Clicks to videos

Clicks to videosOver the counter payments by your customer

UPI solution for large format retail stores, Petrol stations, Hospitals, Airlines, Shipping, Tourism, Cab aggregators and many more. Contact Us

Clicks to videos

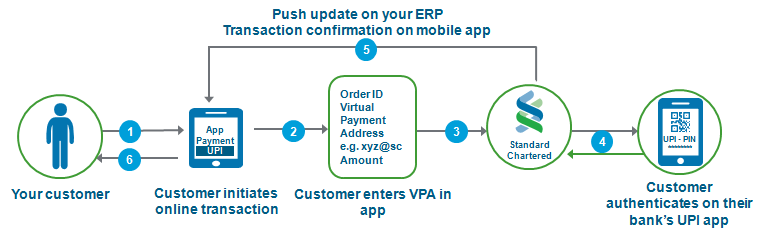

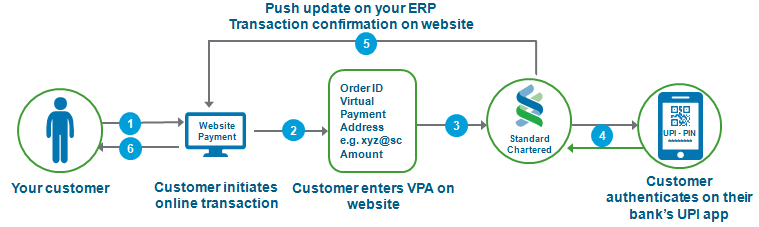

Clicks to videosPayments on Website

UPI solution for E-Commerce, Etail, Online travel bookings, Telecom, Power, DTH, Insurance, Mutual funds and many more. Contact Us

Clicks to videos

Clicks to videosMulti Customer Collect through ERP

UPI solution for Telecom, Power, DTH, Insurance, Mutual funds and many more.Contact Us

Clicks to videos

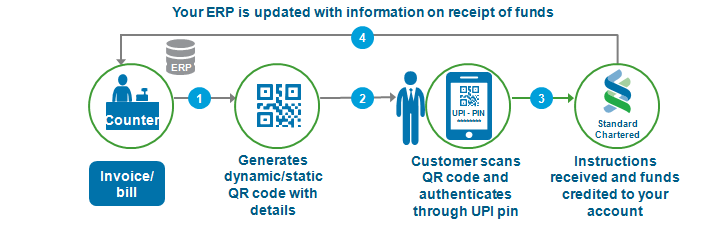

Clicks to videosQR code payments

UPI solution for E-Commerce, Telecom, Power, DTH, Logistics and many more. Contact Us

Clicks to videos

Clicks to videosCash on Delivery Replacement

UPI solution for E-Commerce, Logistics and many more. Contact Us

Clicks to videos

Clicks to videosCustomized VPAs

UPI solution for Telecom, Power, DTH, Insurance, Mutual Funds and many more. Contact Us

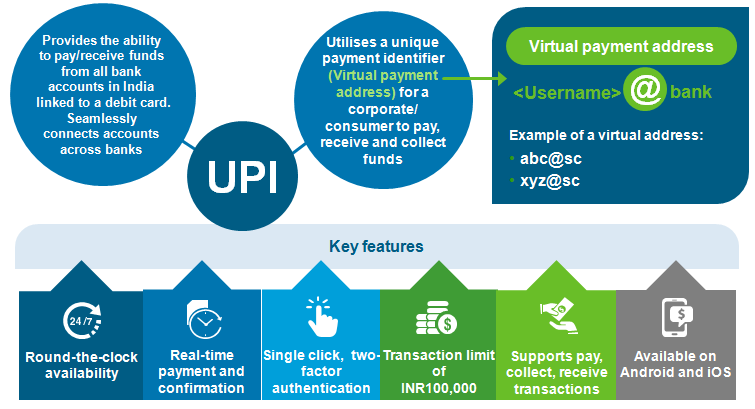

What is UPI?

Standard Chartered UPI solution for Corporates

With UPI solution you can receive money from your customers instantly. Standard Chartered bank has developed unique solutions with UPI which will enable you to collect money as per your requirements.

