4 October 2024

Weekly Market View

A new dawn in China?

The return of ‘animal spirits’ in China’s stock market thanks to a decisive turn in policy could lead to further near-term upside. However, we believe a large fiscal stimulus is likely needed to sustain the rally.

Meanwhile, the long-term market impact of the ongoing flare-up in Middle East tensions is likely to be limited if Iran’s oil supplies are not affected. Gold and energy stocks and bonds remain our preferred hedges against any oil shock.

In FX markets, we see a rangebound USD/JPY in the near term after Japan’s new PM Ishida downplayed the need for further BoJ rate hikes for now.

Also, any CNH upside is likely to be limited, with momentum indicators sending a bullish signal for USD/CNH.

The next focus is on the US employment, inflation and Q3 corporate earnings reports. Indications of job market resilience, further disinflation and earnings beats are likely to fuel the USD and the record-breaking US equity rally.

Should investors chase China equities at this stage?

What is the outlook for US Q3 corporate earnings?

How could Middle East geopolitical risks impact financial markets?

Charts of the week: Significant catch-up potential

Following the policy boost, China’s stocks can potentially unwind their significant underperformance in recent years

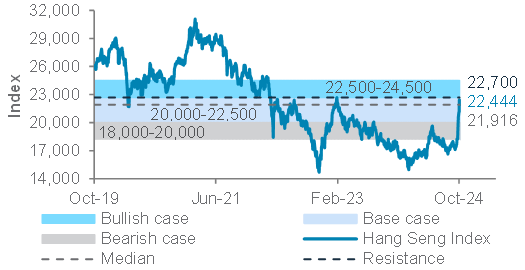

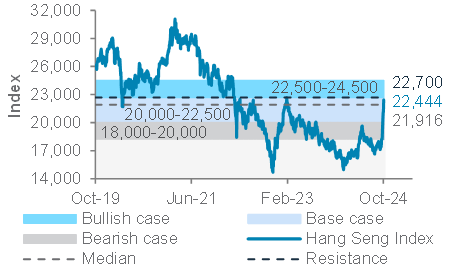

Hang Seng index and base, bullish and bearish scenarios

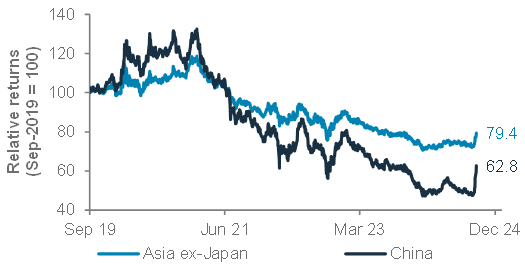

Relative returns of MSCI China, MSCI Asia ex-Japan* indices

Source: Bloomberg, Standard Chartered; *vs. MSCI All Country World index (100 = September 2019)

Editorial

A new dawn in China?

The return of ‘animal spirits’ in China’s stock market thanks to a decisive turn in policy could lead to further near-term upside. However, we believe a large fiscal stimulus is likely needed to sustain the rally. Meanwhile, the long-term market impact of the ongoing flare-up in Middle East tensions is likely to be limited if Iran’s oil supplies are not affected. Gold and energy stocks and bonds remain our preferred hedges against any oil shock. In FX markets, we see a rangebound USD/JPY in the near term after Japan’s new PM Ishida downplayed the need for further BoJ rate hikes for now. The next focus is on the US employment, inflation and Q3 corporate earnings reports. Indications of job market resilience, further disinflation and earnings beats are likely to fuel the USD and the record-breaking US equity rally.

China’s near-term upside potential: The near-term bullish case for China stocks argues for a further c.10% potential upside in the coming weeks (see chart above and page 4). This is especially so given low global investor positioning and inexpensive valuations after the significant underperformance of China stocks vs. global equities over the past five years.

Authorities have vowed to provide more support to revive the stock market if the current proposals, totalling 2% of the onshore equity market capitalisation, prove insufficient. Given this, we believe investors who are still underweight China have an opportunity to rebuild exposure towards a benchmark allocation. Those who are neutral or overweight China can consider adding to laggards in our preferred consumer discretionary and communication services sectors, as well as high dividend yielding state-owned enterprises.

Challenges in sustaining the rally: A longer-term stock market upturn likely requires a sustained revival in economic growth and a stable property market. This, in turn, potentially requires a fiscal spending boost significantly larger than the 1-2% of GDP currently expected. For context, the last major fiscal policy stimulus in 2015-16, which resulted in an 80% trough-to-peak stock market rally, entailed a 10% of GDP

boost in cumulative net government borrowing. There is also the risk of trade tensions with the US, especially if former President Trump returns to power. Given this, we maintain our 6-12-month allocation to China equities in line with global benchmarks.

Hedging against Middle East tensions: The flare-up in the Middle East raises the chance of accidents. However, we see limited long-term market impact from the escalation unless Iran’s oil installations are attacked. The US administration has little incentive to disrupt Iran’s oil supplies and risk higher oil prices heading into the November elections, given its ongoing battle to tame inflationary pressures. Nevertheless, those looking to hedge against any short-term energy shocks can consider gold and energy sector stocks and bonds.

