Personal loan helps to solve the funding problem for overseas studying

Many people have dreamt about studying abroad, learning a foreign language, seeing new things, and experiencing life in a foreign country. An overseas degree also opens the path to better jobs. Even if you did not realize this dream when you were young, you may wish to send your children to study abroad. However, study overseas or acquiring a foreign degree requires a big sum. Perhaps personal loan can help you and your children make the dream come true!

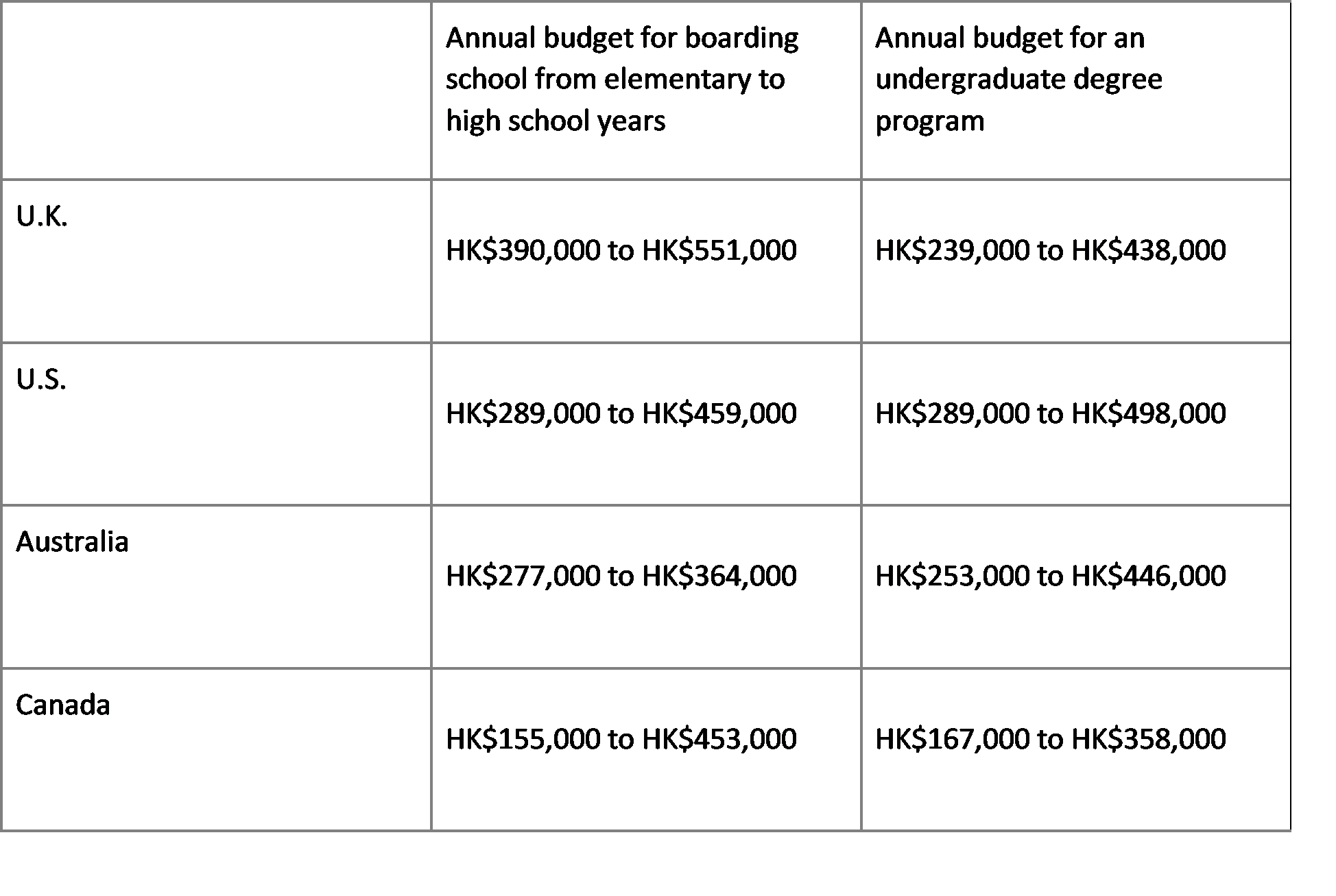

Annual budget for studying in the U.K., the U.S., Australia and Canada

Many people send their children to study overseas since elementary or high school years. Below is a list of annual budgets for elementary schools, high schools and universities in the U.K., the U.S., Australia and Canada. You can refer to these numbers to estimate the total cost of an overseas study plan. These are only proximations for tuitions and living costs (including accommodation, daily expenses, and insurance) as the actual number depends on tuition adjustments, subjects, inflation, exchange rates and living standards.

How to send children to overseas studies with limited self-funding?

How much does it cost to study abroad? The first thing to decide your total budget, which country, what subject and how long the program is. Take the example of the four-year university degree program in the U.S., It is possible to complete the study with a lower annual budget (HK$289,000) for those less-popular state universities require lower tuitions and living costs, which is total HK$1,156,000 for four years. Including other expenses such as airline tickets and summer classes, it will add up to about HK$1,200,000.

If you do not have HK$1,200,000 in cash on hand, does that mean you should drop the idea of studying overseas? You may consider taking a personal loan with monthly installments so that you can achieve the dream for your children. Also, many foreign visa applications require proof of funds. For instance, the U.S. requires deposit certificates for sufficient tuition and living costs (in general, deposits for six months or longer). Therefore, you will need to prepare a deposit of HK$1,200,000 first for a child to obtain the visa.

Take Standard Chartered Personal Loan and installment payments as an example, a loan of HK$1,200,000 with a 12-month repayment period only requires an annualized percentage rate as low as 1.18%1. This helps your child to realize the dream of studying overseas! If you would like to make repayments easier, you can go for a 60-month repayment period. This translates to an annualized percentage rate of 3.97% and a monthly payment of as low as HK$22,0442.

A few thousand HK dollars per month for a long-distance master’s degree to enhance your value at the workplace

In addition to sending your children overseas to study, you may also plan for yourself! If you are working and would like to acquire an overseas master’s degree for greater career prospects, you may consider long-distance master’s degree during the pandemic. You can continue working in Hong Kong and embark on studying, without leaving work for two to three years and without flying to a foreign country.

Long-distance learning is rapidly developing, with more and more universities and programs going online. Some tuitions are reasonable while some can be expensive. For example, the global MBA online program offered by the world-famous Queen Mary University of London can be studied full-time or part-time, the registration fee and the tuition for the 2021-22 long-distance degree (100% online) comes to about HK$184,701.

This is not an unattainable number. Take Standard Chartered Personal Loan and installment payments as an example, a loan of HK$185,000 with a 60-month repayment period only requires an annualized percentage rate of only 5.35% and a monthly payment of as low as HK$3,5122! Compared to the level of difficulty in getting into Queen Mary University of London, a monthly repayment of HK$3,5122 is quite easy for a working professional. If you need to study, do not allow tuition to limit your dream!