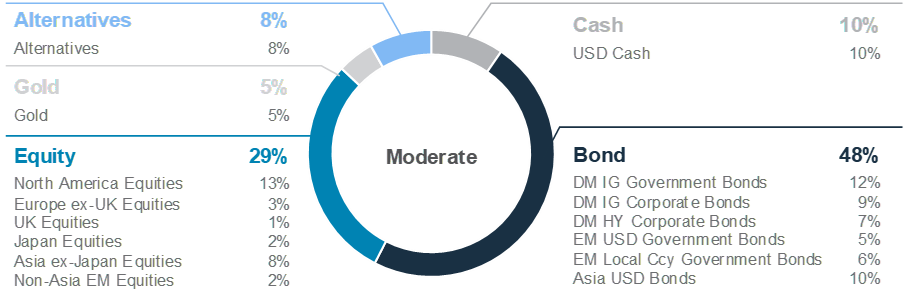

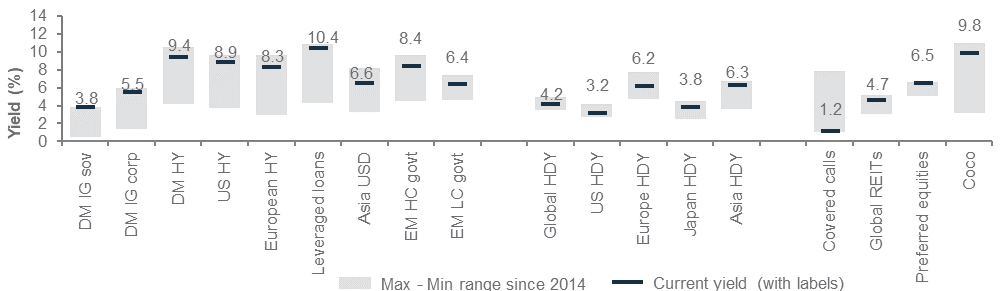

Foundation: Our tactical asset allocation

Global* allocation for a moderate risk profile

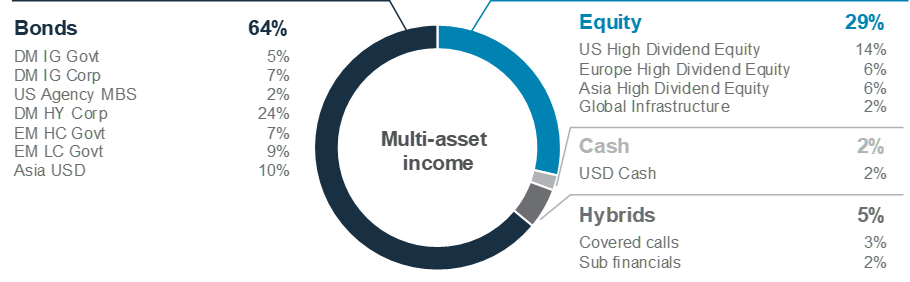

Multi-asset income allocation for a moderate risk profile

Foundation: Multi-asset income strategies

|

|

||||

Key themes

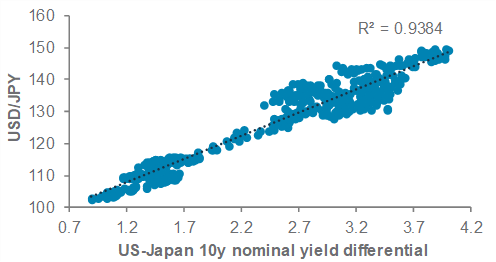

The recent turnaround in markets has supported the performance of multi-asset income (MAI) strategies. On a total return basis, our MAI model allocation returned 3.5% YTD (2.6% since the publication of Outlook 2023) and the income potential now stands at c.6%, which is an attractive absolute level, in our view. We saw gains across the board, with dividend equities, covered calls and EM bonds contributing to the bulk of the positive performance over the past quarter.

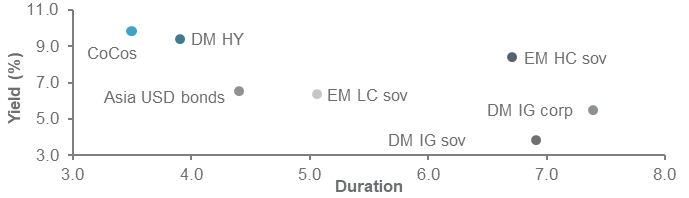

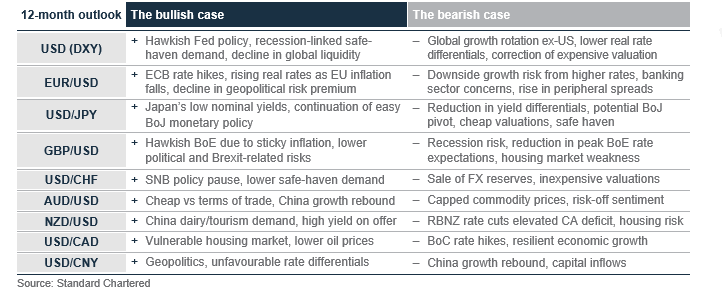

Yields on offer continue to look attractive from an absolute and historical (since 2014) standpoint. In our view, the bulk of the Developed Market (DM) rate hiking cycle is likely behind us. The sensitivity of multi-asset strategies to whether the Fed Funds rate peaks at 5.25% or 5.75% is likely to be low. Yields on offer on MAI strategies remain attractive, against the backdrop of an impending pause in central banks’ hiking cycle.

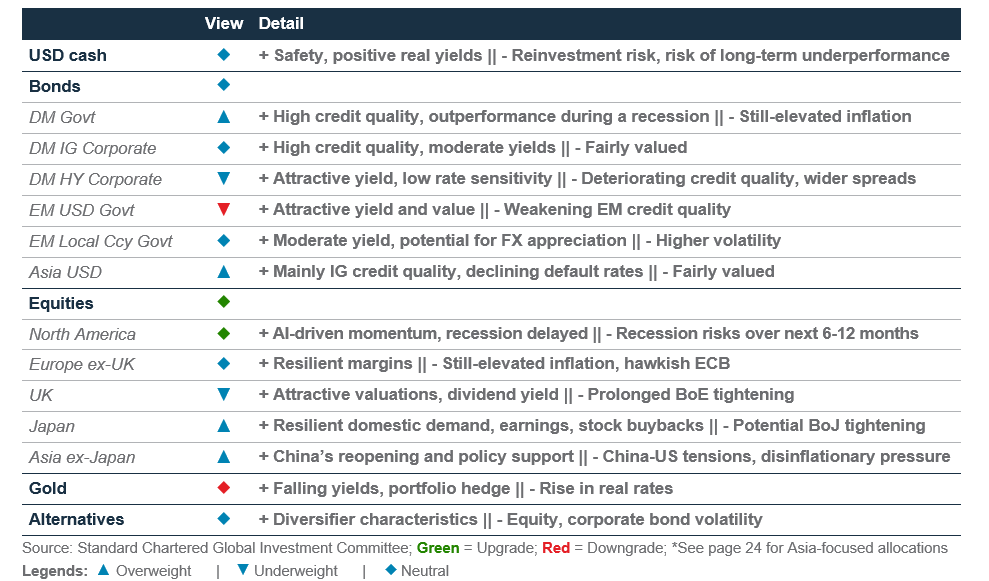

Neutral between Developed Market High Yield (DM HY) bonds and leveraged loans, given a push back in recession risk and the risk of rates remaining high for longer. DM HY also offers attractive yield per unit of interest rate risk across bonds (see the chart below). We remain Neutral between DM HY bonds and subordinated financial debt. Additionally, we closed our preference for covered calls over global dividend equities, following the strong performance in the former.

We reviewed the MAI strategic asset allocation this month to enhance the yield and returns potential. We increased our structural allocation to dividend equities and DM HY bonds, while expanding the income universe to include US agency mortgage-backed securities and infrastructure equities. We believe this will enable the MAI allocation to deliver an attractive total return and yield over the long term. We plan to release a detailed paper on the MAI SAA update in the coming weeks.

Key chart

With interest rates likely to remain high for the remainder of 2023, DM HY and Asia USD bonds offer a good balance of interest rate sensitivity and yield on offer

Fig. 4 DM HY and Asia USD bonds offer more attractive yields per unit of interest rate risk

Yield to worst vs interest rate sensitivity (duration) as of 22 June 2003

Fig. 5 Yields on income assets still attractive and might remain higher for longer

Yield to worst/dividend yield (%), yield range of various income assets since 2014

Contingent Convertibles are complex financial instruments. (Refer to Important Information on page 29 for further details)

Yields still plentiful for now

Our MAI allocation has generated a YTD performance of 3.5%. This was a result of broad-based gains in fixed income, dividend equities and non-core income assets. The Overweight to Asia USD paid off, while the drag on performance from subordinated financial debt faded as performance rebounded over the past three months. Signs of stability in the US banking sector and the reopening of bank debt issuance in Europe supported sentiment in non-core income as well as global dividend equities, which has an outsized allocation to the financial sector. Covered call, which is a strategy that sells options using the S&P500 index as the underlying to earn income, benefitted from the higher volatility prevailing in markets and exposure to technology.