Rangebound JPY: Japan’s new PM Ishiba has played down the need for another imminent BoJ rate hike, although his stated policies imply further BoJ policy tightening in the months ahead to curb inflation. We see any near-term upside in USD/JPY limited to 149. A hawkish turn in BoJ policy, possibly after the US election, could take the pair down to 140.

Downside risk for EUR: Euro area inflation below 2% and a continued downturn in the region’s manufacturing and construction sectors have raised the prospects of another 25bps ECB rate cut in October. Markets are pricing total 50bps of cuts by December and over 160bps of cuts in the next 12 months. The latest weak data raise the risk of further EUR/USD downside, especially if upcoming US data surprises positively.

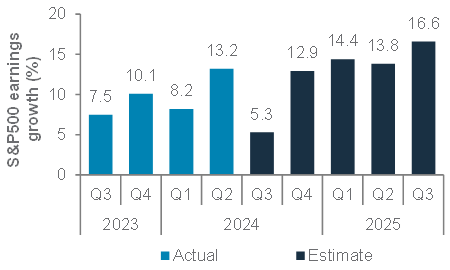

US jobs, inflation, earnings reports in focus: US equities need a resilient September employment report (consensus: 150,000 net jobs), sustained disinflation and Q3 earnings beat (S&P500 consensus: 5.3% y/y) to sustain this year’s rally. Fed Chair Powell’s plans to cut rates further to forestall any further deterioration in the job market is potentially positive for stocks.

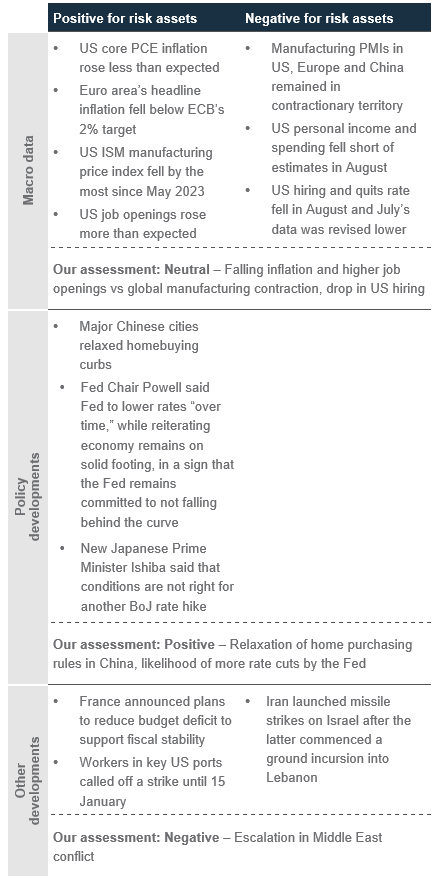

The weekly macro balance sheet

Our weekly net assessment: On balance, we see the past week’s data and policy as neutral for risk assets in the near-term

(+) factors: Supportive China policies; disinflation in Europe and US

(-) factors: Escalation in Middle East conflict

The US labour market has continued to soften

US quits, hiring and job openings rate

US manufacturing remains in contractionary territory

US ISM manufacturing PMI and subcomponents

Euro area headline inflation eased below the ECB’s 2% target for the first time since 2021

Euro area headline and core inflation y/y

Top client questions

Should investors chase China equities at this stage?

There has been much FOMO (Fear Of Missing Out) activity by global investors in China equities, based on strong inflows (the largest since mid-2022) into foreign-domiciled ETFs. In our view, this likely explains the rapidity of the market rally in recent days.

For Chinese equities to move higher longer-term, though, the participation of local investors after the National Day holidays is key. Expectations-beating fiscal stimulus, supportive of consumer spending-led growth, is likely to lead to our ‘bull case’ scenario range of 22,500-24,500 for the Hang Seng. Should the fiscal support come in later, or is smaller in magnitude, than expected, the index may pull back to a ‘bear case’ scenario range of 18,000-20,000.

Overall, valuation levels are still depressed, and Chinese equities are still offering an approximately 19% discount to Asia ex-Japan equities. Our preferred sectors of consumer discretionary and communication services and our non-financial high-dividend yielding SOEs idea can offer opportunities for rotation into laggards.

— Daniel Lam, Head, Equity Strategy

Hang Seng Index (HSI) rose above its 5-year median

HSI 5-year median, resistance, Base/Bull/Bear scenarios

What is the outlook for US Q3 corporate earnings?

Major US banks will report their Q3 earnings next week, after managing down expectations in the past month. For the overall US market, Q3 is expected to see the lowest earnings growth in 2024. Consensus expectations from LSEG I/B/E/S for the S&P500 benchmark are for Q3 earnings to grow 5.3% y/y led by the technology (+15.4%), communication services (+12.3%) and healthcare (+11.2%) sectors. Two sectors are expected to see a fall in Q3 earnings, namely energy (-19.7%) and materials (-2.8%). S&P500 earnings growth are expected to accelerate in Q4 (+12.9%) and Q1 2025 (+14.4%).

