There are special privileges offered to Standard Chartered employees, when it comes to Credit Cards and Loans.

As a Standard Chartered employee, you stand to enjoy pricing privileges and fee waivers, as well as increased convenience with new Credit Card and CashOne applications.

You can express your interest by completing the form on the right, or dial 678-46272 (ext Go2SB).

CBP Credit Cards Staff Roadshow (7th & 8th June 2018)

• CBP 1, at the back of the building facing Signature Building

MBFC Credit Cards Staff Roadshow (21st & 22nd June 2018)

• MBFC Level 17

Unlimited Cashback Credit Card

No cashback cap | No minimum spend | 1.5% cashback on all spend

Click here to apply for the card today. For full terms and conditions, click here.

Rewards+ Credit Card

Up to 10X Rewards Points on foreign currency spend and up to 5X Rewards Points on dining spend | 1X Rewards Point for all other spend | No minimum spend

Click here to apply for the card today. For full terms and conditions, click here.

Important to note:

- Waiver of annual fees* (excluding the Standard Chartered Visa Infinite Credit Card)

- Waiver of one-time service fee for EasyPay Programme

- No hassle as income details and/or documents are obtained from the Human Resources Department directly, with your consent#

* Applicable only if you remain an employee of Standard Chartered Bank (Singapore) Limited or Standard Chartered Bank, Singapore Branch.

# You must complete and sign a valid Staff Banking Consent Form authorising Human Resources Department to provide Staff Banking and/or Lending Operations with your address, Standard Chartered employing entity and address, grade, permanent or contract status, salary (including details of commission paid and fixed component), local or expatriate status, employment pass number (if applicable). Please click here for a copy of the Staff Banking Consent Form.

How to express your interest:

Simply complete the form on the right, or dial 678-46272 (ext Go2SB).

- The applicable interest rate for CashOne/Credit Card Instalment Loan is as follows:

| Loan tenor |

AR (% p.a.) |

EIR (% p.a.) |

| 1-year |

3.88 |

7.09 |

| 2-year |

3.88 |

7.28 |

| 3-year |

2.88 |

5.46 |

| 4-year |

2.88 |

5.45 |

| 5-year |

2.88 |

5.43 |

- No annual fees*

- No early redemption fees*

- No hassle as income details and/or documents are obtained from HR department directly with your consent#

Click here to apply online via theBridge

Please call GoSB (678-46272) or approach the Staff Banking Team to enjoy this offer. Please visit here for more information and the full terms and conditions that apply.

* Applicable only if you remain an employee of Standard Chartered Bank (Singapore) Limited or Standard Chartered Bank, Singapore branch.

#Only for Hard Copy:You must complete and sign a valid Staff Banking Consent Form authorising Human Resources Department to provide Staff Banking and/or Lending Operations with your address, Standard Chartered employing entity and address, grade, permanent or contract, salary (including details of commission paid and fixed component), local or expatriate, employment pass number (if applicable). Please click here for a copy of the Staff Banking Consent Form and click here for a copy of the physical application form.

More details »

To provide our staff with flexibility in servicing their home loans, we offer a Staff MortgageOne SIBOR Package with the following features:

MortgageOne SIBOR Package

100% MortgageOne interest off-set*

3-month SIBOR + 0.65% p.a No partial or full redemption fees#

The Staff MortgageOne SIBOR Package is applicable for the purchase of a residential property which must be for your own occupation. The housing loan must be held in your own name, either singly or jointly.

Alternatively, choose or switch to any commercial mortgage package, which may offer lower interest rates (without the 100% interest offset of the Staff MortgageOne SIBOR package).

If you are interested to re-price your mortgage loan with us to the commercial packages, please send your request to the Mortgage Retention Unit at sg.mru@sc.com with the following documents:

- A copy of all borrowers’ NRIC** or Passport (for foreigners)

- A screenshot of the tax portal showing the tax rate of the subject property under owner occupation

- Any utility bill statement or letter from government/fire insurance company with mailing and/or property address^ and name(s) of account holder(s) printed on the letter (for passport holders only)

** NRIC address should be the same as the mortgaged property address

^ Mailing address should be the same as property address

Stay tuned for new exclusive staff mortgage offers in a few months’ time. For more information, please refer to our FAQ or contact your Staff Banking

relationship manager.

Please visit here for the full terms and conditions that apply to both the Fixed Deposit Rate Package and the MortgageOne SIBOR Package.

