報告查詢功能概述

Straight2Bank上提供標準可編輯報表之報告查詢服務。這些簡單並且準備好可取用的報告提供您有關於與 本行往來金融交易之最新資訊。

整列涵蓋摘要到細節、當日及前日的報告可供線上檢閱或是排程產生。這些報告也提供於當地或是其他國家渣 打銀行所開立帳戶、跨幣別及跨公司之交易資訊。除此之外,您將可以定義每種報告的標準以便於找到您所需 要的資訊。

可用報告類型

以下列出Straight2Bank上提供的24種標準可編輯報告 (24 Standard Editable Reports),以及個別的 簡要說明。如果您想要知道有關這些報告的更多資訊,請您聯繫本行。

應付款項- 付款交易

詢價交易報告 (RFQ Deals Report)

提供在日期範圍內的所有外匯交易清單。

報告將包括交易金額、使用情況、可用金額和期限的資訊。本報告目前僅在新加坡和香港提供。

合併付款項目 (Consolidated Payments Items)

這個報表包含具有付款交易狀態。

已刪除的交易 (Deleted Transaction)

提供在日期範圍內刪除的所有付款交易清單。

借記 / 貸記通知 (Debit / Credit Advice)

開立於渣打銀行之營運帳戶的付款 / 收款交易摘要與通知。

本報告目前僅在美國和英國外的國家提供。

借記 / 貸記明細 (Debit / Credit Detail)

帳戶的付款 / 收款交易明細。

本報告目前僅在美國和英國外的國家提供。

未完成付款項目 (Outstanding Payment Items)

透過Straight2Bank建立但尚未「發送往銀行」,處於未完成狀態的所有付款交易清單。

已處理的付款項目 (Processed Payments Items)

透過Straight2Bank發起並處於最終狀態(根據交易類型)之電子付款指示。

付款授權報告 (Payment Authorization Report)

授權人在日期範圍內授權的所有付款清單。

付款核帳 (Payment Reconciliation)

透過Straight2Bank 建立之所有電子付款的對帳報告及其最新狀態。

本報告將有助於核對,以便了解特定日期的付款狀況。報告將包括已發送往銀行處理的付款以及尚未提 交至銀行的交易。

營運資金 – 營業帳戶

存款帳戶 (Deposit Account)

提供日期範圍內定存的明細,例如存款期間、幣別、帳戶號碼、本金、到期金額和利率等資訊。

此報告可提供特定日期的定存資訊。

此報告可提供之最近資訊為前一日資訊。

存款帳戶餘額歷程 (Deposit Account and Balance History)

提供定存的歷史餘額記錄。

此報告可提供之最近資訊為前一日資訊。

營運資金 - 貸款帳戶

貸款帳戶餘額歷程 (Loan Account Balance History)

提供貸款帳戶的歷史餘額記錄。

此報告可提供之最近資訊為前一日資訊。

貸款帳戶 (Loan Account)

提供特定日期貸款帳戶的資訊。

此報告可提供之前一日資訊,包括本金、貸款帳戶號碼、分行明細、下一期還款等資訊。

營運資金 - 營業帳戶

帳戶餘額 (Account Balance)

提供特定日期範圍內營運、存款和貸款帳戶明細的合併報告。

資訊按帳戶類型、公司、銀行/地點、幣別分組。

貸款額度報告 (Facility Lines Report)

提供貸款帳戶(透支)的明細,例如額度、可用餘額、額度號碼、額度類型和帳戶級別等資訊。

此報告可提供之最近資訊為前一日資訊。

當日交易明細報告 (Intra-day Transaction Details Report)

提供日期範圍內所有當天本行帳戶及設定於Straight2Bank中之第三方銀行的交易明細。

報告詳細內容包括交易類型、日期、金額、敘述等資訊。

當日交易摘要報告 (Intra-day Transaction Summary Report)

提供日期範圍內所有當天本行及於Straight2Bank中設定之第三方銀行的交易摘要。

報告提供交易金額、交易細節、交易類型等資訊。

他行帳戶 (Multibank Account)

提供在Straight2Bank上設定並連結之非渣打銀行帳戶的交易資訊。

營業帳戶餘額歷程 (Operating Account Balance History)

提供日期範圍內本行營運帳戶以及於Straight2Bank中設定之第三方銀行的歷史餘額記錄。

此報告可提供之最近資訊為前一日資訊。

營業帳戶明細 (Operating Account Details)

提供營運帳戶的相關資訊,例如公司名稱、分行、國家、幣別和帳戶號碼等資訊。

報告中的其他資訊包括:期初和期末餘額及最後交易日期等資訊。

此報告可提供之最近資訊為前一日資訊。

營業帳戶對帳單 (Operating Account Statement)

此報告提供本行營運帳戶或第三方銀行當日交易層級之資訊。

報表中的資訊包括:期初和期末分類帳餘額、交易細節及交易金額等。

此報告可提供之最近資訊為前一日資訊。

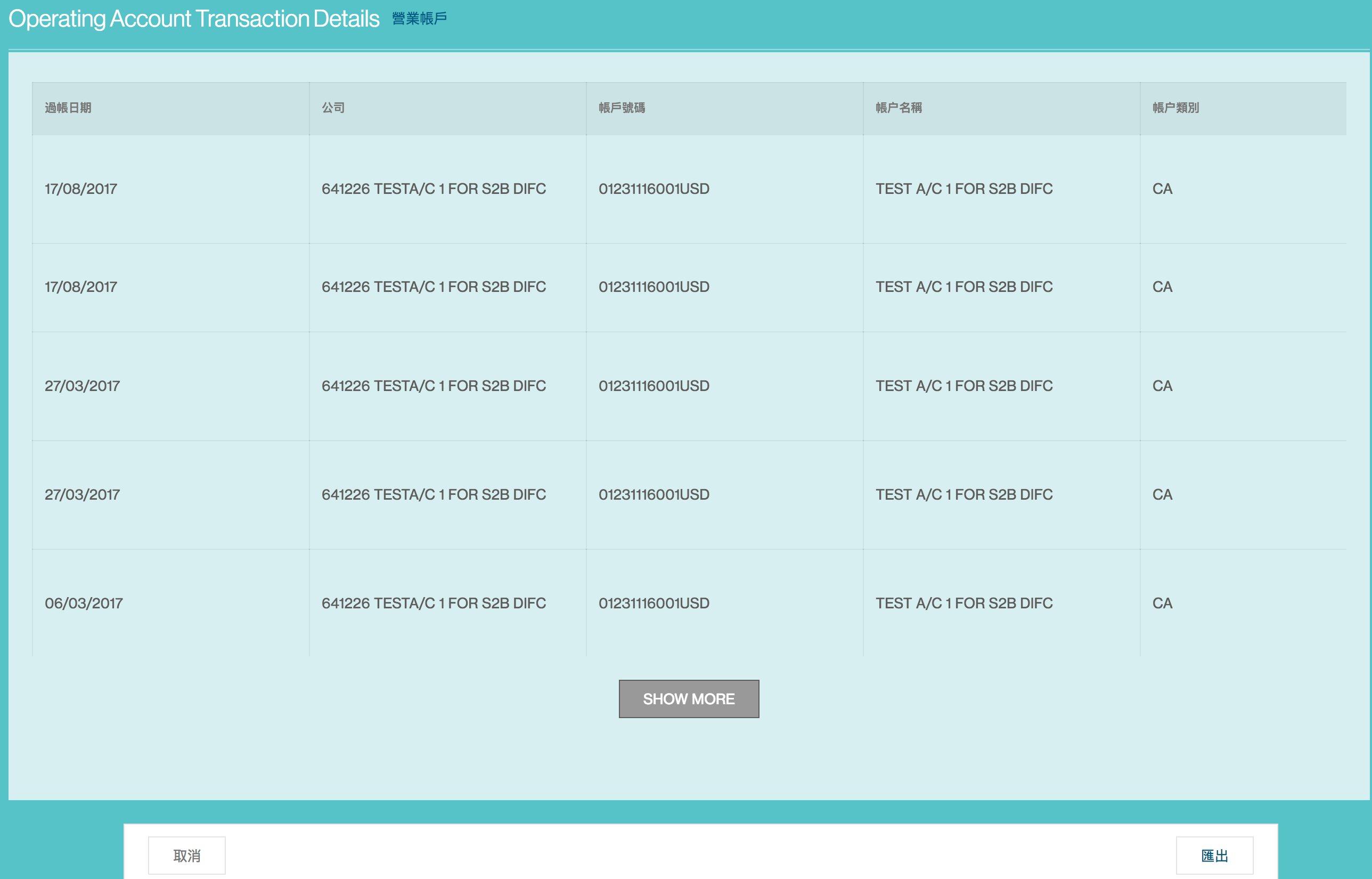

營業帳戶交易明細 (Operating Account Transaction Details)

提供本行營運帳戶以及於Straight2Bank中設定之第三方銀行的歷史交易資訊。

報告中的資訊包括:交易類型、日期、金額、敘述和其他資訊。

營業帳戶 (Operating Account)

提供本行日終(前一日)營運帳戶以及於Straight2Bank中設定之第三方銀行的餘額資訊。

報告中的資訊包括:期初和期末分類帳餘額、可用餘額等。

此報告可提供之最近資訊為前一日資訊。

可用性和控管

標準可編輯報告是所有Straight2Bank使用者的預設服務,每個報告都可以在兩個層級上進行使用者權限控 管。

功能層級

資料層級

「功能」層級的控管是指允許使用者可查看的報告種類。例如「營業帳戶對帳單」、「營業帳戶明細」、「貸 款帳戶」等。

「資料」層級的控管是指允許使用者查看與報告連結的一個或多個帳戶。例如,使用者A只能查詢帳號1的營業 帳戶餘額,而另一個使用者B則可以查詢帳戶1和帳戶2的營業帳戶餘額及營業帳戶明細。