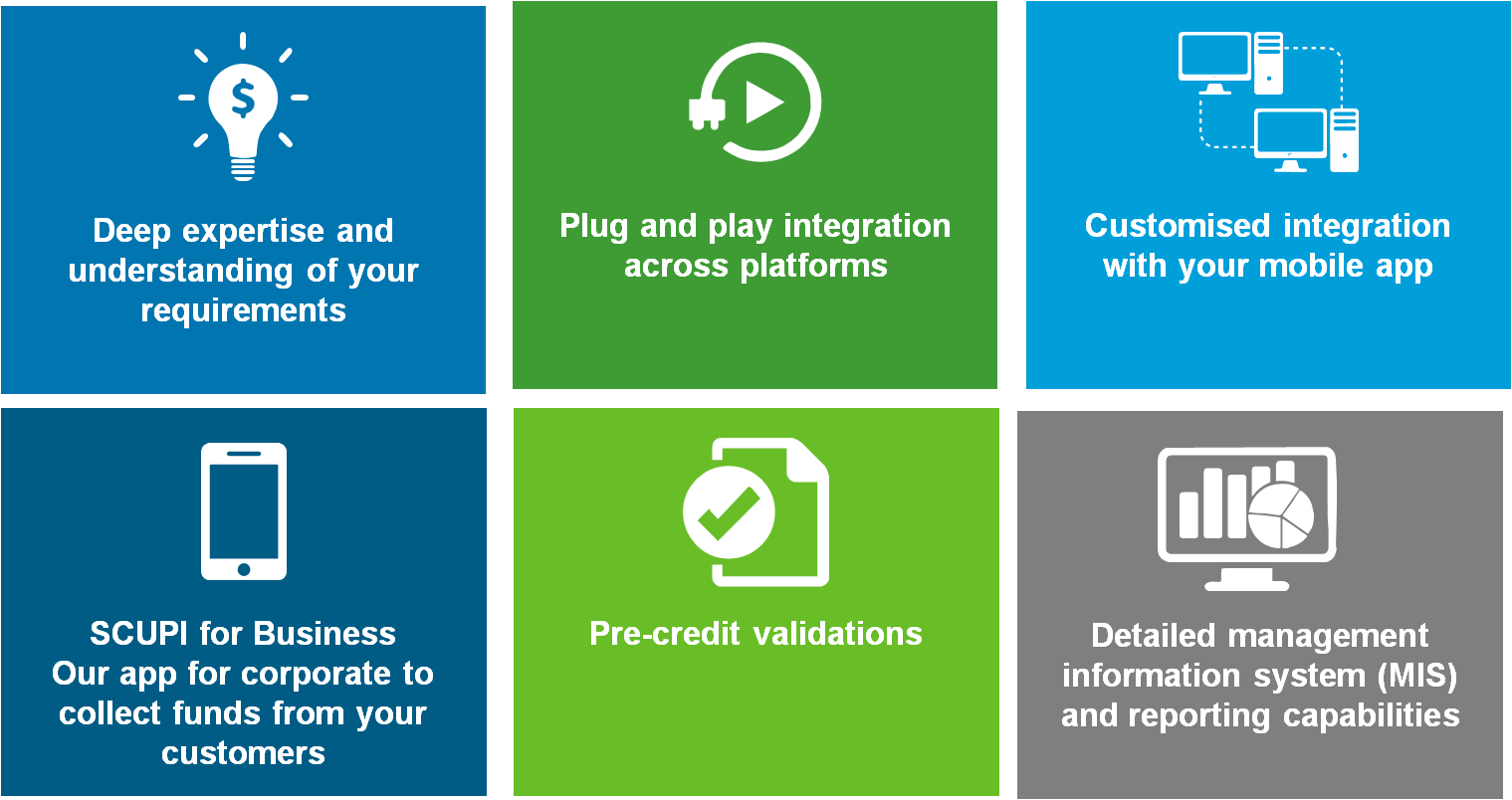

Standard Chartered can be your trusted partner in the journey of digitization. Our deep expertise in technology and industry expertise will help you implement a faster and comprehensive solution.

Standard Chartered Bank can enable you to

Receive payments from your customers through a variety of channels

- Mobile App Integration through Customized Software Development Kit (SDK)

- Seamless integration with your website and billing application

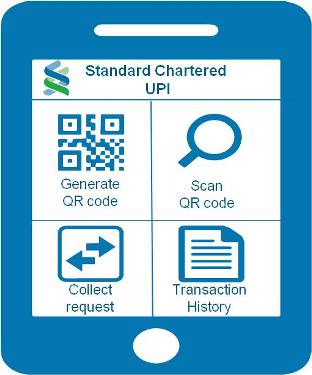

- UPI App designed specifically for your business (Standard Chartered UPI)

- Seamless payment using our Dynamic QR Code solution

- Mobile App Integration through Customized Software Development Kit (SDK)

Customized Dashboards and Management Summary

- Standard Chartered allows the corporate to check transaction status

- Custom MIS reports can be sent at defined intervals to defined destinations

- Online dashboard can also be made available for corporate to view real time transaction statuses

- Why Standard Chartered?

FAQ

-

-

What is UPI?

Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI). NPCI is an umbrella organization for all retail payments system in India and was set up with the guidance and support of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA). UPI is built over the IMPS infrastructure and allows you to instantly transfer money between any two parties' bank accounts.

-

How is UPI better than other electronic modes of funds transfer?