MAI strategies can deliver attractive yields over the next 6-12 months, in our view. We believe that the bulk of the rate-hiking cycle is likely behind us. With inflation still significantly above central banks’ target level, policymakers are likely biased to maintain their hawkish rhetoric. The surprise rate hike by the Reserve Bank of Canada and Australia (after previously signalling a pause) also points to the low risk of any premature easing if inflation remains high. That said, the sensitivity of MAI strategies to whether Fed fund rate peaks at 5.25% or 5.75% is likely to be low. As such, MAI strategies are likely to continue delivering reasonably high yields relative to history over the coming months before central banks move decisively to cut rates.

Fig. 6 Stellar outperformance of covered calls over global dividend equities YTD due to its higher weight to technology and income from selling volatility

Performance of relevant indices rebased on 1 January 2023

Increasing credit risk at the margin…

We have added to DM HY bonds, despite expectations of a likely recession over the next 12 months. Credit spreads are largely in line with historical averages but the risk of higher spread is compensated by current high yields (over 9% yield-to-worst). If our view of a delayed US recession (see the Macro section) and any economic contraction being a mild one proves to be correct, this would suggest a rather benign outlook on default risks and credit spreads. In our assessment, spreads on DM HY bonds will need to expand by as much as 250bps before total returns become negative, assuming a mild default scenario of c. 2-3%. As such, it may be attractive for investors to consider clipping coupon from HY bonds, while maintaining a vigilant eye on any worsening of fundamentals and credit risk.

We have also added to Asia USD bonds, mainly funded from DM IG government and non-core. The yield on offer is attractive at over 6.5% for a predominantly IG asset class. Asia USD bonds will likely benefit as we expect China to introduce further stimulus after the recent spate of underwhelming economic data.

We have turned Neutral between leveraged loans and DM HY bonds. Growth continues to look resilient, while rates will likely remain elevated as policymakers remain wary about any signal of a premature easing, which may revive inflation expectations. This will likely continue to support both yields and total returns on DM HY as well as leveraged loans, underpinning our Neutral stance between the asset classes.

… as well as equity risk

We increased our allocation to dividend equities this month. Improvements in earnings revisions and a push back on the timing of recession are expected to support performance in high dividend equities. The performance of global high dividend equities has been disappointing so far, led by the underperformance of US dividend equities (-0.5%), which significantly underperformed Europe (8.7%) and Asia (10.4%) dividend indices on a YTD basis.

We are closing our preference for covered calls over high dividend equities. The performance of covered calls has been stellar so far this year as they have a broad exposure to global equities and the technology sector, which have performed very well YTD. We expect volatility to likely edge lower over the coming months, which is likely to reduce the income earned from selling volatility.

Strategically expanding our income universe

We have updated the strategic allocation of our MAI model to enhance its yield and return potential. Key changes include increasing the allocation to dividend equities and expanding beyond the global dividend index to include regional dividend equities from Europe as well as Asia ex-Japan. The inclusion of these assets is due to their more superior long-term expected returns, which would likely increase the return potential of our MAI model over the long term. We have also included an allocation to infrastructure equities, given the long-term opportunities in transitioning to a greener economy.

In terms of fixed income, we dialled up the strategic allocation to DM HY bonds at the expense of DM Sovereign bonds and non-core income. This was due to the higher expected returns as well as superior volatility adjusted-returns from DM HY bonds. In addition, we have further expanded our fixed income sleeve to include US agency mortgage-backed securities.

Please look out for our detailed update on the strategic asset allocation to MAI over the coming weeks.

Perspectives on key client questions

|

|

||||

What would extend the uptrend in equities?

There are clear signs of froth in the markets. The volatility index (VIX) has fallen to pre-COVID-19 levels, surveys tracking retail and active managers’ sentiment in the US are now in outright bullish territory, and market leadership in the S&P500 index is narrow. On the surface, these indicators suggest a rising level of complacency in the markets, and that a pullback in equities is likely at some point. But, by solely focusing on the bearish narratives, one would miss out on a more important consideration: whether the fundamental and technical conditions that have allowed equities to advance this year, despite a near-universal bearish view, would persist.

In our latest Global Investment Committee, we closed our Underweight in global and US equities and upgraded the US technology sector to an Overweight. To be clear, we are not convinced that equities are on the cusp of a new bull market. Equities historically only bottom during a recession, not before it has even started, and we continue to see a 70% probability of a recession occurring within the next 12 months. But we believe that a recession is still not overly close, with risks tilted towards a recession occurring later, rather than earlier, and less severe than expected.

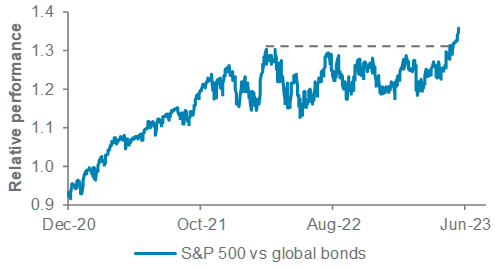

Until signs of a growth retrenchment become clearer, we have decided to avoid an Underweight stance to equities, especially with US stocks now breaking out of a 15-month trading range relative to global bonds (Fig 7). Additionally, a continued easing of inflation should enable the negative stock-bond correlation to extend, enabling one to adopt a more constructive stance on equities within multi-asset portfolios. However, prevailing risks, such as narrow stock market leadership, headwinds to liquidity from the rebuilding of the US government’s cash reserves and seasonal equity underperformance over the summer months, mean caution is still warranted.

This report lays out three conditions that would be necessary for the uptrend in equities to persist.

- A later and milder (or no) recession, which would allow investors to look beyond the trough in earnings and continue pricing in the possibility of a “soft landing”

- A continued decline in inflation, which would dampen the risks of monetary policy triggering another selloff in equities (as in 2022)

- Positioning to remain contained, instead of overstretched

Fig. 7 The relative performance of US equities vs global bonds has broken out of a 15-month range

Relative performance of the S&P 500 index and global bonds

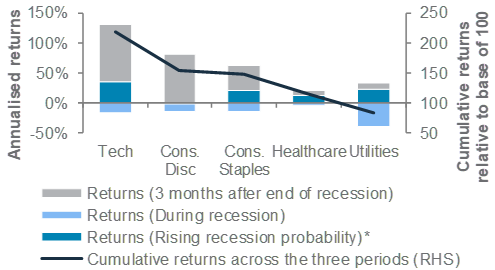

Fig. 8 US Technology sector stocks can be used to hedge potential upside risks, given attractive total return before and following a recession

Condition 1: A later, milder recession

We continue to see a high likelihood of a US recession in the next 12 months. However, the economy continues to grow on the back of strong consumption, which suggests a recession is still not imminent, while inflation continues to decline. Equities could grind higher if a recession is delayed, and investors warm to the possibility of a “soft landing” scenario.

There are certainly signs of cracks emerging. Leading indicators point to a recession, and the manufacturing sector is depressed. But the labour market remains resilient. Non-farm payrolls remain near the top of the pre-COVID-19 range and significantly higher than levels heading into past recessions. At the current 300k+ rate of monthly jobs growth, it has historically taken around seven months before the onset of a recession. This suggests that a recession could still be a few quarters away.

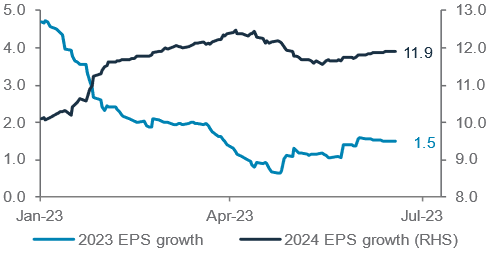

Meanwhile, forward earnings, particularly for the US, have been revised higher after a significant downgrade last year. Price inflation has supported the nominal growth of earnings and forward EPS could continue to stabilise even in the event of a mild economic contraction, provided price inflation stays positive and wage growth eases.

Bottomline: OW to US technology to hedge upside risks. While technology stocks underperform during a recession, their performance before and after a recession more than make up for it (Fig 8). Given the uncertainty on recession timing, an OW stance on technology can hedge against upside risks in markets.