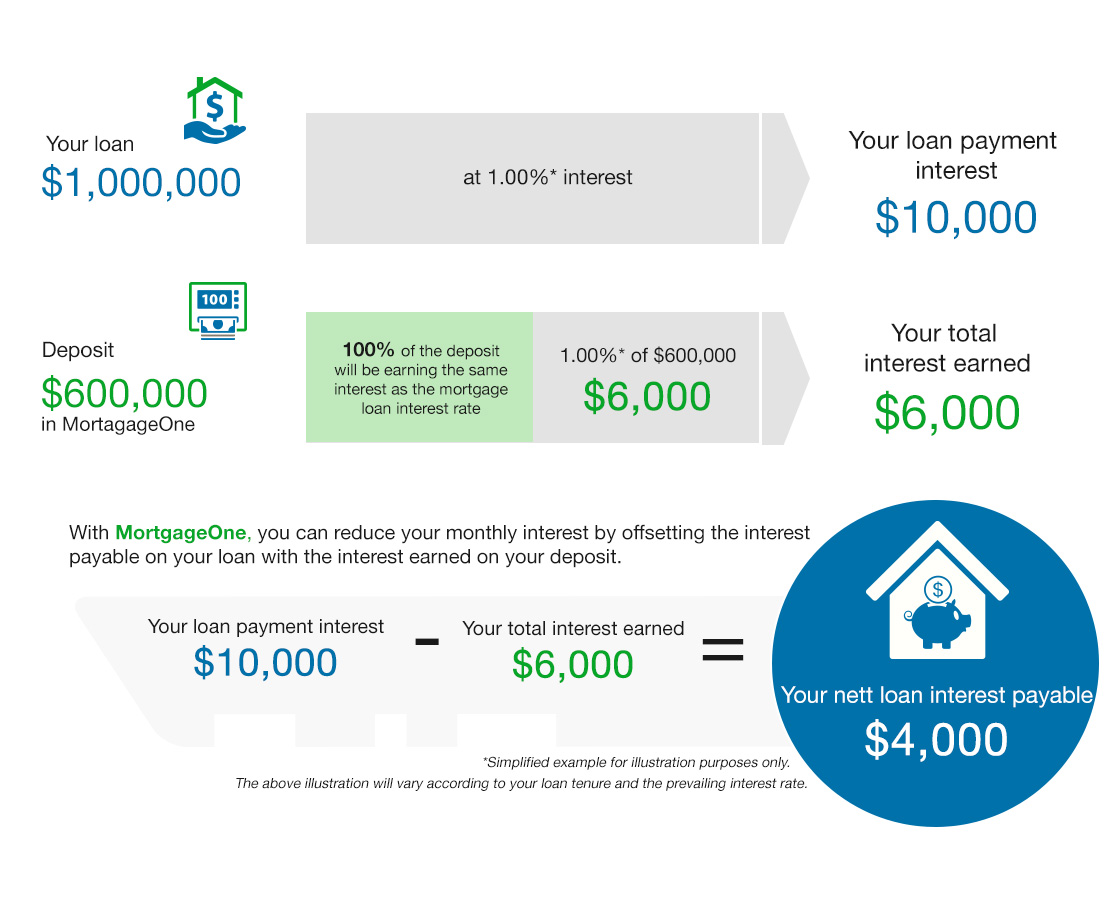

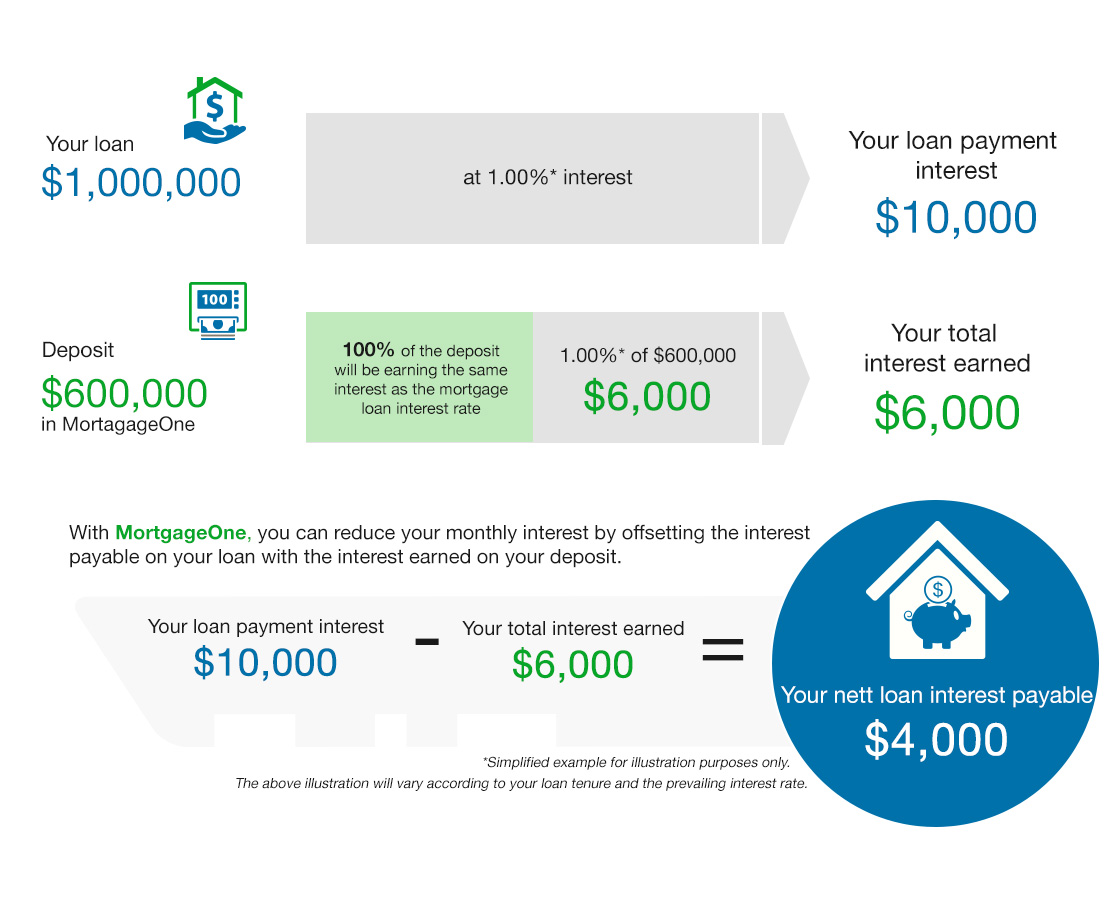

Illustration : How 100% interest offset works

*Applicable only on a housing loan to finance the purchase of a private residential property. The full credit balance in your Mortgage Loan (up to a maximum of your loan) earns the same interest rate that applies to your Mortgage Loan facility on any particular day. You can offset the interest earned on your Mortgage Loan against the interest payable on the Mortgage Loan facility.

#You may redeem your loan in part if you serve us 1 week’s (partial redemption) or 1 month's (full redemption) notice in writing or pay us 1 week's (partial redemption) or 1 month's (full redemption) interest in lieu of notice.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Interest Rate |

Enjoy a preferential staff rate of:

2.38% p.a. for New Car

2.68% p.a. for User Car |

| Loan Tenure

|

Up to 7 years

|

Loan Quantum |

Up to 60% financing for cars with OMV of

more than $20,000 or 70% financing for cars

with OMV of $20,000 or less

|

Please note that all auto applications will have to be submitted through our authorised dealers, a list of which can be found in our Auto Dealer Registry

Upon approval, please note that you must read and sign our Auto Loan Staff Consent Letter which will be furnished to you by our fulfilment team.

For more information, please send an email to SG Client Acquisition Auto Financing with your requests / queries and we will revert.

More details »

We would like to inform you of the important changes to your Staff Unsecured Overdraft (OD) account if you cease your service with Standard Chartered Bank / Standard Chartered Bank (Singapore Limited) (“the Bank”).

With effect from 1 June 2016, should you cease to be an employee with the Bank, your OD account will automatically be converted to a Personal Credit Line (PCL) account at commercial terms. With this conversion*, your account number remains the same and you can continue to use the cheque books that have been issued to you. However, you will no longer be able to enjoy the privileges accorded to you as an employee.

