|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.25 |

| Interest is calculated daily and paid 6-monthly. Effective Date: 25/05/2009. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| Up to 50,000 | 1.75 |

| Above 50,000 | 0.25 |

| Interest is calculated daily and paid 6-monthly. Effective Date: 16/12/2025. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All Balances | 0.10 |

| Interest is calculated daily and paid monthly. Effective Date: 17/04/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All Balances | 0.10 |

| Interest is calculated daily and paid monthly. Effective Date: 05/06/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All Balances | 0.10 |

| Interest is calculated daily and paid monthly. Effective Date: 05/06/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All Balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020 | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/7/2024. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Balance Tier (RM)

|

Interest Rate (%)p.a.

|

|---|---|

| All balances | 0.05 |

| Interest is calculated daily and paid monthly. Effective Date: 1/12/2020. | |

|

Tenure

|

Interest Rate (%) P.A.

|

|---|---|

| 1 month | 1.75 |

| 2 months | 1.75 |

| 3 months | 1.95 |

| 4 months | 1.95 |

| 5 months | 1.95 |

| 6 months | 2.05 |

| 7 months | 2.05 |

| 8 months | 2.05 |

| 9 months | 2.05 |

| 10 months | 2.05 |

| 11 months | 2.05 |

| 12 months | 2.05 |

| Above 12 months | 2.05 |

| Interest is calculated on a contractual basis and paid upon maturity (for tenures of 1-12 months) or on a half yearly basis (for tenures of more than 12 months with maturity instruction to renew principal only).

Effective Date: 16 December 2025 |

|

These are indicative rates and should not be construed to be applicable for any specific transaction.

Published rate as 04/03/2026 9:06:38 AM

The below are indicative rates and subject to change.

|

UNIT

|

CURRENCY

|

SELLING TT/OD

|

BUYINGTT

|

BUYINGCP

|

SWIFT CODE

|

|---|---|---|---|---|---|

| 1 | U.S. DOLLARS | 4.0495 | 3.8436 | 3.8415 | USD |

| 1 | STERLING POUNDS | 5.417 | 5.1116 | 5.083 | GBP |

| 1 | AUSTRALIAN DOLLARS | 2.8735 | 2.6663 | 2.6497 | AUD |

| 1 | CANADIAN DOLLARS | 2.969 | 2.8018 | 2.7875 | CAD |

| 1 | NEW ZEALAND DOLLARS | 2.3988 | 2.2384 | 2.2247 | NZD |

| 100 | CHINESE RENMINBI | 59.0504 | 55.3151 | 0 | CNY |

| 1 | EURO | 4.7533 | 4.3994 | 4.3684 | EUR |

| 100 | BANGLADESH TAKA | 3.3667 | 3.0951 | 3.0704 | BDT |

| 100 | BRUNEI DOLLARS | 318.7293 | 298.9952 | 297.7549 | BND |

| 100 | DANISH KRONERS | 63.3262 | 59.2434 | 58.8878 | DKK |

| 100 | SOUTH AFRICAN RANDS | 24.9467 | 22.884 | 22.6794 | ZAR |

| 100 | HONGKONG DOLLARS | 52.3484 | 48.7575 | 48.3159 | HKD |

| 100 | INDIAN RUPEES | 4.4728 | 4.095 | 3.8985 | INR |

| 100 | INDONESIAN RUPIAH | 0.0245 | 0.0223 | 0.0221 | IDR |

| 100 | JAPANESE YEN | 2.5872 | 2.4223 | 2.4118 | JPY |

| 100 | NORWEGIAN KRONERS | 42.3271 | 39.2712 | 39.0148 | NOK |

| 100 | FILIPINO PESO | 7.0571 | 6.4627 | 6.3996 | PHP |

| 100 | PAKISTAN RUPEES | 1.4731 | 1.3542 | 1.3434 | PKR |

| 100 | SAUDI ARABIAN RIYALS | 109.5584 | 100.8998 | 99.998 | SAR |

| 100 | SINGAPORE DOLLARS | 317.937 | 300.1917 | 298.9467 | SGD |

| 100 | SRI LANKA RUPEES | 1.3262 | 1.2228 | 1.1636 | LKR |

| 100 | SWEDISH KRONERS | 44.0792 | 40.9866 | 40.7032 | SEK |

| 100 | SWISS FRANCS | 524.0181 | 486.2335 | 483.7555 | CHF |

| 100 | THAI BAHTS | 13.0796 | 11.8748 | 11.7922 | THB |

| 100 | U.A.E. DIRHAMS | 0 | 0 | 0 | AED |

What is the Standardised Base Rate (“SBR”)?

