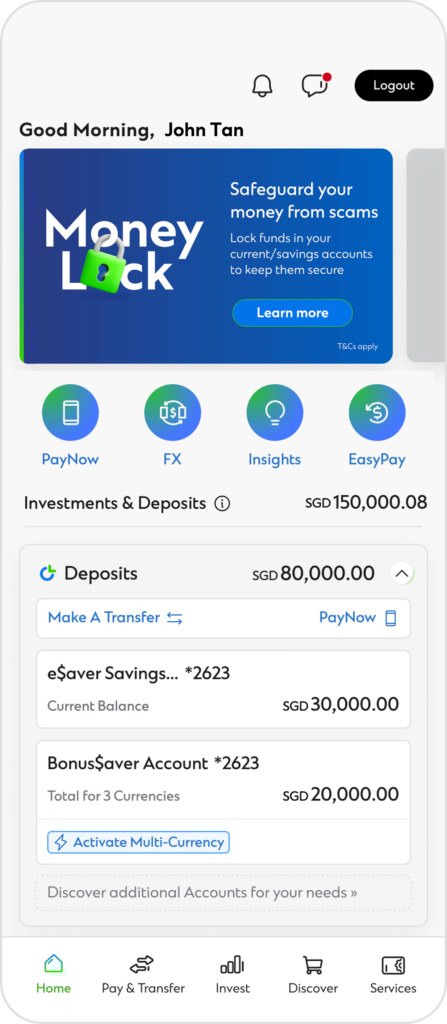

What is Standard Chartered Money Lock?

