Table of Contents

In a rush? Read the summary:

- Insurance moves beyond basic protection to serve as a versatile financial tool for building and preserving wealth.

- Smart strategies use insurance products to address critical protection gaps and offer assets that diversify investment portfolios based on risk tolerance.

- Insurance, particularly whole life and annuities, is essential for boosting retirement income and equal asset distribution without forced liquidation of illiquid assets.

A well-designed insurance strategy is fundamental to a holistic wealth management plan. It can help an insurance policyholder build, preserve, and transfer wealth seamlessly.

Many people have recognised the benefits of insurance, including mitigating risk by diversifying their investment portfolio, ensuring security in their financial planning, and providing retirement and legacy funding. In this article, we’re offering a deeper dive into specific insurance strategies that can help you meet your financial goals.

Secure your income in a crisis

Health insurance helps policyholders and their families manage hospital and medical costs when the policyholder becomes ill, injured, or disabled.

Though insurance can help offset medical expenses, some policyholders may still face a protection gap. It is crucial to have provisions in place for income replacement during the recovery period.

- Hospitalisation and surgical insurance: Covers inpatient care costs, including hospital room and board, surgical procedures, intensive care, and related services.

- Term insurance: An affordable form of life insurance that pays out a death benefit if the policyholder passes away within the specified term.

- Critical illness insurance: Provides a lump-sum payment upon diagnosis of serious conditions such as a heart attack, stroke, or cancer.

- Hospital cash insurance/hospital income plan: Offers a daily cash benefit for every day that a policyholder is hospitalised due to illness or injury.

- Disability insurance: Gives policyholders a lump sum or an income stream to replace some of their lost income if they can no longer hold a job due to illness or disability.

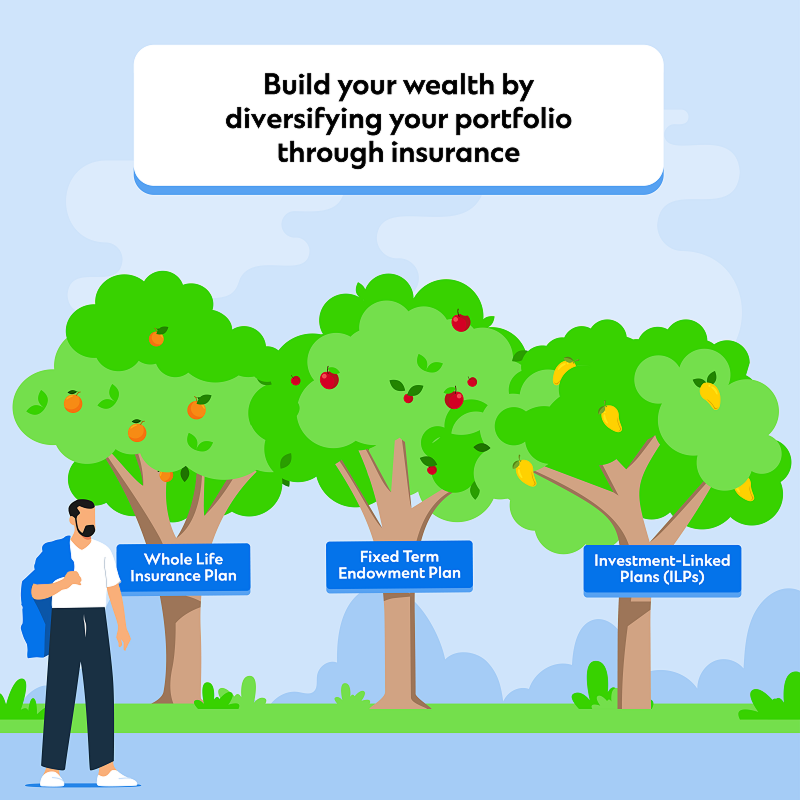

Instill discipline and diversify assets for protecting your wealth

Insurance plans serve as an effective tool for diversifying a portfolio and managing risks, thereby supporting the goal of building and protecting wealth.

A whole life insurance policy provides financial support to dependents upon the death of the breadwinner and builds a guaranteed cash value over the policy term. By contrast, a term life insurance policy covers the insured for a specific period without accumulating cash value.

An endowment insurance plan is a protection plan that also builds savings, allowing the insured to save for retirement or other financial goals. The policyholder receives a guaranteed lump sum amount once the policy matures. On the other hand, if anything happens to the breadwinner, the loved ones receive the sum assured.

An Investment Link Policy (ILP) includes an investment component in which a portion of the premium is invested in the insured’s chosen funds. The policyholder can withdraw the cash value during the policy term or upon policy maturity. The cash value depends on how the chosen funds perform.

If the policyholder’s portfolio is made up of low-risk investment assets like ILPs, they can build a well-rounded portfolio with funds that carry slightly higher risk and the potential for higher returns. Conversely, if most investment assets carry higher risks, such as equity, it may make sense to opt for lower-risk investment assets by adding fixed-term endowment plans.

Build a stable retirement income

The goal of retirement planning is to create a sustainable, steady stream of income that serves your needs when you’re no longer working. A highly effective approach to achieving long-term financial stability is a guaranteed lifetime income solution, such as an annuity.

Under this plan, a person pays a single or monthly premium for a fixed period during their years as a working professional. After retirement, the plan pays out a lump sum or a series of payments to support you in retirement.

These plans offer several options for establishing a secure retirement income stream, often including the option to distribute any remaining funds to the beneficiary upon the annuitant’s death.

Protecting your wealth: Funding legacy goals

Consumers often find themselves making difficult trade-offs between legacy planning and retirement planning. Prioritising one may come at the expense of the other. However, this doesn’t have to be the case, a balance is possible.

For example, purchasing a whole life insurance policy allows policyholders to grow retirement savings for retirement, but if they pass away while covered by the policy, their beneficiaries receive the payout.

On retiring, the policyholder can use the cash value of the whole life plan to get a lifetime annuity. With this approach, individuals can secure a retirement income for life.

Life insurance also helps in solving issues related to equal asset distribution. For example, if beneficiaries face difficult decisions regarding splitting property and heirloom jewellery, which often require liquidation for equal distribution, a life insurance payout can help one beneficiary retain an asset while the other receives the policy payout.

Universal life insurance plans are a useful tool to achieve this. They include a cash value element and can offer better flexibility for legacy planning.

Insurance planning: the right insurance solution

A qualified financial advisor can help you understand the important factors when purchasing an insurance plan and help you structure your portfolio so you can achieve your financial goals while protecting loved ones.

Growing, managing, and protecting wealth requires close attention and planning. Consulting a financial advisor can help you focus on key principles like discipline, diversification, time in the market, risk versus returns, and protection to guide all investing decisions.

To get started, kindly leave your contact information here and one of our Relationship Managers will get in touch with you.