How to split your credit card bill? It takes just a few minutes through SC Mobile App.

*Only applicable to Standard Chartered / MANHATTAN Credit Cards cardholders.

Credit Card Instalment Offer for Taxes and Insurance

Triple Instalment Rewards: Enjoy up to HKD1,500 cashback.

Reward 1: Apply online for credit card instalments of 12 months or more to receive up to HKD600 cashback.

Reward 2: Pay taxes or insurance premiums of HK10,000 or above with your credit card. Apply for 12-month instalments of HKD15,000 or above accumulated monthly, enjoy up to HKD300 cashback in addition to Reward 1.

Reward 3: Apply for instalments of HKD30,000 or above for three consecutive months to enjoy additional HKD600 cashback.

Example: Apply for a 12-month credit card instalment plan for 3 consecutive months of HKD 40,000 per month (one of the month is a tax bill).

You could enjoy HKD1,500 cashback: HKD200 × 3 + HKD300 + HKD600 = HKD1,500

|

Monthly Accumulated Instalment Amount

|

Reward 1: Monthly Instalment Cashback

(12 months or above repayment tenor, once per month for up to 3 months) |

Reward 2: Extra Cashback for Taxes and Insurance Instalments

(bills totaling HKD10,000+, can be enjoyed once) |

Reward 3: Successfully apply for instalments for 3 consecutive months

(can be enjoyed once) |

Total Maximum Rewards

|

|---|---|---|---|---|

| HKD15,000 – 29,999 | HKD100 | HKD100 | / | HKD400 |

| HKD30,000 or above | HKD200 | HKD300 | HKD600 | HKD1,500 |

Repayment period from 3 to 60 months

Settle partial or whole retail purchase with min. spend HKD5002

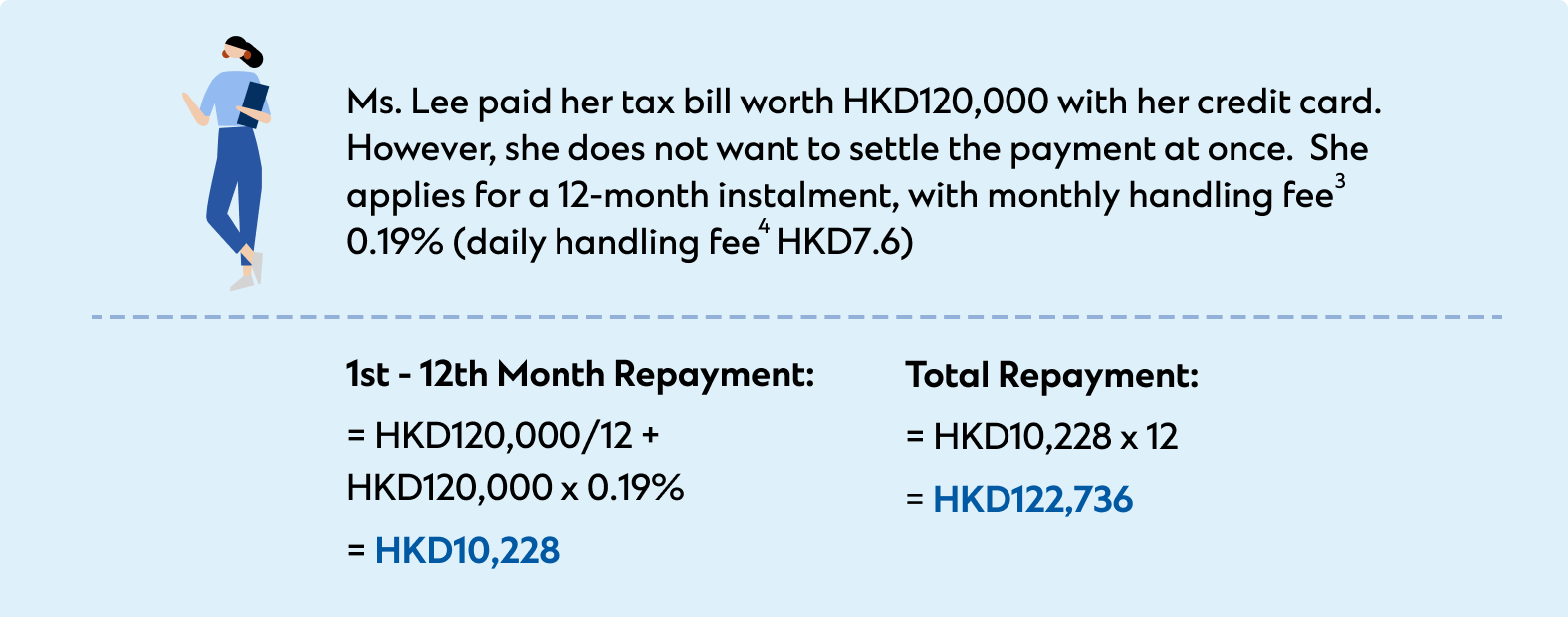

Personlised monthly handling fee3 as low as 0.19%

^A New Cardholder refers to an applicant who does not currently hold and has not cancelled any Standard Chartered or MANHATTAN principal credit card issued by Standard Chartered Bank (Hong Kong) Limited within the past six months from the approval date of the currently applied Standard Chartered principal credit card.

1. An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of a product expressed as an annualized rate. In general, the Instalment Amount is a fixed amount to be charged to the Card Account on a monthly basis, while the APR for the first instalment may be impacted by the loan disbursement date.

2. Application requirements:

• a) Standard Chartered credit card or Standard Chartered co-branded card (Except UnionPay Dual Currency Platinum Credit Card RMB account and Corporate Card) account holders are eligible to apply for the Plan.

