The residential sector in the Johor-Singapore Special Economic Zone

By Mr Samuel Tan CEO, Olive Tree Property Consultants

By Mr Samuel Tan CEO, Olive Tree Property Consultants

March 20, 2025

Grow your wealth globally and connect with the right opportunities, right now. Learn more about the Johor-Singapore Special Economic Zone (JS-SEZ) and how you may be able to benefit from it.

The establishment of the Johor-Singapore Special Economic Zone (JS-SEZ) is likely to have a significant impact on the residential property market in Johor. As an investor, here are some key factors and potential effects to consider:

The JS-SEZ is expected to attract businesses and investments from both Malaysia and Singapore, leading to an influx of expatriates and cross-border workers. This will likely increase demand for residential properties, particularly in areas close to the SEZ.

Given the proximity to Singapore, there may be renewed interest from Singaporean buyers looking for more affordable housing options compared to Singapore’s high property prices.

The other significant group is Malaysians working in Singapore. Earning a stronger Singapore currency and with no legal restrictions, this group is the first movers in most new projects. They are also strong in the secondary market1.

1 Secondary market refers to the subsale market or pre-owned properties in Malaysia.

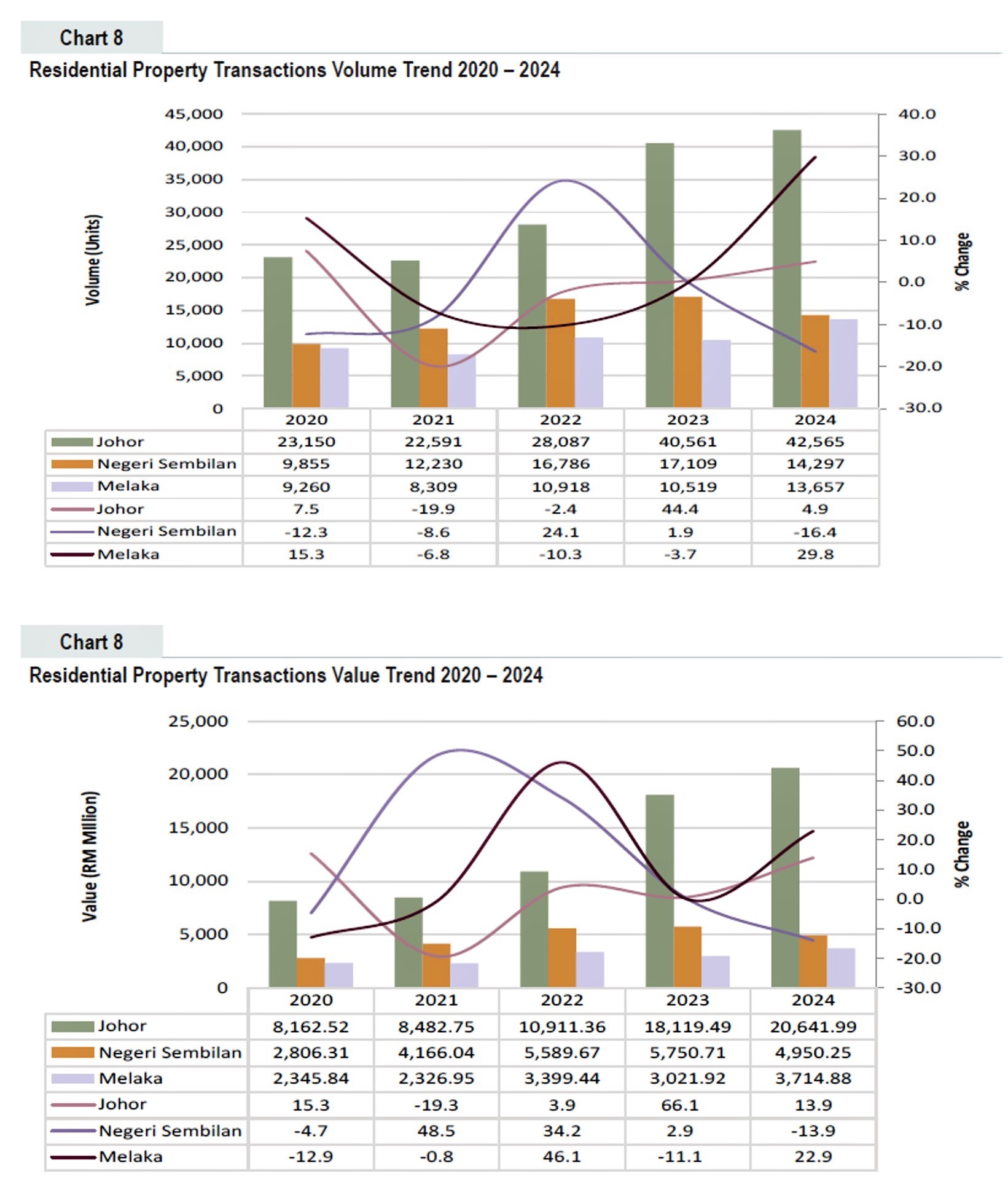

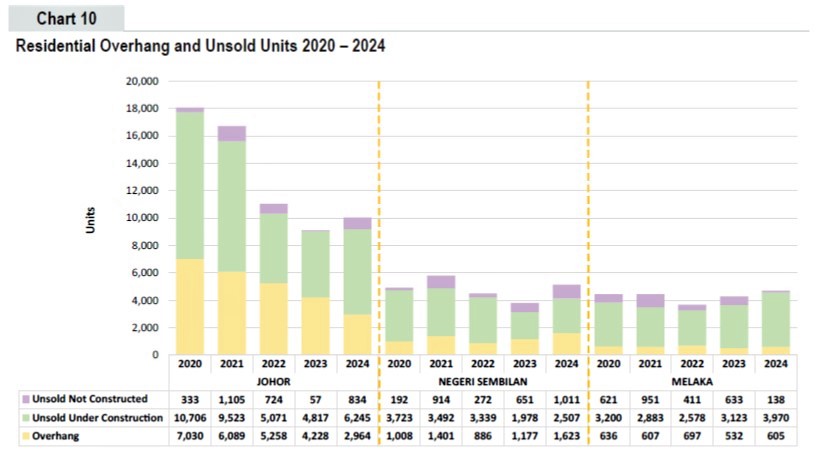

Total transaction volume and value have increased over the years and the number of overhang properties show a declining trend as seen in the charts below:

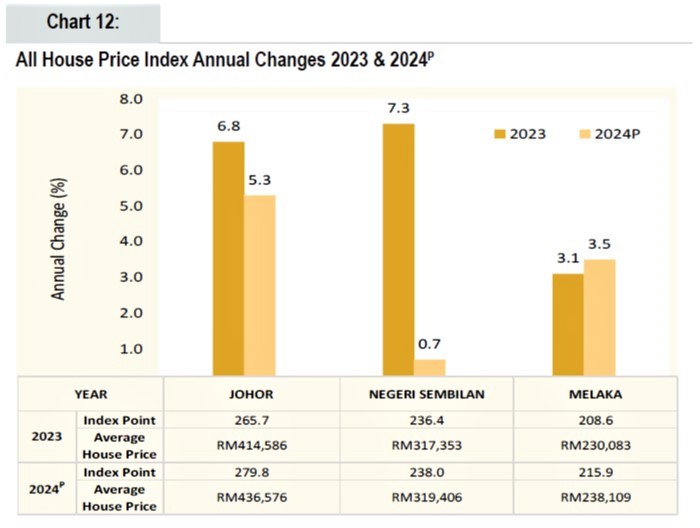

As demand for residential properties increases, property prices in Johor, especially in areas within the JS-SEZ, are likely to rise. This could be beneficial for property owners and investors but may pose affordability challenges for local buyers.

Source: Southern Region Property Market Report 2024, Valuation and Property Services Department, Ministry of Finance, Malaysia

Land values in and around the JS-SEZ are expected to appreciate, which could lead to higher prices for both new and existing residential developments. For instance, lands near to the Johor Bahru-Singapore Rapid Transit System (RTS) Link Project used to be transacted between RM600 to RM900 per sq ft. Recent transactions/listings are between RM1,200 and RM2,000 per sq ft. A recent MOU signed between MRT Corp and the Sunway Group shows a price tag of over RM2,400 per sq ft just for the development right.

The JS-SEZ will likely come with enhanced infrastructure, including better transportation links between Johor and Singapore. Improved connectivity, such as upgraded roads, public transit, and possibly new rail links, will make residential areas more attractive.

Apart from the RTS, an elevated Autonomous Rapid Transit (ART) system will be developed to disperse the passengers upon the arrivals to the station. This elevated ART will run along 3 routes i.e. Iskandar Puteri, Jalan Skudai and Jalan Tebrau. The Iskandar Puteri route may be extended to Forest City, further enhancing the islands as the JS-SFZ. In the long term, there is a possibility of having a LRT system. The revival of the High Speed Rail cannot be dismissed as both Singapore and Malaysia should be connected to the Pan Asian Railway Network, running through Indo China, China and then to Europe.

The JS-SEZ is likely to attract both local and foreign investors looking to capitalize on the anticipated economic growth and property market boom. This could lead to increased competition and higher property prices.

There may be a rise in speculative activity, with investors buying properties in anticipation of future price appreciation. However, in the previous National Budget, the Federal Government has taken steps to avoid this. The tax rates for gains from sales of properties have been increased to the extent it is not worthwhile speculating.

The JS-SEZ is expected to drive long-term economic growth in Johor, which could have a sustained positive impact on the residential property market. The Johor-Singapore special economic zone (JS-SEZ) is set to lift Johor’s GDP to RM250 billion by 2030, according to ANZ Research.

The JS-SEZ could further integrate Johor with Singapore’s economy, making the region a more attractive place to live and work. This initiative should not be seen as a collaboration of two nations. It should be seen from the wider perspective of ASEAN. With a huge population, ASEAN will be growth driver globally. Initiatives like JS-SEZ will be duplicated in other countries driving the region to another level.

Keep abreast of developments related to the JS-SEZ, including infrastructure projects, policy changes, and market trends. Focus on properties with good resale market and renters who are likely to be attracted to the JS-SEZ, such as expatriates, cross-border workers, and investors. Both yield accretion and potential capital appreciation are important considerations.

Consider diversifying your property portfolio to include different types of residential properties that cater to various segments of the market.

Obtain informed advice from reliable professionals on the potential risks and opportunities associated with investing in the Johor property market in light of the JS-SEZ. Go to the ground to have a feel of the actual situation.

In summary, the JS-SEZ is likely to have a positive impact on the residential property market in Johor, driven by increased demand, rising property prices, and infrastructure development. However, it will be important to monitor market dynamics and regulatory changes to navigate the evolving landscape effectively.

The article contained in this page are for general information only. This article and any material contained in this page do not constitute an offer, recommendation, solicitation to take up any products, enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments offered by the Bank. The article have not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice nor an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser on the suitability of a product or an investment for you, taking into account these factors before making a commitment to invest in an investment or to take up any products offered by the Bank.

All information is correct at the time of publishing.