In addition to Q3 earnings surprises, we will be watching how companies’ guidance affect consensus growth expectations for 2024 and 2025. S&P500 earnings are expected to grow by 10.0% in 2024, nudged down from 10.7% expected at the start of July, and by 15.0% in 2025, nudged up from 14.4% expected at the start of July. Our base case for a soft landing in the US economy is supportive of this expected growth acceleration from 2024 to 2025 and underpins our preference for US equities. Our US sector preferences take a barbell approach with overweight views in technology and communication services for growth exposure, financials as a soft-landing beneficiary and healthcare for defensive exposure.

— Fook Hien Yap, Senior Investment Strategist

Q3 2024 is expected to see the lowest earnings growth this year before an acceleration in Q4 2024 and Q1 2025

Consensus earnings growth y/y for S&P500 index

Top client questions (cont’d)

How is China’s policy stimulus going to impact CNH?

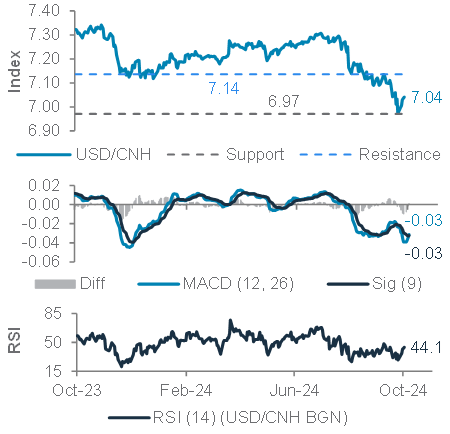

China’s PBoC recently delivered a 50bps cut to the reserve requirement ratio and a 20bps cut to the policy rate. These were accompanied by a broad set of measures to support housing demand, and policymakers signalled further policy easing lay ahead.

These announcements initially pushed USD/CNH lower, but the pair has rebounded over the last few days. We see two key underlying risks ahead: i) further fiscal stimulus is likely needed to support domestic consumer confidence, and ii) A Trump win in the US election in November is likely to resurface worries of a surge in tariffs on Chinese exports, directly raising risks for the Asian economic and currency outlooks.

We, therefore, believe that CNH strength is likely to be capped. Technically, USD/CNH’s momentum indicator (MACD) is sending a gradually more bullish signal, indicating potential upward pressure and a likely test of the next resistance level at 7.1360. Meanwhile, support remains at 6.9710.

USD/CNH downside is likely to be capped

USD/CNH and technical levels

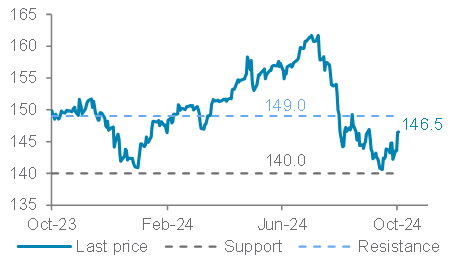

Does Ishiba’s election impact the JPY outlook?

USD/JPY fell as much as 1.8% after Shigeru Ishiba was set to become Japan’s next prime minister. He has called for more clarity on the BOJ’s plans to normalize policy and emphasized greater development of regional economies to revitalise the rural areas, aided by government spending.

However, USD/JPY pared back losses and rose 2% following his comment that Japan’s economy is not ready for further increases in interest rates, an apparent effort to shake off his reputation as a monetary hawk.

While sensitivity to Ishiba’s comments may be high in the very short term, from a currency market perspective, we still see relative interest rate differentials as the key driver. This US-Japan interest rate spread is still narrowing amid expectations of Fed rate cuts. Meanwhile, Japanese inflation has been resilient, the labour market is strong and real household income growth has been sustainably rising since the end of 2023.

On balance, we expect USD/JPY to trade within a relatively wide range between 140 and 149 over the coming month. Over a longer 6-12-month horizon, rate differentials ultimately argue for a fall below this range to 135.

— Iris Yuen, Investment Strategist

USD/JPY remains largely rangebound

USD/JPY and technical levels

Top client questions (cont’d)

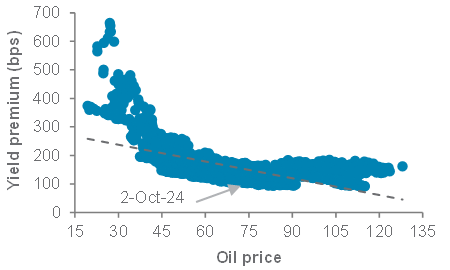

How could Middle East geopolitical risks impact financial markets?

A scenario analysis can be helpful to consider how regional geopolitical risk could impact global financial markets. One scenario is that, similar to prior episodes, any further military action is focused on avoidance of any significant or lasting escalation. From a financial market point of view, this would likely mean any volatility in equities or regional bond yield premiums proves fleeting. A second scenario is one where military action ends up triggering a more significant escalation. For financial markets, this increases the risks of rising equity and regional bond market volatility, and the outperformance of US government bonds and gold as safe havens.

