Setup is simple with Apple Pay

iPhone (for ATM cards only)

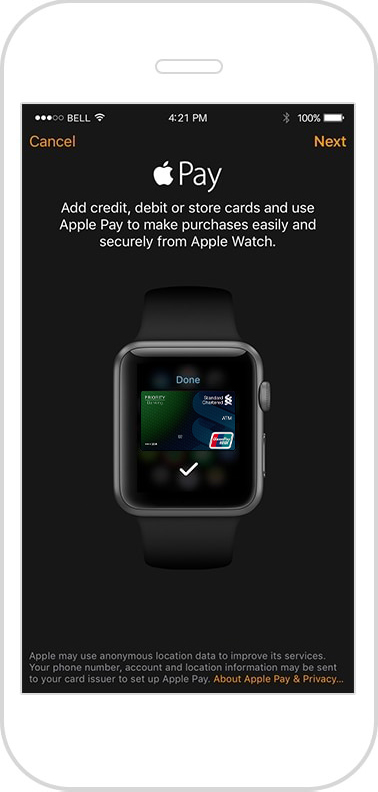

Store your debit and credit cards in the Wallet app to make payments via Apple Pay.

Store your debit and credit cards in the Wallet app to make payments via Apple Pay.

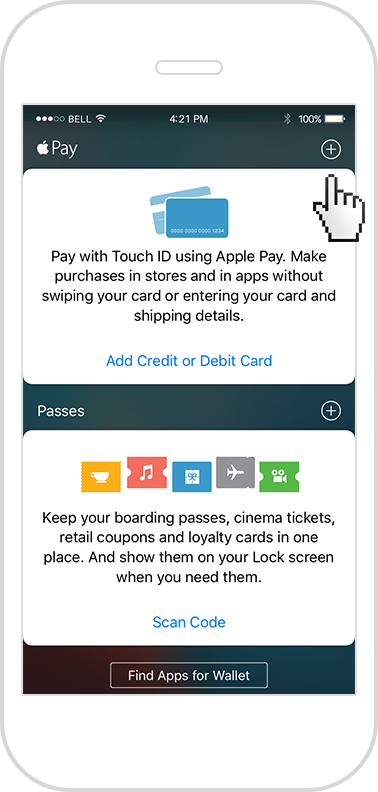

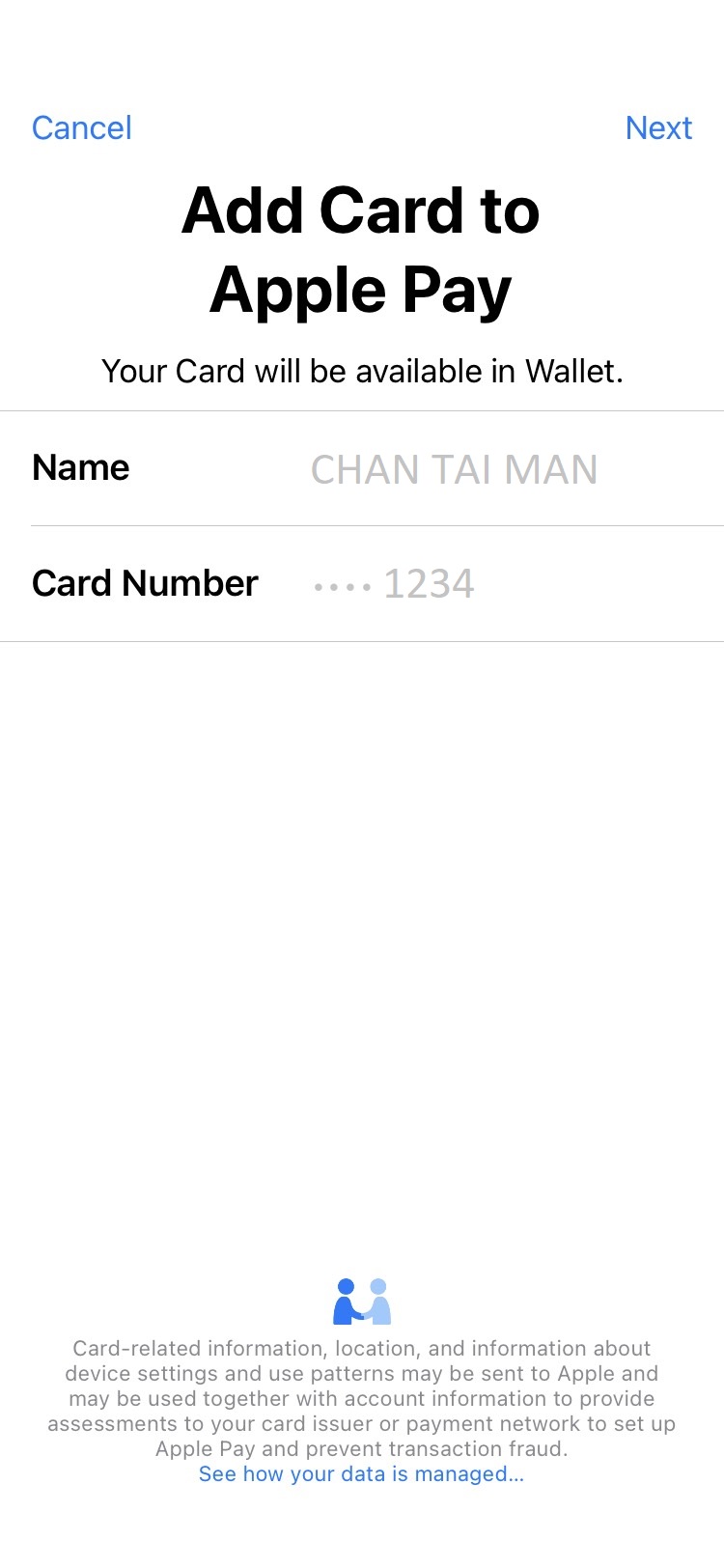

Open the Wallet app

Tap the "+" sign on the top right

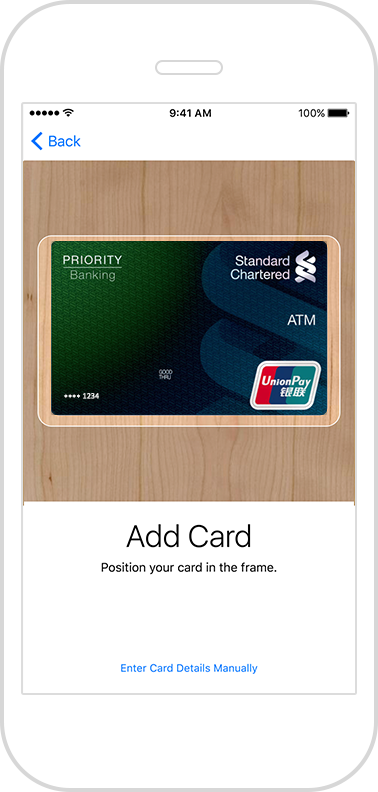

Use your camera to capture the card details (Or manually enter it)

