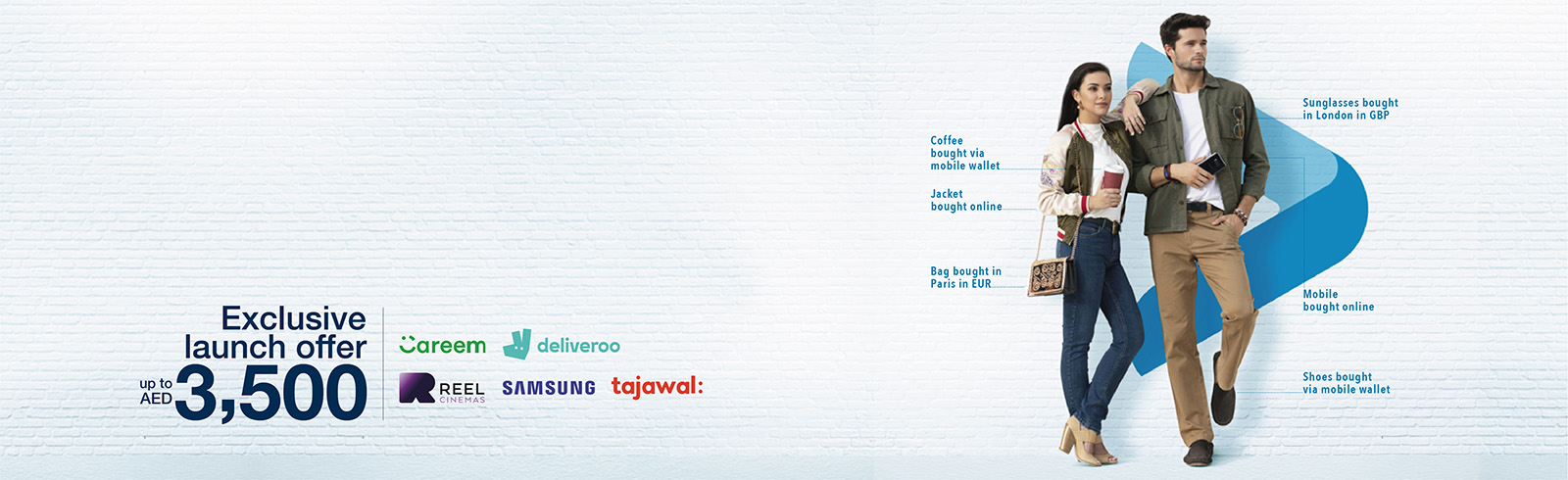

Save more when you spend online with the Platinum X credit card. You will be rewarded for all your online transactions in AED. For example:

All ride hailing apps (e.g. Careem)

All travel booking sites (e.g. tajawal.ae)

All food delivery apps (e.g. Deliveroo)

All shopping sites (e.g. souq.com)

– and everything else you can think of that’s online.

Cashback amounts vary depending on your overall monthly spending. Refer to the table below.

| Total Spends (AED) | Cashback percentage on online spend | MAXIMUM CASHBACK PER MONTH ON ONLINE SPENDS (AED) |

| 0 – 2,499 | 0% | 0 |

| 2,500 – 7,499 | 3% | 100 |

| 7,500 – 14,999 | 5% | 200 |

| 15,000 and above | 10% | 400 |