Apakah Kadar Asas Standard (“KAS”)?

The SBR is the reference rate that all banks will use starting from 1 August 2022 in the pricing of new retail floating-rate loans/financings, refinancing of existing retail loans/financings, and the renewal of revolving retail loans/financings from 1 August 2022. Retail loans/financings refer to loans/financings to individuals (not SMEs or businesses), while ‘floating-rate loans/financings’ refer to loans/financings where the interest/profit/rental rate can change during the lifetime of the loans/financing. The SBR is linked solely to the Overnight Policy Rate (OPR), as determined by the Monetary Policy Committee (MPC) of Bank Negara Malaysia.

KAS ialah kadar rujukan yang akan digunakan oleh semua bank mulai 1 Ogos 2022 dalam penetapan harga pinjaman/ pembiayaan kadar terapung runcit baharu, pembiayaan semula pinjaman/ pembiayaan runcit sedia ada, dan pembaharuan pinjaman/ pembiayaan runcit pusingan mulai 1 Ogos 2022 Pinjaman/pembiayaan runcit merujuk kepada pinjaman/pembiayaan kepada individu (bukan Pembiayaan Komersial untuk Syarikat (“PKS”) atau perniagaan), manakala ‘pinjaman/ pembiayaan kadar terapung’ merujuk kepada pinjaman/ pembiayaan di mana kadar faedah/ keuntungan/ sewaan boleh berubah sepanjang hayat pinjaman/ pembiayaan. KAS dikaitkan semata-mata kepada Kadar Dasar Semalaman (“KDS”), seperti yang ditentukan oleh Jawatankuasa Dasar Monetari (“MPC”) Bank Negara Malaysia.

What are the possible scenarios to trigger a change in SBR?

Apakah senario yang mungkin boleh mencetuskan perubahan dalam KAS?

The SBR can rise or fall due to changes in the benchmark rate, i.e. changes in Overnight Policy Rate (“OPR”).

KAS boleh naik atau turun disebabkan oleh perubahan dalam kadar penanda aras, iaitu perubahan dalam Kadar Dasar Semalaman (“KDS”).

Effective date: 16 July 2025

Tarikh kuat kuasa: 16 Julai 2025

Applicable for new individual financing application.

Terpakai untuk permohonan pembiayaan individu baharu

|

BEFORE 16 July 2025

|

AFTER 16 July 2025

|

|

|---|---|---|

| Reference Rate / Kadar Rujukan | SBR = 3.00% | SBR = 2.75 % |

| Interest Rate / Kadar Bunga | SBR + 1.75% | SBR + 1.85% |

| Effective Lending Rate / Kadar Pinjaman Berkesan | 4.75% | 4.60% |

| Monthly instalment / Ansuran Bulanan (RM) | 2,444.28 | 2,397.34 |

| FOR ILLUSTRATION PURPOSE / UNTUK TUJUAN ILUSTRASI: | ||

| Loan Amount / Jumlah Pinjaman: RM350,000 (No Lock-In Period / Tiada Tempoh Berkunci) | ||