訂閱報告

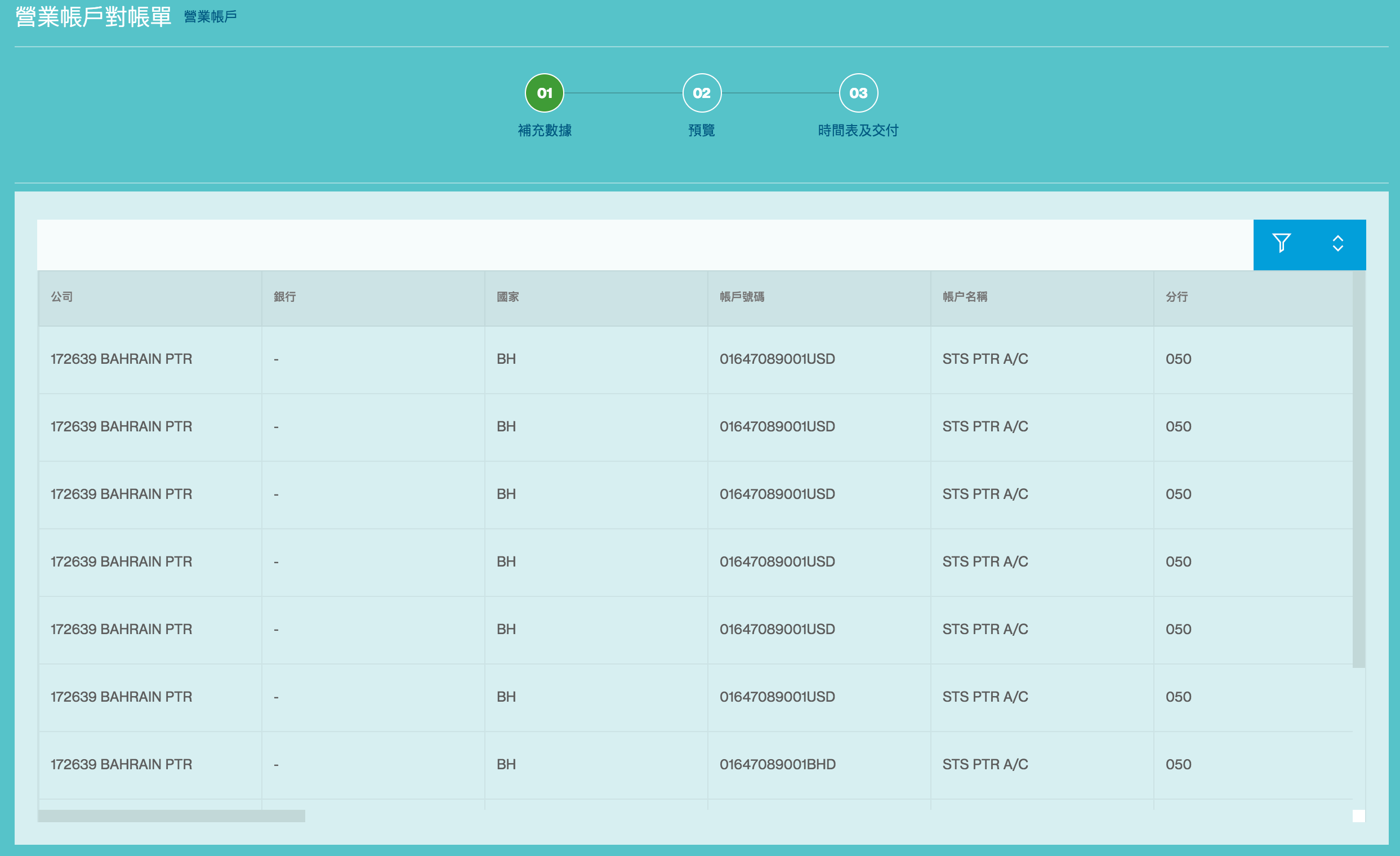

在Straight2Bank上訂閱報告只需要簡單的三個步驟,流程概述如下:

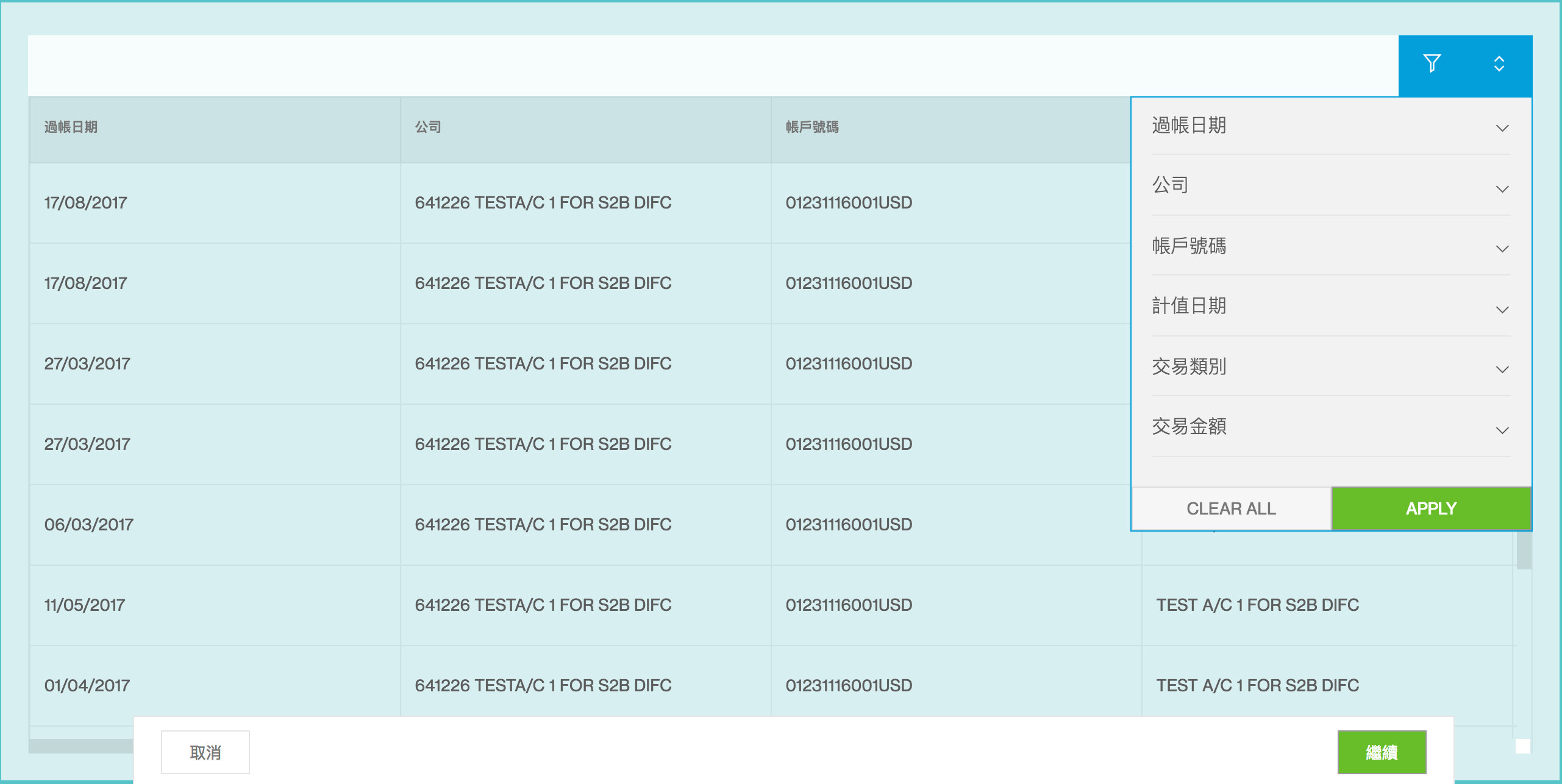

補充數據

- 根據使用者的偏好對資料 列重新排序

- 設定資料順序,包括優先 排序

- 根據使用者的資料權限,使用資料篩選器進行篩選設 定

預覽報告

- 預覽將產生的報告

排程與發送

- 設定報告發送的方式和 格式

- 設定報告發送頻率、排 程開始與結束時間

- 設定報告標題

- 設定電子郵件發送的報 告接收人

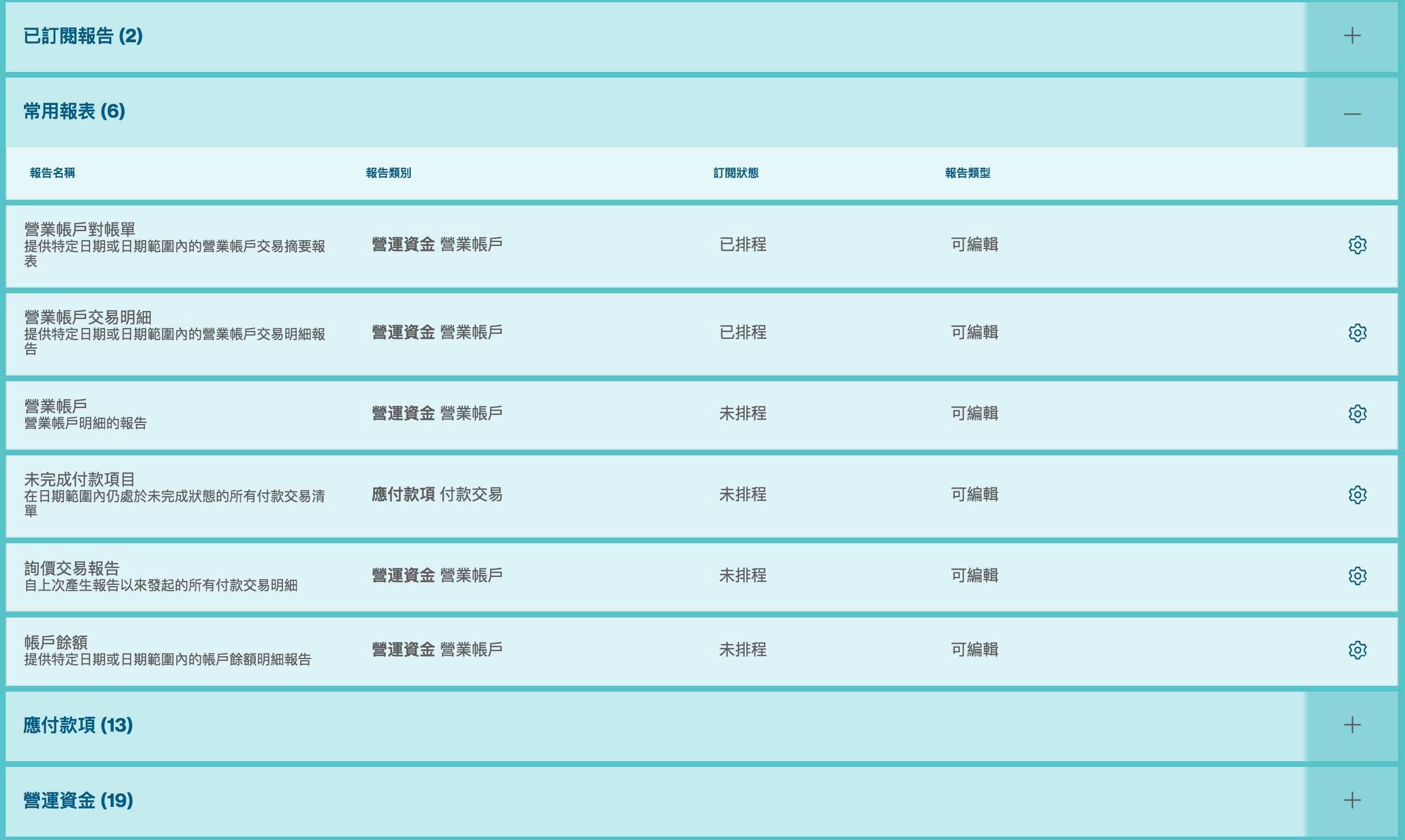

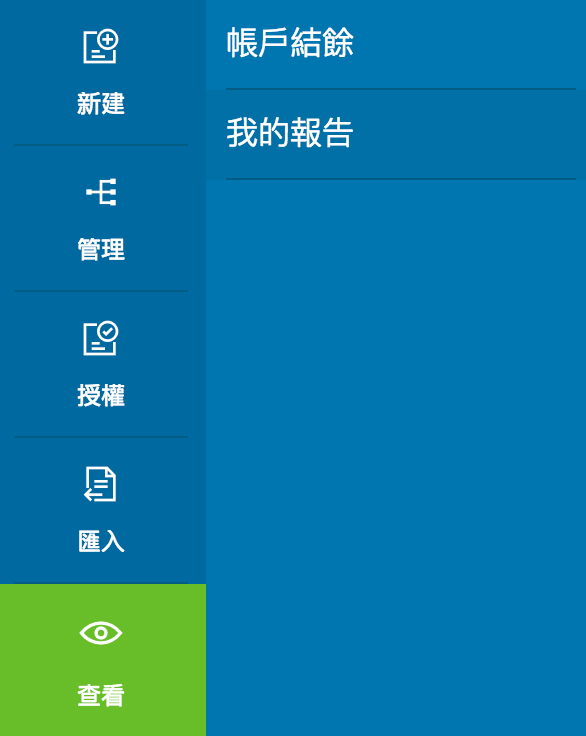

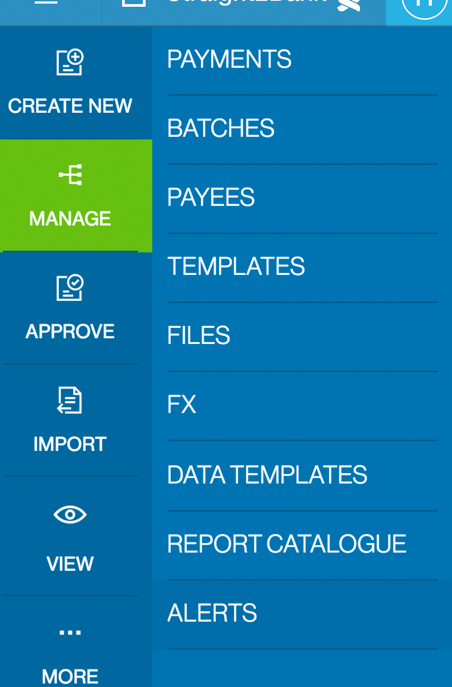

點選「選單 > 管理 > 報告」。 選

選擇您需要的報告。該清單將基於使用者「功能」層級的可用控制設定。

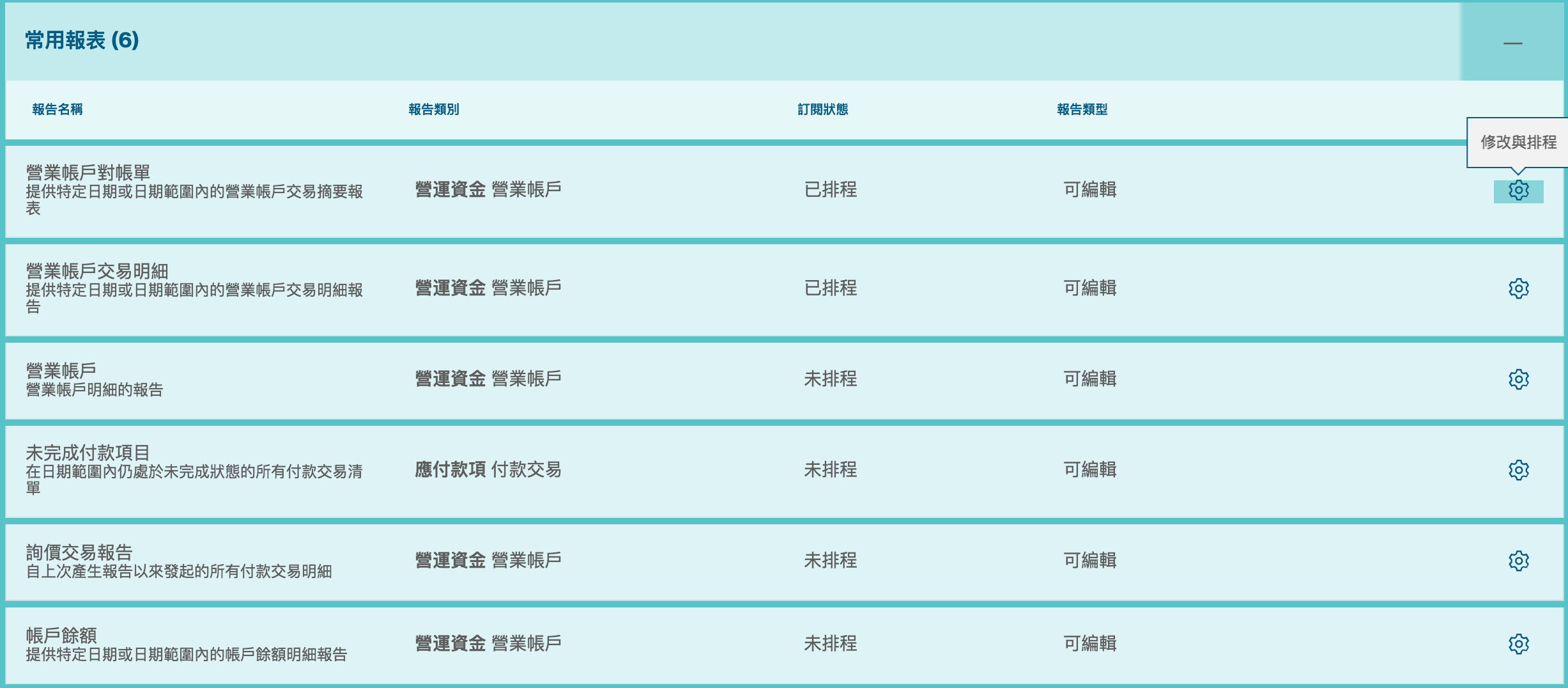

點選右側的「修改與排程」按鈕。

補充數據

「補充數據」頁面允許您為報告選擇的資料及呈現方式,包括對某些欄位進行篩選和排序。

可用於篩選的欄位因報告而異。以下所有或部分欄位可用於篩選報告:

