*Based on assets under management (AUM) as at 31 December 2022.

The information in this document is as at 30 June 2023 except where otherwise stated.

The role of Standard Chartered Bank (Singapore) Limited (“SCB SG”) as the fund’s Investment Advisor is solely advisory in nature while Amundi as the Investment Manager will have the final authority and decision regarding investments of the fund.

The role of SCB SG as the fund’s Investment Advisor does not imply official recommendation, it is not a recommendation or endorsement of a product, nor does it guarantee the commercial merits of a product or its performance.

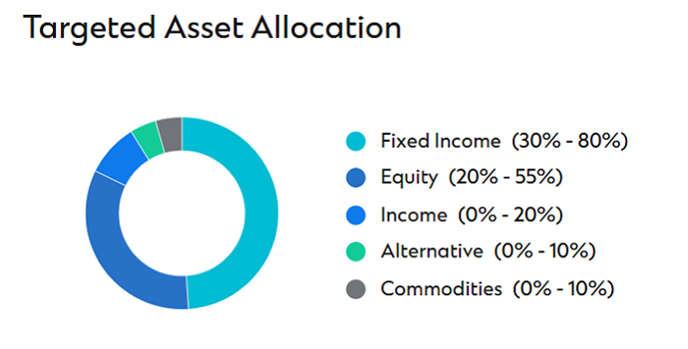

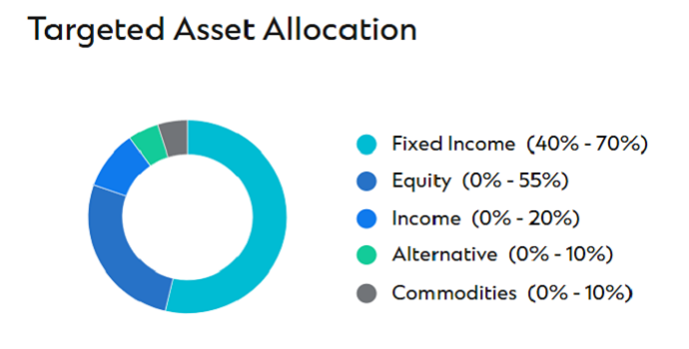

This material contains information about AMUNDI ASIA FUNDS SIGNATURE CIO CONSERVATIVE FUND, AMUNDI ASIA FUNDS SIGNATURE CIO BALANCED FUND, AMUNDI ASIA FUNDS SIGNATURE CIO GROWTH FUND, AMUNDI ASIA FUNDS SIGNATURE CIO INCOME FUND (the “Funds”), sub funds of Amundi Asia Funds, an undertaking for collective investment in transferable securities existing under Part I of the Luxembourg law of 17 December 2010, organized as an open-ended mutual investment fund (“fonds commun de placement”). The management company of the Funds is Amundi Luxembourg S.A., 5, allée Scheffer, L-2520 Luxembourg and the Hong Kong Representative of the Funds is Amundi Hong Kong Limited, Suites 04-06, 32nd Floor, Two Taikoo Place, Taikoo Place, 979 King’s Road, Quarry Bay, Hong Kong (Amundi Luxembourg S.A. and/or its affiliated companies, including without limitation Amundi Hong Kong Limited, being hereinafter referred to individually or jointly as “Amundi”).

Investors should not only base on this document alone to make investment decisions. Investment involves risk. The past performance information of the market, manager and investments and any forecasts on the economy, stock market, bond market or the economic trends of the markets which are targeted by the fund(s) are not indicative of future performance. Investment returns not denominated in HKD or USD is exposed to exchange rate fluctuations. The value of an investment may go down or up. The offering document(s) should be read for further details including the risk factors. The fund(s) may use financial derivatives instruments as part of the investment strategy and invest in securities of emerging markets or smaller companies, or fix income securities. This involves significant risks and is usually more sensitive to price movements. The volatility of fund prices may be relatively increased. Issuers of fixed-income securities may default on its obligation and the fund(s) will not recover its investment. Additional risk factors are described in the offering document(s). Investors are advised to be aware of any new risks that may have emerged in the prevailing market circumstances before subscribing the fund(s).

Amundi is not responsible for the publication of this material. Certain information contained in this material has been obtained from Amundi which has not been independently verified, although Amundi and its affiliated companies believe such information to be fair and not misleading. Amundi does not accept any liability whatsoever whether direct or indirect that may arise from the publication of this material by Standard Chartered Bank (Hong Kong) Limited and use of information contained in this material. Amundi and its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the investments mentioned in this material. Amundi does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. Amundi does not make any representation as to the merits, suitability, expected success, or profitability of any such transaction mentioned herein.