Money Safe

Protect your bank savings from scams

An extra layer of security to keep your savings secured

You can setup Money Safe or increase the locked-in amount anytime via SC Mobile App or Online Banking.

To better protect your funds, you must visit branch in person to submit an application. Funds will be released within 3 business days upon successful verification.

Money Safe is the latest anti-fraud and scam security feature introduced by HKMA to help you better protect your funds. By activating Money Safe, you cannot use the locked funds in account for any types of outgoing payment and transfer transactions via any channels, including but not limited to:

Until you submit a deactivation request at branch in person.

All types of savings, current and TD accounts are eligible for Money Safe. Supported currencies include HKD, RMB, USD, AUD, CAD, CHF, EUR, GBP, JPY, NZD and SGD.

To set up and activate Money Safe against funds in an account, the account must have a minimum balance of, and the minimum amount of funds required to be locked-in is, 100 dollars in the currency in which the account is denominated.

You can activate or increase locked amount under Money Safe instantly via SC Mobile App or Online Banking. Alternatively, you can visit branch in person, calling to (852)2886-8888 or contacting our Live Agent. Your request will be completed within 3 business days.

Yes, funds crediting into the account is not affected.

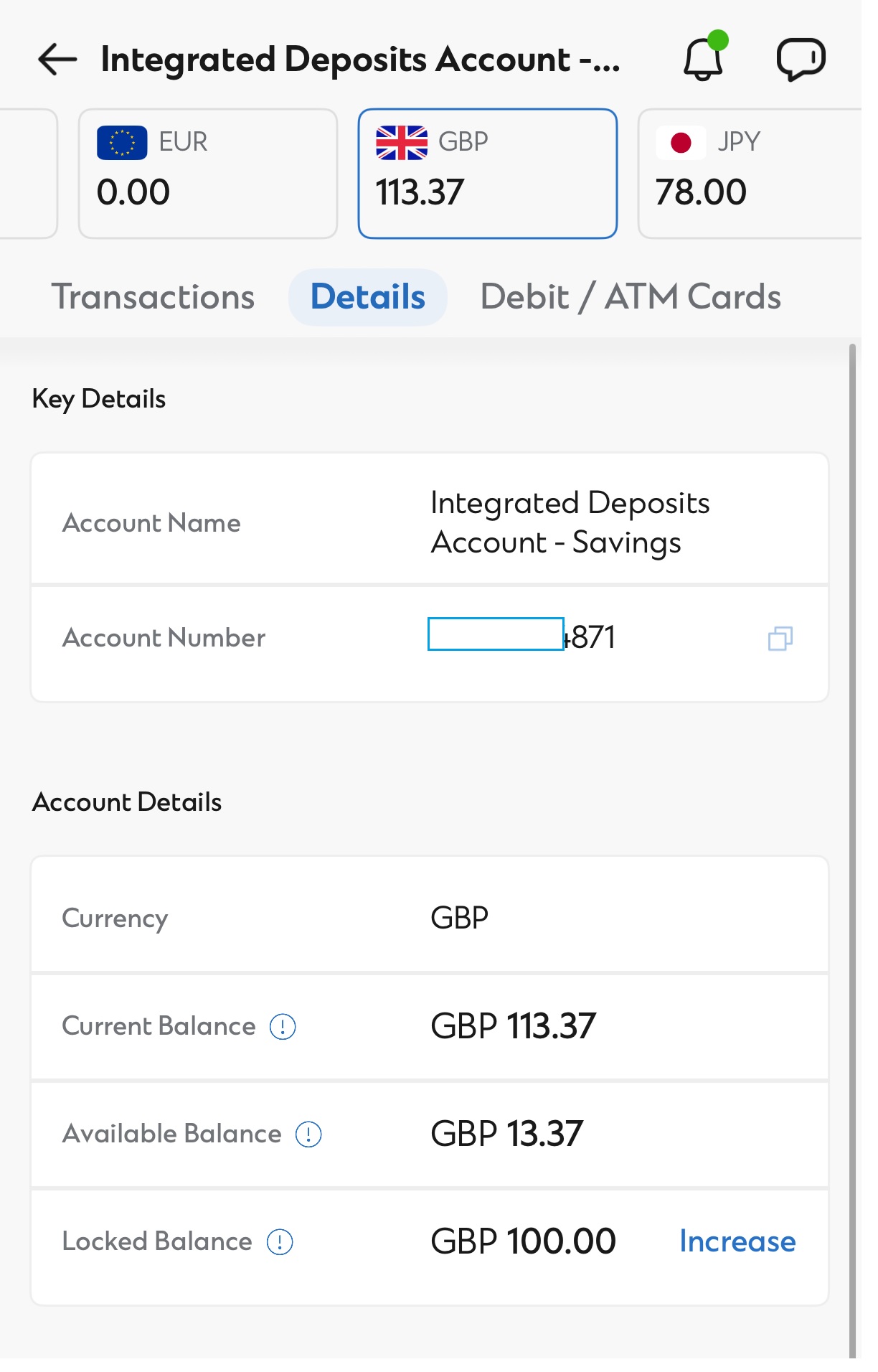

You can check via SC Mobile App. Select the account you would like to check and click “Details”. Refer to the “Locked Balance” field which represents the locked-in amount under Money Safe of this account.

You can apply to reduce the Money Safe locked amount by visiting any of our branches in person to submit a request.

To deactivate or reduce the locked-in amount under Money Safe, you must visit any of our branches to submit a request in person. Funds will be released within 3 business days once the Bank has completed the verification process. The Bank reserves the right at its absolute discretion to reject the deactivation / reduction of locked-in amount requests should the Bank be unable to complete the verification process.

In case you wish to deactivate Money Safe for a joint- name both-to-sign account, all accounts holders must be present for verification purpose.

For security reason, early uplift or change of maturity instruction is not allowed while Money Safe is activated. To do so, you must first visit branch in person to deactivate Money Safe.