It is available 24x7x365 beyond banking hours and even on holidays. Credit happens instantaneously along with confirmation. Unlike mobile wallets, UPI is not a pre-funded mechanism, where payor needs to prefund the mobile wallet using his/ her credit/ debit card and it also does not have restrictions on fund movement to and from the wallet.

-

How can a corporate start receiving funds through UPI

For a corporate, we have an integrated solution. For the set-up and more details, you can contact your Standard Chartered Relationship Manager or can fill the contact form You can also call our dedicated support team on UPI for any clarification 1800-266-2888 / 1800 103 2888

-

In order to use a bank’s UPI App for payment or receipt, do I need to necessarily hold an account with the specific bank?

No. You can use our UPI App and platform to send and receive funds from any account with any bank. Further, you can link multiple bank accounts to the same VPA. However, one of accounts needs to be set as the default account. You can change your default account easily at any point in time.

-

What is the information required to do a transaction on UPI

To make a payment, one needs either VPA of beneficiary OR account number & IFSC code of the beneficiary. Similarly to send a collect request for funds from a payor, the receiver should have the VPA of the payor

-

What is an UPI-PIN?

UPI-PIN (UPI Personal Identification Number) is a 4-6 digit pass code you create/set during first time registration with this App .You have to enter this UPI-PIN to authorize all bank transactions.

-

What happens if I enter wrong UPI-PIN during a transaction?

No problem, the app will prompt you to re-enter the correct UPI-PIN. The maximum number of tries allowed, depends on your bank. Please check with your bank for details.

-

How can a corporate benefit from UPI?

Standard Chartered’s proposition enables corporates to be setup to receive and collect monies from their counterparties. All that is required is a configuration based setup to help you receive and collect monies into your Virtual payment Address

- With the setup, Standard Chartered would enable the corporate to

- Receive payments from counterparties 24*7

- Collect from counterparties through a variety of channels (Web, Mobile and Over the Counter)

- Additionally, Standard Chartered provides corporates with a mobile app that can be used to initiate collect requests, receive money and get notified of monies received through SMS and in-app notifications

- Online / Information:

- Standard Chartered allows the corporates to check transaction status (CheckTransactionStatus API)

- In case the corporates have a NotifyPayment API, Standard Chartered can subscribe to the corporate API and notify the client upon the change in the status of the transaction

- Custom MIS reports can be sent at defined times to defined destinations

- Advices can also be dispatched at defined events with custom content

- An online dashboard can also be made available for corporates to view transaction statuses as they happen

-

What is the amount limit set for counterparties to pay (and therefore for corporates to collect)

For payments, consumers / counterparties can make 20 transactions per day with a daily cap of INR100,000. There is no cap for receipt of funds (applicable for your business)

-

Do money transfers happen on UPI only during banking hours?

All payments are instant and 24/7, regardless of your bank's working hours!

-

I have paid for my transaction but not received anything. Why is that?

Once you complete a transaction, you should see a success status on the UPI App screen and receive an SMS from your bank. In some cases due to operator issues it can take longer time. In case you have not received your confirmation within an hour please contact our customer support at your bank.

-

How is UPI different from IMPS?

UPI is providing additional benefits to IMPS in the following ways:

- Provides for a Person-2-Person Pull functionality

- Simplifies Corporate Payments

- Single APP for money transfer

- Single click two factor authentication

-

Does the customer need to register a beneficiary before transferring funds through UPI? What details of beneficiary will be required?

No, registration of Beneficiary is not required for transferring funds through UPI as the fund would be transferred on the basis of VPA/ Account+IFSC / Mobile No+MMID / Aadhaar Number.

Note: Please check with your PSP and Issuing bank with regard to the services enabled on the UPI App.

-

Does customer need to have a bank account or this can be linked to a card or wallet?

No, customer cannot link a wallet to UPI, only bank accounts can be added.

-

Does the beneficiary also have to register for UPI for receiving funds?

Payments through UPI can to made to another VPA (requires beneficiary to be registered). Alternately, payments can also be made to the following combinations

- Account+ IFSC

- Mobile+ MMID

- Aadhaar number

Note: Please check with your PSP and Issuing bank with regard to the services enabled on the UPI App.

-

What happens if my mobile phone is lost?

In case of mobile loss, one needs to simply block his mobile number thus no transaction can be initiated from the same mobile number which is a part of device tracking and at the same time UPI pin would be required for any transaction which is not to be shared with anyone.

-

Can I link more than one bank account to the same VPA?

Yes, several bank accounts can be linked to the same VPA depending on the functionalities being made available by the respective PSPs.

-

What are the different channels for transferring funds using UPI?

The different channels for transferring funds using UPI are:

- Transfer through VPA

- Account Number + IFSC

- Mobile Number + MMID

- Aadhaar Number

- Collect / Pull money basis VPA

-

What if a corporate has an issue/complain that he is facing with UPI system?

For all corporate related issues/complaints; their sponsor bank can take this up with NPCI and ensure resolution

-