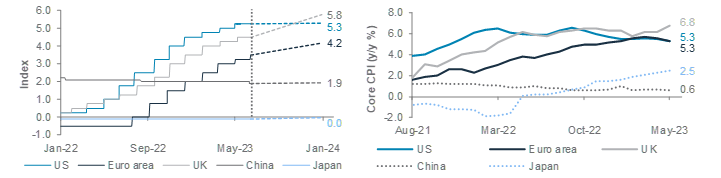

Condition 2: Inflation to decline, keeping the risk of a policy-led selloff at bay

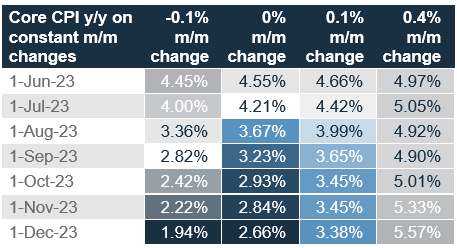

Fig. 9 Inflation is likely to drop due to base effects

Trajectory of y/y core CPI based on constant m/m changes

There are initial signs that monthly inflation changes may slow over the coming months. While core inflation remains sticky, the more important “super-core” inflation, which excludes food, energy and shelter, has fallen below 3%. There are uncertainties pertaining to wage pressures, which remain elevated and could feed into core PCE over time as productivity declines. However, leading indicators, such as quits rate, also point to further cooling of wage pressures.

Bottomline: With the Fed likely to extend the pause in its hiking cycle as inflation declines, interest rate-sensitive assets (technology equities, IG bonds) could benefit.

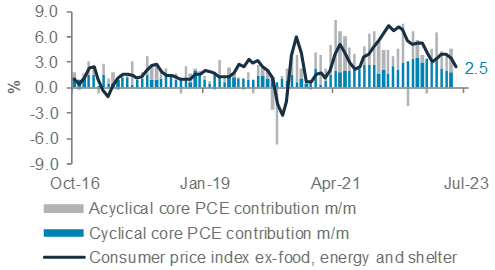

Fig. 10 “Super-core” inflation has fallen below 3%

Consumer price index ex-food, energy and shelter and monthly core PCE by cyclical / acyclical components

Condition 3: Investor positioning contained

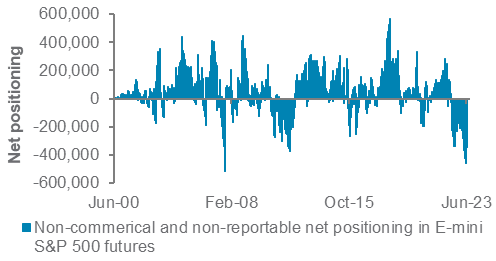

While the risks of a policy-led selloff in equities remain low and economic conditions arguably still resilient, positioning in US equities has seen rapid changes. Surveys tracking sentiment of retail investors and active managers have improved considerably from peak bearishness in Q3 last year, and bets on the AI-related stocks have become notably crowded, leading to only 24% of the S&P500 companies outperforming the index in May. However, although sentiment has clearly improved, it is not yet at levels that would be concerning. CFTC net positioning in the S&P index also remains near multi-year lows.

Fig. 11 Bearish positioning in S&P500 index remains near extreme levels, which bodes well for forward returns

Net positioning in E-mini S&P500 futures

Bottomline: Sentiment has improved, but not yet to levels that would indicate an exhaustion in the equity market uptrend

Macro overview at a glance

Summary

|

|

||||

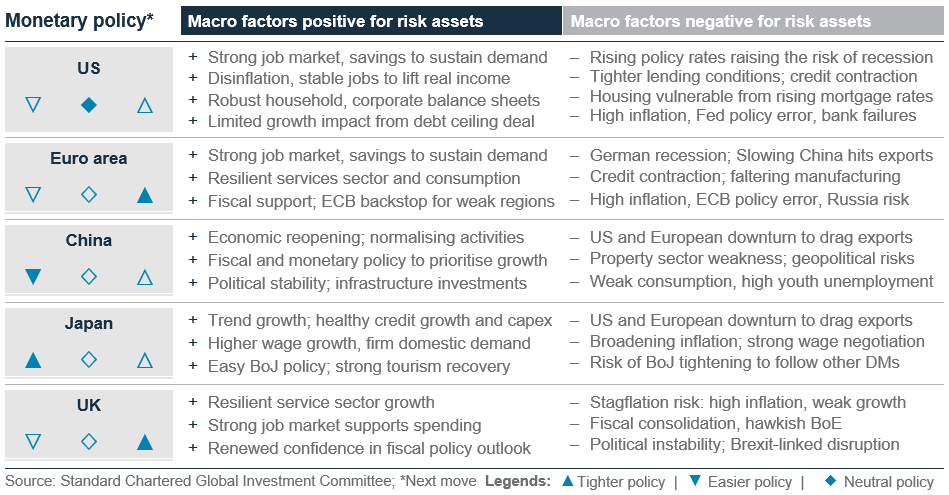

Key themes

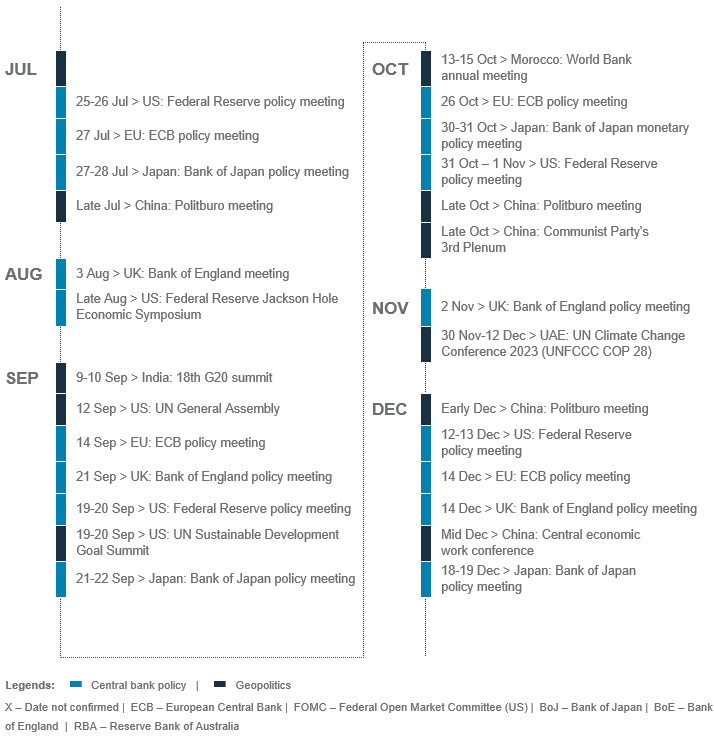

We see 70% probability of a US and Euro area recession over the next 12 months, but now expect a recession to start from Q1 24, later than previously expected. Resilient services consumption, aided by pent-up demand and excess savings built up during the pandemic, is sustaining growth longer. However, our leading indicators are showing that the sharp monetary policy tightening over the past year is starting to impact economic activity. Hence, we expect the Fed to pause for the rest of the year before cutting rates in H1 24 as a recession sets in. The ECB is likely to hike rates by 25bps one more time amid elevated inflation, before pausing, and then cutting rates next year. Key risk: elevated inflation forcing higher rates.

China remains at the other end of the global economic cycle. While the pace of the post-pandemic recovery has slowed, we expect growth to exceed Beijing’s 5% target this year. Building disinflationary pressures meanChina’s policymakers are likely to sustain monetary and fiscal stimulus to support ‘quality’ growth. The PBoC cut rates in June, while authorities have rolled out incentives to support home buyers and boost household goods consumption. We expect more support, including for the property sector, in H2.Key risks: prolonged deflationary pressures, subdued business and consumer confidence.

Key chart

The inflation paths of US/Europe and China have diverged; this explains sustained hawkishness of US and European central banks, while China policymakers focus on extending the post-pandemic recovery

Fig. 12 Monetary policies between US/Europe and China have diverged with inflation

Benchmark rates, rate expectations over next 6 months and core inflation of major economies

East-West divergence continues

The divergence in economic and policy outlook between the US and Europe versus China remains in place.

Will the US economy experience a recession at all? The short answer is: Yes, we still expect a recession over the next 12 months, only that a recession has likely been delayed to Q1 24 (from Q4 23 anticipated earlier) due to excess household savings, which is sustaining the consumption-led growth longer than initially anticipated.

A US recession has been widely anticipated by markets since last year, especially after the US government bond yield curve inverted (10-year yield fell below 2-year yield in July last year and below 3-month yield in November, signalling monetary conditions were tight enough to cause a sharp downturn in the coming years). Since the 1960s, the inversion of the 10-year versus 3-month yield curve has foretold the start of a US recession 4-21 months later (median: 11 months). Using the historical range, a recession is anticipated to start anytime between Q1 23 and Q3 24 (median: from Q4 23). In this cycle, since the US economy has seen the second-steepest Fed rate hiking cycle in history, there is arguably a higher probability of a recession occurring sooner than the historical average.