| Loan Tenure / Tempoh Pinjaman: 30 years/ tahun | ||

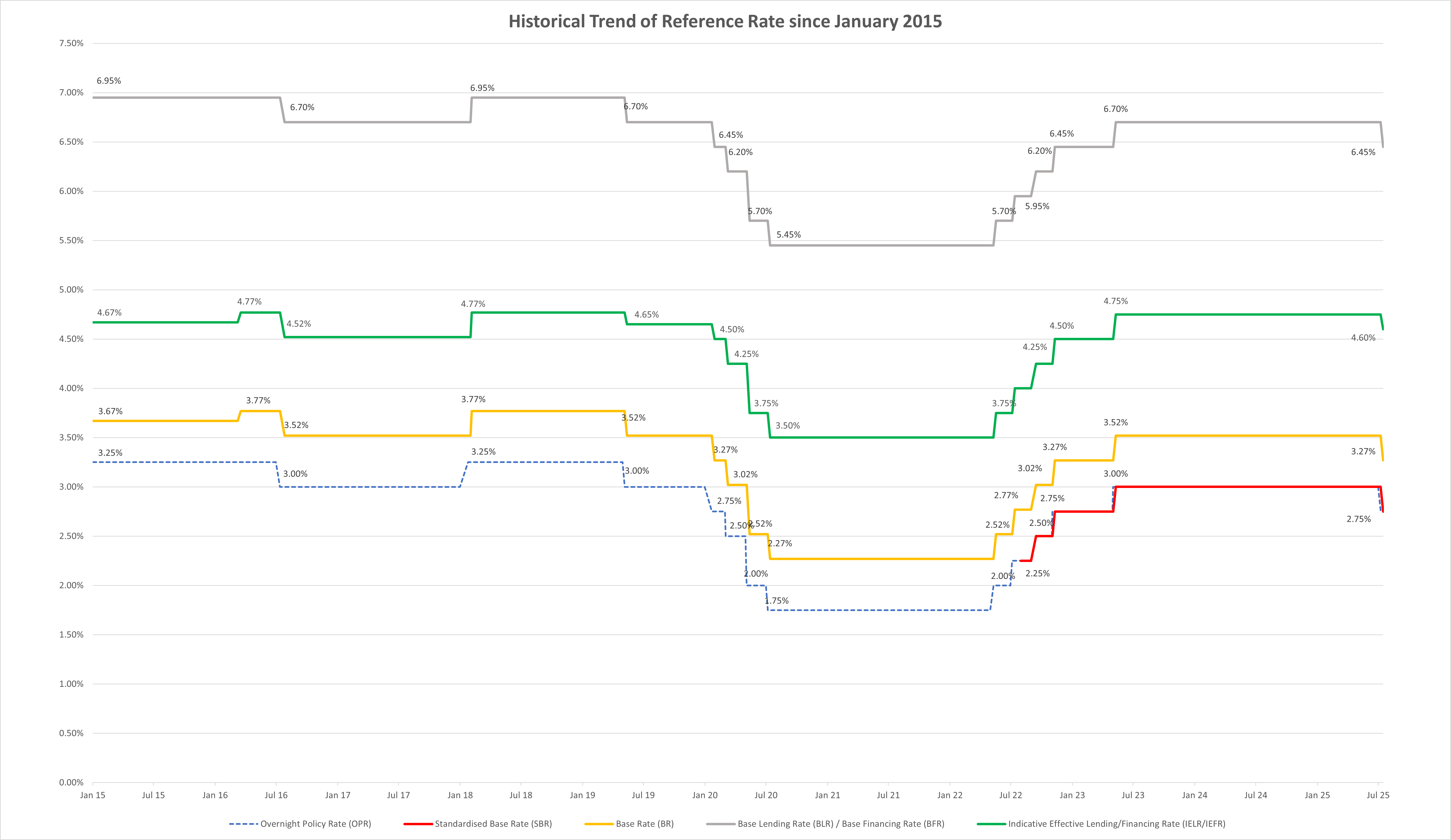

Historical trend of Reference Rate since January 2015 below for your reference. / Trend sejarah Kadar Rujukan sejak Januari 2015 di bawah untuk rujukan anda.

|

Effective Date

|

Jan-15

|

Mar-16

|

Jul-16

|

Feb-18

|

May-19

|

Jan-20

|

Mar-20

|

May-20

|

Jul-20

|

May-22

|

Jul-22

|

Aug-22

|

Sep-22

|

Nov-22

|

May-23

|

Jul-25

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Standardised Base Rate (SBR) | 3.25% | 3.25% | 3.00% | 3.25% | 3.00% | 2.75% | 2.50% | 2.00% | 1.75% | 2.00% | 2.25% | 2.25% | 2.50% | 2.75% | 3.00% | 2.75% |

