Dollar Cost Ave

Short on time? Here’s what to expect from the article:

- Dollar cost averaging (DCA) helps investors mitigate market risk by regularly investing a fixed amount, allowing them to benefit from long-term compounding.

- It removes the stress of entering the market at the right time and fosters investment discipline, helping to avoid panic selling.

- DCA allows investors with limited capital to start early, grow wealth through compounding, and build a favourable return profile over the long term.

Predicting the closing value of an equity index when the market fluctuates is a difficult task. Therefore, investors with a low risk appetite typically prefer the dollar cost averaging (DCA) strategy to mitigate market volatility and capitalise on long-term growth.

The core concept of dollar cost averaging (DCA)

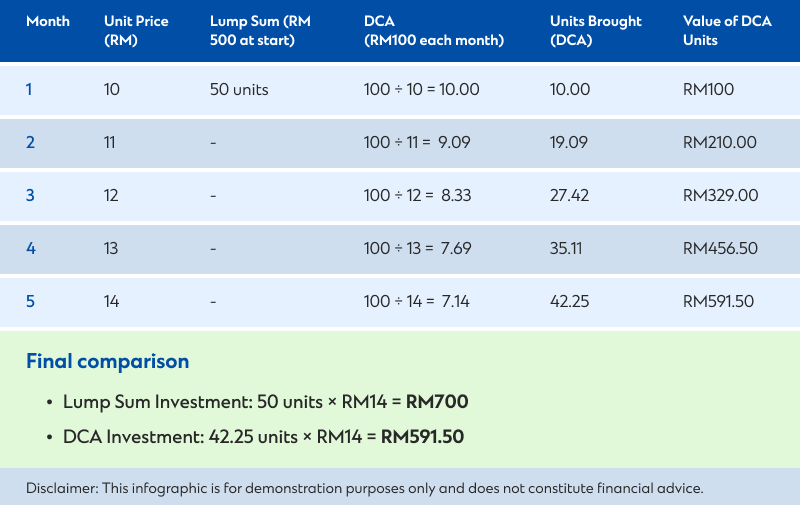

DCA investing is a method where individuals invest a set amount on a regular schedule, regardless of market price fluctuations. This strategy leads to the purchase of more units when the market price is low and fewer units when the market price is high. It’s a sound financial strategy for reducing the effects of short-term market volatility by averaging out the cost of units over time.

Benefits of dollar cost averaging

Let’s take a closer look at how dollar cost averaging works and what makes it an effective approach to investing.

Reducing market volatility impact

Since the financial market is unpredictable, stability-seeking investors are usually concerned about price volatility. They can mitigate investment risk and navigate market fluctuations with a regular and long-term investment plan. This is achieved by committing to investing a fixed amount regardless of the current market price, and at a predetermined interval. Investors can worry less about timing the market and instead focus on receiving stable returns over the long run.

Making investment a habit

Many investors attempt to time the market, but predicting price movements is challenging even for seasoned professionals. That’s because numerous factors influence how prices change persistently. Dollar cost averaging approaches take the emotion and stress out of investing, but allow investors to retain control over when, how often, and what amount they want to invest. DCA helps investors make regular investing a habit.

Building patience through market volatility

When the market is down and the economic outlook is not promising, many investors succumb to panic selling out of fear and anxiety. Conversely, when asset prices are rising, investors are often tempted to take on unnecessary risks such as chasing speculative gains or over-concentrating their portfolios in high-flying assets. A regular investment plan helps investors avoid these fear- and anxiety-driven decisions. It provides a structured opportunity to invest consistently, regardless of the current market sentiment or price.

Enhancing investment accessibility.

An investor who lacks a sizable lump sum of capital can start investing early by devising a monthly investment plan instead of waiting to save up a large amount first. If one is not satisfied with the interest rate of a savings account, regular investment can help one grow wealth by taking advantage of compounding.

Who should employ a DCA strategy?

Financial markets often fluctuate, and investors typically face difficulty determining the most suitable time to invest. While no single investment strategy can guarantee wealth building and significant returns, it’s essential to take a viable long-term approach that matches an investor’s financial goals, budget and risk appetite.

- Investors usually invest a smaller amount compared to a lump sum amount under the DCA strategy, making it ideal for those who prefer to preserve capital flexibility.

- This strategy is suitable for investors with a low risk appetite, who lack the time to monitor relevant asset prices regularly, as well as those with limited funds.

- Inexperienced investors, who often sell out of fear during unexpected market movements to avoid further losses, can benefit from the DCA strategy. This approach helps alleviate the potential adverse effects of panic selling, likelocking in losses and missing out on subsequent market recoveries.

- Investors who aim to accumulate more units at a lower price and diversify their risks to earn positive returns by the end of the period can also take advantage of the DCA strategy.

However, an investor should keep in mind that if the market remains higher for an extended period, the DCA strategy offers lower potential gains compared to a lump sum investment.

To know more about DCA or to get started, kindly leave your contact information on the lead form and one of our Relationship Mangers will get in touch with you.