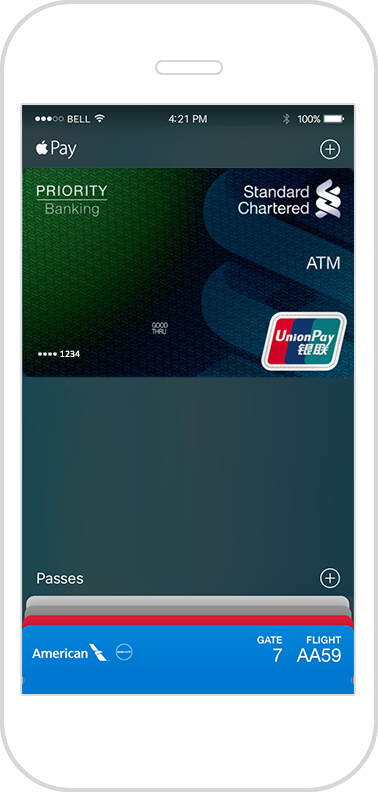

Make Standard Chartered UnionPay ATM Card the default card

Login to the SC Mobile app

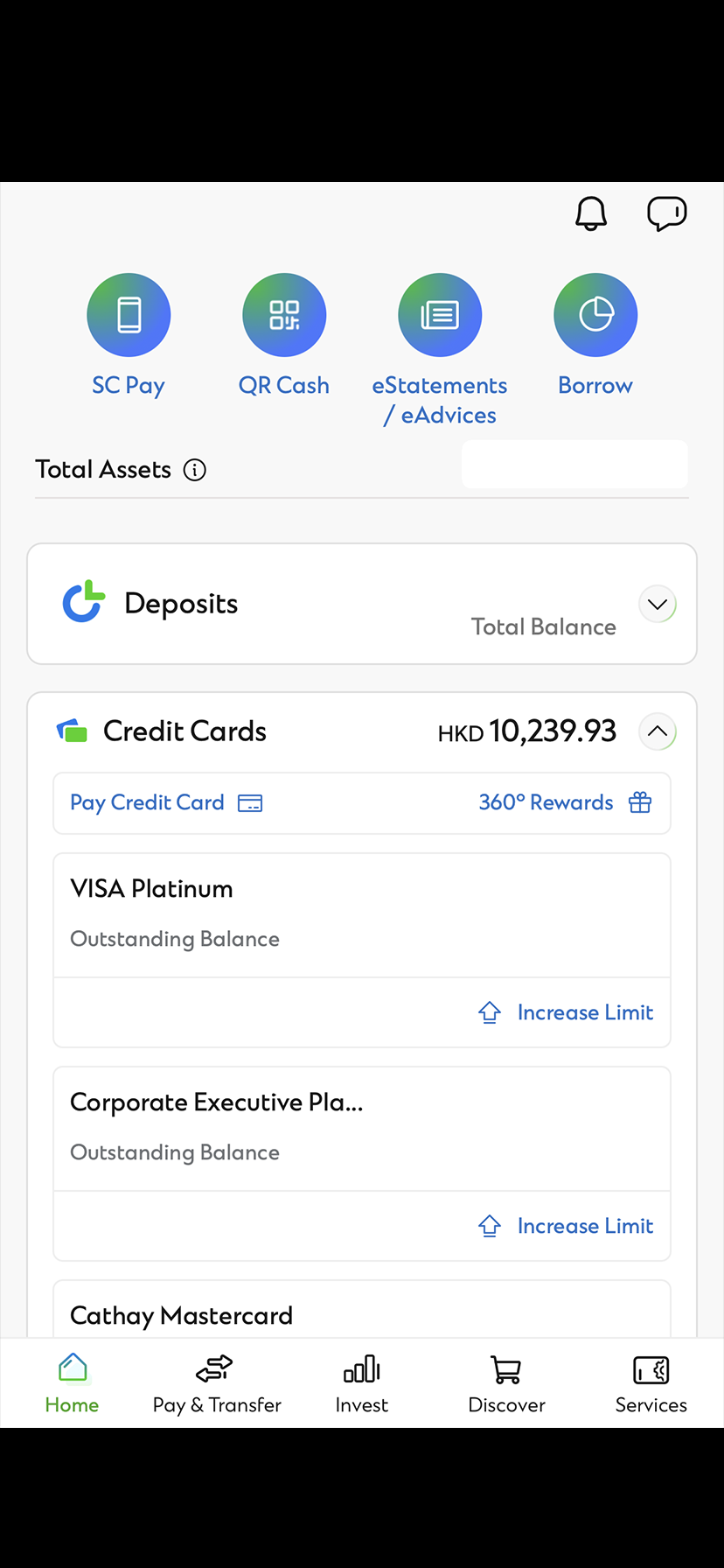

Go to Home page > scroll down and click the card you wish to add to your apple pay

