3 Things You Should Know About Using Your Credit Card

According to the HKMA, there were 19.18 million¹ active credit cards in Hong Kong as of Q3 2021.

However, many people are not fully aware of how to use credit cards other than just to make purchases. This article explains the 3 important things you can do with credit cards.

1. Purchase with credit

Purchasing is the most common way to use your credit card. Consumers can make purchases with their approved credit limit by paying in-store, contactless payment, online payment, adding value for Octopus and bundled e-wallets. With most credit cards, you are only charged interest if you don’t pay your bill in full each month. You can also earn cashback rewards, miles, and bonus points for spending on certain credit cards.

2. Instalment

Instalment is an alternative payment option after spending. Some banks allow credit cardholders to split the credit card bills or retail purchases of over HK$500 by instalment. It can help you to keep a manageable balance every month.

3. Instalment Credit

Instalment credit is also known as Get Cash From Card. It provides express approval and relatively low-interest Instalment plan based on your credit limit. It allows you to get instant cash from credit card and repay it in Instalments without additional supporting document and paperwork2.

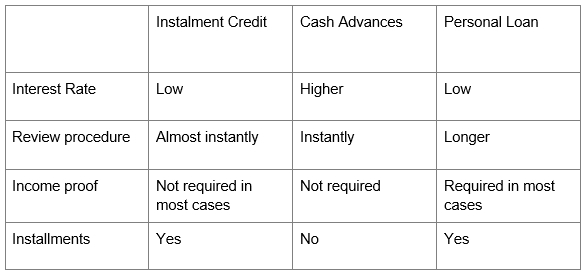

Instalment Credit is different from cash advance. Cash advance means using a credit card to withdraw cash at ATMs, and you will be charged at a very high interest rate. In contrast, Instalment Credit is similar to personal Instalment loans, which offers low interest rates and flexible repayment terms. The application for an Instalment Credit can be approved almost instantly. Some Instalment Credit plans offer a monthly handling fee as low as 0.13%^, with loan amount up to 18 times your monthly salary or up to HK$1,200,000 (whichever is lower). The repayment term is up to 60 months.

Moreover, the entire application process can be stayed online, and no income proof is required with instant approval, so you can receive the cash immediately via the “Faster Payment System”. Instalment Credit offers much lower interest rates than cash advances. Also, Instalment Credit can be approved more quickly than personal loans, which solves your cash flow needs easily. The following table shows the pros and cons of instalment credit, cash advances, and personal loans.

Product Comparison3