Oil prices remain the key channel of transmission to financial markets. This helps explain why the market impact has thus far been relatively muted. This also suggests investors looking for a short-term hedge can consider US energy sector equities and bonds given their correlation with oil prices.

More broadly, current risks are consistent with our asset allocation Overweight to gold. High quality bonds (particularly US Treasuries) should also do well in an environment of volatility. Equities may face the most volatility in scenario 2, but for longer term investors this is likely to create an opportunity to add exposure if the US economy otherwise remains on a soft-landing path. Chinese equities also offer an opportunity to diversify sources of returns given the market is currently more focused on domestic policy drivers.

— Manpreet Gill, Chief Investment Officer AMEE

— Cedric Lam, Senior Investment Strategist

Energy bond yield premiums typically tighten when oil prices rise

Bloomberg IG Energy Index vs Brent Oil Price (since 2014 to date)

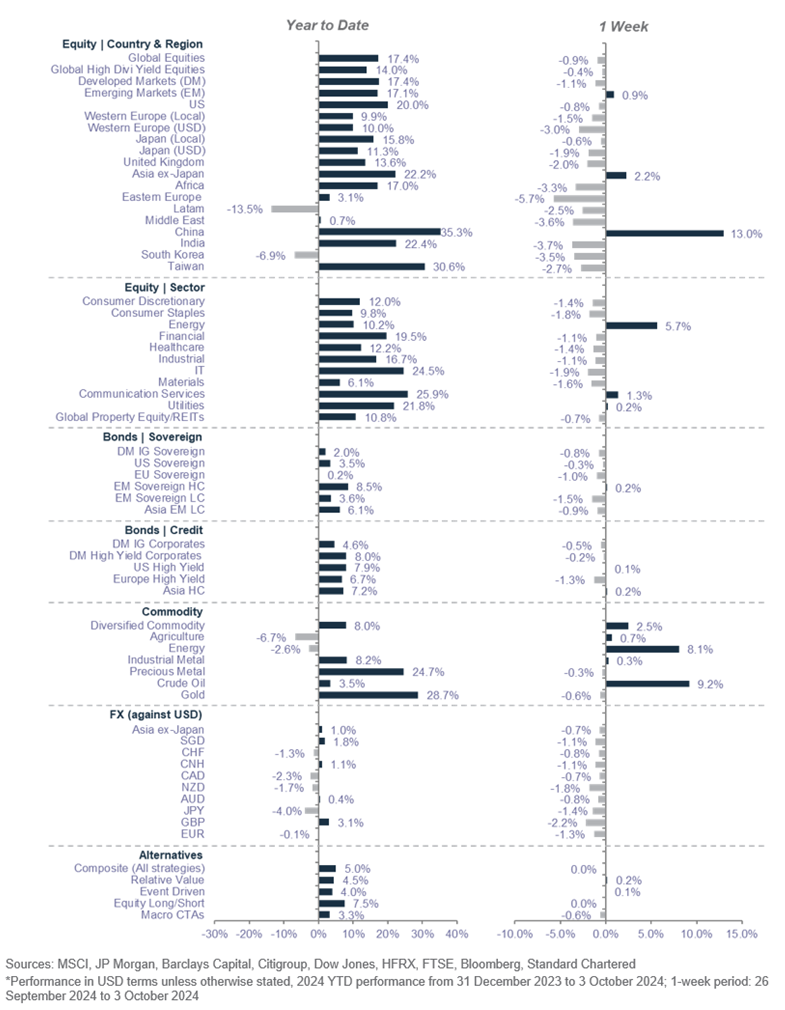

Market performance summary*

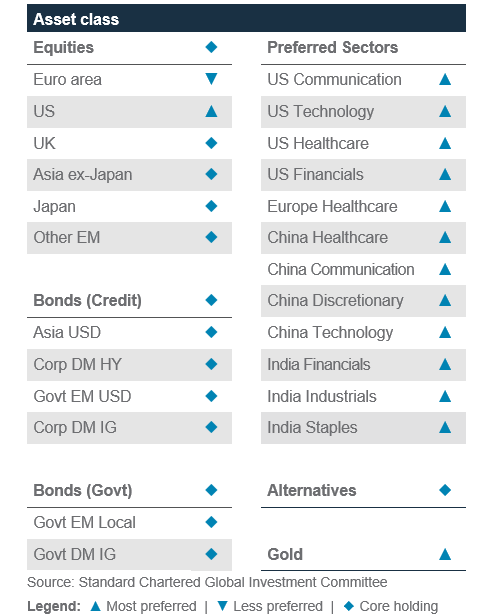

Our 12-month asset class views at a glance

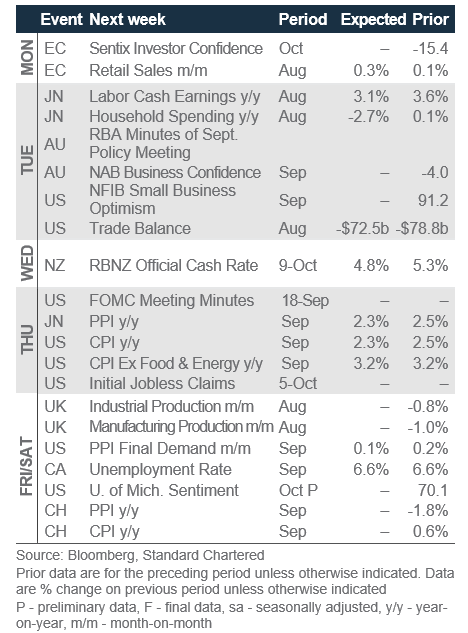

Economic and market calendar

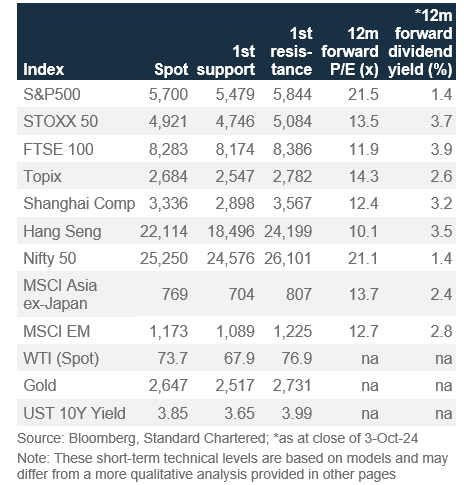

The S&P500 has next interim resistance at 5,844

Technical indicators for key markets as of 3 Oct close

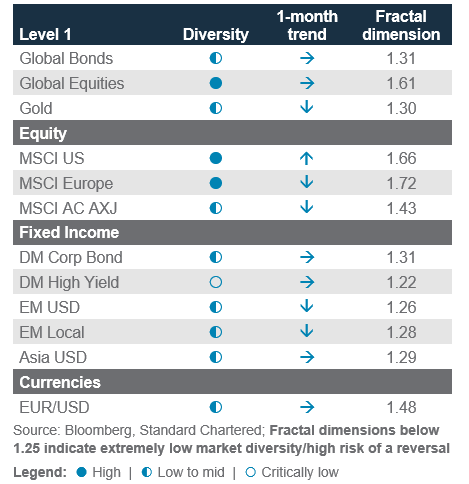

Investor diversity has normalised across asset classes

Our proprietary market diversity indicators as of 3 Oct close

Disclosure

This document is confidential and may also be privileged. If you are not the intended recipient, please destroy all copies and notify the sender immediately. This document is being distributed for general information only and is subject to the relevant disclaimers available at our Standard Chartered website under Regulatory disclosures. It is not and does not constitute research material, independent research, an offer, recommendation or solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. This document is for general evaluation only. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person or class of persons and it has not been prepared for any particular person or class of persons. You should not rely on any contents of this document in making any investment decisions. Before making any investment, you should carefully read the relevant offering documents and seek independent legal, tax and regulatory advice. In particular, we recommend you to seek advice regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before you make a commitment to purchase the investment product. Opinions, projections and estimates are solely those of SC at the date of this document and subject to change without notice. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. You are not certain to make a profit and may lose money. Any forecast contained herein as to likely future movements in rates or prices or likely future events or occurrences constitutes an opinion only and is not indicative of actual future movements in rates or prices or actual future events or occurrences (as the case may be). This document must not be forwarded or otherwise made available to any other person without the express written consent of the Standard Chartered Group (as defined below). Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its subsidiaries and affiliates (including each branch or representative office), form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of Standard Chartered Private Bank and may not be able to offer products and services or offer advice to clients.

Copyright © 2026, Accounting Research & Analytics, LLC d/b/a CFRA (and its affiliates, as applicable). Reproduction of content provided by CFRA in any form is prohibited except with the prior written permission of CFRA. CFRA content is not investment advice and a reference to or observation concerning a security or investment provided in the CFRA SERVICES is not a recommendation to buy, sell or hold such investment or security or make any other investment decisions. The CFRA content contains opinions of CFRA based upon publicly-available information that CFRA believes to be reliable and the opinions are subject to change without notice. This analysis has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. While CFRA exercised due care in compiling this analysis, CFRA, ITS THIRD-PARTY SUPPLIERS, AND ALL RELATED ENTITIES SPECIFICALLY DISCLAIM ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, to the full extent permitted by law, regarding the accuracy, completeness, or usefulness of this information and assumes no liability with respect to the consequences of relying on this information for investment or other purposes. No content provided by CFRA (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of CFRA, and such content shall not be used for any unlawful or unauthorized purposes. CFRA and any third-party providers, as well as their directors, officers, shareholders, employees or agents do not guarantee the accuracy, completeness, timeliness or availability of such content. In no event shall CFRA, its affiliates, or their third-party suppliers be liable for any direct, indirect, special, or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with a subscriber’s, subscriber’s customer’s, or other’s use of CFRA’s content.