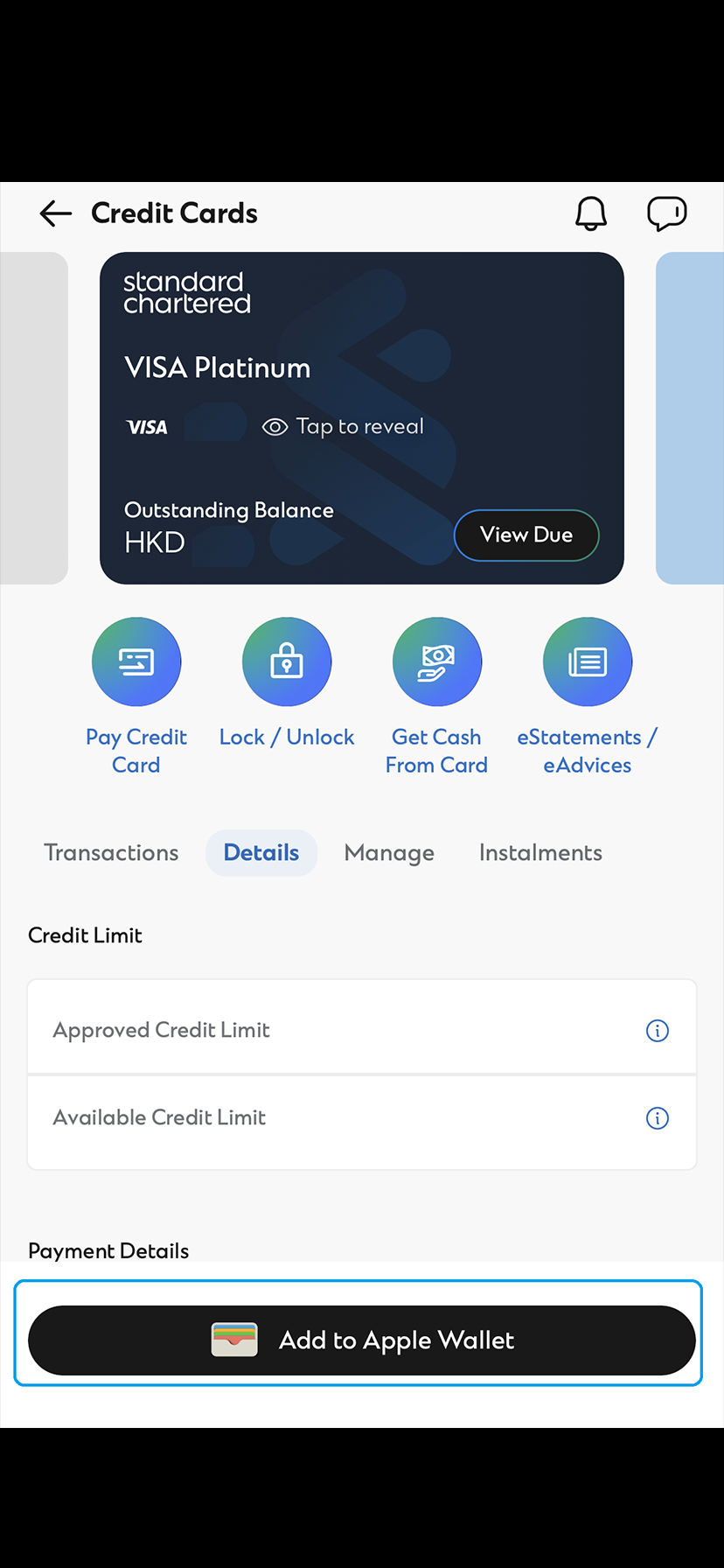

Click “Details” > “Add to Apple Wallet”

