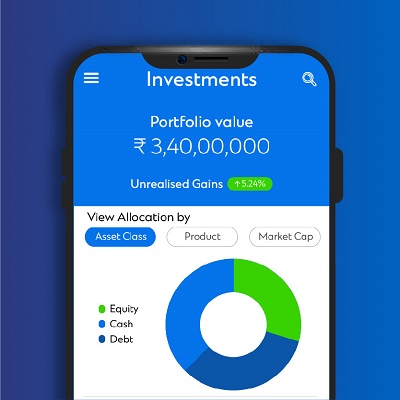

Investments

Standard Chartered Bank, India is an AMFI-registered Mutual Fund Distributor. In its capacity of a distributor/referrer, Standard Chartered Bank may offer advice which is incidental to its activity of distributors /referral.

Standard Chartered Bank will not charge any fee / consideration for such advice and such advice should not be construed as ‘Investment Advice’ as defined under the Securities and Exchange Board of India (Investment Advisors) Regulations, 2013 or otherwise.

Investments are subject to market risks. Please read scheme related documents carefully before investing. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the scheme(s). All products are subject to suitability and availability.

Online Mutual Funds:

The Online Mutual Funds platform is an EXECUTION-ONLY platform.

If you wish to receive advice from us in relation to transacting in Mutual Funds, you should not use the Online Mutual Funds Platform but should instead contact your banker for further information.

We are not acting as your Investment Advisor nor providing Investment Recommendations in respect of any transaction effected through the Online Mutual Funds platform, and you must not regard it or us as acting in that capacity.

You should consult your own Independent Legal, tax and Investment Advisors before entering into any transaction via the Online Mutual Funds platform and only enter into a transaction if you have fully understood its nature, the contractual relationship into which you are entering, all relevant terms and conditions and the nature and extent of your exposure to loss.

Insurance

For life insurance products : Standard Chartered Bank, India having its office at Crescenzo Building C-38/C-39 G Block, Bandra Kurla Complex, Bandra (East), Mumbai – 400051 is a licensed Corporate Agent of ICICI Prudential Life Insurance Company Limited (IRDA registration no. 105)

For General Insurance Products : Royal Sundaram General Insurance Co. Limited (IRDA Registration No. 102)

For standalone Health Insurance Products : Niva Bupa Health Insurance Company Limited (IRDA Registration no. 145) vide composite license number CA0028.

All insurance plans are underwritten by the respective insurance companies. The benefits/ features of the products are indicative only. For more details on risk factors and terms and conditions, Please read sales brochure carefully before concluding sale. Insurance is the subject matter of solicitation.

ICICI Prudential Life Insurance Company Limited(IRDA Registration No.105. CIN:L66010MH2000PLC127837)

Registered Office Address : ICICI Pru Life Towers, 1089 Appasaheb Marathe Marg, Prabhadevi, Mumbai – 400 025.

Local Contact : 1-860-266-7766 (10am-7pm, Monday to Saturday, Except on national holidays and valid only for calls made from India)

Niva Bupa Health Insurance Company Limited (IRDA Registration No.145 CIN No. U66000DL2008PLC182918)

Registered Office Address: Max House, 1 Dr. Jha Marg, Okhla, New Delhi – 110020 Fax: +91 11 30902010.

Local Contact : 1800-3010-3333(Toll Free).

Website : www.nivabupa.com

Royal Sundaram General Insurance Co. Limited (formerly known as Royal Sundaram Alliance Insurance Company Limited , IRDA Registration No. 102. CIN: U67200TN2000PLC045611)

Registered Office Address: Vishranthi Melaram Towers, No.2/319 , Rajiv Gandhi Salai(OMR), Karapakkam, Chennai – 600097.

Contact : 1860 425 0000.

Website: www.royalsundaram.in

Beware of spurious phone calls and fictitious / fraudulent offers

IRDA clarifies to public that

- IRDA or Its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums.

- IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number.