Other leading (early warning) economic indicators, such as new orders-to-inventory ratio, initial jobless claims, the pace of hiring of temporary workers and consumer confidence, have been flagging heightened risk of a recession in the past few months. The latest warning sign is the rising unemployment rate. Historically, when the US unemployment rate rose on an annual basis, a recession became imminent, and when the three-month moving average (3mma) rose 50bps from its lows in the previous 12 months, a recession had started (the so-called Sahm rule). So far, the US jobless rate has risen on a y/y basis but the 3mma is barely above its 54-year low of 3.4% hit in January. Meanwhile, a leading indicator of the overall unemployment rate is the jobless rate of permanent job losers (those whose employment ended involuntarily and are not on temporary layoff). Historically, when this rate rose more than 30bps from its cycle lows, a recession had started. The rate has risen 23bps so far. These indicators (see GMO presentation for details) show why we allot a 70% probability of a recession over the next 12 months.

What is delaying the recession? Various estimates show US households still have more than USD 1trn of excess savings built up during the pandemic, which they continue to spend, particularly on services consumption. While this has dwindled from a peak of c. USD 2trn, it can potentially continue to drive the consumption-led growth for a few more quarters until the lagged impact of 500bps of Fed rate hikes on the economy tightens financial conditions enough to cause a recession.

Is the Euro area already in a recession? The Euro area economy has contracted 0.1% on two subsequent quarters (Q4 22-Q1 23). The drawdown was led by Germany, which also fell into a technical recession during those two quarters. However, other large Euro area economies have continued to grow, albeit slowly. This divergence within the Euro area can be explained by the German economy’s previous over-reliance on Russian gas. The cut-off in Russian gas supplies following the Ukraine war has impacted Germany more than other parts of Europe. Also, the German economy is more reliant on the manufacturing sector, which is slowing worldwide, while southern Europe is more reliant on services consumption. The ECB’s 400bps of rate hikes over the past year is starting to tighten bank lending. Nevertheless, job markets remain historically tight and Europeans have barely spent their excess savings built during the pandemic. This suggests we could see a few quarters of weak growth before the impact of ECB rates lead to a recession early next year.

Is China’s recovery over? China’s post-pandemic recovery has been brief, with various economic activity indicators starting to peak. The manufacturing and exports sector is particularly impacted by sharply slowing demand for goods in the US and Europe as pent-up demand from the pandemic wanes. China’s domestic consumption picked up strongly, as seen from recent holiday season spending, but here too there are signs of waning consumer confidence, with lesser demand for big-ticket items. As a result, disinflationary pressures have increased, with producer prices in outright deflation. We expect authorities to unveil more stimulus measures to revive consumer and business confidence in H2, which could include steps to revive demand for housing, boost youth unemployment and promote China’s drive towards self-sufficiency in high technology, including a green economy.

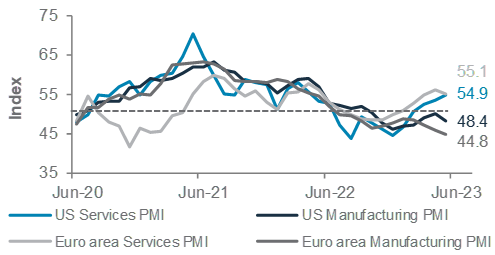

Fig. 13 US and Euro area services sector still strong

US and Euro area manufacturing and services PMI

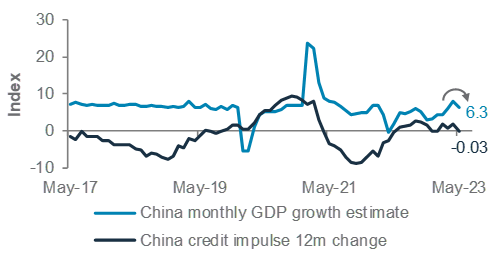

Fig. 14 China to stimulate further as recovery stalls

China’s monthly growth estimate, 12m credit impulse change

Asset Classes

Bonds – at a glance

|

|

||||

Key themes

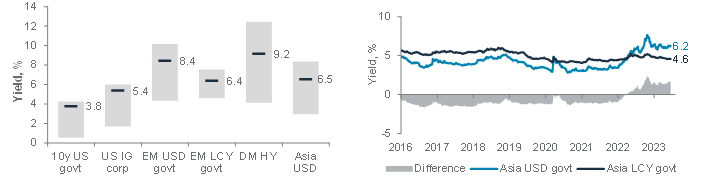

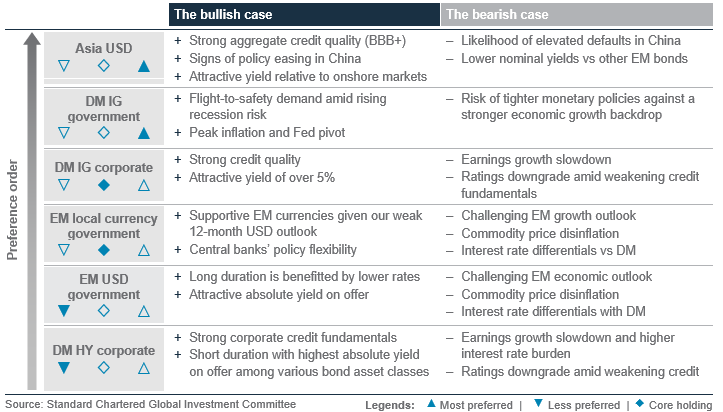

We favour Rates (or government bonds) over Credit (or corporate bonds) as our US and Euro area recession expectations lead us to have a more defensive stance. We are Overweight Developed Market (DM) Investment-Grade (IG) government bonds as tightening financial conditions in the US and Europe implies a high likelihood of a recession by Q1 24, despite recent resilience in data. We revise our 12-month 10-year US government bond yield target range to 3.00-3.25%.

We are Overweight Asia USD bonds. Expectations of policy support in China should lift investor sentiment and corporate profitability. Additionally, we like the asset class for its high aggregate credit quality (nearly 85% IG bonds) and low volatility relative to DM IG government and corporate bonds. We downgrade Emerging Market (EM) USD government bonds to Underweight, alongside our DM High Yield (HY) bonds (Underweight). We believe their yield premium are too low given the macro-economic risks. An ‘immaculate disinflation’ scenario, where US avoids a recession, is the key risk to our views.

Key chart

Asia USD bonds and DM IG government bonds are still offering attractive reward when factoring in credit quality, yield on offer and potential for capital appreciation; Lower LCY bond yields offer a unique opportunity of switching into Asia USD bonds

Fig. 15 Bonds are still offering above-historical-average yield; Asia USD bonds are likely to attract domestic local currency-based investors

Current yield for bond asset classes and their 10-year range; JPMorgan Asia Credit government bond yield and JPMorgan

How high-quality bonds play their part in the CALM investment framework?

We believe that high-quality bonds offer an attractive risk-reward irrespective of whether our base case of economic slowdown or the extreme “no-recession” narrative plays out. Analysis of past recessions shows that DM IG government bonds outperform equities and other bond asset classes in recessions as they benefit from capital appreciation when central banks cut interest rates. However, they should perform even in a no-recession scenario as investors can lock in the attractive yield and benefit from modest capital appreciation as the Fed cuts rates gradually towards its long-term target.

Why are we Overweight Asia USD bonds?

Asia USD bonds are ranked as our most preferred bond asset class. They delivered positive returns but underperformed DM HY bonds in the H1 2023 as Asia’s growth momentum slipped. We expect more Chinese policy stimulus and structural growth in India to drive decline in credit spreads, which could help Asia USD bonds outperform in H2 2023.

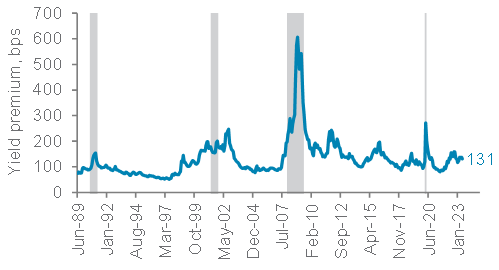

Asia USD bonds comprise of 85% IG bonds, and offer an aggregate BBB+ credit quality, which offers defensive exposure in the event of a DM-led recession. In addition, Asia USD bonds have a lower price volatility versus DM government bonds and corporate bonds. Valuations of Asia USD bonds are still attractive, offering 6.5% and c.315bps nominal yield and yield premium, respectively, which are both above historical average. Asia USD bonds also continue to offer attractive yield premium over Asia local currency bonds and offer an attractive alternative to gain Asia exposure.

Why are we Overweight government bonds, but Neutral IG corporate bonds?