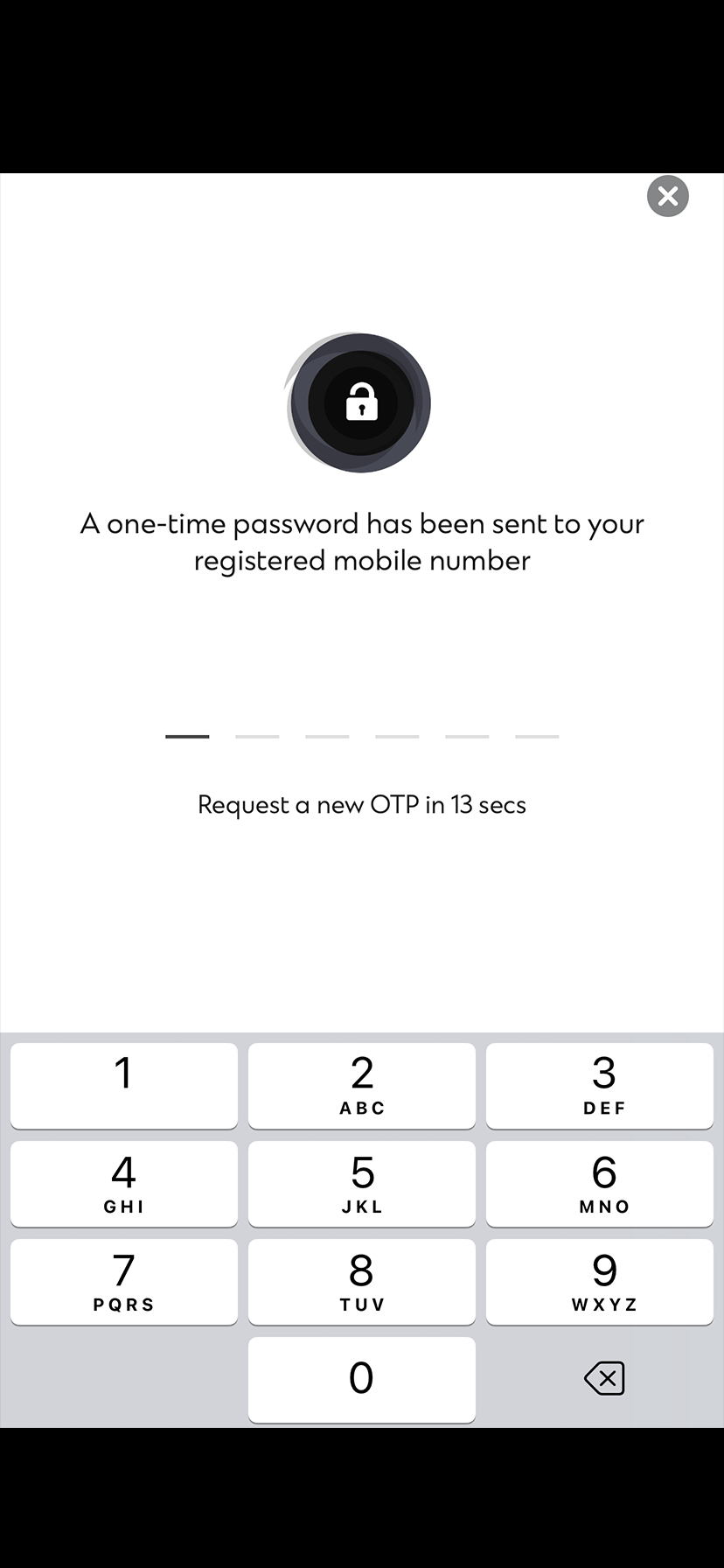

Authenticate your request with SMS OTP

From there, follow the onscreen instructions

Open the Wallet app

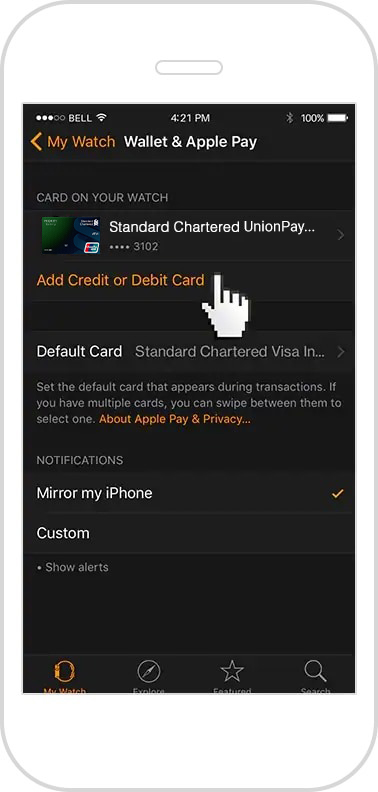

Tap "Wallet & Apple Pay"

Tap "Add a Credit or Debit Card"

