Kickstart Your Dream Car Journey: Car Loan vs. Personal Loan: Which Is Better?

New car buyer? Compare car loans vs personal loans

Ready to buy your dream car but unsure whether to go for a car loan or a personal loan? Is collateral always necessary for auto financing? This article will address your questions, compare two types of auto financing options, explain how car loan calculations work, outline the car buying process and detail the conditions for car loans to help new or used car buyers choose the most suitable financing option.

What is a car loan? How is it calculated?

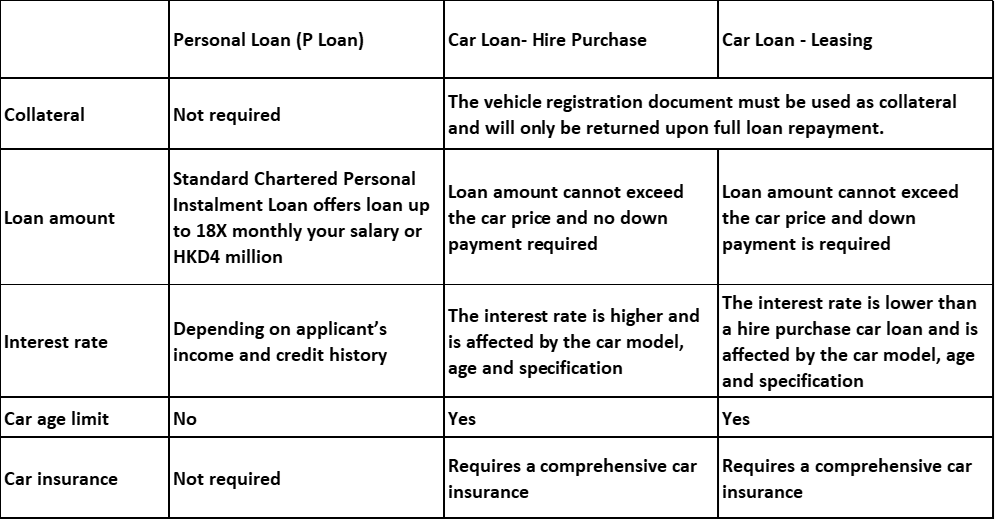

A car loan, typically arranged through dealerships or agents, enables buyers to purchase a vehicle. This type of loan is secured, with the vehicle registration document held as collateral until the loan is fully repaid. There are generally two different calculation methods used to determine the loan’s repayment schedule:

- Hire Purchase: No down payment is required and you only need to make monthly payments. However, the car loan interest rate is usually higher.

- Leasing: A down payment is required and is often calculated as the repayment period plus one month. For example, if the repayment period is 5 years, the down payment would be equivalent to 6 months of repayments. The benefit is that the car loan interest rate is generally lower.

Important considerations for traditional car loans:

- The vehicle registration document must be used as collateral and will only be returned upon full loan repayment.

- You must purchase a comprehensive insurance for the car.

- The annual interest rates for auto financing are generally less transparent and the options available are limited.

What is the car buying process?

Regardless if you are eyeing the latest models, snagging a discounted car or exploring a classic used car, you will need to follow the car buying process and prepare your budget once you have chosen your dream car. The car buying process can be broken down into the following steps:

- Arranging test drives and inspections.

- Signing the contract and placing a deposit while choosing the right car loan or personal loan option.

- Purchasing car insurance.

- Completing vehicle transfer (for used cars).

- Making final payments and taking possession.

With a Standard Chartered Personal Instalment Loan, you can borrow up to 18 times your monthly salary or HKD4 million (whichever is lower) to help you achieve your dream of hitting the road quickly. You can also use the Personal Instalment Loan calculator to estimate your monthly payments and the actual annual interest rate to start planning immediately.

Required documents for a car loan (traditional auto financing):

- HK ID

- Driver’s license

- Proof of address for the last 3 months

- Salary or tax statements for the last 3 months

- Bank statements for the last 3 months

Once submitted, initial approval usually takes a few working days

Conditions and limitations of a car loan (traditional auto financing):

- Collateral requirement: The vehicle registration document must be submitted as collateral when applying for auto financing. If you wish to change cars, renew your registration or change the license plate number during the loan period, the process can become cumbersome.

- Designated loan banks/companies: Car dealerships typically work with specific banks or financing companies, limiting your ability to compare and choose the most favourable car loan interest rates. This also results in lower transparency regarding interest rates.

- Mandatory insurance purchases: When applying for auto financing, you are generally required to purchase comprehensive car insurance and often from a specified insurance company. This restricts your freedom to choose the best insurance deal available in the market, making it difficult to ensure you secure the most cost-effective premium.

Personal loans (P loans) to purchase cars: A more flexible option

Due to limitations associated with traditional car loans, more car owners are opting for personal loans to purchase cars in recent years. Reasons Include:

- Transparent interest rates: Personal loans offer clear and transparent information on interest rates and promotions with no hidden fees. In contrast, car loan interest rates can be influenced by brokers, making objective comparisons difficult.

- Diverse options: You can choose from various loan plans, amounts, and repayment terms based on your needs. The loan amount can even exceed the car’s price, allowing you to manage your overall financial planning without affecting other financial and life goals.

- No age restrictions on cars: Personal loans can be used to purchase new cars, used cars or even older vehicles.

- High flexibility: Unlike traditional auto financing, which requires collateral, personal loans do not have such requirements and come with fewer restrictions. You do not need to pay off the remaining balance to the relevant institution before selling the car, making the process much more convenient. Applicants with good credit records may enjoy lower interest rates and take advantage of seasonal loan offers and trade-in deals to purchase vehicles at a better price.

- Flexible insurance options: Car loans often require you to purchase comprehensive insurance, but with personal loans, used car owners are not subject to this requirement and can opt for third-party insurance instead.

Comparing a personal loan vs a car loan for car purchases:

You can also visit the Investor and Financial Education Council website for more financial tips related to car purchases.

Apply for a Personal Instalment Loan and get ready to hit the road!

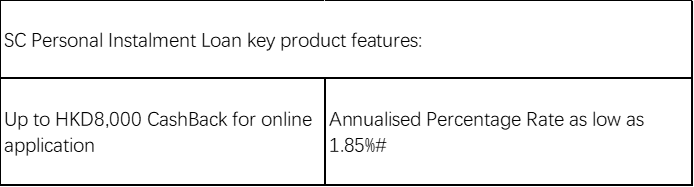

Using a personal loan strategically is a great choice for paving the way to the life you desire. Standard Chartered’s Personal Instalment Loan offers an effective Annualised Percentage Rate as low as 1.85%¹ with a repayment period of up to 60 months. You can borrow up to 18 times your monthly salary or HKD4,000,000², along with generous CashBack and Welcome Offer. Additionally, applications can be approved in as fast as 5 minutes, helping you seize every moment! You can use our Personal Instalment Loan calculator to customise your repayment period as well as calculate monthly instalments and interest rates based on your needs. The entire loan application process can be completed online with selected clients enjoying document-free applications (no income proof or credit reports required). Instant disbursement and various promotional offers are also available from time to time!

1The actual Annualised Percentage Rate and daily interest payments will vary based on your final approved loan amount and repayment period.

2The final approved loan amount will be the lower of two and is based on your personal credit status.

3Borrowers must comply with the bank’s terms and conditions.