5 Tips to Improve Your TransUnion (TU) Credit Score

Boost your credit rating and achieve future dreams

Planning for a fulfilling life begins with improving your credit ratin

Credit cards and personal loans have become popular choices for borrowing funds. However, when bills and card debts pile up or snowball into a cycle of debts, repayments can become challenging. Accumulated debts will eventually impact your TU credit rating and hinder your future life plans.

Does my TransUnion (TU) credit rating affect my major life plans?

Mortgage, loan application approval and loan amount

Many people may encounter unexpected challenges when entering new stages of life such as planning to buy a car, purchasing a property or getting married. These challenges may include inadequate loan amounts for car financing or property mortgages, higher than expected loan interest rates or the potential of having loan applications rejected, leading to substantial budget setbacks.

During the loan approval process, credit institutions assess client credit reports provided by TransUnion (TU). Clients with higher credit scores (TU) may qualify for better loan terms, including higher loan amounts, lower interest rates and longer repayment periods. According to a report by the Consumer Council*, a credit information service provider once conducted a comprehensive analysis and found significant disparities in loan terms offered to applicants seeking loans ranging from HKD50,000 to HKD75,000 with a 24-month repayment period. Applicants with an A-grade credit rating may receive an interest rate of approximately 6%, while those with an I-grade rating could face interest rates as high as 55%. That is a difference of up to 9 times! Therefore, it is important to establish a solid credit record and improve your credit rating early to secure favourable loan interest rates and reduce borrowing costs.

The factors that influence a successful immigration application

When applying for immigration, many countries may require applicants to provide credit reports. A favourable credit report enhances the likelihood of a successful immigration application. The longer your credit history, the more valuable it becomes as a reference. Consequently, if you are planning to immigrate, be sure to establish a positive and robust personal credit record as early as possible.

Impeding employment opportunities

Employers in finance, banking, insurance, accounting, information technology and law enforcement sectors may request applicants for credit reports. They review these credit records as part of their recruiting process to assess the applicant’s integrity and financial management abilities. So, it is important to maintain a positive credit record to increase your chances of being hired.

Can relying on financial companies lead to a vicious cycle?

Many individuals with poor credit ratings (TU) often find it challenging to secure funds from large financial institutions and turn to financial companies offering loans without credit reports instead. However, these types of loans have higher interest rates with lower loan amount compared to personal loans. As a result, applicants may struggle to make timely repayment due to the high interest rate, resulting in further declines in their credit ratings.

Above are common scenarios that contribute to financial difficulties and perpetuate a vicious cycle. Therefore, you may consider Standard Chartered Debt Consolidation Programme as a solution to improve your credit rating and effectively address these financial challenges.

How to improve and boost credit rating?

If you want to avoid the above challenges caused by poor credit ratings (TU), you must start “cleaning up” your credit rating today and put a stop to various harmful habits that affect your credit score negatively.

Make sure to repay credit card debts and all loans on time every month

Just one day of late payment for your credit card balances can impact your credit rating! It will also stay on your credit record for 5 years. To avoid accidentally missing repayments, you can set up automatic transfers for repayment. If you only pay the minimum amount over a long period, your total debt will continue to grow. This raises concerns from financial institutions about your repayment capability and negatively impact your credit rating. Standard Chartered Debt Consolidation Programme can specifically help you address the issue of excessive interest expenses.

Establish a good credit history

A good credit card repayment habit can help you establish a positive TU credit rating. Because without a credit card or any loan/mortgage record, it would mean you do not have a TransUnion credit report for financial institutions to assess your credit status. Apply for one or two credit cards to officially be on the record and repay on time to help yourself build a positive TU credit rating.

Pay attention to your credit card usage

Calculate your credit utilisation by dividing your credit card balances over the total credit limit of all your cards. If your credit utilisation is too high, financial institutions may question your spending habits and repayment capability, affecting your credit rating (TU). Accordingly, having more than one credit card can increase your total credit limit and lower your credit utilisation ratio while improving your credit score.

Regularly review your credit report information

The information in your credit report is provided by your financial institutions but you also have the right to contest any inaccuracies and request for corrections. Just submit your request to TransUnion and include a brief statement in your credit report. This statement will be recorded to provide the institutions inquiring about your credit rating with a clearer understanding of your situation.

Check your credit rating before borrowing

If you plan to apply for a personal loan, it is advisable to check your credit rating 6 to 12 months in advance. This gives you adequate time to improve your rating before borrowing funds.

Debt Consolidation Programme – A better option to save on interest, ea

If you are worried about your credit rating (TU), thinking of cleaning up your record but do not know where to start, or unable to cope with high interest repayments, Standard Chartered Debt Consolidation Programme can help. It allows you to consolidate various debts including credit card bills, outstanding loans and even credit card instalment payments at one go into one manageable repayment. This reduces the risk of missing repayment dates across different loan institutions and incurring late fees. Additionally, the plan also uses low-interest loans to repay high-interest credit cards or old debts, thereby reducing your interest expenses and improving your credit score. Standard Chartered Debt Consolidation Programme offers loans of up to 24 times your monthly salary or HKD2 million (whichever is lower), with monthly interest rates as low as 0.20% and zero handling fees. It helps you repay high-interest debts at a lower cost and save up to 95% on interest expenses. You can also choose repayment tenor of up to 84 months according to your needs.

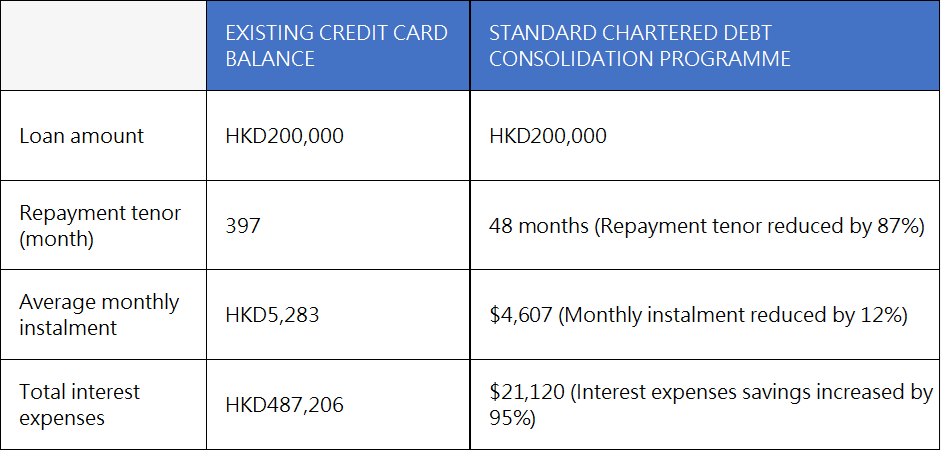

The following example illustrates how Standard Chartered Debt Consolidation Programme can help you save on repayment expenses by consolidating a HKD200,000 loan:

Our Debt Consolidation Programme also offers an additional cash reserve of up to 14 times your monthly salary to provide you the flexibility to pursuit major life plans such as renovations, wedding or furthering education. We also regularly offer promotions that provide cash rebates, lucky draws and other exciting rewards. If interested, please click here to apply now!

You can also use our loan calculator to quickly calculate repayment details and preview the monthly interest calculation formulas or visit the TransUnion website to learn how to read TU credit reports.

*Source: Consumer Council