Table of Contents

Don’t have time to read the whole article? Check out our summary below.

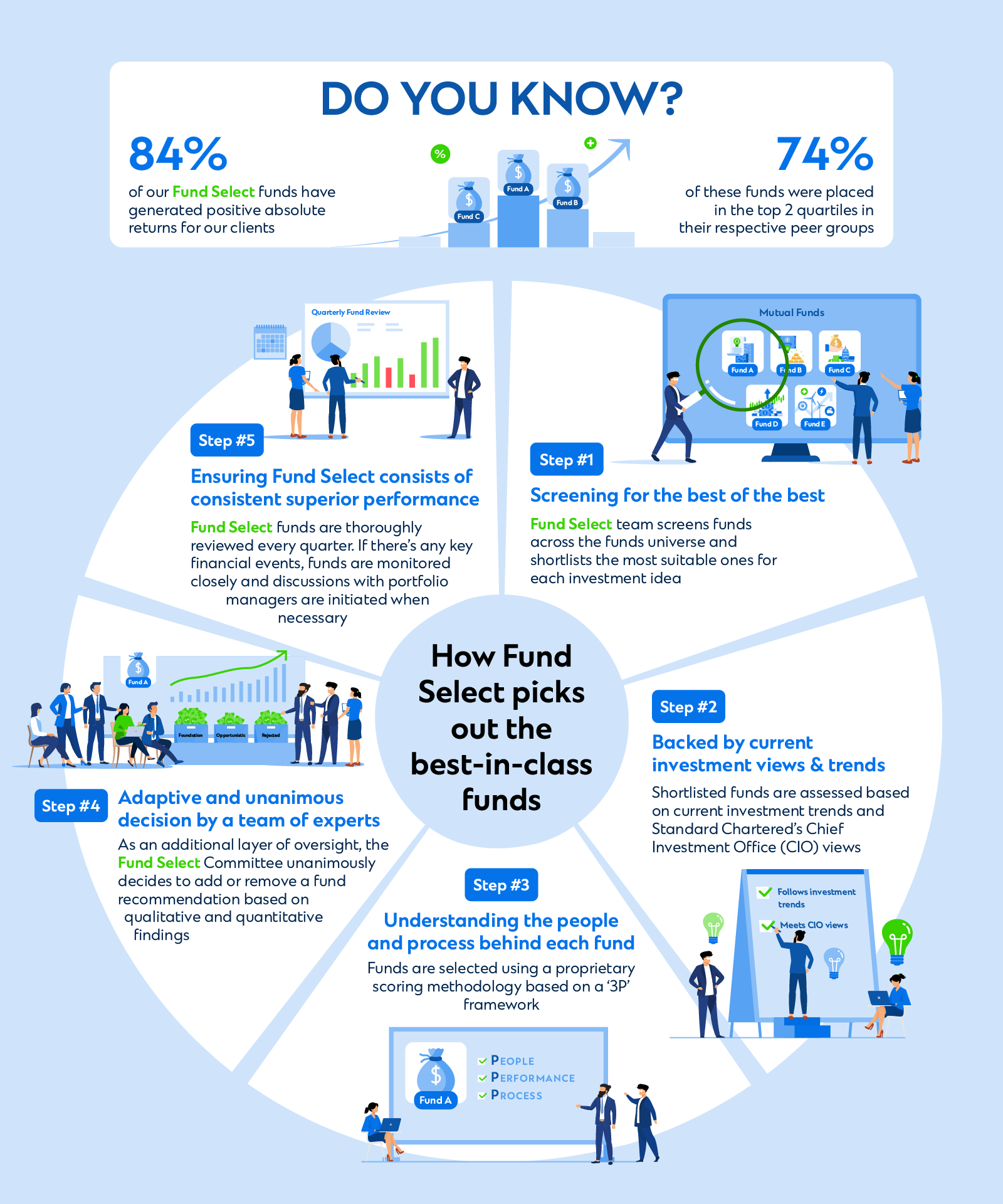

- Fund Select’s proprietary framework carefully assesses, monitors and distils over 110,000 mutual funds from about 100 fund providers to provide you with high quality investment options to choose from.

- All Fund Select funds are continuously monitored, and when there are any key financial events, discussions with portfolio managers are initiated as necessary.

- 84% of our Fund Select funds have generated positive absolute returns for our clients, and 74% of these funds were placed in the top 2 quartiles in their respective peer groups.

Not all funds are made equal

With so many managed mutual funds available in the market today, it can be a challenge finding the right ones. Standard Chartered’s Fund Select makes it easier to find the right funds for your investment needs by narrowing down high-quality funds to invest in.

Established since June 2009, Fund Select started as a proprietary fund selection process driven by Standard Chartered’s Chief Investment Office (CIO) views to discover mutual funds and ETFs that outperformed their peers and benchmarks. This selection process has been refined over more than a decade to give investors access to funds with the greatest potential to add value to their portfolios. In fact, as of end Dec 2021, 84% of our Fund Select funds have generated positive absolute returns for our clients, and 74% of these funds were placed in the top 2 quartiles in their respective peer groups.

How Fund Select’s pick out the best-in-class funds

Fund Select follows a proprietary five-steps framework to assess, curate and continuously monitor market trends and the performance of each carefully selected fund. Aligned with Standard Chartered Advisory framework, it weaves in the concept of foundation and opportunistic investments to help investors put together a portfolio that can withstand different market conditions and drive long-term returns.

The infographic below gives a quick overview of the selection process for best-in-class funds:

Step #1: Screening for the best of the best from the fund universe

Standard Chartered’s Fund Select team actively screen funds across the 110,000 available in the market and shortlists the most suitable for each investment idea.

Step #2: Shortlisted funds backed by current investment views & trends

All funds are assessed according to the current investment trends and Standard Chartered’s Chief Investment Office (CIO) views. Only those that are aligned with the latest investment views and trends move to the next stage.

Step #3: Looking beyond fund past performance, by understanding the experience, expertise & team stability of people behind each fund

Regular interviews are conducted directly with the fund managers to assess the relevance and merit of their fund strategies. Funds are then scored according to Standard Chartered’s proprietary ‘3P’ framework of Performance, People and Process before further selection for approval.

Step #4: Further assessment and unanimous decision for the Fund Select list

Fund analysts present a fund’s qualitative and quantitative findings to the Fund Select Committee. The Fund Select Committee assesses and debates the findings before coming to a vote, with opposing viewpoints strongly encouraged for discussion. The Fund Select Committee unanimously agrees to accept or reject the fund recommendation.

Step #5: Regular reviews for consistent superior performance in this fastchanging market

Approved funds are thoroughly reviewed every quarter, with key financial events being monitored and discussions with portfolio managers being initiated when necessary.

While we prioritise accountability to our clients and will not hesitate to make changes to our Fund Select funds when need arises, it is important to note that as with any investment, past performance is not necessarily indicative of future or likely performance. Past performance of the fund manager or sub-manager is not necessarily indicative of its future performance either.

Start using Fund Select today

As sweet sounding as the word ‘guarantee’ is, funds do not offer guaranteed returns. Investment in funds is subject to investment risks, including the possible loss of the full principal amount invested. The value of and income from the funds work in both directions – it may rise as well as fall.

Looking to take the next step in adding Fund Select funds to your investment portfolio? Check out the latest quarter of Fund Select funds and apply using Standard Chartered’s Online Unit Trust platform to get started.

Alternatively, you can reach out to a Standard Chartered Relationship Manager by using the MyRM feature via Online Banking or the SC Mobile Banking App.