The short answer is yes – of course it does. The emerging-market asset class is still small and depends on flow of funds from developed market investors. Moreover, it is non-homogenous and disaggregated, and therefore tends to be a price taker rather than a price setter. This makes the EM asset class dependent on markets that are price setters, such as the US and Europe. In this article, we examine the linkages and dependencies between EM and Europe.

Outlook for EM exports should improve as European economies recover EM countries around the world have close trade linkages to Europe. Europe accounts for 37% of global trade and absorbs 14% of Asian (ex-Japan) exports. Growth conditions in Europe therefore have an impact on EM and Asian growth via the trade channel. Earlier this decade, when Europe experienced stress, trade with EM suffered. In Asia, China, India and Malaysia in particular, saw fairly sharp declines in exports to Europe during that period.

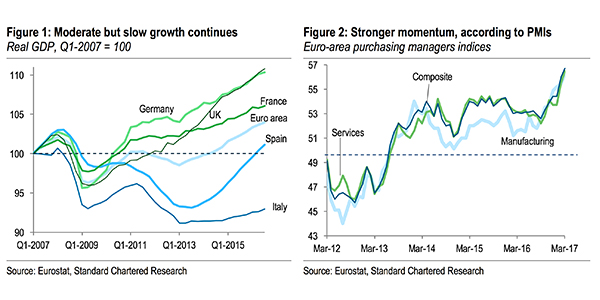

European growth has been on the mend since mid-2013, with Northern Europe leading the charge. Germany and the UK have seen particularly strong growth momentum over this period (Figure 1). Even some southern European countries, such as Spain, have seen a turnaround in their economic fortunes. Italy, meanwhile, remains a laggard, experiencing very little growth over this period; the country’s economic prospects are likely to be in sharp focus ahead of next year’s elections.

Euro-area purchasing managers’ indices (PMIs) point to further momentum for this growth story (Figure 2). Manufacturing and services PMIs are pointing up, suggesting a broad-based recovery in the region. This positive assessment is confirmed by improved consumer and business sentiment surveys in recent months. With the economic outlook for Europe firming up, we expect a positive impact on EM and particularly Asian trade – and hence growth. Asian and other EM countries could also see a potential boost in trade flows as the UK begins the process of renegotiating bilateral trade deals following the Brexit vote.

Financial linkages are more important for EM risk assets

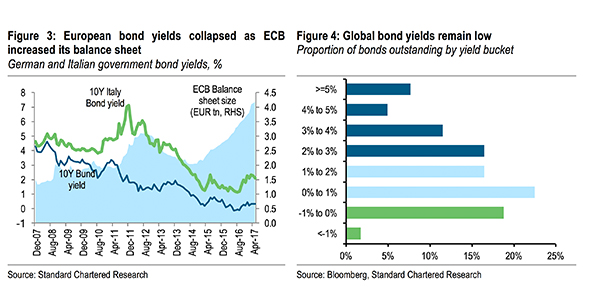

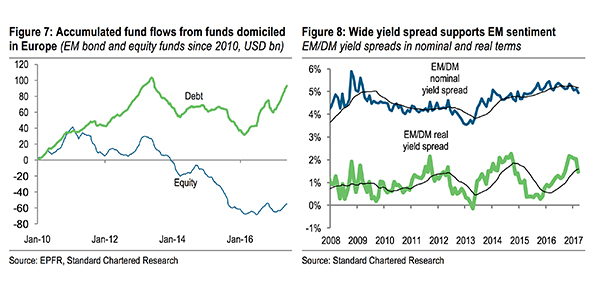

While growth and trade linkages are more obvious, there is also a strong financial-market connection between EM and Europe. Europe has been an important source of fund flows into EM over the years. These flows have picked up significantly since the European financial crisis earlier this decade, when investors became concerned about their exposure to Europe. More importantly, European bond yields collapsed as the European Central Bank (ECB) embarked on a large quantitative easing programme (Figure 3), forcing much of the money to seek alternative investment destinations. Emerging Europe was the initial beneficiary of these flows, but subsequently, other EM regions have also seen healthy flows from Europe. Global bond yields are still very low (Figure 4), with more than 60% of bonds yielding less than 2%. This has resulted in heavy outflows from developed markets like Europe into EM fixed income; Asia has been a big beneficiary of these flows given its higher ratings relative to other EM regions.

Will we see a reversal of these flows?

With European growth starting to pick up and inflation also starting to rise, some market participants are rightly asking whether the positive inflows of the past few years are likely to reverse. Higher growth in the euro area is likely to support earnings in the region, boosting regional equity markets.

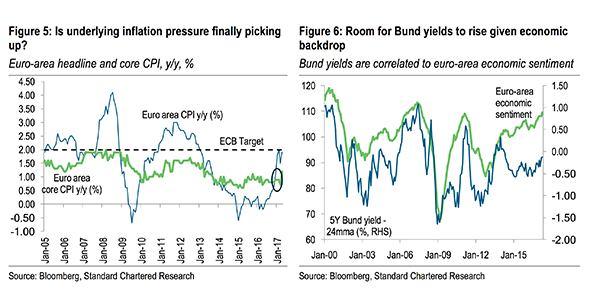

However, the bigger issue is inflation, in our view. Euro-area inflation has started to rise, and this has implications for ECB policy. With the growth outlook improving and inflation moving higher, the ECB arguably no longer needs to run the large balance-sheet expansion programme it has had in place since 2011. We expect it to announce a tapering programme later this year. While inflation has picked up, it does not appear to be a threat just yet (Figure 5). Having spent the past few years worried about downside risks to inflation, the ECB is unlikely to be proactive in hiking rates; we expect it to hike in H2-2018, which is still more than 12 months away. Moreover, like its US counterpart, the ECB is likely to adopt a gradual rate-hiking cycle.

EM fixed income is more at risk, but it’s not time to worry yet

EM fixed income has been a clear beneficiary of inflows in the past few years (Figure 7). On a net basis, EM equities have seen withdrawals over the same period. Should the ECB be more hawkish than we currently anticipate, we would expect euro-area government bond yields to rise (Figure 6). While this may not have an immediate impact on EM assets, flows from Europe to EM are likely to slow as European investors redirect money to their own bond markets. That said, we are not worried about this yet. Yield differentials – both nominal and real – favour investment in EM (Figure 8). With the EM outlook expected to improve (driven partly by the improved euro-area outlook), EM should remain an attractive investment destination for the time being.

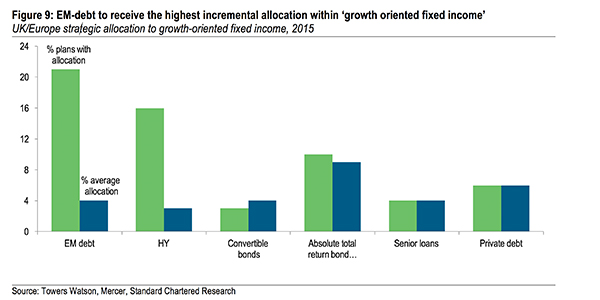

Finally, we see further scope for European pension funds to add to their exposure to EM fixed income; EM fixed income represents around 4% of their portfolio (Figure 9). So while cyclical pressures may emerge short-term, especially with the rise in euro-area bond yields, structural investment in EM may continue to increase. Asia in particular offers an attractive combination of high ratings and healthy risk-adjusted returns – and warrants a position in European portfolios.

Please click here to read our disclaimer