Market Abuse Regulation (MAR) Disclaimer

Banking activities may be carried out internationally by different branches, subsidiaries and affiliates within the Standard Chartered Group according to local regulatory requirements. Opinions may contain outright “buy”, “sell”, “hold” or other opinions. The time horizon of this opinion is dependent on prevailing market conditions and there is no planned frequency for updates to the opinion. This opinion is not independent of Standard Chartered Group’s trading strategies or positions. Standard Chartered Group and/or its affiliates or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document or have material interest in any such securities or related investments. Therefore, it is possible, and you should assume, that Standard Chartered Group has a material interest in one or more of the financial instruments mentioned herein. Please refer to our Standard Chartered website under Regulatory disclosures for more detailed disclosures, including past opinions/ recommendations in the last 12 months and conflict of interests, as well as disclaimers. A covering strategist may have a financial interest in the debt or equity securities of this company/issuer. All covering strategist are licensed to provide investment recommendations under Monetary Authority of Singapore or Hong Kong Monetary Authority. This document must not be forwarded or otherwise made available to any other person without the express written consent of Standard Chartered Group.

Sustainable Investments

Any ESG data used or referred to has been provided by Morningstar, Sustainalytics, MSCI or Bloomberg. Refer to 1) Morningstar website under Sustainable Investing, 2) Sustainalytics website under ESG Risk Ratings, 3) MCSI website under ESG Business Involvement Screening Research and 4) Bloomberg green, social & sustainability bonds guide for more information. The ESG data is as at the date of publication based on data provided, is for informational purpose only and is not warranted to be complete, timely, accurate or suitable for a particular purpose, and it may be subject to change. Sustainable Investments (SI): This refers to funds that have been classified as ‘ESG Intentional Investments – Overall’ by Morningstar. SI funds have explicitly stated in their prospectus and regulatory filings that they either incorporate ESG factors into the investment process or have a thematic focus on the environment, gender diversity, low carbon, renewable energy, water or community development. For equity, it refers to shares/stocks issued by companies with Sustainalytics ESG Risk Rating of Low/Negligible. For bonds, it refers to debt instruments issued by issuers with Sustainalytics ESG Risk Rating of Low/Negligible, and/or those being certified green, social, sustainable bonds by Bloomberg. For structured products, it refers to products that are issued by any issuer who has a Sustainable Finance framework that aligns with Standard Chartered’s Green and Sustainable Product Framework, with underlying assets that are part of the Sustainable Investment universe or separately approved by Standard Chartered’s Sustainable Finance Governance Committee. Sustainalytics ESG risk ratings shown are factual and are not an indicator that the product is classified or marketed as “green”, “sustainable” or similar under any particular classification system or framework.