Deactivation will take 3 days and we will only accept your request on early uplift or change of maturity instruction after Money Safe is deactivated on the Time Deposit.

We will automatically renew your Time Deposit placement at prevailing interest rate until you deactivate Money safe. For Asia Miles Time Deposit, we will renew at 0.01% p.a. and no Asia Miles entitlement.

You are not eligible for Current Account Overdraft Protection (also known as No Bounce Cheque Protection) while Money Safe is activated for any of your Current Accounts. In the event that remaining available balance (except locked-in amount) in current account is not sufficient for your cheque payment / direct debit authorisation payment, your cheques and direct debit authorization payments will be rejected. Relevant fees and charges may incur due to such payment rejection.

You need to apply for resuming the protection. Please indicate on the Money Safe deactivation form accordingly and we will resume the service in parallel.

These transactions will automatically resume. You do not need to resubmit instruction again.

For security reason, you must visit branch to submit a deactivation request in person, as we must conduct face-to-face verification before we can proceed to deactivate the service.

Yes, you can do so provided that the Bank is able to authenticate your identity following existing procedures.

Yes, you can activate Money Safe for your dormant account (s). It will not trigger account re-activation.

In case you wish to close the account, you will need to first deactivate Money Safe before proceeding on account closure. Deactivation will take 3 days and we will only accept your account closure request after Money Safe is deactivated.

No impact. If you have sufficient available balance in that corresponding foreign currency, the amount will be deducted from that foreign currency account and settled automatically. If you don’t have sufficient available balance in that foreign currency or if the transaction is outside of the 11 supported currencies, it will be settled in Hong Kong dollars and deducted from your HKD account.

This hyperlink will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to Standard Chartered Bank (Hong Kong) Limited or any member of Standard Chartered Group ( the “Bank”).

The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein.

The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link.

Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.

Proceed to third party website