While the Fed has guided towards two more rate hikes in 2023, markets continue to price in the probability of only one more. Given that 10-year bond yields tend to rise to a lower degree than actual rate hikes, we see limited upside in yields, with 4% acting as near-term peak. This suggests limited downside risk for investors. However, our expectation of US recession in early 2024 could mean that Fed may need to start

cutting rates sooner than expected, and thus we expect 10-year US government bond yield to fall to 3.00-3.25% by June 2024. Hence, we are Overweight DM IG government bonds.

This raises the question as to why we are less optimistic on DM IG corporate bonds, which offer similar credit quality and interest rate sensitivity. While we expect DM IG corporate fundamentals to remain robust, the increasing risk of rating downgrades, combined with expensive valuations, lead us to view it as a fair but uncompelling opportunity.

Why are we Underweight DM HY bonds?

While we understand the attractiveness of HY bonds from an income perspective given its high nominal yield (c.9%), we are not tempted to upgrade our view for two key reasons:

- Although prior opportunistic refinancing by corporates has pushed the so-called maturity wall further, the elevated borrowing costs are likely to create a challenge for debt refinancing and interest payments, which could lead to a higher default rate.

- Deterioration in credit quality and increase in rating downgrades could speak a sharp increase in credit spreads, which are too low, in our assessment.

EM USD government bonds downgraded to Underweight, local currency bonds at Neutral

We believe elevated recession risk in DMs is likely to weigh on the commodity and goods/services export demand for EM countries. This could lead to a decline balance of payments and increased external vulnerability. Hence, we downgrade EM USD government bonds to Underweight as we see the risk of an increase in credit spreads due to credit deterioration.

We are Neutral on EM local currency government bonds. Our expectation of a modestly weaker USD on a 12-month view would likely be beneficial to EM FX (often a large contributor of returns) and bonds. We view EM central banks as having more flexibility to ease monetary policies given more manageable domestic inflation. However, their high volatility leads us to view the risk-reward as more balanced.

Fig. 15 DM IG corporate yield premium looks expensive when compared to levels during previous recessions

DM IG corporate yield premium; NBER defined US recession

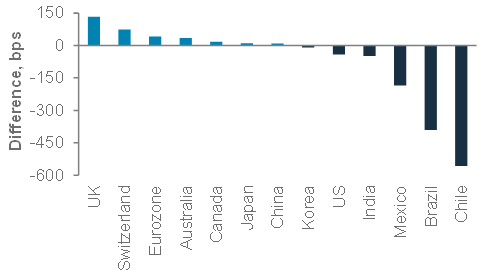

Fig. 16 EM central banks are expected to cut rates more than their DM counterparts

1-year market implied change in interest rates

Equity – at a glance

|

|

||||

|

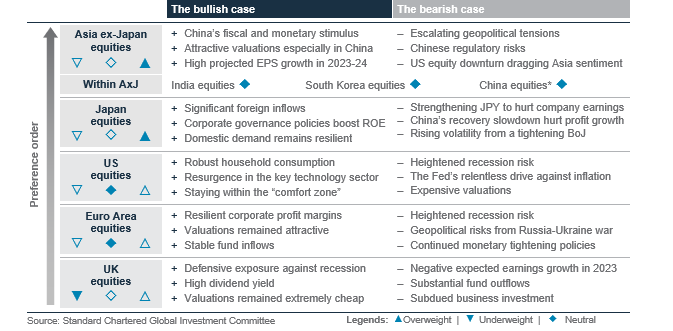

Key themes

We closed our Underweight on global equities (and US equities) on a 12-month horizon. Economic data, particularly in the US, has been stronger than expected. This pushes the timing of a US recession to around Q1 24.

We have the strongest conviction on Asia ex-Japan – hence we are Overweight the region’s equities. We believe China equities are likely to perform in line with the region. Economic data has been under-delivering, but the Chinese government is likely to continue with targeted stimulus to support growth. Visits from prominent US business leaders and key officials from the US government suggest a potential thaw in US-China relations, soothing geopolitical concerns – one of the key headwinds in H1 23 – in the short term. We believe India equities are also likely to perform in line with the region– a tug-of-war between high valuation premium versus strong estimated (consensus) EPS growth in excess of 20% in FY23 and FY24.

We are Overweight Japan. Improving corporate governance, share buybacks and still reasonable valuation continue to attract investor attention. We are Neutral Euro area equities. Valuation discount continues to be significant and corporate margins resilient, offset by the ECB’s hawkish policies. Finally, we are Underweight UK equities where we see the weakest earnings growth this year, offsetting its low valuation. The risk lies in a shift in investor sentiment back in favour of Value stocks.

Key chart

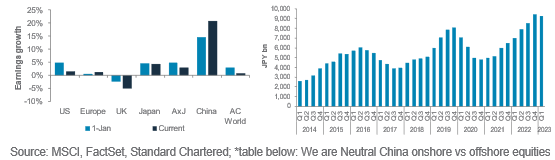

A smoother operating and regulatory environment in China is likely to help earnings growth. Meanwhile, the Tokyo Stock Exchange’s initiative to improve corporate governance has led to more transparency and share buybacks from Japanese companies

Fig. 17 China’s earnings prospect is tailwind for Asia ex-Japan equities, while Japan is riding on improving corporate governance

Regional earnings growth (LHS); Japan share buybacks

Closing Underweight on global equities

We upgraded global equities to Neutral because we are expecting a delay in the timing of recessions in the US and the Euro area to around Q1 24 (versus Q4 23). Corporate earnings and economic data have been more resilient than initially expected.

Fig. 18 EPS growth in US equities revising upwards as the year passes

MSCI US EPS growth

Overweight Asia ex-Japan equities

We remain Overweight Asia ex-Japan equities. The timing of a recession in Developed Markets (DMs) appears to be pushed but is still likely in a 12-month horizon. This may prompt investors to rotate into Asia ex-Japan, where the monetary environment remains relatively easy versus DMs. The region is reasonably valued, in our view. The 12-month forward P/E is at a 16% discount to global equities, which is below its historical average.

We expect China equities to perform in line within our Overweight region in Asia ex-Japan. China equities have disappointed in H1 23. The recent economic data releases have led to disinflationary fears, and we believe this is likely to lead to more stimulus from the central government. China’s valuations remained attractive, with equities currently trading at a 25% discount in terms of P/E to Asia ex-Japan equities, which is below -1 standard deviation from the long-term average.

We are Neutral China onshore versus offshore. The recent visit by Anthony Blinken, the US Secretary of State, may help to soothe tensions between the US and China, which is likely to improve performance in the offshore market that is more sensitive to foreign inflow and outflows.

We expect India equities to perform in line within our Overweight region in Asia ex-Japan They are projected to enjoy stellar EPS in 2023 – north of 20%. However, they are trading expensive versus Asia ex-Japan equities, at a 60% premium on a 12-month forward P/E basis.

Fig. 19 Asia ex-Japan equities trading cheaper than its long-term average discount vs global equities

12-month forward EPS growth estimates of MSCI Asia ex-Japan vs MSCI All-Country World

Overweight Japan equities

We stay Overweight Japan equities. Poor corporate governance has been the long-term Achilles’ heel of Japan equities, but there have been encouraging signs of improvement on that front, with increasing transparency from companies and dialogue with investors. Despite the recent rally, valuations versus global equities remain below the long-term average. A potentially strengthening JPY may hinder Japan’s economic recovery and dampen corporate earnings, but an unhedged FX exposure mitigates some of this risk. Potential termination in the BoJ’s yield curve control (YCC) policy may lead to heightened market volatility.

Neutral US equities

We upgraded US equities to Neutral. Economic data has been beating expectations and is resilient. Concerns about the financial sector has not triggered further risk-off sentiment. Meanwhile, the AI-driven rally had propelled the “growth-heavy” US equities to break key resistances on the upside. However, this is a double-edged sword, where the rally has been concentrated and not broad-based. The region’s valuation remains relatively expensive, and the Fed has signalled further tightening ahead.

Neutral Euro Area equities

We stay Neutral Euro area equities. The region is currently trading at a significant valuation discount, which could offset the negative impacts from the ECB’s aggressive interest rate hikes. We see Euro area equities underperforming US ones because of its heavier Value tilt – an environment of capped yields is continuing to lend tailwind to Growth stocks.

Underweight UK equities

UK equities remain Underweight. We acknowledge that valuations remain extremely cheap, but its earnings growth is negative and the weakest among our regions. Inflation remains a key concern and may lead to further tightening by the BoE. Lastly, UK equities is heavy in the Value sectors, which are being overshadowed by the Growth ones globally.

ESG investing in Asia

|

|

||||

|

ESG investing in Asia remains relevant

The rise of energy prices and rotation out of Growth stocks in Asia have weighed on the relative performance of ESG investments, leading to investor scrutiny on the role of ESG in their investments. We believe that ESG continues to add resilience to investment portfolios.