Please refer to the table below for the changes to PCL account fees and charges:

| Interest rate

|

The interest rate of 18.88% p.a. will apply on any outstanding balance within the overdraft limit. |

| Minimum monthly repayment

|

1% of outstanding principal amount, plus interest, fees and charges,plus any amount in the account balance exceeding your credit limit, and any past due amount or a minimum of $50, whichever is higher.If the outstanding balance is less than $50, the entire outstanding balance is payable by the due date. |

| Late payment charges

|

$80 per month when you miss the payment due date, or pay less than the minimum repayment amount. |

| Annual fee

|

$85.60 |

| Over limit charges

|

5% p.a. in addition to the prevailing interest rate on the over-limit balances |

| Fees

|

- Returned cheque fee: $50 per cheque

- Stop cheque fee: $40 per cheque

- GIRO returned fee: $10 per transaction

- Over the counter payment: $5 per transaction

- Lost card replacement: $5 per card

- Chequebook: No charge

|

| Overseas cash withdrawal fee

|

2% of the amount withdrawn, subject to a minimum of $5 and maximum of $60 per withdrawal. |

If you wish to opt out of the auto-conversion, you may choose to close your account and pay off any outstanding balance on your account.

For enquiries, please contact our 24-hour Staff Banking hotline at 6784 6272.

* This is without prejudice to the Bank’s right to require you to immediately repay the overdraft outstanding or all outstanding sums upon the cessation of your employment with the Bank. Upon conversion, your account will be governed by our Personal Loan/Personal Credit Line terms, and our Customer Terms and all other applicable standard terms forming our banking agreement will continue to apply. These are available on our website or at any of our branches. You can also request for a hard copy by calling our 24−hour Staff Banking hotline.