• b) The minimum amount of each Statement Instalment Transaction is HKD500 (only applicable to new retail purchases charged to a single account). Retail transactions charged to different accounts could not be applied under the same Plan.

3. The availability of exclusive personalized Monthly Handling Fee of 0.19% is individualized and subject to account status checking. Different Statement Instalment Transactions could not be combined for the purpose of calculating the handling fee. Monthly Handling Fee ranges from 0.19% to 1.35%.

4. Annualised Percentage Rate (APR) of 0.19% Monthly Handling Fee is:

|

Transaction Amount: $25,000

|

Non statement instalment:

Apply the instalment loan before the issuance of credit card statement |

Statement instalment:

Apply the instalment loan after the issuance of credit card statement |

|---|---|---|

| Tenor | APR | |

| 6 month | 3.97% | 4.20% |

| 12 month | 4.26% | 4.40% |

| 18 month | 4.36% | 4.45% |

| 24 month | 4.4o% | 4.48% |

For Statement Instalment, this APR is calculated in the assumption that the instalment application date is 25 days prior to the statement repayment date, and the first two months handling fee will be posted in the next monthly statement.

An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of a product expressed as an annualized rate. In general, the Instalment Amount is a fixed amount to be charged to the Card Account on a monthly basis, while the APR for the first instalment may be impacted by the loan disbursement date.

Please note there is no difference in the total handling fee (or total absolute amount of interest) charged and repayment amount between Non Statement Instalment and Statement Instalment.

5. Daily handling fee is calculated based on 30 days per month.

If you choose to repay the total Statement Instalment Transaction Amount outstanding in full for each Statement Instalment Transaction prior to the end of the Instalment Period, or if the Card Account on which the Statement Instalment Transaction Amount appears is cancelled due to any reason, the total Statement Instalment Transaction(s) Amount outstanding at the relevant time and the Monthly Handling Fees (if applicable) for the remaining Instalment Period will be immediately due and payable. Also, administration fee for early repayment of HKD150 for each Statement Instalment Transaction will be charged directly to your Card Account.