From there, follow the onscreen instructions

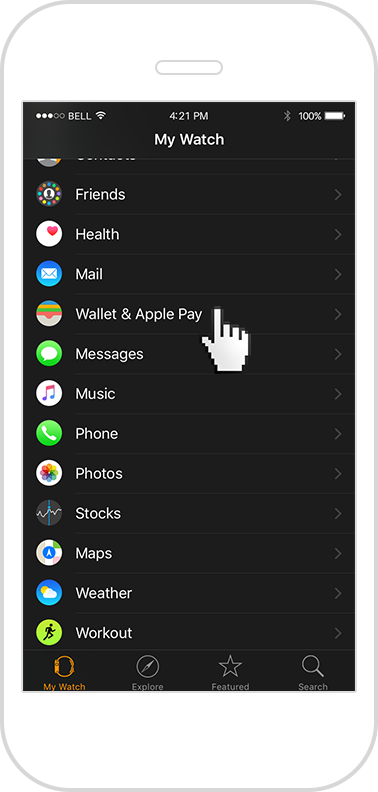

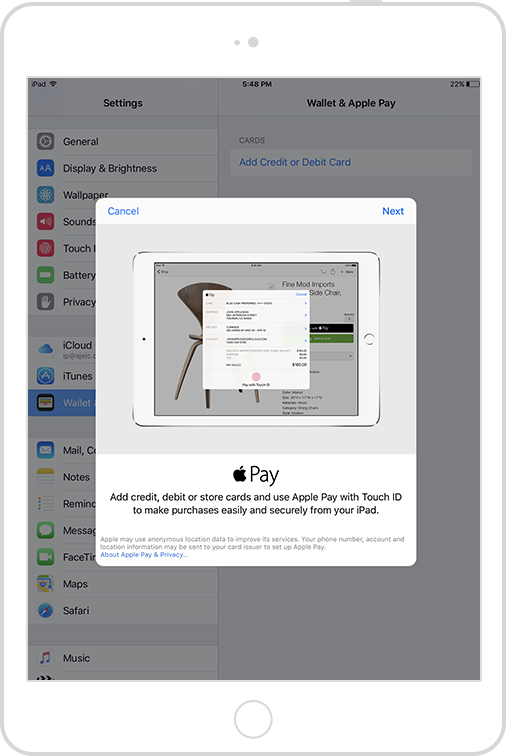

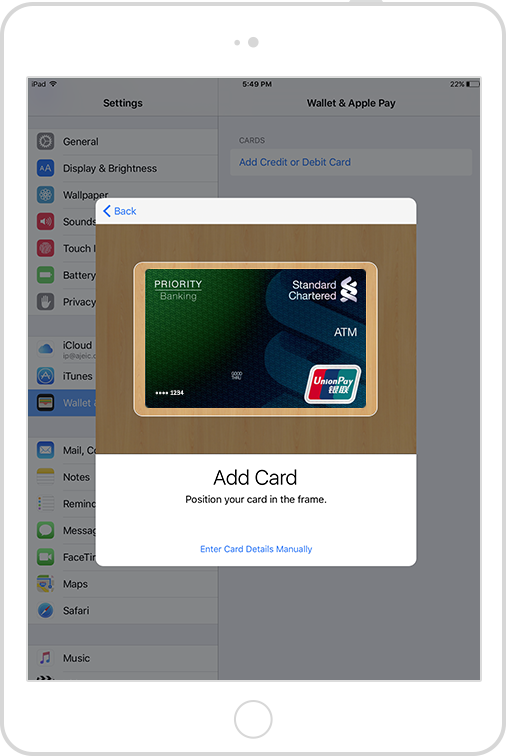

Open settings, tap "Wallet & Apple Pay"

Then tap "Add a Credit or Debit Card"

From there, follow the onscreen instructions

To ensure privacy, Apple doesn’t save nor share any of your card details or your transaction information.

Protect your accounts even if you lose your device. Reset your device to factory setting or activate ‘Lost Mode’ under ‘Find My iPhone’ to suspend Apple Pay.

Apple Pay is accepted in grocery stores, boutiques, restaurants, hotels and so many places you already enjoy. You can also use Apple Pay in all kinds of apps — and on participating websites using Safari on your Mac, iPhone, and iPad.

Use Apple Pay wherever you see one of these symbols.

The following cards issued by Standard Chartered (Hong Kong) Bank are eligible to use Apple Pay: Standard Chartered Credit Card and its Co-branded Card, MANHATTAN Credit Card and its Co-branded Card (except Standard Chartered UnionPay Credit Card, Standard Chartered Business Card and Standard Chartered Corporate Card).

The following ATM cards issued by Standard Chartered (Hong Kong) Bank are eligible to use Apple Pay: Standard Chartered MARVEL ATM Card, Standard Chartered Disney ATM Card, Standard Chartered UnionPay Single Currency ATM Card and Standard Chartered UnionPay Dual Currency ATM Card (except any ATM Card under SME Banking).

No, we will not charge you for using Apple Pay.

To learn more about the list of compatible Apple Pay devices, please visit www.apple.com/apple-pay/

Apple Pay can be used wherever you see the contactless payment symbol. You can also make in-app purchases on your compatible iPhone or iPad.

Yes, Apple Pay allows a maximum of eight cards to be loaded to the Wallet.

The first card you load to Apple Pay will automatically become your default card. You can change your default card by opening Apple Pay app, and holding on a credit/ATM card and dragging it to the front. You will receive a notification confirming your new default card setting.

Launch Apple Pay, select the card you want to remove, click “i” at the bottom right, and select “Remove Card”.