| 資料欄位/參數 | 使用說明 |

|---|---|

| 公司 Company |

您在Straight2Bank上設定的公司將在此列出。此清單將基於登入使用者的 權限。其他欄位如「幣別」、「銀行」和 「帳戶號碼」將依此條件進行更新。 |

| 於該日期 As at Date |

此欄位可用於根據計值日期(交易處理日)來優化交易報告的輸出結果。 |

| 銀行 Bank |

主要適用於多銀行報告以優化報告的輸出結果。 |

| 幣別 Currency |

根據使用者資料設定的帳戶貨幣清單。可以選擇一種或多種貨幣。「帳戶號碼 」清單將依此條件進行更新。 |

| 帳戶號碼 Account Number |

根據使用者權限所列出的「帳戶號碼」和「帳戶名稱」清單。可以選擇一個或 多個帳戶。 |

| 帳戶類別 Account Type |

根據使用者權限的「帳戶類別」清單。可以選擇一個或多個帳戶類別。 |

| 分類帳期末節餘 Closing Ledger Balance |

在某些例如「營業帳戶」和「帳戶餘額」等餘額報告中會有此選項。這些欄位 可根據各種餘額欄位來優化報告的輸出結果。 |

| 期末可用結餘 Closing Available Balance |

在某些例如「營業帳戶」和「帳戶餘額」等餘額報告中會有此選項。這些欄位 可根據各種餘額欄位來優化報告的輸出結果。 |

點選右下角的「繼續」會進入預覽報告 (Report Preview)頁面。預覽報告及設定並確認無誤後,點選「繼 續」。

排程與交付

最後一步是設定報告發送的管道和時間。您可以選擇透過電郵 (Email) 或訊息中心 (Message Centre) 接 收報告。

可用的報告格式包括CSV、XLS、XLSX和 PDF。

設定發送時間:選擇報告的開始日期、結束日期和發送頻率(包括每次發送的時間點)。

也有「自訂報告名稱」、「報告接收人及電子郵件主旨」等欄位。

更改後,點選「提交」以完成訂閱報告的設定。

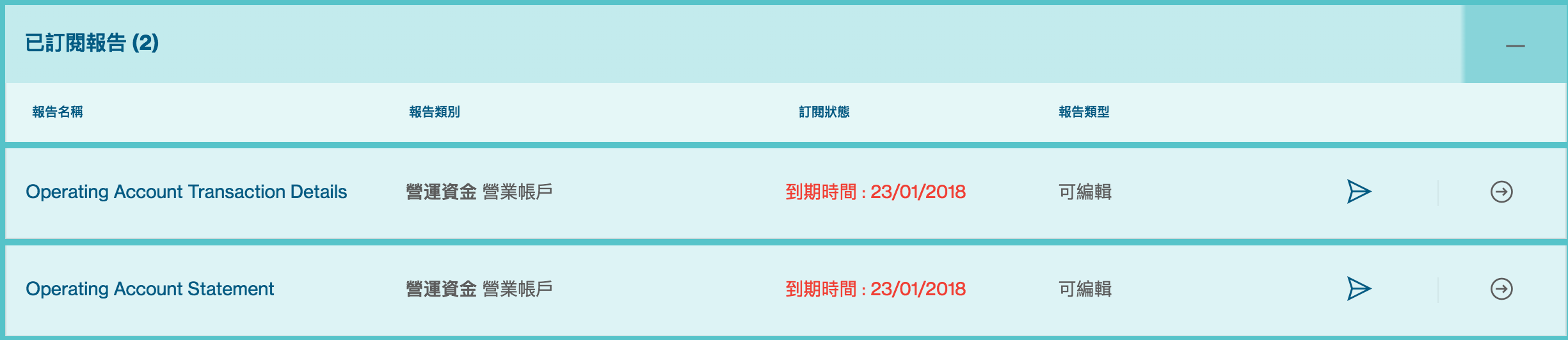

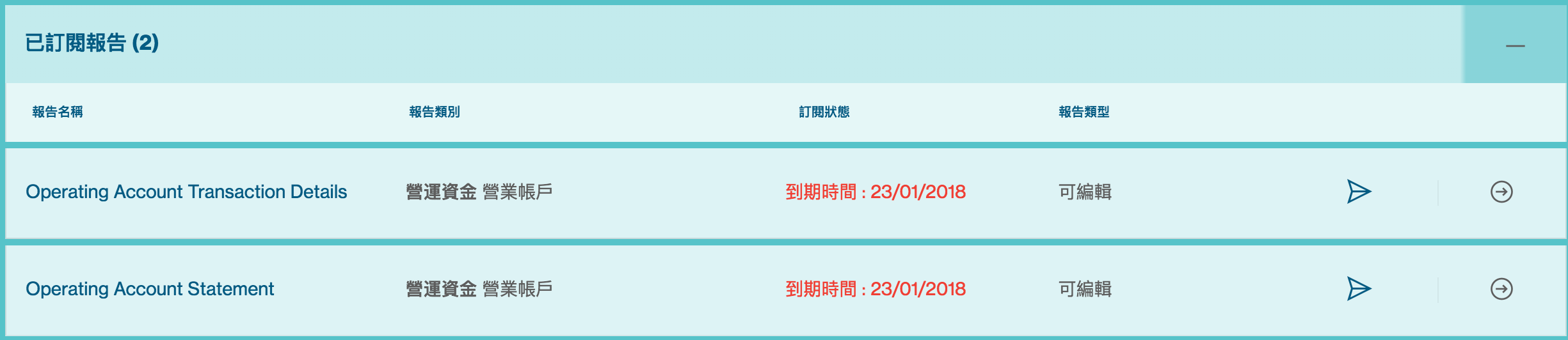

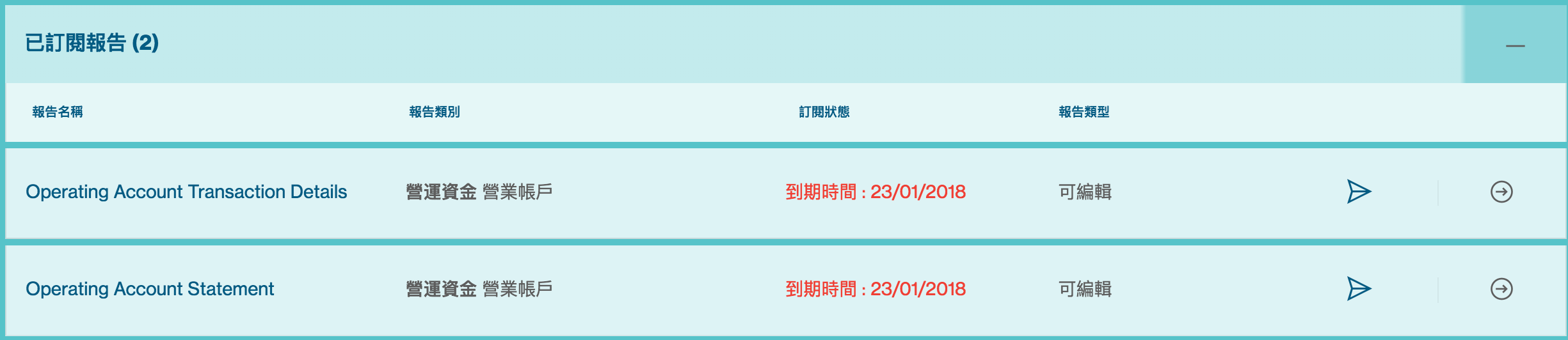

提交後,該報告即會作為已訂閱報告顯示在「我的報告」清單中。

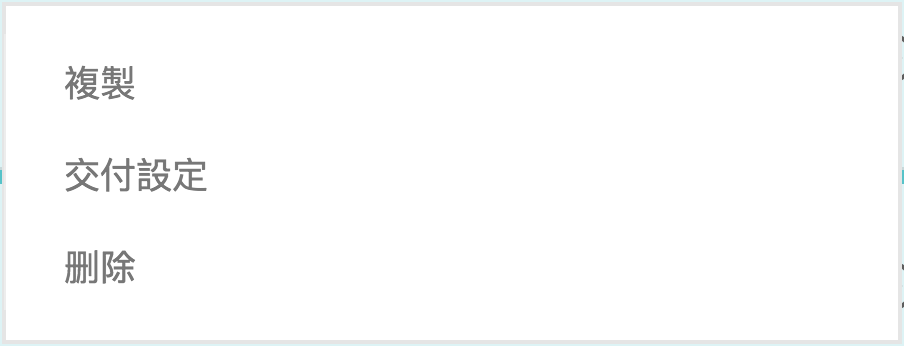

複製報告

複製報告功能允許使用者將可編輯報告複製為範本,以便建立新的報告。

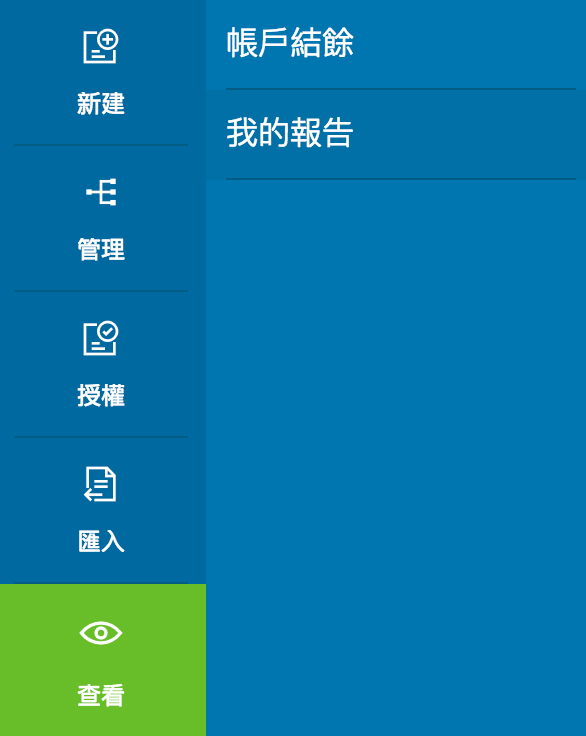

您可以透過「選單 > 查看」,然後點選「我的報告」。

該頁面會顯示個別使用者訂閱或發送給特定使用者的報告清單。

如果您希望自訂現有報告,請選擇一個報告並點選右側的「動作」按鈕,再點選「複製 (Copy)」選項。

您可以使用報告設定頁面以添加或刪除資料欄位、修改頁面的篩選及排序方式等。

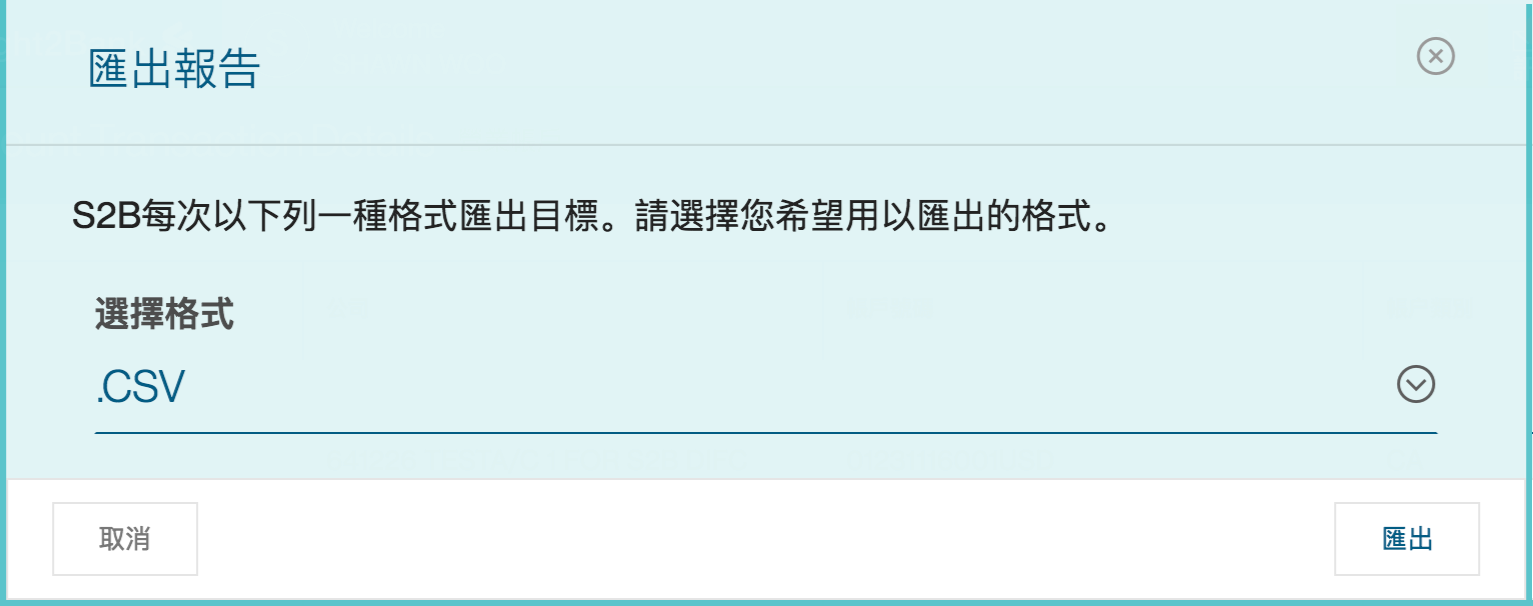

匯出報告

除了線上查看外,標準可編輯報告可匯出為PDF、CSV和XLS格式。Straight2Bank提供多達90天的歷史 數據,匯出的報告可用於資訊儲存目的,或讓您在ERP或會計軟體裡進行銷帳使用。