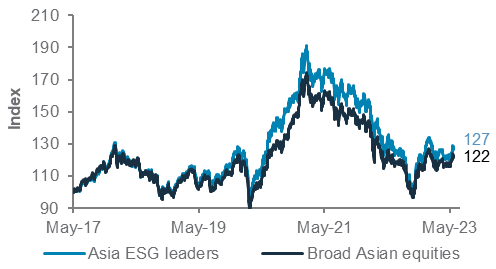

Fig. 20 Asia ESG leaders have generally outperformed

Total return from MSCI EM Asia ESG Leaders and MSCI EM Asia indices (rebased May-2017=100)

This is consistent with empirical research that shows a positive correlation between broad financial performance and ESG factors, especially in Emerging Markets (EMs). In our view, this positive correlation is underpinned by two long-term drivers: 1) sustainability opportunities are aligned to Asia’s growth; and 2) strong ESG credentials protect companies against business risks. The caveat to this performance is the quality of ESG integration and the ability to assess key ESG factors.

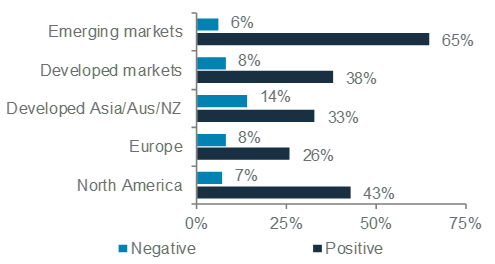

Fig. 21 ESG factors are positively correlated to broad financial performance, especially in EMs

Correlation between ESG factors and financial performance*

The ESG opportunity in Asia

In past decades, the effort to lift Asia out of extreme poverty was often fuelled by “growth at all costs” policies, which is increasingly unviable. Governments are now focusing on sustainable growth, resulting in a rich set of opportunities for ESG investing in Asia.

Asia’s low carbon transition continues to enjoy structural tailwinds as more governments step up their net zero commitments. In fact, almost two-thirds of the renewable power built globally in 2020 was in Asia. Asia has also emerged as a key producer of critical components for the shift to a low carbon economy, such as electric vehicle batteries.

Beyond climate, there are also growth prospects associated with social needs in the region. Two sectors that stand to benefit are healthcare and financial services. Growing affluence has led to a health focus, lifting the demand for healthcare. In financial services, there remains a huge opportunity in financial inclusion for the under-banked.

Supportive policies benefit early adopters

Policy makers and regulators in Asia have been increasing the number of policy interventions in the recent years, making it more costly for companies with poor ESG management to operate. This has, in turn, driven companies to accelerate their implementation of ESG policies.

In Asia, investors are in an advantageous position, given a relatively higher number of firms with room to improve their ESG profiles. Better ESG track records can unlock access to lower-cost capital, enhancing financial performance over time. Conversely, companies with poor ESG practices might be penalised and potentially excluded from portfolios.

Challenges in ESG Investing

That said, ESG investing is not without its challenges. While there are several taxonomies in place, the lack of standardisation in ESG disclosure makes it challenging for investors to make comparisons across companies in the region.

Beyond the equities and corporate bonds space, there is also a lack of meaningful ESG data in non-core asset classes, in particular sovereigns and private assets. This makes it challenging for investors to incorporate ESG considerations into their multi-asset portfolios.

In summary, despite the recent bumps with ESG investing, we continue to believe that a focus on the material ESG factors and relevant sustainable themes in Asia will have a positive impact on investors’ portfolios.

Equity sector views

|

Prefer resilient growth in DMs

Buy consumption-oriented sectors in China

- We shift our preference towards sectors with resilient growth in the US and Europe. This is in line with our view that a US recession is delayed to 2024.

- Meanwhile, we believe China’s consumption recovery offers attractive opportunities to buy the Communication services and Consumer discretionary sectors.

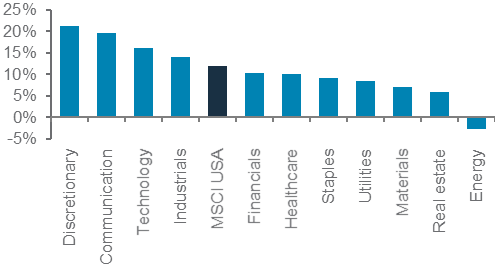

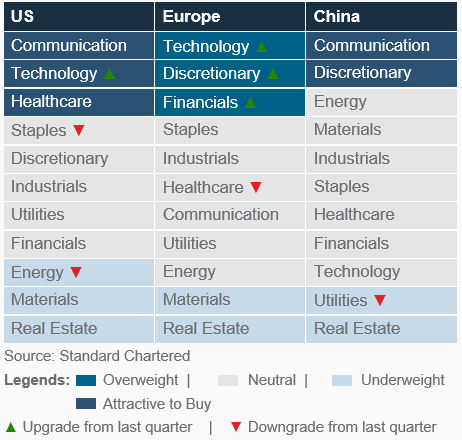

US

Our view is to buy three sectors – Communication services and Technology for their resilient growth and the defensive Healthcare to balance out the risks. Communication services has the strongest 2023 earnings momentum among the sectors in the US. The media and entertainment segment could also benefit from AI applications, and its valuation remains attractive. Technology is upgraded to a buy. Its largest software segment continues to see defensive recurring revenue, and AI has sparked significant orders benefitting the semiconductor segment. Although valuation has climbed to elevated levels, we see further scope for gains as price momentum is strong and investor positioning is not extreme. Healthcare is our preferred defensive exposure to balance out the risks as we still see an upcoming US recession, albeit delayed to 2024. Relative valuation of the sector remains reasonable.

Other views: We downgrade Energy to Underweight as price momentum is poor and its earnings have been revised down consistently since the start of the year. We are Underweight Materials as its earnings are still above trend. We are Underweight Real estate as higher interest rates continue to weigh on property prices.

Fig. 22 We believe US Communication services and Technology sectors offer attractive growth; the defensive Healthcare is also preferred to balance out the risk

Consensus 2024 EPS growth by sectors in the US

Europe

We upgrade Technology to Overweight. The semiconductor segment accounts for over 50% of the sector and is expected to benefit from AI investments, driving strong earnings growth up to 2025. Consumer discretionary is upgraded to Overweight. Luxury goods continue to drive sector earnings and autos exceeded expectations in Q1 23 results. We view the sector as a play on China’s reopening. Financials is upgraded to Overweight as more interest rate hikes drive strong earnings growth and valuation remains attractive.

Other views: We are Underweight Real estate as price momentum remains poor and Underweight Materials as we see risk of further earnings weakness as growth slows.

China

We see value in the two China sectors we consider a Buy. Communication services is dominated by media and entertainment companies that we believe will benefit from greater consumer spending and policy support for internet firms. Earnings revision in the sector has rebounded strongly. We also see Consumer discretionary as a beneficiary of the ongoing recovery and policymakers’ priority in boosting domestic consumption. The recovery is likely to gather pace in H2 23 as job markets recover and income growth steps up.

Other views: We downgrade Utilities to Underweight along with Real estate as we expect both to lag a market rebound.

Fig. 23 Our sector views by region

FX – at a glance

|

Key themes

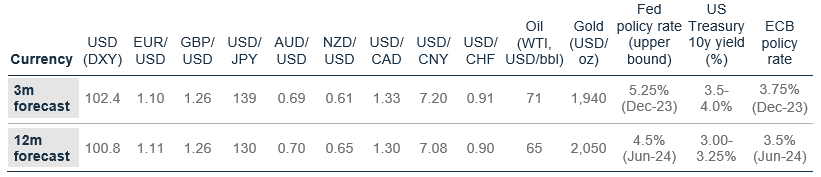

We expect the USD to be rangebound over the next three months before resuming its decline on a 12-month horizon. The Fed’s recent guidance towards a higher terminal Fed Funds rate due to a resilient labour market and sticky inflation will likely keep the 2-year US government bond yield elevated. This means the USD will remain rangebound over the next three months owing to the interest rate advantage over other major currencies. Additionally, the decline in US and global liquidity, due to a combination of ongoing reduction in central bank balance sheets and the US Treasury refilling cash reserves, is also supportive for the USD. However, we still see a high likelihood of a US recession over the next 12 months. Hence, we expect the Fed to start cutting interest rates sooner than its current guidance. As markets price Fed rate cuts in advance, we expect 2- and 10-year US government bond yields to decline substantially over the next 12 months, leading to narrower interest rate differentials and pushing the USD lower. Persistent US inflation or a sharper-than-expected US growth slowdown are key risks to our bearish USD view as they may spark safe-haven demand leading to USD resilience, or even USD strength.

