Short on time? Here’s what to expect from the article:

- Blue-chip stocks offer stability and steady dividends but are not risk-free investments

- They are highly liquid and can help diversify your portfolio

- Assess a company’s recent and historical performance before making investment decisions

What are blue-chip stocks?

Blue-chip stocks are associated with established and reputable companies that have shown a strong track record of financial performance. The term “blue chip” dates to 1923 and comes from poker, where blue chip tokens had the highest value. In the world of finance, blue-chip stock is associated with high price, quality, and reliability.

Share prices for such companies may be high, but they are valued for their ability to provide stable dividend payouts. In Malaysia, some examples of companies with blue chip stocks found on KLCI are Petronas Gas Bhd, Maxis Bhd, Telekom Malaysia, Tenaga Nasional Bhd, CelcomDigi Berhad, MISC Bhd, Top Glove Bhd, and Genting Malaysia, to name a few. Due to their stable nature, blue-chip stocks are seen as a reliable investment option and are often added as a form of diversification in an investment portfolio.

Advantages of blue-chip stocks

Wondering what makes blue chip stocks a strong addition to your portfolio? Learn what they offer below.

– Stability and reliability: Blue chip companies are generally well-established and financially stable industry leaders. In Malaysia, these firms are often part of the FTSE Bursa Malaysia KLCI (FBM KLCI) index, which tracks the 30 largest companies. Their size and track record make them a resilient choice during market downturns, offering your portfolio stability.

– Comparatively lower risk: Blue-chip companies tend to have a stable financial performance overall thanks to factors like established reputation, strong balance sheets, or dominance in specific industries. This makes them generally less volatile compared to mid- or small-cap stocks.

– Assured returns: Many Malaysian blue chips are known for paying consistent dividends. Investors enjoy a safe and steady stream of passive income, which is especially attractive for anyone seeking both growth and income.

– Liquidity and market trust: A stock has high liquidity if it has large trading volumes with a vast number of investors actively taking part in the trading. Blue chips are heavily traded which makes them highly liquid. This means you can easily sell shares without worrying about exit difficulty.

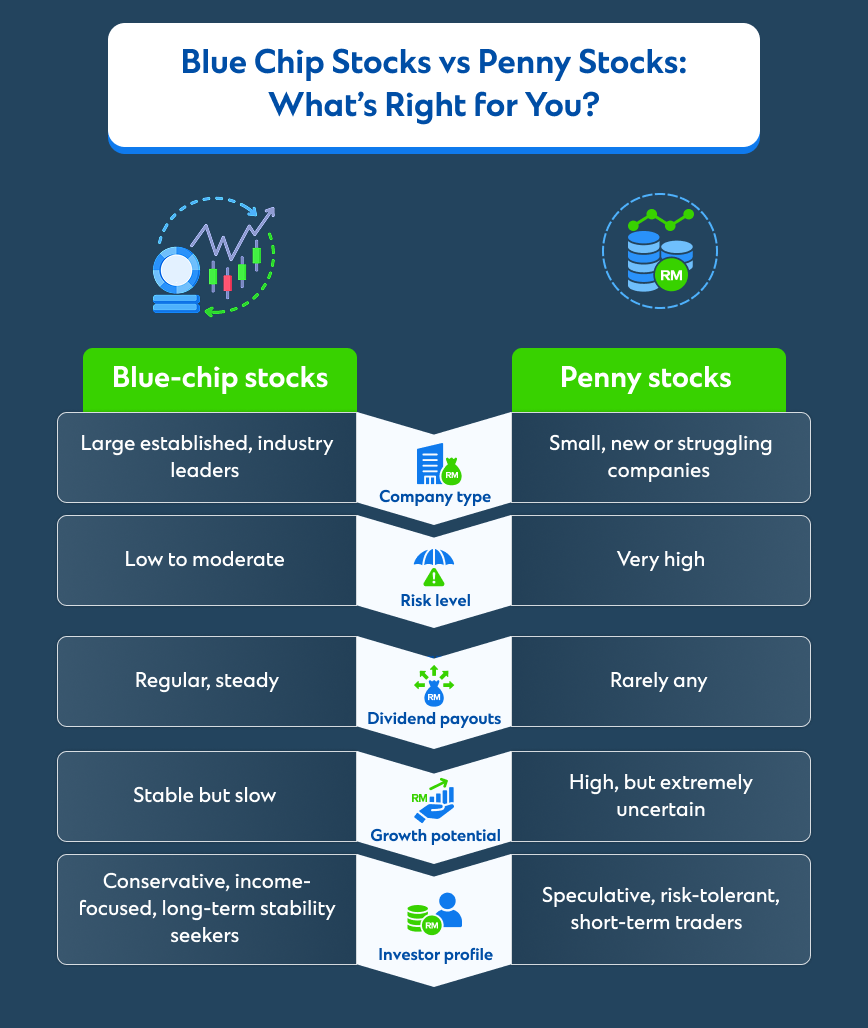

– Portfolio diversification: Blue chip stocks provide a strong foundation for diversified portfolios. In Malaysia, they tend to cover key sectors like banking, energy, telecommunications, and property, and may help spread your investments across industries, reducing the impact if one sector underperforms. Blue chip stocks can be a good addition to portfolios that prioritize riskier investments like penny stocks and foreign exchange.

Blue-chip stocks are a great investment option for the majority of investors. However, there are some disadvantages associated with investing in blue-chip stocks.

– Low growth: Since all blue-chip companies have moved past the high growth phase, they can offer stable returns but slow growth.

– High stock price: Blue-chip stocks tend to be from companies with a long history of consistent financial growth. Hence, their stock prices may be on the higher end.

What to consider when investing in blue chip stocks

Here’s what investors should focus on when evaluating blue-chip stocks to invest in.

– Market capitalisation: An easy way to identify blue-chip companies is that they’re often (but not always) among the top companies with large market capitalisation.

– Company performance: Evaluate the company’s annual and quarterly reports to understand its recent performance and any management changes.

– Historical performance: Analyse the company’s performance with its dividend payments (both amount and frequency) and reported earnings over the decade.

– Stock diversification: Diversifying the portfolio across high-quality blue-chip stocks helps mitigate some of the risks investors face.

– Global presence: The blue-chip companies with global presence tend to do well by offering growth opportunities in various markets.

If you’re a Standard Chartered client with a Current or Savings account, log in to SC Mobile app to explore our proprietary equity trading platform SmartStocks.

Related articles:

The Definitive Guide to Gold Investment in Malaysia