您可以透過「選單 > 查看」,然後點選「我的報告」。

該頁面會顯示個別使用者訂閱或發送給特定使用者的報告清單。

如果您想要自訂現有的報告,請選擇一個報告並點選右側的「匯出」按鈕。

系統將會進入預覽報告頁面。

點選頁面右下角的「匯出 (Export)」按鈕。

點選「匯出」按鈕後將跳出確認資訊,並顯示匯出的報告可在Straight2Bank「訊息中心」查閱。我

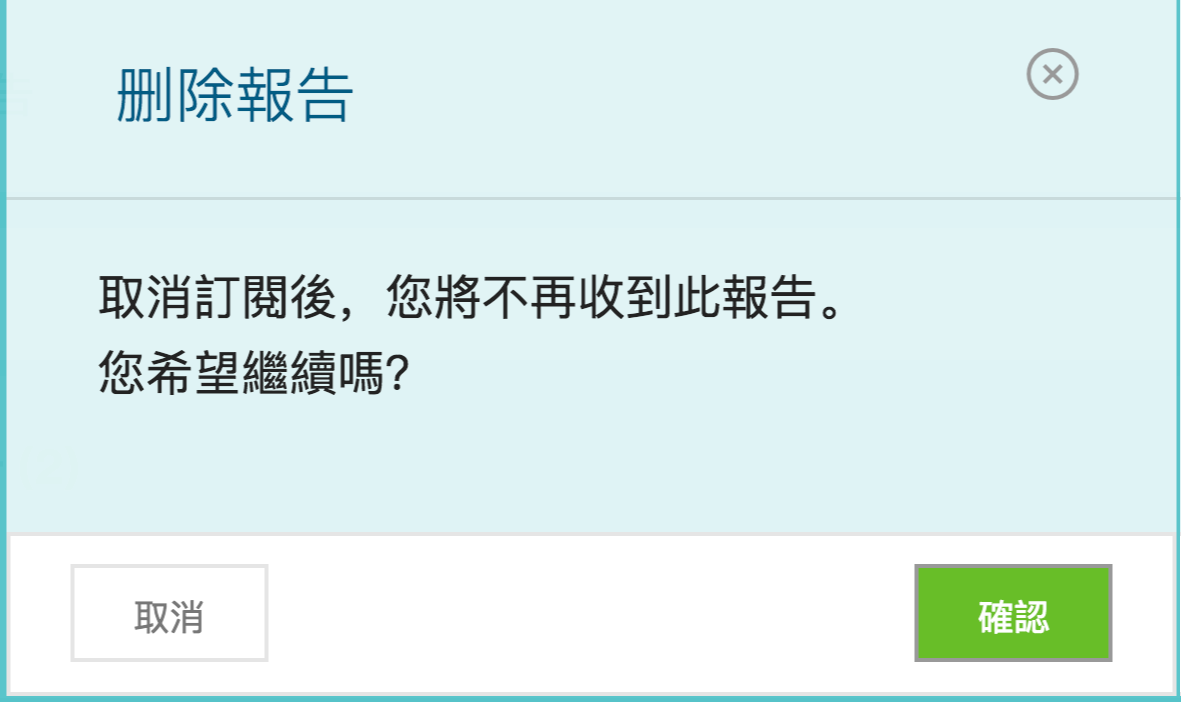

刪除報告

刪除報告功能可讓使用者取消訂閱報告。

您可以透過「選單 > 查看」,然後點選「我的報告」。

該頁面會顯示個別使用者訂閱或發送給特定使用者的報告清單。

如果您想要刪除已訂閱的報告,請選擇一個報告並點選右側的「動作」按鈕,再點選「刪除 (Unsubscribe) 」選項。

點選「刪除」按鈕後將跳出確認訊息。

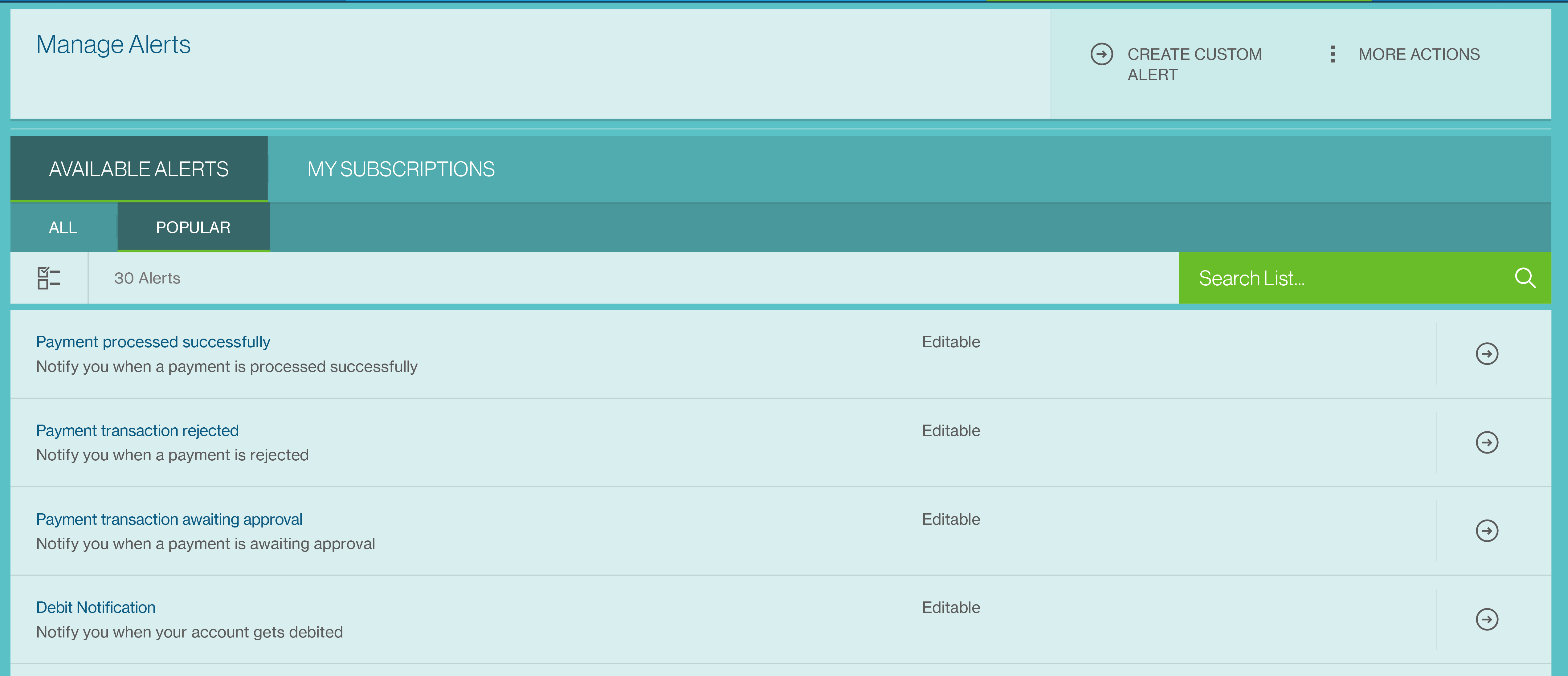

Alerts Available on Straight2Bank

The below list provides a summary of the various alert activities available on Straight2Bank across the different products and their bene fits. Please contact the Bank if y ou need more information on any of these alerts.

Payables - Payments

Payment processed successfully

Alert will be generated when the payments submitted to the Bank have been processed successfully.

This will be useful to be aware of payments have been processed successfully by the bank and inform the beneficiary of the same for next steps.

Payment transaction rejected

Alert will be generated when the payments submitted to the Bank have been rejected by the beneficiary bank for various reasons such as in valid account number, invalid beneficiary, etc.

This will be us eful to be aware of payments have been rejected by the beneficiary bank and inform the beneficiary of the same for next steps.

Payment transaction returned

Alert will be generated when the payments submitted to the Bank have been “Returned” for various reasons such as insufficien t funds, invalid FX, etc.

You will be no tified if the pa yments submitted have been “Returned” by the Bank t o contact and inform the beneficiary of any delays as a result or make alternative arrangements for the payment.

Payment transaction awaiting approval

Alert will be generated when the status of the payment changes to "Completed" (i.e.) after the initiator have created the payments instruction.

The alert is s end to the authoriser. This will be us eful to receive notifications when the payments instruction is awaiting approval.

Credit Successful

Alert will be generated when the payments submitted to the Bank have been credited successfully by the beneficiary bank.

This will be us eful to be aware of payments have been credited successfully by the beneficiary bank and inform the beneficiary of the same for next steps.

Transaction Status Change

Alert will be generated when there is a change in the status of a transaction.

This will be useful to be aware of the change in the status of a transaction.

Approver Alert

Alert will be generated when a transaction is approved by the selected approver.

This will be useful to be aware of payments have been approved successfully by the selected approver, and the status of the payment changes to "fully authorised" / "partially authorised".

Payment Transaction Approved

Alert will be generated when all authorisers have successfully authorised the Payment and is pending to be Sent to the Bank.

This will be useful to be aware of payments have been fully authorised.

Transaction Sent to Bank

Alert will be generated when all authorisers have successfully authorised the Payment and is pending to be Sent to the Bank.

This will be useful to be aware of payments have been fully authorised.

Payables - Batches

Batch Fully Signed

Alert will be generated when the status of the payment batch changes to "Fully Signed" (i.e.) after all the authorisers have authorised the batch.

The alert is send to the “Releaser” (or the user who has “Send to Bank” function). This will be useful to receive notifications when the pa yment batches(es) are ready to be released to the Bank for processing.

Payables - Payee

New Payee Creation and Awaiting Approval

Alert will be generated when a new payee is created and is awaiting approval.

The alert is s end to the authoriser. This will be us eful to receive notifications when the new payee is awaiting approval.

Working Capital - Operating Accounts

Debit Amount

Alerts will be generated based on debit transactions on your account and the criteria configured.

This will be us eful to receive notifications on high-value payments, payments out of certain designated accounts, entities, payment reference and various other parameters.

Credit Amount

Alerts will be generated based on inward credits to your account and the crit eria configured.

This will be us eful to receive notifications on high-value inward receipts, inwards to certain designated accounts, entities, transaction reference and various other parameters.

Closing Ledger Balance

Alerts will be generated based on the threshold of the “Closing Ledger Balance”.

Several parameters are available to define the filter criteria and receive alert notification.

Closing Available Balance

Alerts will be generated based on the threshold of the “Closing Available Balance”.

Several parameters are available to define the filter criteria and receive alert notification.

