Hassle-Free with Instant Cash

There are options besides a personal loan when you need some instant cash. You can choose the credit card cash advance plan. Help is here right away!

The credit card cash advance plan allows you to use your credit card limit flexibly. The application can usually be made online and it is fairly simple. No documents are required for some and will be approved immediately. Money will be transferred through the Faster Payment System (FPS) to you and cash is ready at hand! There are also generous cash rebates!

Instant Review of the Pre-Approved Credit Limit and Repayment Period

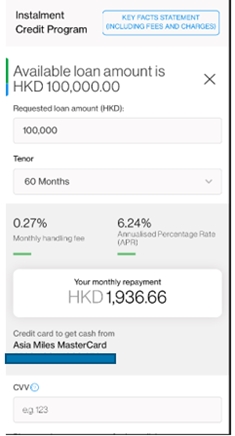

The credit card cash advance is taken against your credit card’s pre-approved credit limit. This is why there are some credit card cash advance plans in the market that enable you to review your individual pre-approved cash advance limit instantly when you make an online application. One example is Standard Chartered’s “Installment Credit Program” that enables you to preview the different repayment periods at a glance. You can easily compare the monthly repayment amount for the 6-60 months repayment plans and see the interest expenses.

Instant online approval. Instant Cash Transfer to Your Account.

After you have decided on the repayment period plans, the application will basically be approved in one click. A majority of the credit card cash advance plans do not require any additional documents, saving the review time! General loan application usage such as personal use, home renovation, medical, study and wedding preparations can be instantly approved!

Using Standard Chartered’s “Installment Credit Program” as an example, instant cash is transferred to your account immediately via the FPS after approval1. Not affected by factors such as weekends or working time, you can use the related funds instantly to meet your needs! The whole process can be completed on your mobile phone, no documents2 required, and approved in as fast as 30 seconds for instant transfer. Fast and convenient in solving your financial needs. Easy to transfer, get hold of every opportunity!

Low Interest Rates, High Loan Amount, and Flexible Repayment Period

Apart from having no requirements for income certificates and instant transfer upon instant approval, there are some credit card cash advance plans that have the advantages of relatively low interest rates and flexibility as compared to personal loans. One example is Standard Chartered’s “Installment Credit Program,” with actual annual interest rates lower than 3.04%3, loan amounts as high as 18 times the monthly salary or HK$1,200,000 (based on whichever is lower), and the repayment period is up to 60 months. This is similar to a personal loan! You can use the Installment Credit Calculator to enter your repayment amount and period to calculate the lowest actual annual rates and the lowest monthly repayment for your reference.

Some of the Credit Card Cash Advance Offers Additional Cash Rebates

Similar to a personal loan, some banks will offer additional rewards to the credit card cash advance plan. One example is Standard Chartered’s “Installment Credit Program,” the designated loan amount that can be received successfully for the designated repayment period can be as high as HK$5,000 cash rebate4! Regarding the loan amount and repayment period requirement, please refer to offer details or browse through the Bank’s website for the latest information.