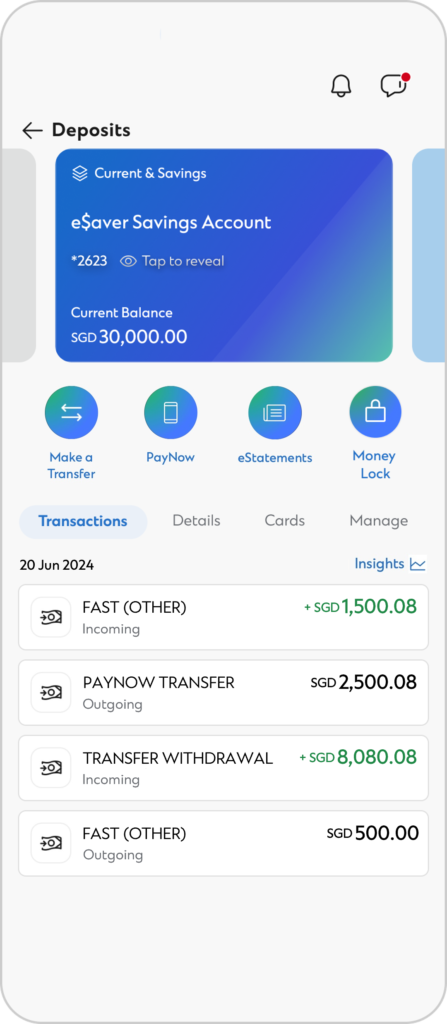

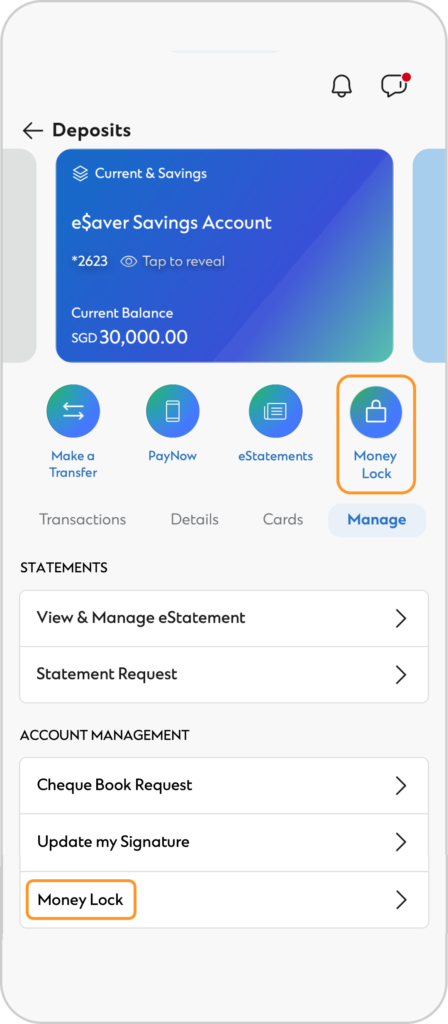

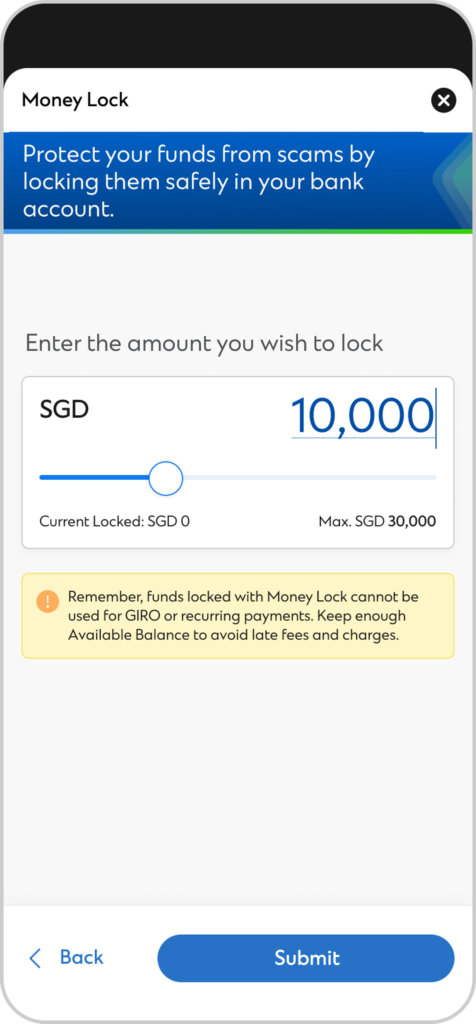

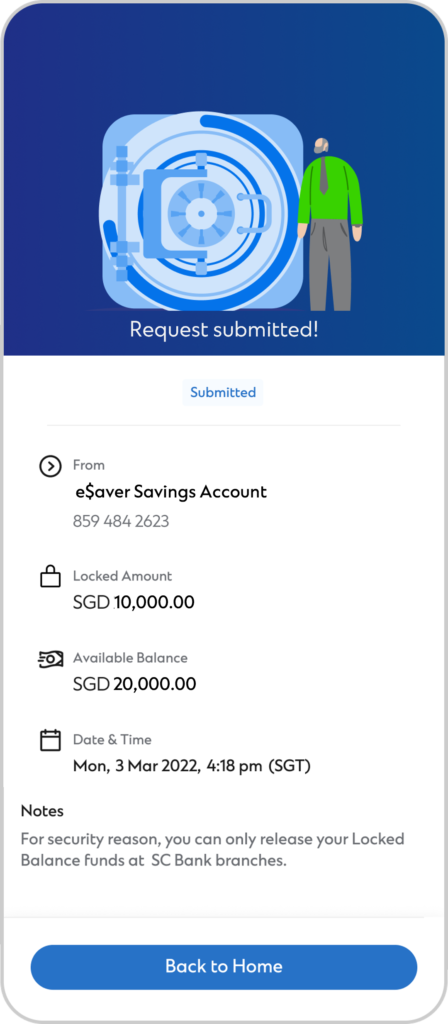

Standard Chartered Money Lock is a new anti-scam security feature that helps protect your funds from scams and unauthorised transfers or withdrawals.

By locking money from your current / savings accounts that you don’t need everyday access to, you can bank with us securely while you continue to earn interest at current rates.

Unlocking your funds

Need to unlock your funds? For added security and protection, you need to verify your identity in person at any Standard Chartered Singapore branch to unlock your money.