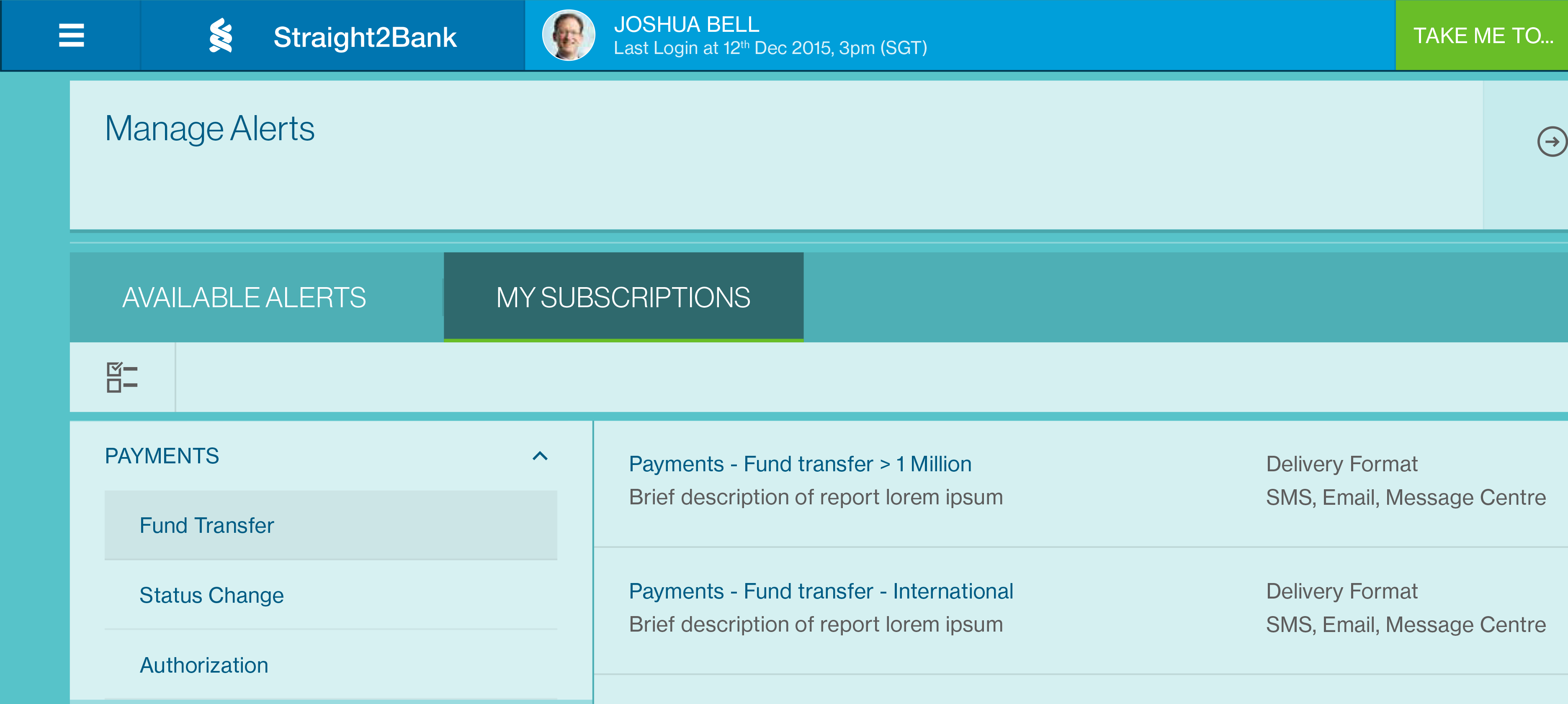

Subscribe Alerts

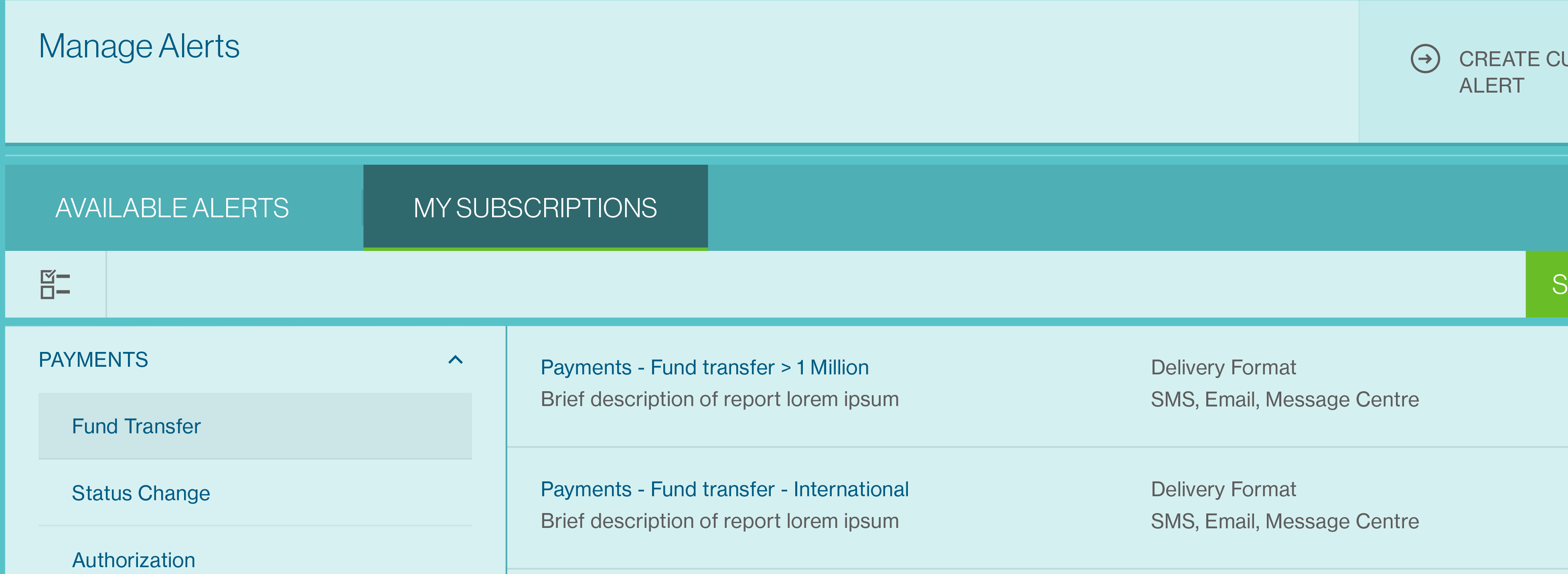

Setting up of alert notifications across the various products on Straight2Bank is a simple 3 s teps process like the “Subscribe Report”.

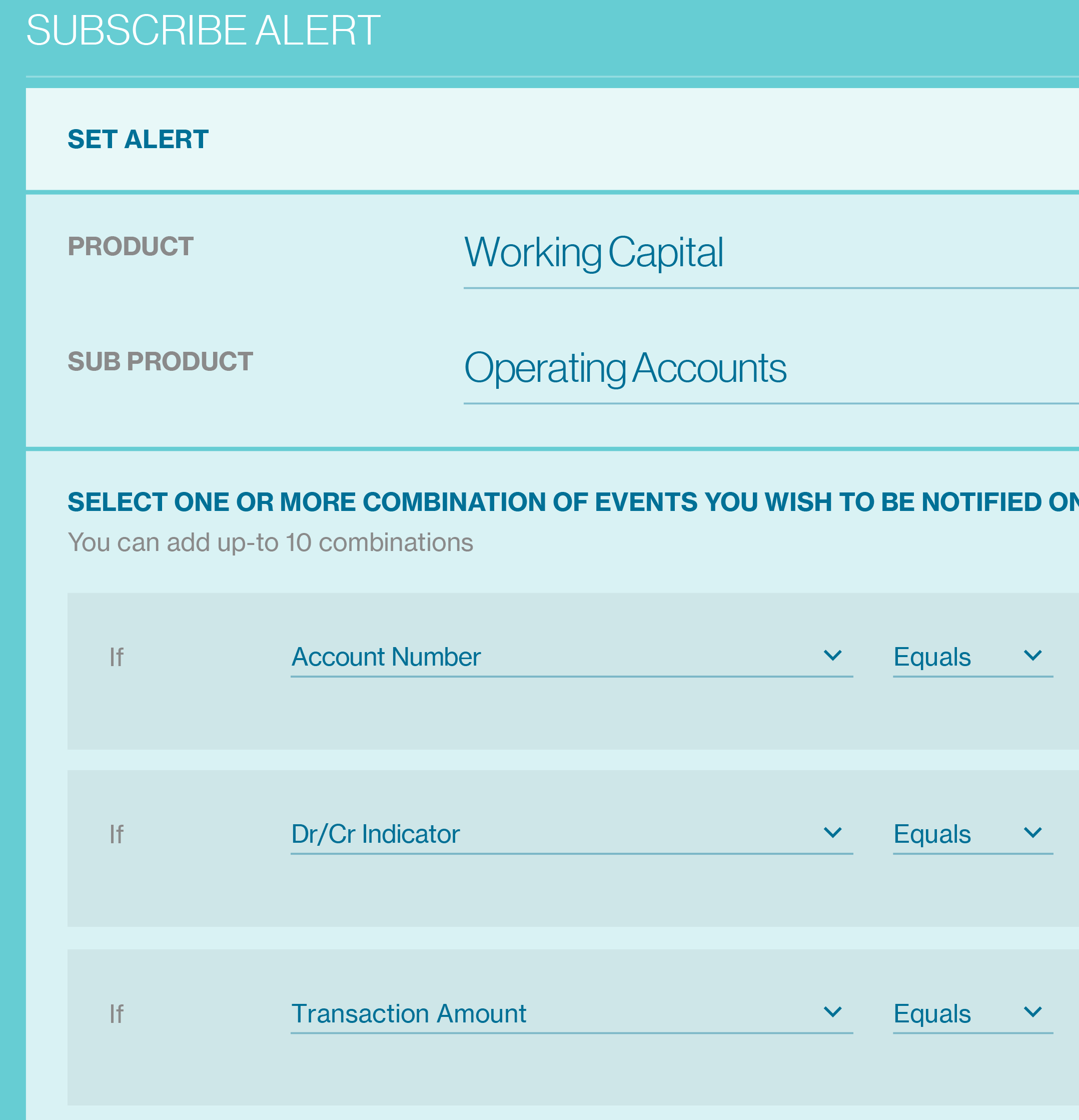

Subscribe Alert

- Choose the alert activity based on the “Product”

Set Alert

- Customise Content and Delivery Options

Save Alert

- Define Criteria & Save Alert

The steps involved for the “Working Capital - Operating Account - Debit No tification Alert” are used for illustration purposes in this section. Same steps will be relevant to other products and sub-products and hence have not been described in detail.

Under the Manage menu, choose the "Alert"

You will be presented with a s creen to select the most popular alerts t o configure. Please refer to ‘Alerts available on Straight2Banks’ for more details.

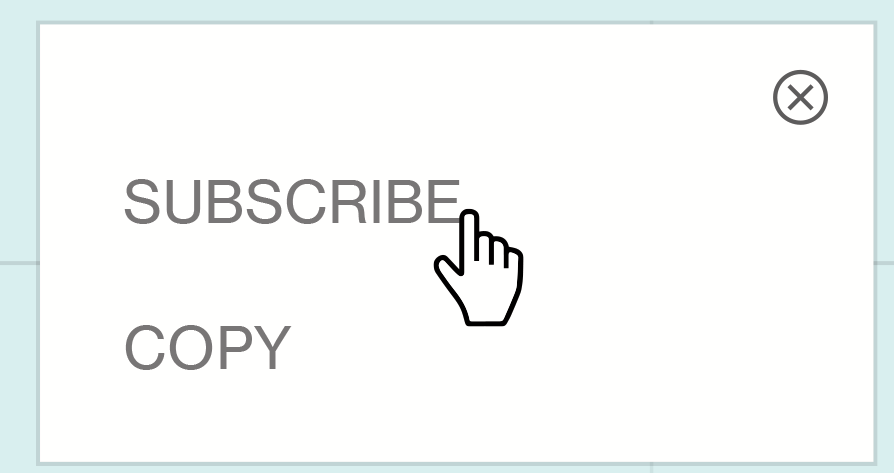

Click on subscribe to configure the debit notification alert.

Debit account number selection is mandatory for debit nofication and other combinations will be prefilled with appropriate values.

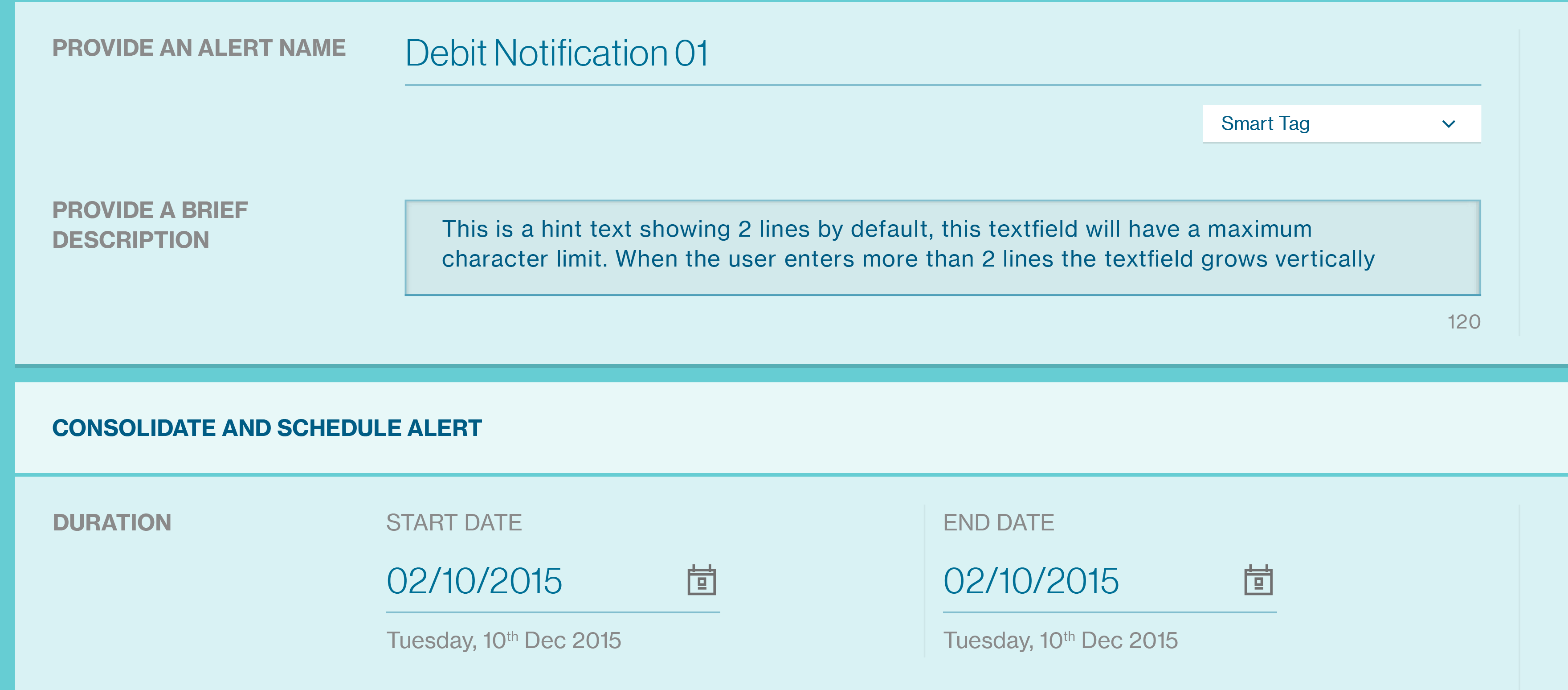

Please provide the Alert Name for tracking under my subscriptions. And also End date is optional for schedule duration.

