says Standard Chartered Wealth Management

KUALA LUMPUR, 27 July 2016— In the current uncertain environment, investors should complement multi-asset income with more absolute return multi-asset macro strategies in order to manage allocation drawdown risks, says Standard Chartered Wealth Management Group.

Steve Brice, Chief Investment Strategist, Standard Chartered Bank, commented:

“Finding value is the key challenge facing investors. With the US economy likely late in its cycle, equity markets fully valued and increased volatility following the Brexit decision, there are significant risks to the outlook for global equities. That said, we would still hold an allocation to equities given the possibility of improvements in the performance of equities and positive earnings surprises.”

Emerging Market (EM) equities are expected to continue underperforming, particularly with China quickly backtracking on the economic stimulus implemented earlier this year. With the growth differential expectations between Developed Market (DM) and EM a key factor in the relative performance of each investment class, and a lower conviction as to which regions will outperform or underperform, a more balanced exposure within equities may make sense.

Within EM equities, Asia ex-Japan is preferred over non-Asia EM, with developing Asia (India, Indonesia, Thailand and Malaysia) expected to outperform developed Asia (Taiwan, China, Hong Kong and Singapore).

Danny Chang, Head of Managed Investments and Product Management, Wealth Management, Standard Chartered Bank Malaysia, said:

“Relative to the start of the year, we have become considerably more selective within equities while our preference for bonds has been on a rising trend through H1 2016. We would advise investors to increase their allocation to more defensive asset classes, such as US investment grade corporate bonds and global macro strategies.”

From a commodities perspective, the Wealth Management Group is more bullish on the outlook for gold and oil than for base metals. Gold looks set to target $1400 in the coming 3 months while oil prices are likely to be capped around $60-65 per barrel.

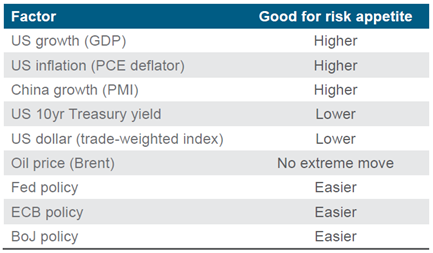

In its H2 2016 Global Market Outlook, which provides a review of 2016’s A.D.A.P.T. investment framework, the Wealth Management Group analyses nine macro variables through four scenarios for the rest of the year.

By understanding the implications of each scenario for each asset class, investors can opt for a more balanced allocation or be more dynamic and focus on short-term tactical opportunities that may arise when asset classes become oversold.

Table 1: Nine macro variables and their impact on risk appetite

“The bottom line is that focusing on just one asset class is very risky – investors should adopt a balanced approach to investing, including some hedges against volatility,” added Chang.

-ENDS-Quick Links

Executive Bios

Our Views

Our experts share their opinions on the world of banking. Read their views and add your own.

Hear from our experts

Our experts share their opinions on the world of banking. Read their views and add your own.

Hear from our experts

Global Research

Our exclusive research is available for clients, journalists and staff. Please register or login for full access.

Register for our research

Read our latest reports

Our exclusive research is available for clients, journalists and staff. Please register or login for full access.

Register for our research

Read our latest reports