Although we expect further upside in the EUR on the back of the ECB’s hawkish guidance, we lower our 12-month forecast as renewed hawkishness from the Fed, the RBA and the BoC means that interest rate differentials for the EUR may narrow less than previously expected. GBP/USD is likely to decline over the next three months as we believe markets have overpriced the number of BoE rate hikes, and a recalibration lower could weigh on the pair. Improvement in China’s growth expectations should lead to modest appreciation for the CNH and commodity currencies – the AUD, the NZD and the CAD.

Key chart

Decline in global liquidity, including US Treasury’s cash refill, is likely to put upward pressure on the USD in the next three months. Over the next 12 months, lower real (net of inflation) interest rate differentials, our expectation of Fed rate cuts and decline in US government bond yields to push the USD lower

Fig. 24 Decline in global liquidity is supportive for the USD in the near term

Performance of USD (DXY index around US Treasury cash reserve refills; table of forecasts)

Fig. 25 Summary of major currency drivers

Preparing for more muted FX markets

We expect EUR/USD to appreciate modestly towards 1.10-1.12 over the next three months before settling into a range. We believe the ECB will hike rates further over the next few months and then pause, which should be supportive for the EUR. However, in the near term, elevated long speculative positioning and the diminishing return from the dip in energy costs could limit EUR/USD appreciation. However, the EUR’s high sensitivity to risk sentiment means that unless we see upside surprise in the region’s growth, the EUR is likely to appreciate only modestly before settling in a range.

Fig. 26 Dip in excessively hawkish market expectations of the BoE rate hikes to drive GBP/USD lower

Market-implied and Bloomberg consensus forecast for the BoE policy rate

May 2024 market-implied rates as a proxy for Q2 24

We see elevated downside risks to GBP/USD over the next 3- and 12-month horizons. While UK’s inflation remains uncomfortably high for policymakers, markets have priced in an excessive degree of rate hikes, in our view. Downside risks to UK’s economy, especially the softness in the housing market, should lead the BoE to hike less than expected. This could lead to a decline in GBP bond yields, which combined with normalisation of elevated speculative positioning should lead GBP/USD to decline towards 1.24-1.26.

The outlook for USD/CHF has turned more balanced and should trade around 0.90. While the SNB hiked rates by 25bps this week, we see elevated risk of a policy pause. Swiss inflation has steadily declined, with core inflation falling below the 2% target. Our less bullish EUR forecast also reduces pressure on the SNB to be hawkish, given the central bank focusses on the EUR/CHF level to manage imported inflation.

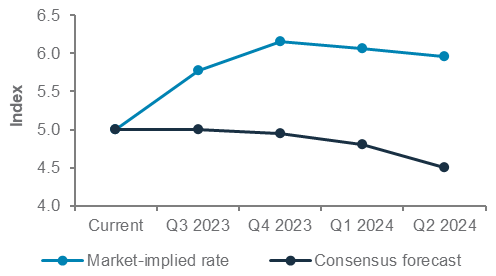

Over the next three months, our range-bound USD view and lack of signs of BoJ policy normalisation

could keep the pair around 139-140. However, elevated inflation and the recent wage hikes mean that the pressure on the BoJ to tweak or scrap its Yield Curve Control (YCC) policy persist, which could spark a sharp move lower. This, combined with our expectation of lower US yields, leads us to expect USD/JPY to decline towards 125-130 over the next 12 months.

Fig. 27 Expected decline in US yields and normalisation of the BoJ policy to lead to lower USD/JPY

USD/JPY and differential between 10-year US and Japan government bond yields

Surprise rate hikes from the RBA and the BoC due to sticky inflation, and expectations of stimulus in China have led the recent AUD and CAD appreciation. We expect commodity currencies (AUD, CAD and NZD) to consolidate recent gains and trade sideways over the next three months. Over the 12-month horizon, we expect a modest rise, led by China’s growth resilience and favourable rate differentials.

We expect near-term increase in USD/CNH towards 7.20, even possibly 7.30, as the recent PBoC easing will lead to wider interest rate differentials and as the CNH CFETS basket is still not cheap. Over the next 12 months, we expect USD/CNH to decline towards 7.00-7.08 as the CNH benefits from robust domestic growth and potential investor flows.

We expect USD/INR to decline modestly towards 80-81 over the next 12 months. The INR could benefit from a broad USD weakness, strong domestic growth and declining current account deficit. However, greater risk premium ahead of the 2024 elections and RBI’s rebuild of FX reserves may cap gains. USD/SGD is likely to decline modestly towards 1.30-1.32 over the next 12-months, as the MAS is likely to maintain its tightening bias on the monetary policy and SGD NEER basket benefit from EUR, MYR and CNH appreciation.

Fig. 28 Summary of Asian currency drivers

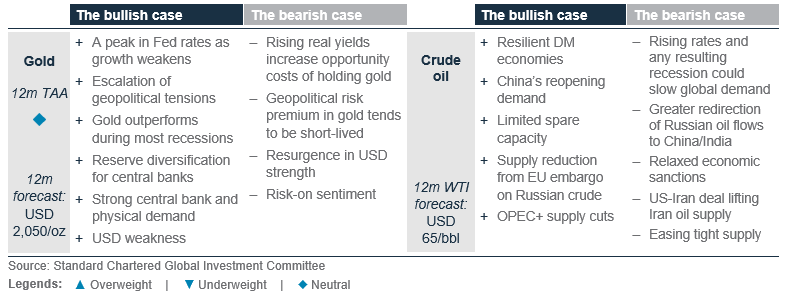

Gold, crude oil – at a glance

|

Key themes

We moderate our bullish views on gold, downgrading it to Neutral versus other major asset classes, with a 12-month forecast of USD 2,050. Upward revisions to our forecasts of 10-year bond yields and the USD, which are negatively correlated to gold, lead us to see smaller upside for gold from here. Furthermore, hedging demand is likely to be lower with the suspension of the US debt-ceiling. With that said, we still see a place for the yellow metal as a portfolio ballast within a diversified allocation. Gold has historically outperformed in recessions, and it has displayed safe-haven properties during times of crisis. These features increase the appeal of gold as a hedge against a backdrop of elevated macro uncertainty, especially with the current low investor allocation. Continued demand from central banks, households and investors are other key drivers behind our constructive view.

We stay bearish on oil as recession risks remain elevated on the back of tight central bank policies. On a 12-month horizon, we expect WTI oil to trend lower towards USD 65/bbl on (1) weaker oil demand and depressed positioning from a slowing global economy, (2) resilience of Russia’s exports amid redirection of flows, and (3) the build-up of inventories from supply beats. The muted performance despite Saudi Arabia’s voluntary cut of 1mb/d suggests that in the absence of a big cut, further OPEC+ interventions are unlikely to offset the demand-led downward price pressure. In the next 1-3 months, though, WTI oil price is likely to be well supported around USD 71/bbl on the back of stronger demand from China.

Key chart

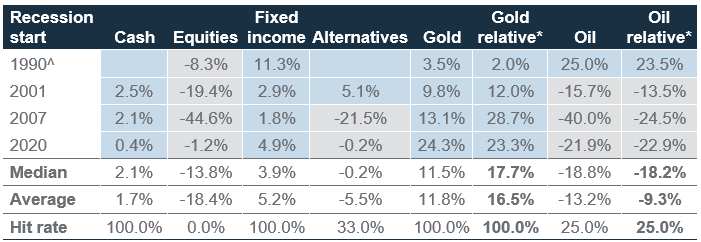

Gold historically shone through periods of recession

Crude oil collapsed outside of war-related recessions as demand contracted sharply

Fig. 29 In the last four recessions, gold delivered positive returns on an absolute and relative basis, while crude oil underperformed, aside from the Gulf War recession

Absolute and relative performance of gold and oil during the last four recessions

Quant perspective

US risk model projects high equity market risks

|

Model prefers bonds over equities

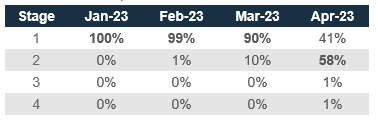

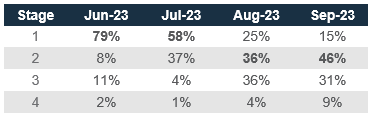

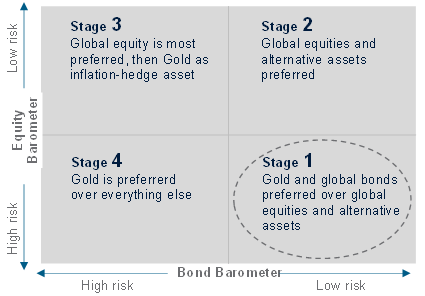

Our US Equity-Bond Market Risk (EBMR) models the downside risks in US equities and the 10-year US government bonds. It uses 11 economic and market factors to create equity and bond risk barometers. If the value of a barometer falls below 50, it signals higher downside risks and vice versa.

