Table of Contents

In a rush? Read the summary:

- Malaysians can choose from a range of investment products such as bonds, unit trusts, stocks and more.

- Bonds are a safer investment, but stocks, forex, ETFs, etc. may hold potential for better returns.

- The most important thing is to educate yourself about investment risks before making big decisions.

While saving money is an important aspect of personal finance, most people know that the real key to building wealth is good investing habits. Investing is a path to increasing your savings through products such as bonds, real estate, unit trusts, equities and more. While keeping your money in a traditional savings account is a low-risk way to earn money through interest, these financial products may offer better returns over time. The risk varies based on many factors like the investment product itself, the industry, the market conditions, etc.

With many investment options available in the market, it can be difficult for a novice to choose the right investments. We’re simplifying the complex landscape of investing by breaking down how different investments work and offering tips for investors.

Traditional investment options in Malaysia

Stocks

Stocks offer investors equity in companies such as public listed companies. They offer two forms of return. Firstly, investors can benefit from dividend payments. Secondly, when stock prices increase, investors can enjoy capital gains by selling their stocks. Stock investments offer good potential for returns but investors should be willing to take on market risks. After all, if the company you own stock in liquidates, creditors like bond holders are paid off before shareholders.

Bonds

A bond is a debt security that represents an investor’s loan to the government or a private company. They have a fixed maturity and typically offer periodic returns (known as the coupon rate) as well as the principal on maturity. While bonds are considered less volatile compared to stocks, the price of a bond may decrease under certain conditions. The returns may also be lower than other investment products.

Are stocks riskier than bonds?

Common investment wisdom suggests that investing in stocks is riskier than bonds. However, a closer look reveals that each investment product has its own pros and cons. Coupon payments and fixed maturity dates make returns from bonds all but guaranteed. The primary concern for bond holders is whether or not the bond issuer can fulfil their debt commitments. On the other hand, returns with stocks are not as certain.

Even so, stocks may be able to generate better returns compared to bonds, especially if investors seek out dividend-paying stocks. The potential gain is higher with stocks provided investors are willing to brave the risk.

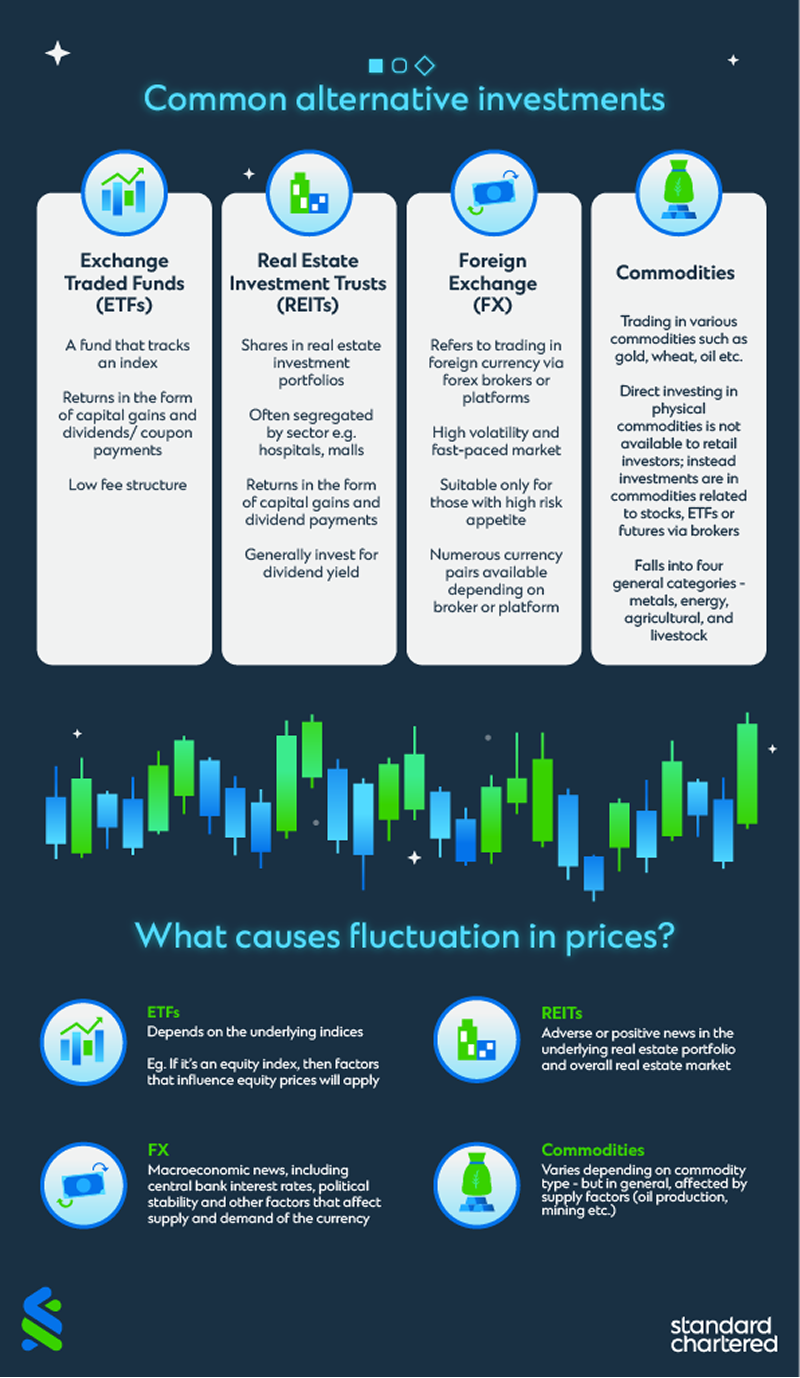

Types of alternative investments

There’s a wealth of options available to investors who want to look past stocks and bonds.

Real Estate Investment Trusts (REITS):

REITs are an accessible way for investors to buy fractional shares of commercial real estate. They can benefit from rental income distribution and capital appreciation with the hassle of owning real property.

Exchange Traded Funds (ETFS)

An ETF is a basket of securities tied to the performance of an underlying asset such as an index or a commodity. Investors can choose from many different types of ETFs (Passive ETFs, actively managed, commodity ETFs, currency ETFs etc.). ETFs offer a cost-effective path to investing in many different sectors.

Foreign Exchange (FX)

Forex investing involves trading different currencies in an effort to profit from currency rate fluctuations. Buying and selling foreign currency can be a good bet for some investors, but this approach requires considerable market knowledge.

Commodities

Commodity trading refers to the sale and purchase of products like oil, gold, wheat, and other raw materials/natural resources without physical ownership. This is usually done through instruments like futures contracts.

Unit trusts: the best of traditional and alternative investments

A unit trust pools funds from different investors to buy securities that align with the fund’s objective. Unit trusts are usually actively managed by a professional fund manager and may have management fees, but they’re still considered affordable and accessible, especially for novice investors. Investors can turn a profit by selling their units at a bid price that’s higher than their original purchase price. Read our guide to learn how unit trusts compare to ETFs and find your best fit.

To get started, kindly leave your contact information here and one of our Relationship Managers will get in touch with you.