Example (for indication purpose only):

|

Single Instalment Transaction Amount

|

Monthly Handling Fee

|

Instalment Period

|

|---|---|---|

| HKD15,000 | 0.25% | 12-month |

If you repay the total Statement Instalment Transaction Amount after the 6th month, you shall be liable to pay the remaining period of 6 months of:

= Total Statement Instalment Transaction Amount outstanding + Monthly Handling Fees

= HKD15,000 / 12 x (12-6) + HKD15,000 x 0.25% x (12-6)

= HKD7,725

plus an administration fee of HKD150, = HKD7,875.

Application hours for registration hotline: 9a.m. to 10p.m. daily (Monday – Sunday).

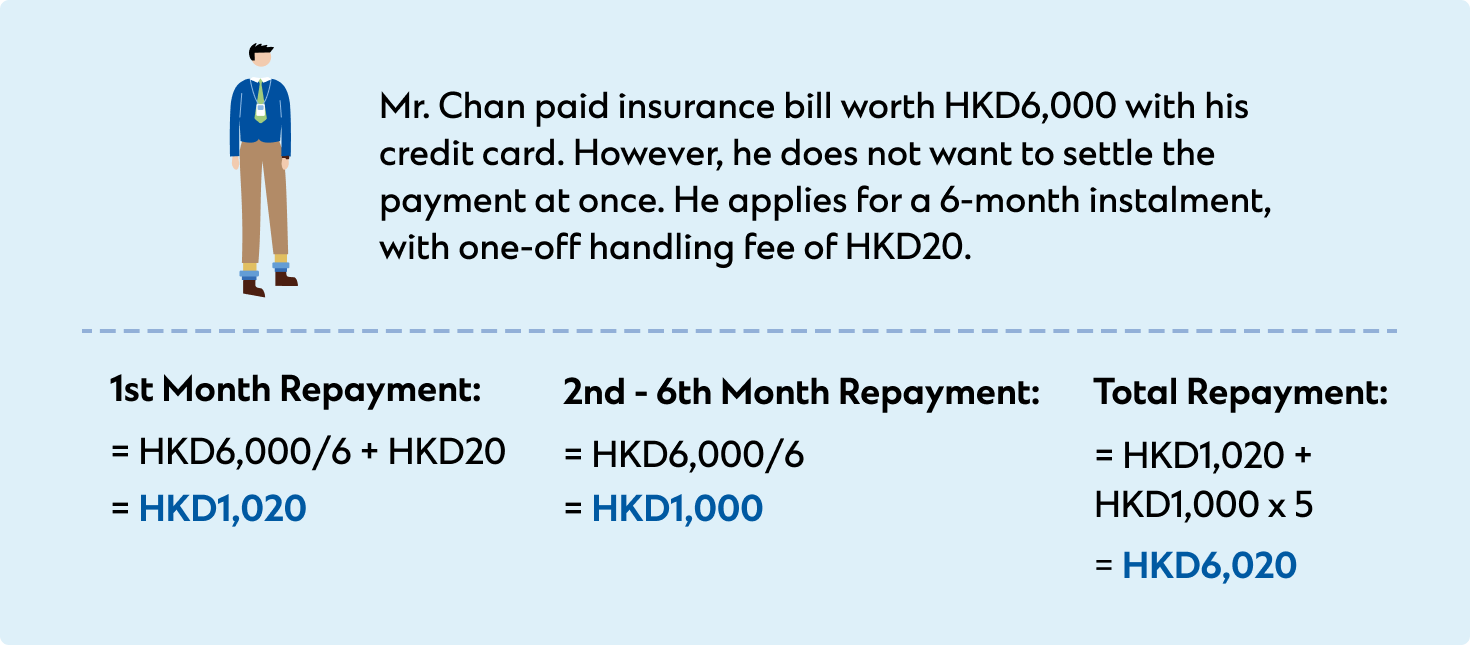

Selected Customers can enjoy one-time handling fee with min. spend HKD500

Seasonal / Merchant offers with one-time handling fee

Easy application in app – as fast as 1 minute