The model remains in Stage 1 since June 2022, where market risk is expected to be high for US equities but low for US government bonds. The model continues to turn less bearish on equity market risk, due to easing in US inflation and strong equity market momentum. Meanwhile, the model continues to predict lower upside risks to 10-year US government bond yield as the Fed approaches peak rates. It has previously captured the rise in 10-year US government bond yield last year but it has reacted early by turning bullish in June 2022.

Fig. 30 EBMR bearish on equities, albeit modestly

US equity and bond market risk barometers

The equity barometer has improved to 45. Aside from equity market momentum, easing inflation (though it remains elevated) has been a primary contributor to the improvement. Meanwhile, factors such as housing starts, still high interest rates and weaker commodity prices are holding the barometer down. Among these negative factors, a sustained fall in interest rates will likely be needed to push the barometer into the bullish territory (> 50). This does not look imminent based on the recent Fed signalling. As the equity barometer remains below 50, it is suggesting investors to err on the side of caution despite the recent equity market rally, which has been mainly driven by a handful of Technology sector stocks.

The bond barometer remains strong at 86, supported by factors indicating slower economic growth. These factors include contraction of industrial activity, downtrend in US housing starts and a slowdown in US capacity utilisation. Softer commodity prices are also a supportive signal for the barometer as they alleviate inflationary pressure that could lead to further rate hikes. Strong equity market momentum remains the only unsupportive factor, as they are typically more supportive of assets which are riskier than bonds.

Our model projects that the US is more likely to remain in Stage 1 till July 2023. The probabilities of Stage 2 and 3, however, have been increasing due to the improvement in the equity barometer. Both stages are positive for risky assets.

Implications on global assets

Data since 1999 suggest gold and bonds are the most preferred in Stage 1. The model’s preference for the assets is based on its long-term relationship with the market cycle, which favours gold and bonds as defensive assets in Stage 1.

Fig. 31 Probability of the evolution of financial market risk cycle from the current Stage 1 and preferred assets

Scenarios over the coming months till September 2023 vs December 2022 projections

Model’s estimated probabilities in December 2022

Model’s estimated probabilities in June 2023

Tracking market diversity

|

About our market diversity indicators

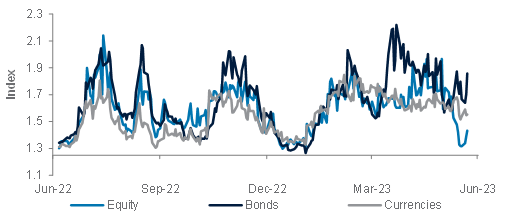

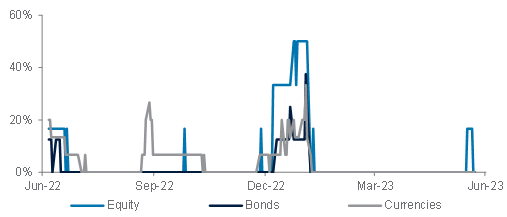

Our market diversity indicators help to identify a potential change in short-term trends due to a fall in market breadth across equities, credit, FX and commodities. When market diversity falls, it implies either buyers or sellers are dominating, leading to a rapid rise or fall in asset prices. This is usually unsustainable and is likely to be followed by a slowdown or a reversal. Our diversity indicator is based on a statistical index called fractal dimension; a value below 1.25 serves as a guideline that prices are rising or falling too fast.

Where is diversity falling or rising this month?

Market diversity across equity, bond and currency markets has started to trend lower this month, albeit it has been more volatile for bond markets. The biggest shift has been in equities as their average diversity declined sharply to 1.43 currently from 1.75 at the start of the month. Meanwhile, diversity of currencies remains high despite trending lower.

Market diversity for bonds has fallen, except for DM bonds. Diversity of EM local currency bonds continues to deteriorate since we last highlighted it in May. It is among the best performing bond market with a YTD return of c.8.0%. With its diversity currently standing at 1.29, we suggest keeping a close eye on potential reversal should it fall below the 1.25 threshold. Meanwhile, EM USD bonds and Asia credits remain two bond markets with the highest diversity.

Fig. 32 Average market diversity score by asset class

Diversity across asset classes coming off peaks

Fig. 33 Percentage of assets with diversity score <1.25

Equities showed signs of stretched positioning in June

Market diversity across equity markets has fallen except for Asia ex-Japan equities. In June, the diversity of US equities briefly touched its 2-year low of 1.26. With low market breadth due to FANG stocks being the primary driver of YTD rally, a low market diversity in US equities can be especially fragile. While the diversity of US equities has reverted slightly higher to 1.28 after a brief correction in the IT sector, we suggest caution in the case of a resurgence. Meanwhile, Japan equities is another market to keep an eye on as its diversity is currently low at 1.29.

For currencies, market diversity of USD/CNH, USD/JPY and USD/MYR are among the lowest, sitting at 1.25, 1.29 and 1.32, respectively. All three currency pairs have recorded strong gains of 6.8%, 10.8% and 9.6%, respectively, since their January lows. These indicators suggest it may not be prudent to chase USD/CNH’s gains, and USDJPY and USD/MYR should be put on watchlist.

Fig. 34 Diversity across key assets

Performance Review

Foundation: Asset allocation summary

Performance of our calls

Fig. 35 Summary of our 2023 calls outlook-to-date

Performance measured from 15 December 2022 or when the call was opened, to 22 June 2023 or when the view was closed.

Past performance is not an indication of future performance. There is no assurance, representation or prediction given as to any results or returns that would actually be achieved in a transaction based on any historical data.

‘Absolute’ represents the simple absolute return. ‘Relative’ tracks our Tactical Asset Allocations vs. our Strategic Asset Allocation, or if a relative measure was specified in individual themes.

Global moderate and Asia moderate comprise our Tactical Asset Allocations as described in the Global Market Outlook publications. Broad asset class allocations are represented by MSCI AC World, FTSE Non-MBS WorldBIG Index, Bloomberg commodities ex-agriculture & livestock, HFRX total return and Bloomberg U.S. Treasury Bills: 1-3 Months Index. Equity allocations are represented by MSCI USA, EMU, UK, Japan, Asia ex-Japan and Other EM total return indices. Bond allocations are represented by FTSE WorldBig Government Index, FTSE WorldBig Corp Index, J.P. Morgan EMBI Global Diversified, EM Local, Asia Credit Index and Bloomberg Global High Yield indices.

Equity sector allocations are represented by MSCI USA sector indices, MSCI Europe sector indices and MSCI China sector indices, based on total returns. In our Multi-Asset Income allocation, bond allocations are represented by Bloomberg Global High Yield Index, S&P Global Leveraged Loan Index, J.P. Morgan EMBI Global Diversified, EM Local, Asia Credit and Asia Credit Index Non- Investment Grade, FTSE WorldBig Corp Index and FTSE WorldBig Government Index. Equity allocations are represented by MSCI AC World Dividend Yield Index. Non-core allocations are represented by Chicago Board Options Exchange S&P 500 BuyWrite Index, Barclays Global Contingent Capital Index Value Unhedged USD, SPDR ICE Preferred Securities ETF, FTSE EPRA/NAREIT Asia Pacific Index and FTSE EPRA/NAREIT Global Index.

Market performance summary*

*All performance shown in USD terms, unless otherwise stated

*YTD performance data from 31 December 2022 to 22 June 2023 and 1 week-performance from 15 June 2023 to 22 June 2023

Our key forecasts and calendar events

Explanatory notes

1. The figures on page 6 show allocations for a moderate risk profile only – different risk profiles may produce significantly different asset allocation results. Page 6 is only an example, provided for general information only and they do not constitute investment advice, an offer, recommendation or solicitation. They do not take into account the specific investment objectives, needs or risk tolerances of a particular person or class of persons and they have not been prepared for any particular person or class of persons.

2. Contingent Convertibles are complex financial instruments and are not a suitable or appropriate investment for all investors. This document is not an offer to sell or an invitation to buy any securities or any beneficial interests therein. Contingent convertible securities are not intended to be sold and should not be sold to retail clients in the European Economic Area (EEA) (each as defined in the Policy Statement on the Restrictions on the Retail Distribution of Regulatory Capital Instruments (Feedback to CP14/23 and Final Rules) (“Policy Statement”), read together with the Product Intervention (Contingent Convertible Instruments and Mutual Society Shares) Instrument 2015 (“Instrument”, and together with the Policy Statement, the “Permanent Marketing Restrictions”), which were published by the United Kingdom’s Financial Conduct Authority in June 2015), other than in circumstances that do not give rise to a contravention of the Permanent Marketing Restrictions.

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2026, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘ESG Intentional Investments – Overall’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures