Fast forward your plans with CashOne Personal Loan

Apply Now Apply Now

Enjoy preferential staff interest rate as low as 2.88%p.a. (EIR 5.43%p.a.) on your CashOne Personal Loan

|

Loan Tenor

|

AR (% p.a.)

|

EIR (% p.a.)

|

|---|---|---|

| 1-year | 3.88 | 7.09 |

| 2-year | 3.88 | 7.28 |

| 3-year | 2.88 | 5.46 |

| 4-year | 2.88 | 5.45 |

| 5-year | 2.88 | 5.43 |

|

FEE

|

CHARGE

|

|---|---|

| Change of tenor | $50 per change |

| Default interest (payment is not received by payment due date twice within 6 consecutive months) | 4% p.a. will be added to the original EIR on your entire outstanding balance. The loan tenor will be extended so that your monthly instalment stays the same. This revised EIR will be reinstated to the original EIR when minimum payment due is made by payment due date for six consecutive months. |

| Late payment | $100 will be charged if minimum payment is not received by the due date. If the instalment amount payment is not received on or before the due date in full and a balance is carried forward from the relevant statement, finance charges will be calculated on a daily basis at the EIR of 29.9% (0.082% per day). |

| Annual Fee for Standard Chartered Platinum Visa Credit Card | $196.20 (including GST) –waived for staff Please click here for more information on the Platinum Visa Credit Card, including the applicable fees and charges (such as the finance charges and late payment fee) |

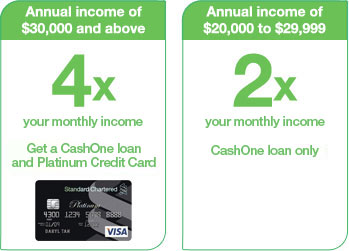

CashOne is an instalment loan on your credit card that allows you to enjoy a loan amount of up to 4 times your monthly income.

Loan tenors available are 1, 2, 3, 4 and 5 years.

If your annual income is $30,000 and above, you will be issued a Platinum Credit Card. As the credit limit on your Platinum Credit Card or existing Standard Chartered Credit Card is treated as a loan, you will only be able to use the available credit limit on your Platinum Credit Card for retail transactions as and when you have repaid the CashOne loan.

You must be 21 years of age and above with a minimum annual income of:

No. Your loan amount will either be up to 2 times or 4 times your monthly income depending on your credit history and annual income.

| Annual Income | Approved Limit | Approved Products | Approved Products |

| $30,000 and above | Up to 4X monthly income | Personal Loan on Platinum Credit Card | Personal Loan disbursement advice Platinum Credit Card pack |

| $20,000 and $29,999 | Up to 2X monthly income | Personal Loan | Personal Loan disbursement advice |

If you are an existing Standard Chartered Personal Credit customer, your line of credit may be converted to CashOne.

If you are an existing Standard Chartered Credit Cardholder, the credit limit on your existing credit card is treated as a loan. As such, you will only be able to use the available credit limit on your credit card for retail transactions as and when you have repaid the CashOne.

If you hold any of our credit cards with a credit limit of $500 and your annual income ranges from $20,000 to $29,999, your credit card account will be closed upon approval of the CashOne.

The applicable interest rate for CashOne/Credit Card Instalment Loan for staff is as follows:

| Loan tenor | AR (% p.a.) | AR (% p.a.) |

| 1-year | 3.88 | 7.09 |

| 2-year | 3.88 | 7.28 |

| 3-year | 2.88 | 5.46 |

| 4-year | 2.88 | 5.45 |

| 5-year | 2.88 | 5.43 |

AR: Applied / flat interest rate

EIR: Effective interest rate

Interest is calculated based on the ‘front-end add-on’ method by multiplying the principal loan amount with the specified annual Applied Interest Rate / Flat Interest Rate for the full tenor of the plan. The interest charged per month is not spread equally throughout the tenor. But the total interest chargeable is based on the above calculation.

For illustration only:

| Loan Amount | $20,000 |

|---|---|

| Flat Interest Rate | 7.50% p.a. (Effective Interest Rate of 14.39% p.a.) |

| Tenor | 3 years |

| Total Interest Charged for the Loan | $20,000 x 7.50% p.a. x 3 years = $4,500 |

| Loan amount + Total Interest | $20,000 + $4,500 = $24,500 |

| Monthly Instalment | $24,500 / 36 = $680.56 |

Below is an illustration of a loan amortisation schedule based on an approved loan of $20,000 over a 3-year tenor. Note that monthly instalment is constant throughout the loan tenor.

Monthly interest and principal is apportioned differently; amount of instalment apportioned to interest is highest in the first month and decreases gradually throughout the loan tenor.

| Loan amount | $20,000 |

| Applied / Flat Interest Rate p.a. | 7.50% |

| Effective Interest Rate p.a. | 14.39% |

| Tenor | 3 years |

| Period (month) |

Loan balance ($) |

Interest ($) |

Principal ($) |

Instalment ($) (sum of Interest and Principal) |

| 1 | 20,000 | 228 | 452 | 681 |

| 2 | 19,548 | 223 | 458 | 681 |

| 3 | 19,090 | 218 | 463 | 681 |

| 4 | 18,627 | 213 | 468 | 681 |

| 5 | 18,159 | 207 | 473 | 681 |

| 6 | 17,686 | 202 | 479 | 681 |

| 7 | 17,207 | 196 | 484 | 681 |

| 8 | 16,723 | 191 | 490 | 681 |

| 9 | 16,233 | 185 | 495 | 681 |

| 10 | 15,738 | 180 | 501 | 681 |

| 11 | 15,237 | 174 | 507 | 681 |

| 12 | 14,730 | 168 | 512 | 681 |

| 13 | 14,218 | 162 | 518 | 681 |

| 14 | 13,699 | 156 | 524 | 681 |

| 15 | 13,175 | 150 | 530 | 681 |

| 16 | 12,645 | 144 | 536 | 681 |

| 17 | 12,108 | 138 | 542 | 681 |

| 18 | 11,566 | 132 | 549 | 681 |

| 19 | 11,017 | 126 | 555 | 681 |

| 20 | 10,463 | 119 | 561 | 681 |

| 21 | 9,901 | 113 | 568 | 681 |

| 22 | 9,334 | 106 | 574 | 681 |

| 23 | 8,760 | 100 | 581 | 681 |

| 24 | 8,179 | 93 | 587 | 681 |

| 25 | 7,592 | 87 | 594 | 681 |

| 26 | 6,998 | 80 | 601 | 681 |

| 27 | 6,397 | 73 | 608 | 681 |

| 28 | 5,790 | 66 | 614 | 681 |

| 29 | 5,175 | 59 | 622 | 681 |

| 30 | 4,554 | 52 | 629 | 681 |

| 31 | 3,925 | 45 | 636 | 681 |

| 32 | 3,289 | 38 | 643 | 681 |

| 33 | 2,646 | 30 | 650 | 681 |

| 34 | 1,996 | 23 | 658 | 681 |

| 35 | 1,338 | 15 | 665 | 681 |

| 36 | 673 | 8 | 673 | 681 |

| Total | 4,500 | 20,000 | 24,500 |

The above table is for illustrative purpose only (figures above have been rounded off to whole numbers) and is based on a loan of $20,000 with a tenor of 3 years (36 months).

Please follow the payment due date stated on your monthly statement

| Approved Product | CashOne |

| Repayment Account | Starts with “9702 2228 xxx xxx” |

| Repayment Amount | Stated on your monthly statement |

| Payment Due Date | Stated on your monthly statement |

CashOne offers a range of repayment channels:

If we do not receive your payment in full by the instalment payment due date for 2 instalments within any consecutive 6 month period, 4% p.a. will be added to the original effective interest rate (EIR) on your entire CashOne outstanding balance. The revised EIR will be effective starting from the next statement date immediately after the second instalment payment due date is missed. The loan tenor will be extended so that your monthly instalment remains the same.

The following illustration is based on a loan amount of $10,000 with a 12 month tenor, applied/flat interest rate of 8.58% and original EIR of 15.48%.

Refer to Table 1

Your original monthly instalments are reflected in Table 1 below

If payment is not received by the instalment payment due date for Month 2 and Month 3, the revised EIR (refer to Table 2) will be effective starting from the next statement date, i.e from the statement you receive in Month 4 onwards.

Refer to Table 2

Your revised EIR is reflected in Table 2 below. Revised EIR = 15.48% p.a. + 4% p.a. (i.e. 19.48% p.a. is payable from the statement you receive in Month 4 onwards)

Refer to Table 3

The revised EIR will be reinstated to the original EIR, if the instalment payment due is made in full by the instalment payment due date for 6 consecutive months. The reinstatement (if any) will be effective from the next statement date after we receive the 6th instalment payment. In the above example, if you make payment in full before the instalment payment due date for 6 consecutive months (Month 4 to Month 9 statements), your revised EIR will revert to the original EIR on the Month 10 statement. After your original EIR has been reinstated, your loan tenor will be recalculated and extended accordingly.

| Table 1, Original EIR | |

| Loan Balance | 10,000.00 |

| Total Interest ($) | 858.20 |

| Effective Interest Rate (EIR) | 15.48 |

| Month | Loan Balance ($) | Interest ($) |

Principal ($) |

Instalment ($) (sum of Interest and Principal) |

| 1 | 10,000.00 | 129.00 | 775.85 | 904.85 |

| 2 | 9,224.15 | 118.99 | 785.86 | 904.85 |

| 3 | 8,438.29 | 108.85 | 796.00 | 904.85 |

| 4 | 7,642.30 | 98.59 | 806.26 | 904.85 |

| 5 | 6,836.03 | 88.18 | 816.66 | 904.85 |

| 6 | 6,019.37 | 77.65 | 827.20 | 904.85 |

| 7 | 5,192.17 | 66.98 | 837.87 | 904.85 |

| 8 | 4,354.30 | 56.17 | 848.68 | 904.85 |

| 9 | 3,505.62 | 45.22 | 859.63 | 904.85 |

| 10 | 2,645.99 | 34.13 | 870.72 | 904.85 |

| 11 | 1,775.27 | 22.90 | 881.95 | 904.85 |

| 12 | 893.33 | 11.52 | 893.33 | 904.85 |

| Table 2, Revised EIR | |

| Loan Balance | 6,836.03 |

| Total Interest ($) | 516.79 |

| Effective Interest Rate (EIR) | 19.48 |

| Month | Loan Balance ($) | Interest ($) |

Principal ($) |

Instalment ($) (sum of Interest and Principal) |

| 4 | 7,642.30 | 124.06 | 780.79 | 904.85 |

| 5 | 6,861.51 | 111.39 | 793.46 | 904.85 |

| 6 | 6,068.04 | 98.50 | 806.35 | 904.85 |

| 7 | 5,261.70 | 85.41 | 819.43 | 904.85 |

| 8 | 4,442.26 | 72.11 | 832.74 | 904.85 |

| 9 | 3,609.53 | 58.59 | 846.26 | 904.85 |

| 10 | 2,763.27 | 44.86 | 859.99 | 904.85 |

| 11 | 1,903.28 | 30.90 | 873.95 | 904.85 |

| 12 | 1,029.32 | 16.71 | 888.14 | 904.85 |

| 13 | 141.18 | 2.29 | 141.18 | 143.48 |

| Table 3, Reinstated EIR | |

| Loan Balance | 1,875.22 |

| Total Interest ($) | 38.34 |

| Effective Interest Rate (EIR) | 15.48 |

| Month | Loan Balance ($) | Interest ($) |

Principal ($) |

Instalment ($) (sum of Interest and Principal) |

| 10 | 2,763.27 | 35.65 | 869.20 | $904.85 |

| 11 | 1,894.07 | 24.43 | 880.42 | 904.85 |

| 12 | 1,013.65 | 13.08 | 891.77 | 904.85 |

| 13 | 121.88 | 1.57 | 121.88 | 123.45 |

If you are an existing Standard Chartered Credit Cardholder, you will be applying for a Credit Card Instalment Loan which will drawdown from your existing Credit Card limit.

If you are an existing Standard Chartered Personal Credit customer, your line of credit may be converted to a CashOne personal loan.

If you hold any of our Credit Cards with a credit limit of $500 and your annual income ranges from $20,000 to $29,999, your Credit Card account will be closed upon approval of the CashOne Personal Loan.

iPhone and Android Apps