Large-Cap, Mid-Cap, and Small-Cap Funds: A Definitive Guide

Learn More Learn More

In a hurry? Read this summary:

Equity mutual funds, with the long-term capital appreciation and risk mitigation they offer via diversification, have become a popular choice amongst Indian investors. Equity funds are further classified into various sub-categories, depending on whether they invest in equity instruments by sector, geography, or market capitalisation.

Market capitalisation-weighted funds (or market-cap mutual funds) focus on companies of varied sizes across sectors and geographies. Read on to find out how they enable smarter asset allocation for one’s investment portfolio.

Market capitalisation (or market cap) refers to the total market value of a company’s outstanding shares. This is derived from multiplying a company’s share price by the total number of shares issued. Based on this number, companies are classified into small, mid, and large-cap companies.

Companies are ranked between 1 to 250 and accordingly categorised as large, mid or small-cap by the Association of Mutual Funds of India (AMFI) twice a year. This ensures changes in companies’ market cap, owing to share price movements, are reflected in their rankings regularly.

Types of market caps

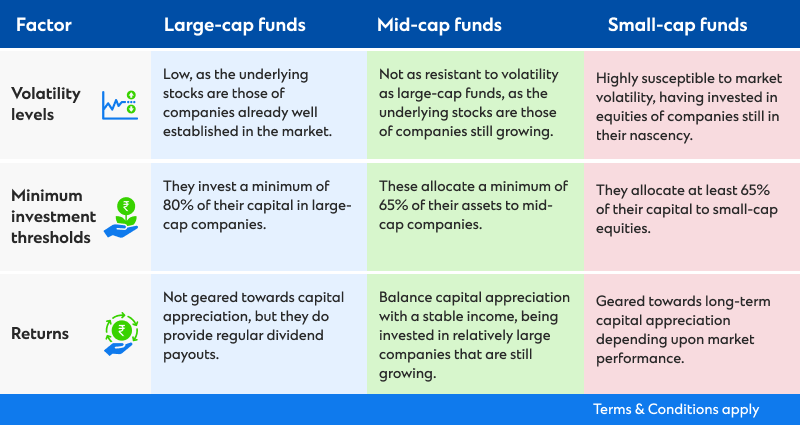

Large-cap funds invest at least 80% of their assets in equity-linked instruments of large-cap companies, as per SEBI (Securities Exchange Board of India) rules. These companies are highly reputed and are known to provide stable income streams via dividend payouts and capital preservation. Absolute returns on these funds may be lower than mid-cap and small-cap funds, however. During market slumps, large-cap funds also experience volatility in their net asset values (NAV). Since money is invested in financially strong companies, however, they overcome this volatility relatively quickly.

Mid-cap funds invest a minimum of 65% of their capital in companies ranked between 101 to 250 by AMFI. These funds are geared towards investors looking for higher returns compared to large-cap funds, bearing in mind the future growth potential of companies in this segment, while also being ready to take on higher levels of risk. Mid-cap funds are suited to investors with a horizon of at least five to seven years, to be able to reap the benefits of the power of compounding.

Large and midcap funds: The middle ground

Large and mid-cap funds provide investors with a middle ground between growth and stability. They allow them to invest in a larger universe of as many as 250 companies in the country. A minimum of 35% of their capital is invested in each large and mid-cap companies.

In the short term, these funds are susceptible to higher volatility levels, arising from mid-cap equities. It is therefore generally recommended that one stay invested in these funds for at least three years or longer.

Small-cap funds invest at least 65% of their capital in companies ranked 250 and beyond in terms of market capitalisation in India. These funds are extremely sensitive to market movements and, therefore, often see elevated levels of volatility. The slightest shifts in the market can have a substantial impact on the prices of their underlying assets.

At the same time, however, companies that are growing and expanding may also offer substantial returns in the long run. They are recommended more for investors with a higher risk appetite and a longer investment horizon. This typically includes those just starting out in their careers, as they may have more time and capital over an extended period to recover from any potential losses.

Each fund responds to market cycles differently. Their relevance in investor portfolios is therefore dynamic. Aligning each one with evolving financial goals at various stages allows one to build an investment portfolio that balances resilience and growth in equal measure.

Start your investment journey via SC Invest on the SC Mobile app today.

How to Choose Mutual Funds: Insights for Savvy Investors

Standard Chartered Bank, India (‘Bank’) is an AMFI-registered distributor of mutual funds and referrer of other third-party investment products and does not provide any investment advisory services as defined under the SEBI (Investment Advisers) Regulations, 2013. Mutual fund investments are subject to market risks, please read scheme related documents carefully before investing. Past performance is not indicative of future returns. Apart from the RM-assisted journey, SC Invest is an EXECUTION-ONLY platform. The Bank does not provide any investment advice or investment recommendations in respect of any transaction effected through the SC Invest platform.

The contents on this webpage are for general information only and does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. You are fully responsible for your investment decision, including whether the product or service described here is suitable for you. Standard Chartered Bank will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of the information in this webpage. The contents herein are for general evaluation only and has not been prepared to be suitable for any particular person or class of persons. Standard Chartered Bank makes no representation or warranty of any kind, express, implied or statutory regarding the contents on this webpage or any information contained or referred to herein. This webpage is distributed on the express understanding that, whilst the information in it is believed to be reliable, it has not been independently verified by us.

This communication has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Standard Chartered Bank India (“SCB/ Bank”) does not warrant its completeness and accuracy. This information is not intended as an offer or solicitation for the purchase or sale of any financial instrument / units of Mutual Fund. Recipients of this information should rely on their own investigations and take their own professional advice. Neither SCB/Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. SCB Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may, from time to time, have investments / positions in Mutual Funds / schemes referred in the document.

Standard Chartered Bank (“SCB/ Bank”) is a AMFI-registered Mutual Fund Distributor & a Corporate Agent for Insurance products.