If you need to return a purchase made with Apple Pay, you will have to bring along your physical card and request the merchant to issue the refund back on your card.

For verification purposes, you may be asked to provide the last four digits of your Device Account Number to the merchant. This number can be found in the “Settings” menu in the Apple Pay app.

Please contact Apple Support hotline at (852)2112-0099.

All contactless payments and/or within app transaction payments made through your ATM Card will be subject to the maximum daily electronic payment limit (HKD50,000 per day at client level) applicable to card holder. Besides, different merchants may have different setting in their contactless terminals. For more details, please check with merchants.

How secure is an Apple Pay transaction?

When making purchases, the Apple Pay app verifies your fingerprint through your ‘Touch ID’. After you have added a card to Apple Pay, your card number will be converted into a Device Account Number (token) which is stored securely and use for Apple Pay transactions only. Your physical card number is not stored in the app (you can only view the last 4 digit of your card number). This adds additional security to protecting your card details.

What is tokenization?

Tokenization is a method of replacing your sensitive payment card information (card number, expiration date, security code, etc. (if applicable)) with a device-specific ‘token’ which acts as a surrogate value. For Apple Pay, tokens are used to protect your payment information and to reduce the security risks inherent to plastic card. Your card information is never stored in your phone.

Can anyone other than myself pay for goods and services using my device?

Anyone with your device ‘Passcode’ or fingerprint registered to your device will be able to authorise transactions using your card with Apple Pay.

You must keep your device safe and secure, and your device ‘Passcode’ secret. Do not let anyone else to have their fingerprint registered to your device while your card is registered with it.

My device has been lost or stolen and I want to delete or suspend my Card. What should I do?

If your iPhone, Apple Watch or iPad is lost or stolen, you can go to icloud.com or use the “Find My iPhone” app to suspend or permanently remove your card record from that device. Your card will be suspended or removed from the device even if it is offline and not connect to a mobile or Wi-Fi network.

You may also call Apple support hotline at (852)2112-0099 and they will be able to remove your card(s) from your device.

Alternatively, you can call us at the below hotlines to suspend or remove your card from Apple Pay:

Credit card – (852)2886-4111

ATM card – (852)2886-8888

What if I lose my credit / ATM card?

If you lose your credit card, please contact us immediately at (852)2886-6016.

If you lose your ATM card, please contact us immediately at (852)2886-8888.

Once your physical credit / ATM card has been deactivated, you will not be able to continue to use Apple Pay with this credit / ATM card.

When we issue you a new credit / ATM card, you will need to register it with Apple Pay again.

For credit cards, please register via SC Mobile App.

What if my card is up for renewal?

If you have previously registered your credit card on Apple Pay, when your credit card is due to renewal, your replacement credit card will automatically be registered back to Apple Pay when you activate your renewal credit card.

If you have previously registered your ATM card on Apple Pay, when your ATM card is due to renewal, we will send you a renewal ATM card. Upon receiving the renewal ATM card, you are required to enrol your renewal ATM card.

If I receive a replacement credit / ATM card, do I need to update my card information with Apple Pay on my existing device?

If you lose your physical credit / ATM card and then receive a replacement credit / ATM card, you will need to remove the original credit / ATM card record from Apple Pay and register your new credit / ATM card again.

For credit cards, please register via SC Mobile App.

What happens when I reset, format or update my device?

When performing a factory data reset/ format or update, all payment information in Apple Pay will be deleted.

You will need to set up and add your credit/ATM card information into Apple Pay again after your device has been reset.

For credit cards, please register via SC Mobile App.

If I send in my phone for repair, do I have to reset Apple Pay?

Please make sure to delete your credit/ATM card details from Apple Pay before sending your device for repair. All payment information in Apple Pay will be deleted after the repair and you will need to set up Apple Pay and add your credit/ATM card information again.

For credit cards, please register via SC Mobile App.

What happens if my device does not recognize my fingerprint or my face?

Please contact Apple Support hotline at (852)2112-0099.

What is NFC?

Near Field Communication or NFC is a method of wirelessly transmitting data using radio waves. Apple Pay uses NFC to wirelessly transmit payment data to payment terminals with NFC readers that have been activated for use.

Which wallet provider uses NFC?

Apple Pay uses NFC to wirelessly transmit payment data to payment terminals after authentication with NFC readers that have been activated for use.