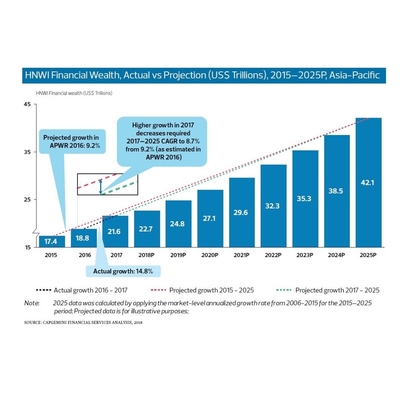

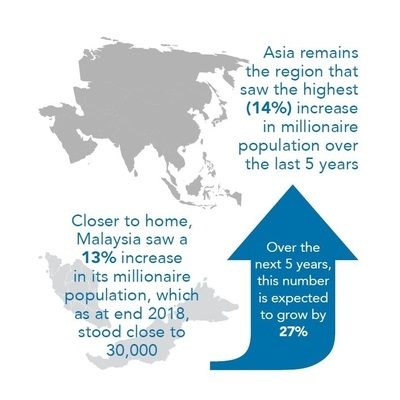

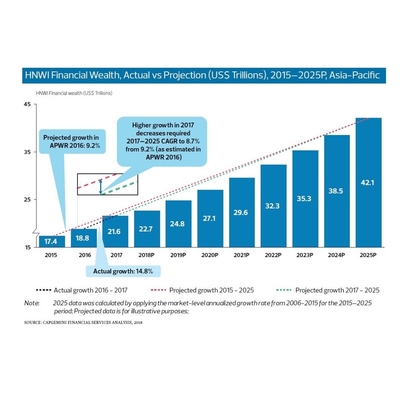

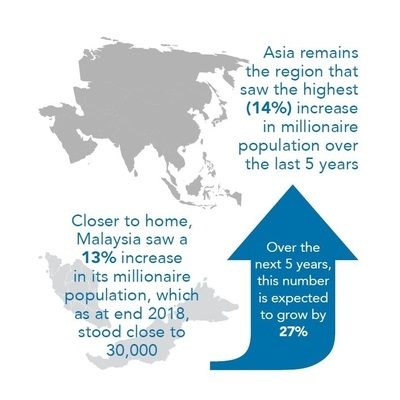

Asia is the new growth engine of the world. From China, India and United Arab Emirates, to Indonesia, Vietnam, Thailand, and Malaysia, countries in Asia have undergone rapid economic growth over the past few decades. This has brought newfound wealth for the people as they continue to scale the ladder of social and financial success.

Such double-digit growth in private wealth in the region is only expected to trend upwards. As wealth and prosperity make inroads into Asia, the demand for wealth management services is also expected to pick up.

As demand for wealth management picks up, it is imperative that we take a step back and ask what clients are looking for. Your wealth manager should be constantly thinking of your financial well-being so that when the need arises, they can offer quality financial advice. This is needed more in Asia where the culture is collectivist in nature and people value relationships that are stable, strong and long-lasting.

A good wealth manager should constantly invest his time to help you navigate troubled financial waters and arrive at better investment decisions. At Standard Chartered, our SMART framework uses a combination of Solutions, Market insights, Advisory, Relationship management and Technology to gain a good understanding of what clients want and help them achieve their financial goals.

Are returns the only means of client satisfaction?

Good wealth management goes beyond just numbers. Yet, quality service is often mistaken to mean producing higher returns and nothing else. Are returns really the only driver of client satisfaction? In early 2018, when markets were riding euphoric highs, research showed that client satisfaction was lacklustre amidst an otherwise positive backdrop of returns.

Wealth managers often lack foresight to see that returns are only the outcome of the service they offer. The most important step, which involves conducting a proper needs analysis and customer profiling, is often undermined as mere paperwork.

Customer engagement is at the heart of our SMART framework, which uses profiling to build deeper, more personalised relationships with clients to better understand their financial needs prior to making product recommendations. This ensures that your conversations with your advisor are always needs-driven and the quality of advice is always consistent.

What are clients asking for?

The emergence of big data and advanced analytics has led to personalised offerings across many industries. We live in an era of Amazon’s “customers also bought” feature which makes it easier to discover products we didn’t even know we needed. We also have Netflix’s “recommendations for you”, which knows precisely what movie you want to watch next. Personalisation has become so ubiquitous that no service industry can afford to ignore it, all the more so in the wealth management industry where clients’ needs form the core of the offering.

At Standard Chartered, our Market insights approach is built around using deep research and data analytics to perform adequate market and product due diligence to offer solutions tailored to every client’s unique needs. Our commitment to personalisation is reflected in pioneering Solutions where we have added lending (Wealth Power) to our suite of offering for clients who want to turbo-charge their wealth for enhanced returns. For clients with foreign currency needs, further customisation is available in as many as seven currencies.

As the industry shifts towards personalised advisory and a relationship-based approach, there is also a demand for holistic wealth services. These offerings may include retirement, inheritance, legacy planning and insurance advisory, to name a few. As clients increasingly seek a one-stop shop for their wealth needs, the need for account aggregation services becomes apparent. Our Asset Transfer programme, for example, is a Solution that lets you pool your investments under one roof, enabling clients to get a well-rounded, 360⁰ view of their holdings and helping our Advisory outfit offer more holistic recommendations around the investment, foreign currency and insurance needs of our clients.

Summary

Everything you have done, seen and experienced in life has come together to make your situation absolutely unique. Your needs and those of your family, your business and your future are unlike anyone else’s, and that’s the way your investments must be approached too.

As wealth managers, we understand it’s all about listening and understanding the life you envision, then offering advice and guidance that will help make it happen. It’s about working together to give you the confidence and excitement about what’s next.

Uncertainty has a silver lining

As the economic expansion ages, we think market volatility will be the new normal. This calls for a significantly different approach to investing than the one that has prevailed over the last 10 years. Market volatility has the potential to impact your financial objectives, but short-term volatility is also a price for long-term performance. When markets get choppy, it pays to have an investment plan and stick to it.

Market volatility should be a reminder for us to have a disciplined investment approach by reviewing our investments regularly and making sure we consider an investing strategy with exposure to different areas of the markets. Market downturns may be unsettling, but history shows stocks have recovered and delivered long-term gains. Therefore, a mix of stocks, bonds and short-term investments will determine potential returns in your portfolio.

Let’s chat. Leave your details here for more insights and tips on how to turbocharge your financial future.