| Base Rate (BR) | 3.67% | 3.77% | 3.52% | 3.77% | 3.52% | 3.27% | 3.02% | 2.52% | 2.27% | 2.52% | 2.77% | 2.77% | 3.02% | 3.27% | 3.52% | 3.27% |

| Base Lending Rate (BLR) / Base Financing Rate (BFR) | 6.95% | 6.95% | 6.70% | 6.95% | 6.70% | 6.45% | 6.20% | 5.70% | 5.45% | 5.70% | 5.95% | 5.95% | 6.20% | 6.45% | 6.70% | 6.45% |

| Indicative Effective Lending (IELR) / Indicative Financing Rate (IEFR) | 4.67% | 4.77% | 4.52% | 4.77% | 4.65% | 4.50% | 4.25% | 3.75% | 3.50% | 3.75% | 4.00% | 4.00% | 4.25% | 4.50% | 4.75% | 4.60% |

| Note:The SBR was introduced on 1 August 2022.The dotted line in the graph and the grey numbers in the table shows the historical series of the OPR, which is the benchmark rate of the SBR.

Indicative effective rate refers to the indicative annual effective lending/financing rate for a standard 30- year housing loan / home financing product with financing amount of RM350k and has no lock-in period. Catatan: KAS telah diperkenalkan pada 1 Ogos 2022. Garis putus-putus dalam graf dan nombor kelabu dalam jadual menunjukkan siri sejarah KDS, iaitu kadar penanda aras KSA. Kadar berkesan indikatif merujuk kepada indikatif kadar pinjaman/pembiayaan berkesan tahunan untuk pinjaman perumahan / produk pembiayaan rumah untuk 30 tahun dengan jumlah pembiayaan RM350k dan tidak mempunyai tempoh berkunci. |

||||||||||||||||

What is the base rate (BR)?

Apakah Kadar Asas (KA)?

The BR we offer on this product is made up of two parts, our benchmark cost of funds (“COF”) and the Statutory Reserve Requirement (“SRR”) cost imposed by Bank Negara Malaysia. Our benchmark COF is the marginal cost of raising funds for the property financings for individual.

KA yang kami tawarkan pada produk ini terdiri daripada dua bahagian, kos penanda aras dana (“COF”) dan kos Keperluan Rizab Berkanun (“SRR”) yang dikenakan oleh Bank Negara Malaysia. Penanda aras COF kami ialah kos marginal untuk mengumpul dana bagi pembiayaan hartanah untuk individu.

What are possible scenarios to trigger a change in the BR?

Apakah senario yang mungkin boleh mencetuskan perubahan dalam KA?

Our BR can rise or fall due to changes in the benchmark COF and changes in the SRR.

KA kami boleh naik atau turun disebabkan oleh perubahan dalam penanda aras COF dan perubahan dalam SRR.

Changes in the benchmark COF could occur due to changes in the Overnight Policy Rate (“OPR”) as decided by the Monetary Policy Committee (MPC) of Bank Negara Malaysia. In addition, as the benchmark COF is the marginal cost of raising funds, it will change in line with fluctuation in the market funding condition.

Perubahan dalam COF penanda aras boleh berlaku disebabkan perubahan dalam Kadar Dasar Semalaman (“KDS”) seperti yang diputuskan oleh Jawatankuasa Dasar Monetari (“MPC”) Bank Negara Malaysia. Di samping itu, sebagai penanda aras COF ialah kos marginal untuk mengumpul dana, ia akan berubah sejajar dengan turun naik dalam keadaan pembiayaan pasaran.

SRR cost will change in line with changes in the SRR rate as decided by MPC of Bank Negara Malaysia.

Kos SRR akan berubah selaras dengan perubahan dalam kadar SRR seperti yang diputuskan oleh MPC Bank Negara Malaysia.

Effective date: 16 July 2025

Tarikh kuat kuasa: 16 Julai 2025

Effective date: 16 July 2025

Tarikh kuat kuasa: 16 Julai 2025

Note:

Catatan:

Effective Date : 1 January 2026 – 31 March 2026

Not applicable for new individual loan / financing applications from 2 January 2015 onwards.

*Product not available for account opening effective 2 January 2013

* Protected by PIDM up to RM250,000 for each depositor