Country/Market Specific Disclosures

Bahrain: This document is being distributed in Bahrain by Standard Chartered Bank, Bahrain Branch, having its address at P.O. 29, Manama, Kingdom of Bahrain, is a branch of Standard Chartered Bank and is licensed by the Central Bank of Bahrain as a conventional retail bank. Botswana: This document is being distributed in Botswana by, and is attributable to, Standard Chartered Bank Botswana Limited which is a financial institution licensed under the Section 6 of the Banking Act CAP 46.04 and is listed in the Botswana Stock Exchange. Brunei Darussalam: This document is being distributed in Brunei Darussalam by, and is attributable to, Standard Chartered Bank (Brunei Branch) | Registration Number RFC/61 and Standard Chartered Securities (B) Sdn Bhd | Registration Number RC20001003. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. Standard Chartered Securities (B) Sdn Bhd is a limited liability company registered with the Registry of Companies with Registration Number RC20001003 and licensed by Brunei Darussalam Central Bank as a Capital Markets Service License Holder with License Number BDCB/R/CMU/S3-CL and it is authorised to conduct Islamic investment business through an Islamic window. China Mainland: This document is being distributed in China by, and is attributable to, Standard Chartered Bank (China) Limited which is mainly regulated by National Financial Regulatory Administration (NFRA), State Administration of Foreign Exchange (SAFE), and People’s Bank of China (PBOC). Hong Kong: In Hong Kong, this document, except for any portion advising on or facilitating any decision on futures contracts trading, is distributed by Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), a subsidiary of Standard Chartered PLC. SCBHK has its registered address at 32/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong and is regulated by the Hong Kong Monetary Authority and registered with the Securities and Futures Commission (“SFC”) to carry on Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activity under the Securities and Futures Ordinance (Cap. 571) (“SFO”) (CE No. AJI614). The contents of this document have not been reviewed by any regulatory authority in Hong Kong and you are advised to exercise caution in relation to any offer set out herein. If you are in doubt about any of the contents of this document, you should obtain independent professional advice. Any product named herein may not be offered or sold in Hong Kong by means of any document at any time other than to “professional investors” as defined in the SFO and any rules made under that ordinance. In addition, this document may not be issued or possessed for the purposes of issue, whether in Hong Kong or elsewhere, and any interests may not be disposed of, to any person unless such person is outside Hong Kong or is a “professional investor” as defined in the SFO and any rules made under that ordinance, or as otherwise may be permitted by that ordinance. In Hong Kong, Standard Chartered Private Bank is the private banking division of SCBHK, a subsidiary of Standard Chartered PLC. Ghana: Standard Chartered Bank Ghana Limited accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to feedback.ghana@sc.com. Please do not reply to this email. Call our Priority Banking on 0302610750 for any questions or service queries. You are advised not to send any confidential and/or important information to Standard Chartered via e-mail, as Standard Chartered makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Standard Chartered shall not be responsible for any loss or damage suffered by you arising from your decision to use e-mail to communicate with the Bank. India: This document is being distributed in India by Standard Chartered in its capacity as a distributor of mutual funds and referrer of any other third party financial products. Standard Chartered does not offer any ‘Investment Advice’ as defined in the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 or otherwise. Services/products related securities business offered by Standard Charted are not intended for any person, who is a resident of any jurisdiction, the laws of which imposes prohibition on soliciting the securities business in that jurisdiction without going through the registration requirements and/or prohibit the use of any information contained in this document. Indonesia: This document is being distributed in Indonesia by Standard Chartered Bank, Indonesia branch, which is a financial institution licensed and supervised by Otoritas Jasa Keuangan (Financial Service Authority) and Bank Indonesia. Jersey: In Jersey, Standard Chartered Private Bank is the Registered Business Name of the Jersey Branch of Standard Chartered Bank. The Jersey Branch of Standard Chartered Bank is regulated by the Jersey Financial Services Commission. Copies of the latest audited accounts of Standard Chartered Bank are available from its principal place of business in Jersey: PO Box 80, 15 Castle Street, St Helier, Jersey JE4 8PT. Standard Chartered Bank is incorporated in England with limited liability by Royal Charter in 1853 Reference Number ZC 18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. The Jersey Branch of Standard Chartered Bank is also an authorised financial services provider under license number 44946 issued by the Financial Sector Conduct Authority of the Republic of South Africa. Jersey is not part of the United Kingdom and all business transacted with Standard Chartered Bank, Jersey Branch and other SC Group Entity outside of the United Kingdom, are not subject to some or any of the investor protection and compensation schemes available under United Kingdom law. Kenya: This document is being distributed in Kenya by and is attributable to Standard Chartered Bank Kenya Limited. Investment Products and Services are distributed by Standard Chartered Investment Services Limited, a wholly owned subsidiary of Standard Chartered Bank Kenya Limited that is licensed by the Capital Markets Authority in Kenya, as a Fund Manager. Standard Chartered Bank Kenya Limited is regulated by the Central Bank of Kenya. Malaysia: This document is being distributed in Malaysia by Standard Chartered Bank Malaysia Berhad (“SCBMB”). Recipients in Malaysia should contact SCBMB in relation to any matters arising from, or in connection with, this document. This document has not been reviewed by the Securities Commission Malaysia. The product lodgement, registration, submission or approval by the Securities Commission of Malaysia does not amount to nor indicate recommendation or endorsement of the product, service or promotional activity. Investment products are not deposits and are not obligations of, not guaranteed by, and not protected by SCBMB or any of the affiliates or subsidiaries, or by Perbadanan Insurans Deposit Malaysia, any government or insurance agency. Investment products are subject to investment risks, including the possible loss of the principal amount invested. SCBMB expressly disclaim any liability and responsibility for any loss arising directly or indirectly (including special, incidental or consequential loss or damage) arising from the financial losses of the Investment Products due to market condition. Nigeria: This document is being distributed in Nigeria by Standard Chartered Bank Nigeria Limited (SCB Nigeria), a bank duly licensed and regulated by the Central Bank of Nigeria. SCB Nigeria accepts no liability for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of these documents. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment. To unsubscribe from receiving further updates, please send an email to clientcare.ng@sc.com requesting to be removed from our mailing list. Please do not reply to this email. Call our Priority Banking on 02 012772514 for any questions or service queries. SCB Nigeria shall not be responsible for any loss or damage arising from your decision to send confidential and/or important information to Standard Chartered via e-mail. SCB Nigeria makes no representations or warranties as to the security or accuracy of any information transmitted via e-mail. Pakistan: This document is being distributed in Pakistan by, and attributable to Standard Chartered Bank (Pakistan) Limited having its registered office at PO Box 5556, I.I Chundrigar Road Karachi, which is a banking company registered with State Bank of Pakistan under Banking Companies Ordinance 1962 and is also having licensed issued by Securities & Exchange Commission of Pakistan for Security Advisors. Standard Chartered Bank (Pakistan) Limited acts as a distributor of mutual funds and referrer of other third-party financial products. Singapore: This document is being distributed in Singapore by, and is attributable to, Standard Chartered Bank (Singapore) Limited (Registration No. 201224747C/ GST Group Registration No. MR-8500053-0, “SCBSL”). Recipients in Singapore should contact SCBSL in relation to any matters arising from, or in connection with, this document. SCBSL is an indirect wholly owned subsidiary of Standard Chartered Bank and is licensed to conduct banking business in Singapore under the Singapore Banking Act, 1970. Standard Chartered Private Bank is the private banking division of SCBSL. IN RELATION TO ANY SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT REFERRED TO IN THIS DOCUMENT, THIS DOCUMENT, TOGETHER WITH THE ISSUER DOCUMENTATION, SHALL BE DEEMED AN INFORMATION MEMORANDUM (AS DEFINED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT, 2001 (“SFA”)). THIS DOCUMENT IS INTENDED FOR DISTRIBUTION TO ACCREDITED INVESTORS, AS DEFINED IN SECTION 4A(1)(a) OF THE SFA, OR ON THE BASIS THAT THE SECURITY OR SECURITIES-BASED DERIVATIVES CONTRACT MAY ONLY BE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION. Further, in relation to any security or securities-based derivatives contract, neither this document nor the Issuer Documentation has been registered as a prospectus with the Monetary Authority of Singapore under the SFA. Accordingly, this document and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the product may not be circulated or distributed, nor may the product be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons other than a relevant person pursuant to section 275(1) of the SFA, or any person pursuant to section 275(1A) of the SFA, and in accordance with the conditions specified in section 275 of the SFA, or pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA. In relation to any collective investment schemes referred to in this document, this document is for general information purposes only and is not an offering document or prospectus (as defined in the SFA). This document is not, nor is it intended to be (i) an offer or solicitation of an offer to buy or sell any capital markets product; or (ii) an advertisement of an offer or intended offer of any capital markets product. Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. This advertisement has not been reviewed by the Monetary Authority of Singapore. Taiwan: SC Group Entity or Standard Chartered Bank (Taiwan) Limited (“SCB (Taiwan)”) may be involved in the financial instruments contained herein or other related financial instruments. The author of this document may have discussed the information contained herein with other employees or agents of SC or SCB (Taiwan). The author and the above-mentioned employees of SC or SCB (Taiwan) may have taken related actions in respect of the information involved (including communication with customers of SC or SCB (Taiwan) as to the information contained herein). The opinions contained in this document may change, or differ from the opinions of employees of SC or SCB (Taiwan). SC and SCB (Taiwan) will not provide any notice of any changes to or differences between the above-mentioned opinions. This document may cover companies with which SC or SCB (Taiwan) seeks to do business at times and issuers of financial instruments. Therefore, investors should understand that the information contained herein may serve as specific purposes as a result of conflict of interests of SC or SCB (Taiwan). SC, SCB (Taiwan), the employees (including those who have discussions with the author) or customers of SC or SCB (Taiwan) may have an interest in the products, related financial instruments or related derivative financial products contained herein; invest in those products at various prices and on different market conditions; have different or conflicting interests in those products. The potential impacts include market makers’ related activities, such as dealing, investment, acting as agents, or performing financial or consulting services in relation to any of the products referred to in this document. UAE: DIFC – Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18.The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered Bank, Dubai International Financial Centre having its offices at Dubai International Financial Centre, Building 1, Gate Precinct, P.O. Box 999, Dubai, UAE is a branch of Standard Chartered Bank and is regulated by the Dubai Financial Services Authority (“DFSA”). This document is intended for use only by Professional Clients and is not directed at Retail Clients as defined by the DFSA Rulebook. In the DIFC we are authorised to provide financial services only to clients who qualify as Professional Clients and Market Counterparties and not to Retail Clients. As a Professional Client you will not be given the higher retail client protection and compensation rights and if you use your right to be classified as a Retail Client we will be unable to provide financial services and products to you as we do not hold the required license to undertake such activities. For Islamic transactions, we are acting under the supervision of our Shariah Supervisory Committee. Relevant information on our Shariah Supervisory Committee is currently available on the Standard Chartered Bank website in the Islamic banking section. For residents of the UAE – Standard Chartered UAE (“SC UAE”) is licensed by the Central Bank of the U.A.E. SC UAE is licensed by Securities and Commodities Authority to practice Promotion Activity. SC UAE does not provide financial analysis or consultation services in or into the UAE within the meaning of UAE Securities and Commodities Authority Decision No. 48/r of 2008 concerning financial consultation and financial analysis. Uganda: Our Investment products and services are distributed by Standard Chartered Bank Uganda Limited, which is licensed by the Capital Markets Authority as an investment adviser. United Kingdom: In the UK, Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. This communication has been approved by Standard Chartered Bank for the purposes of Section 21 (2) (b) of the United Kingdom’s Financial Services and Markets Act 2000 (“FSMA”) as amended in 2010 and 2012 only. Standard Chartered Bank (trading as Standard Chartered Private Bank) is also an authorised financial services provider (license number 45747) in terms of the South African Financial Advisory and Intermediary Services Act, 2002. The Materials have not been prepared in accordance with UK legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. Vietnam: This document is being distributed in Vietnam by, and is attributable to, Standard Chartered Bank (Vietnam) Limited which is mainly regulated by State Bank of Vietnam (SBV). Recipients in Vietnam should contact Standard Chartered Bank (Vietnam) Limited for any queries regarding any content of this document. Zambia: This document is distributed by Standard Chartered Bank Zambia Plc, a company incorporated in Zambia and registered as a commercial bank and licensed by the Bank of Zambia under the Banking and Financial Services Act Chapter 387 of the Laws of Zambia.