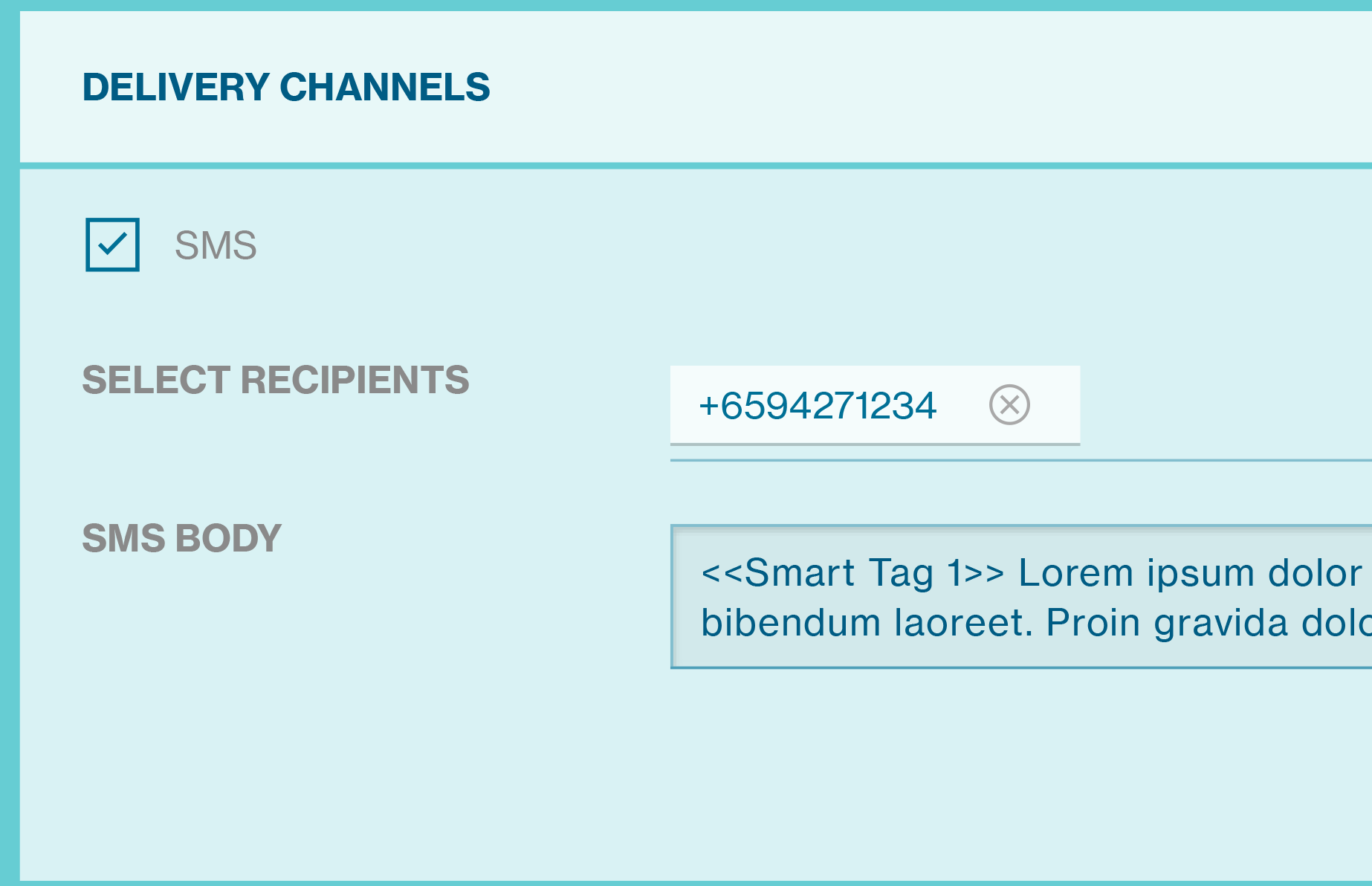

For SMS configurations please provide the mobile number with country code prefix. You can configure multiple recipients with comma s eparator.

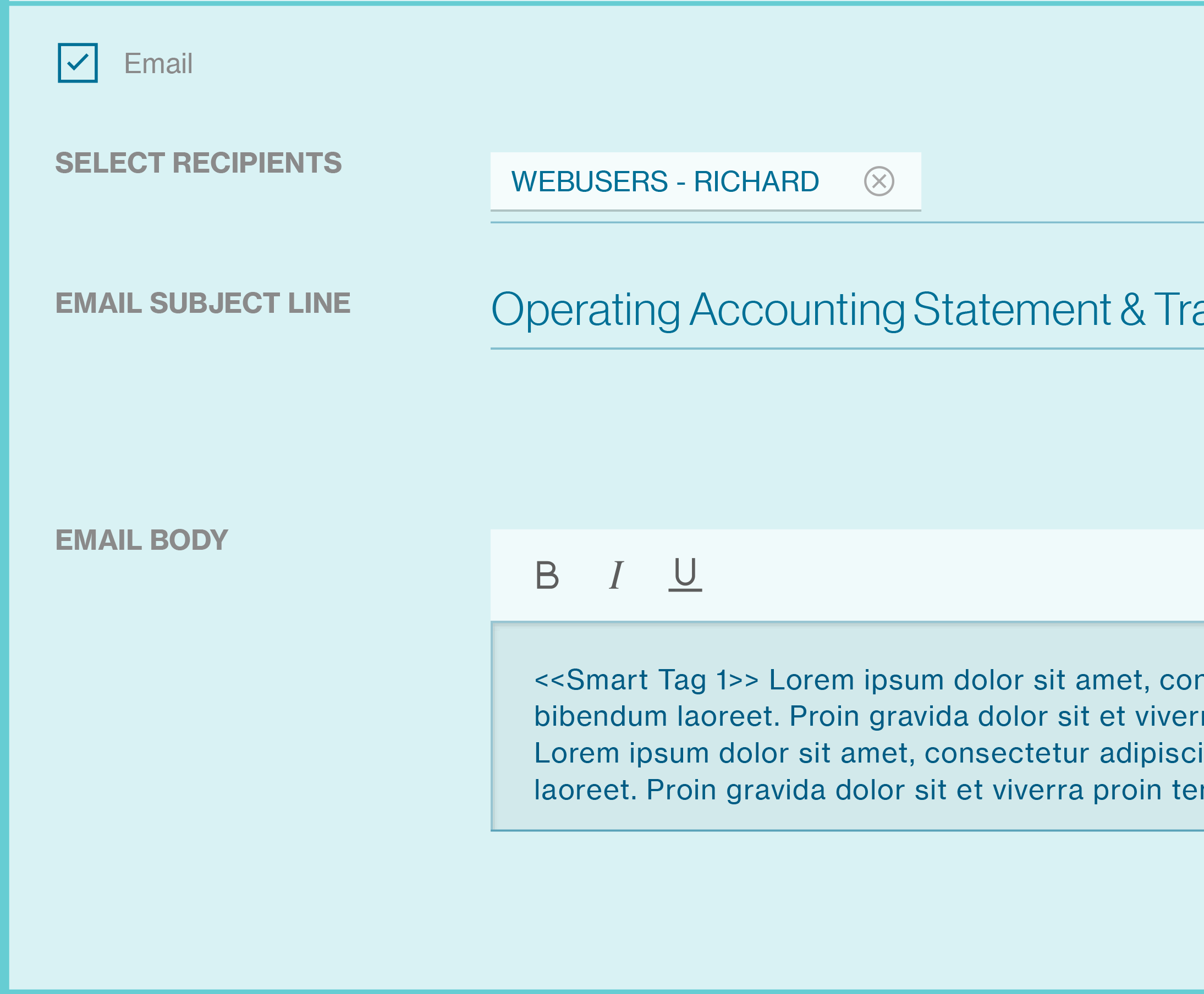

For Email configurations please provide the whitelisted Email ID. Client can configure multiple recipients with comma separator

The list of fields available as the crit eria may vary for each of the alerts. All or s ome of the below fields would be available to define the alerts crit eria.

| Data Field / Parameter | Usage Description |

|---|---|

| Set Alert | Select the activity from the drop-down list based on which the alert needs to be triggered. This varies based on the “Product” and “Sub-Product” chosen for the alert. |

| Combinations | List of data fields available to customise the content of the alert. Each of these fields will be r eplaced with the v alue from the transaction (e.g.) Account Number will be replaced with the actual account number. |

| Alert Name | Mandatory field for the alert t o be saved. This should be unique t o other alerts. |

| Description | Description of the alert f or easy identification and retrieval. |

| SMS Delivery | Provide the mobile number with coun try code prefix to generate the alert notifications and deliver through SMS. Multiple mobile number may be provided with comma separator. |

| Email Delivery | Provide email addresses to generate the alert no tifications and deliver through email. Multiple email addresses may be provided with comma separator but the domain of the email address must match the domain information provided during setup of Straight2Bank. (whitelisted email) |

| Subject | This is the subject title o f the email alert no tification. |

| Body Content | The content of the email ma y be customised here and the da ta-fields can be replaced as Smart Tag appropriately. |

| Alert Schedule | Start Date, End Date and Frequency at which the report schedule needs to run. |

| Consolidated Alerts | Select “Yes” for a consolidated notification (instead of individual) to be generated and delivered based on your preferred delivery time. Select “No” to send individual alerts. |

Once Alert is submitted, you can track/modify alert from My Subscriptions.

