It removes emotions from investment decisions and ensures you maintain focus on your long-term investment and protection goals through regular investing, monitoring and portfolio rebalancing.

Putting it into action:

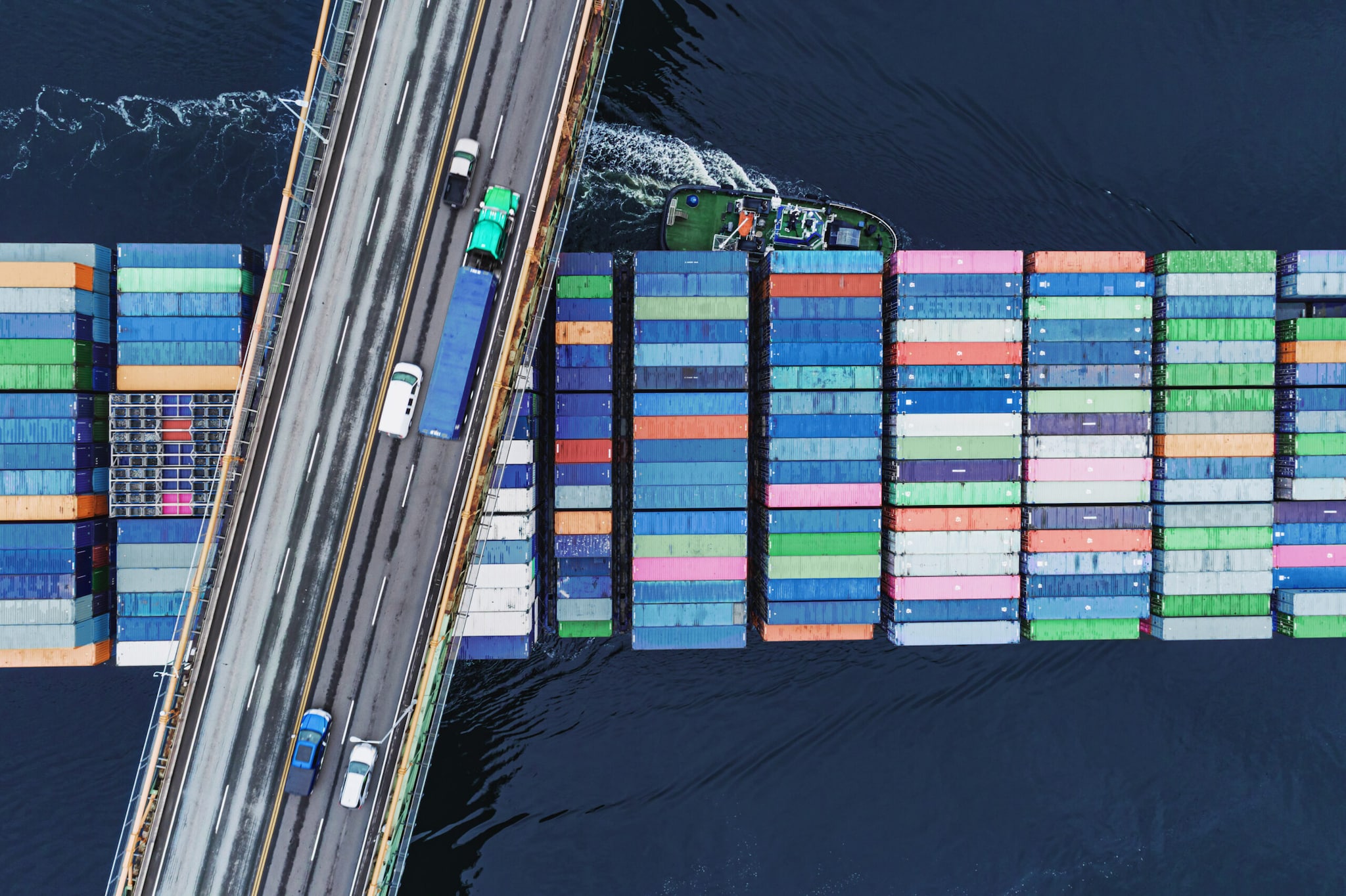

Don’t put all your eggs in one basket. Diversification allocates your investments into a variety of asset classes, geographies and sectors, to build a portfolio with a variety of investments that have different expected risks and returns. This can reduce the risk in your portfolio and achieve more stability.

Building a diversified portfolio:

Time in the market generates more consistent returns. Investing for the long term, and not worrying about daily market fluctuations, helps ride out bumps and avoid missing the best performing days, which can impact your returns.

Avoid timing risk:

The relationship between risk and return is important in making sound financial decisions. Understanding what risk you’re willing to take, and how best you can manage these risks, helps maximise returns on your portfolio.

Managing risks:

Don’t let the unexpected catch you unprepared. Protecting the value of what you have, and what you will generate in the future is important.

A good protection plan:

Please complete the following and we’ll reach out soon. Thanks!

Full Name as per IC

Mobile Number

Preferred Area

I am an existing standard chartered bank customer