Table of Contents

Key takeaways:

- MRTA or mortgage reducing term assurance helps pay off a homeowner’s mortgage if they pass away during the mortgage term

- The sum assured of an MRTA policy decreases over the term of the policy

- It helps protect your family from the burden of paying off a mortgage if the unthinkable happens

What is MRTA insurance?

MRTA or Mortgage Reducing Term Assurance is an insurance product designed to alleviate the financial burden of paying off a home loan if the homeowner passes away or becomes permanently disabled.

Why Malaysians need MRTA insurance

Mortgage requirements can vary by lender. Some lenders require borrowers to get a Mortgage Reducing Term Assurance (MRTA) policy to ensure that the mortgage can be paid off even if the borrower passes away or becomes sick or disabled. The policy acts as a payment guarantee for the lender, but it also protects the borrower’s family from losing their home or having to face the burden of repaying a mortgage if the unthinkable happens.

How does MRTA differ from other insurance types?

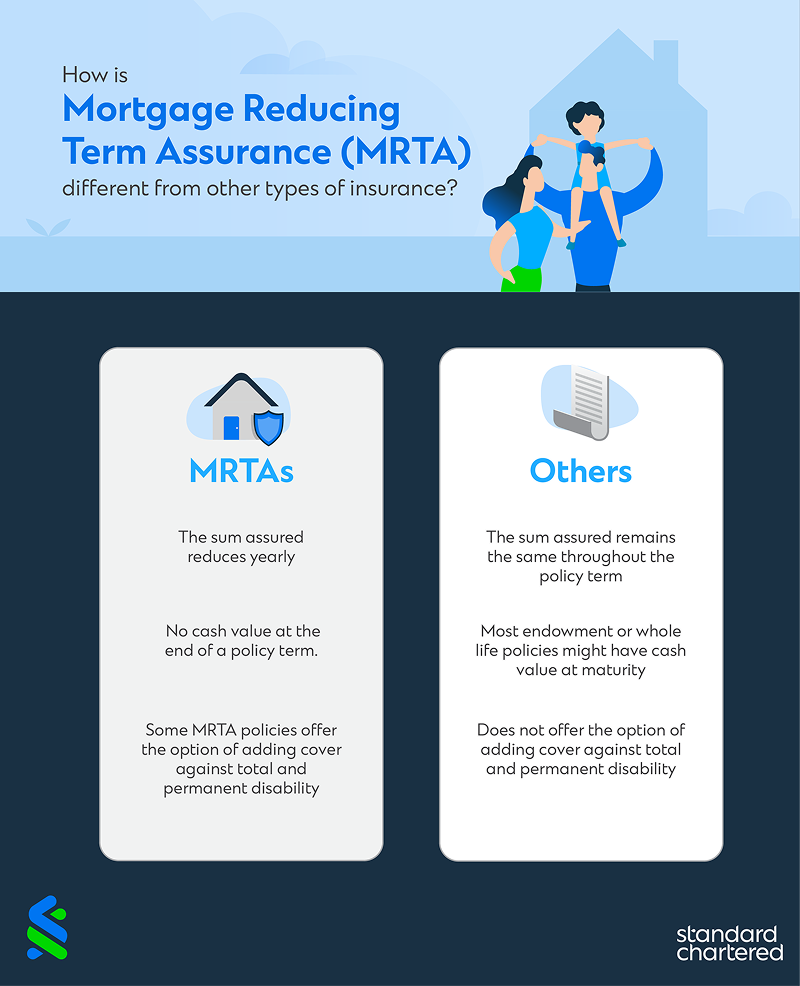

Most traditional life insurance policies have an agreed-upon sum assured that remains constant throughout the policy term. What sets MRTA apart from other types of life insurance policies is that the sum assured generally reduces as the mortgage is paid off. This means that while the sum assured may be the full mortgage amount at the beginning of the insurance term, it can be notably lower, about 5 or 10 years in. This makes MRTA a decreasing term policy; it generally has no cash value by the end of the term. The rate at which the sum assured decreases is usually linked to the mortgage interest rate.

The benefits of MRTA insurance

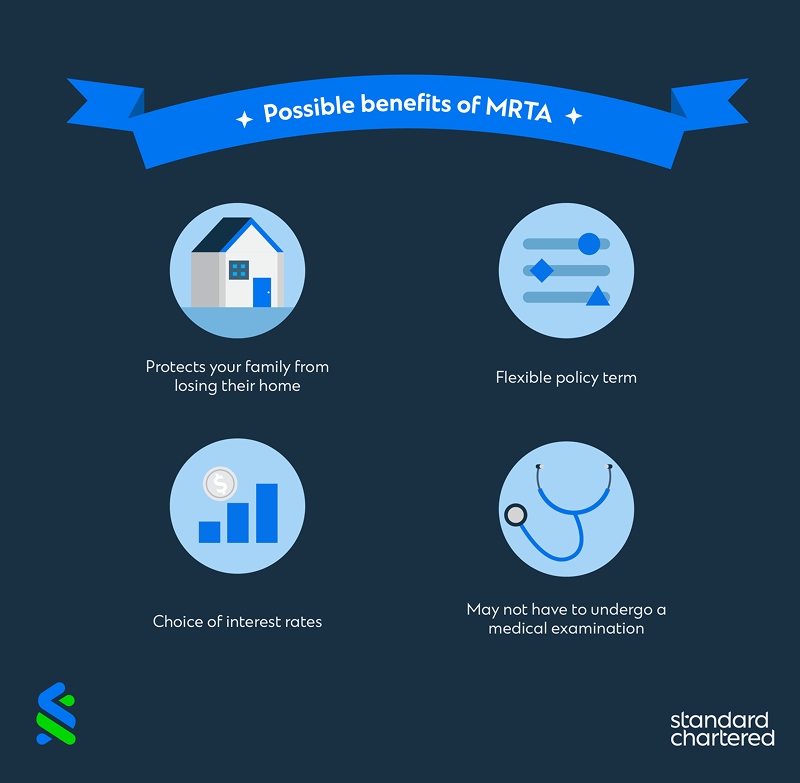

The primary benefit of an MRTA policy is that it prevents the policyholder’s family/heirs from losing their home. Some additional benefits include flexible terms to fit different mortgage term requirements and a wide range of interest rates.

Some insurance providers may not mandate medical examinations if the policy is purchased soon after the mortgage. Certain policies may offer additional coverage for total and permanent disability or terminal illness.

MRTA Insurance considerations for Malaysians

As with any other insurance policy, MRTA policies state a list of covered events and a list of exclusions. It’s important to consider the exclusions before you buy a policy. A few common MRTA policy exclusions are self-inflicted injuries, pre-existing illnesses, injuries from service in the armed forces, injuries incurred under the influence of substances or alcohol, injuries arising from participating in adventure sports like mountaineering, scuba diving, hang gliding, racing etc. So, if you’re an adventure sports junkie or are currently serving in the military, navy or air force, you can talk to your insurance provider about other options.

An MRTA insurance policy can be a great way to give yourself more peace of mind as a new homeowner. Discover even more insurance solutions from Standard Chartered to protect yourself and your family.

To get started, kindly leave your contact information here and one of our Relationship Managers will get in touch with you.