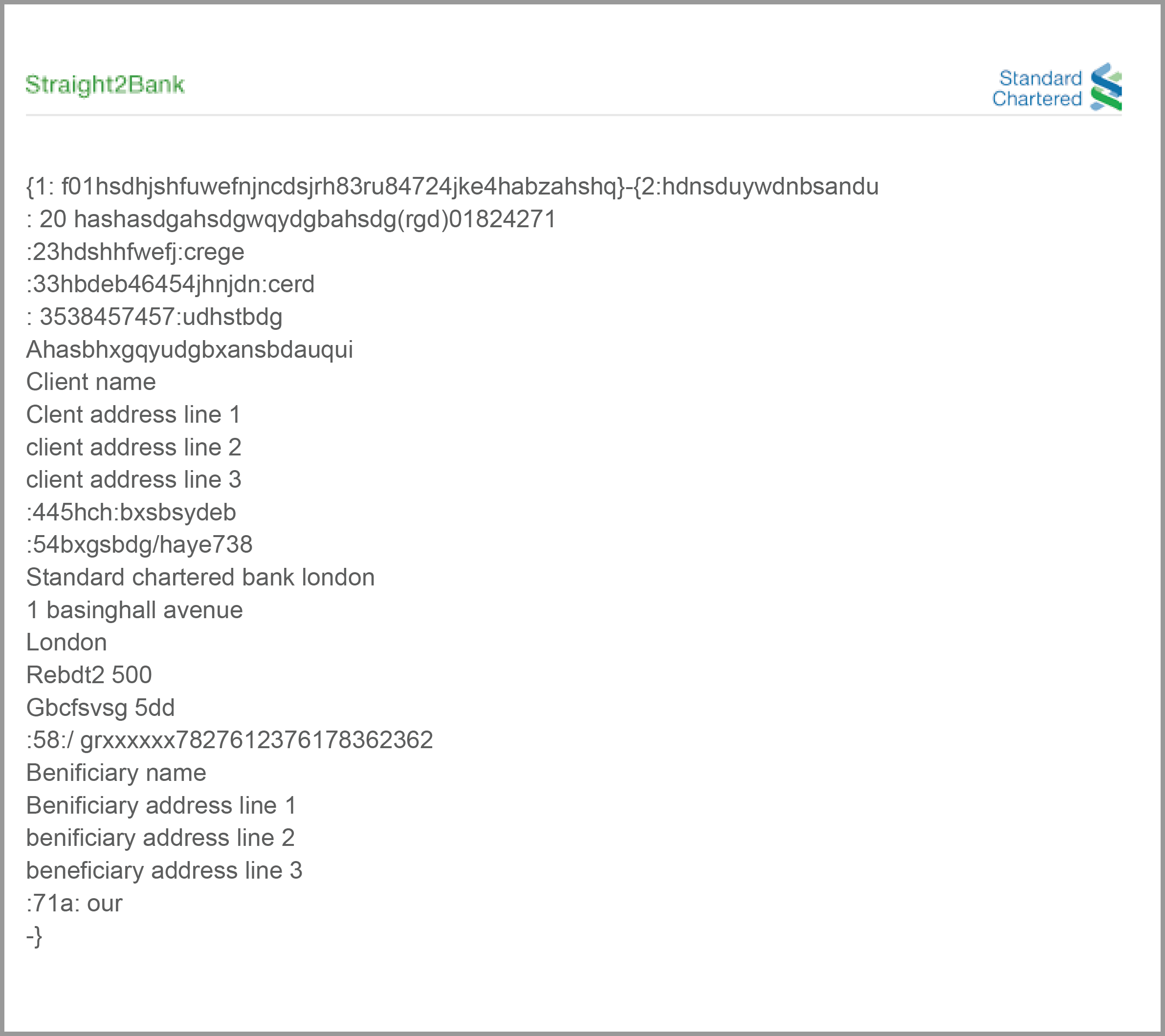

MT103 Copy

This feature allows you to generate a copy of the MT103 con firmation message for Outward Telegraphic Transfers (OTT’s) made on Straight2Bank.

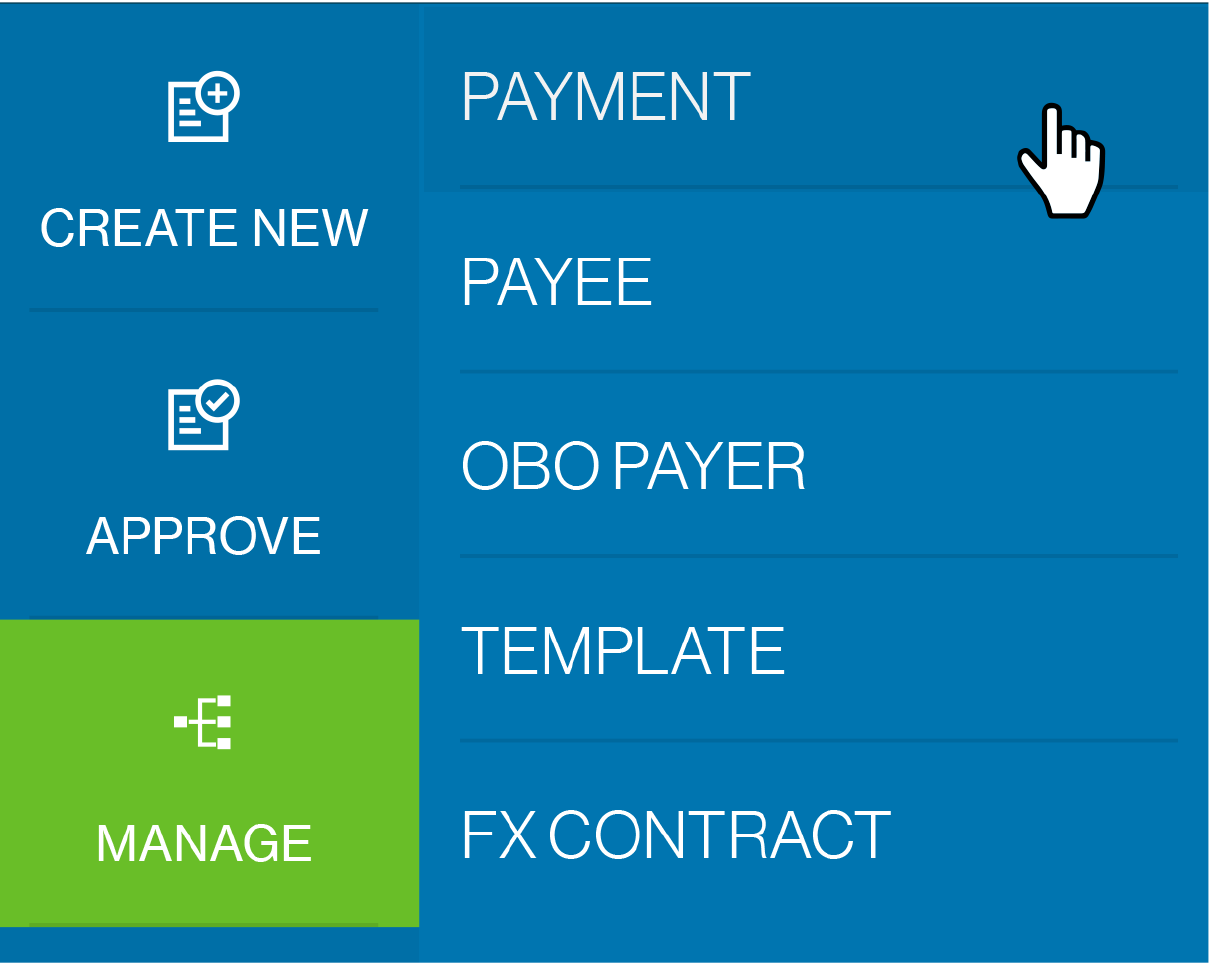

The option will be available on the Manage Payments List Screen - from the "Menu" > "Manage" > "Payment".

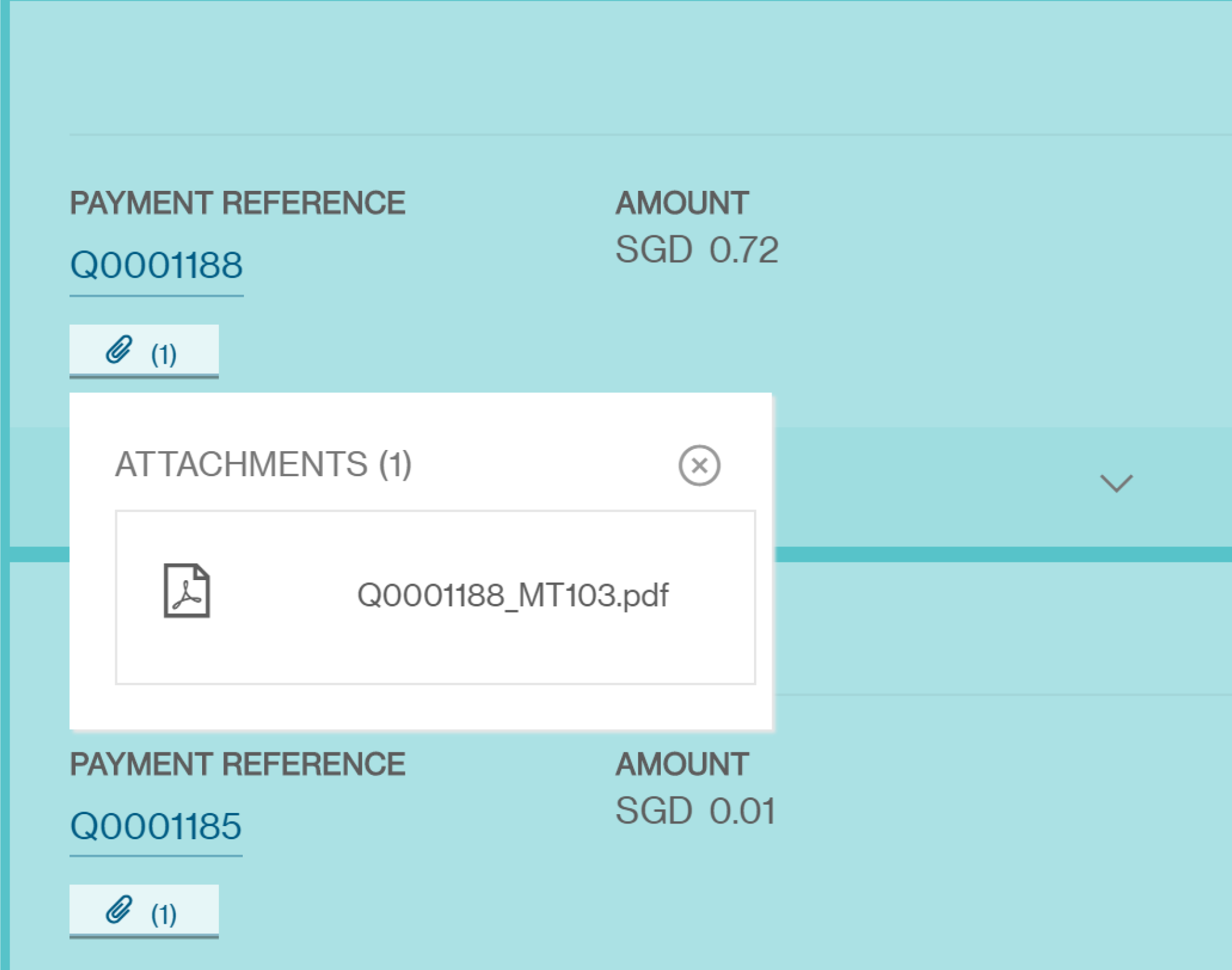

You should be able to access MT103 copy from Transactions List view on Manage List.

Copy of the MT103 message can be downloaded any number of times till the payment gets purged in Straight2Bank, via the attachment icon found beneath Payment Reference.

There will be no audit trail maintained when you click on the MT103 Swift Message Link to download the copy of MT103 PDF message.

Data / contents present in the MT103 pdf will no t be modified and will be displa yed the same as the one in column according to the mapping table.

MT103 Advice Fields for Main Information:

Mandatory Data Field & Description:

20: If left blank, the system will default the customer referenceas < P > < I > < GroupID > < Sequence Number >

32A: Calculated based on float. Allow client to overwrite the date.

33B: Currency , Gross Amount

53B: List of account set up for the client

33B: Currency , Gross Amount

50K: Defaulted to debit account name. Allow client overwrite. 57A: Beneficiary Bank name + Code

59: Name/Account/Address of Beneficiary

70: Payment details

71A: The codes for the above options are OUR,BEN,SHA and will be in SWIFT Message.

Optional Data Field & Description:

56A: Intermediary Bank Name + Code

54A: Receiver Correspondent Bank + Bank code

71F,71G: Default to 0.00 with currency the same as the currency of the debit account.

23E: Instruction Codes eg.

-------

SDVA: Payment must be executed with same day value to the beneficiary

INTC: Intra-Company Payment

REPA: Related E-Payments Reference

CORT: Settlement of a Trade

HOLD: Beneficiary Customer/Claimant will call

CHQB: Pay Only by Cheque

PHOB: Advise Beneficiary/Claimant by Phone

TELB: Advise Beneficiary/Claimant by the most efficient means of telecommunication

PHON: Advise Account with Institution by Phone

TELE: Advise Account with Institution by the most efficient means of telecommunication

PHOI: Advise Intermediary by Phone

TELI: Advise Intermediary by the most efficient means of telecommunication