SmartStocks online trading platform: Invest in global stocks seamlessly

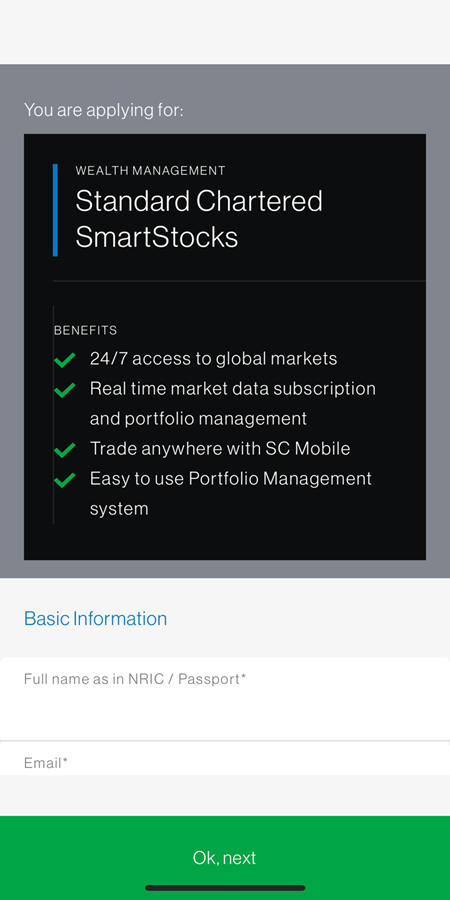

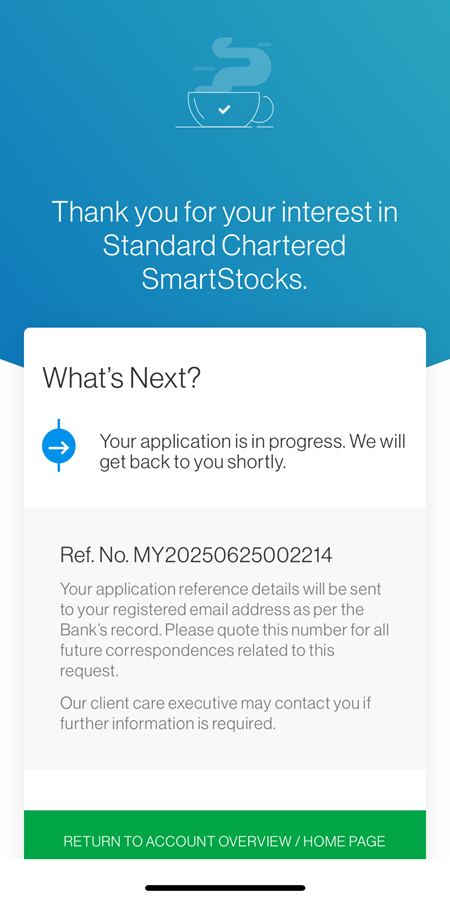

Trade with SmartStocks and access 12 exchanges across 7 global markets. Enjoy preferential brokerage rates with no hidden fees.

Equity investment involves risks. Terms and conditions apply.

Get ahead with up to 0% brokerage fees on your trading account

Start trading today as a Priority Banking client to take advantage of our current campaign. Terms and conditions apply.

Why SmartStocks?

What sets our proprietary equity trading platform apart

Trade and invest smarter

Navigate global equity markets confidently, backed by in-depth market analyses and expert insights with StockReport+ on our award-winning online platform.

Secure

Sleep soundly by securing your money with Malaysia’s first bank.

Invest in global stocks

Global trading has never been easier, with all-in-one pricing for seamless transactions. Unlock opportunities across 12 exchanges in 7 markets today.

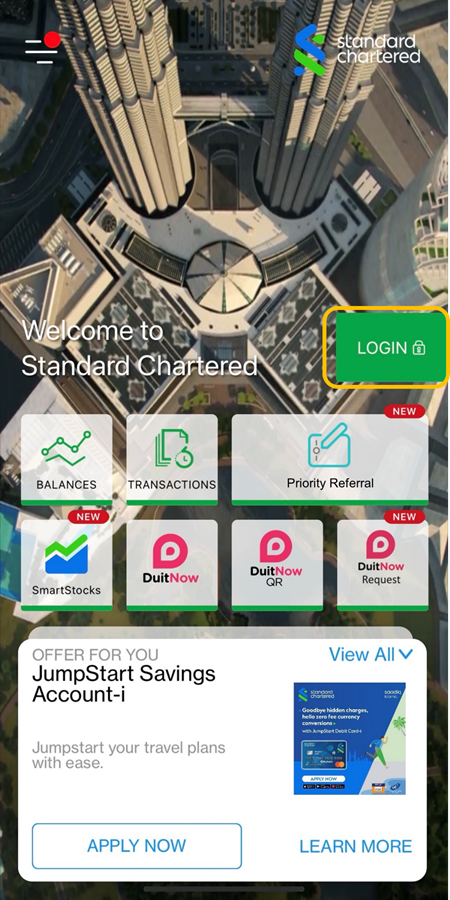

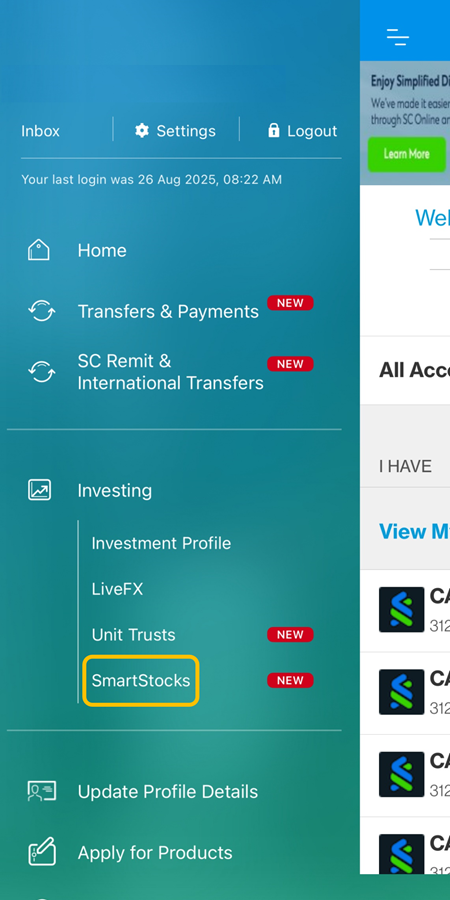

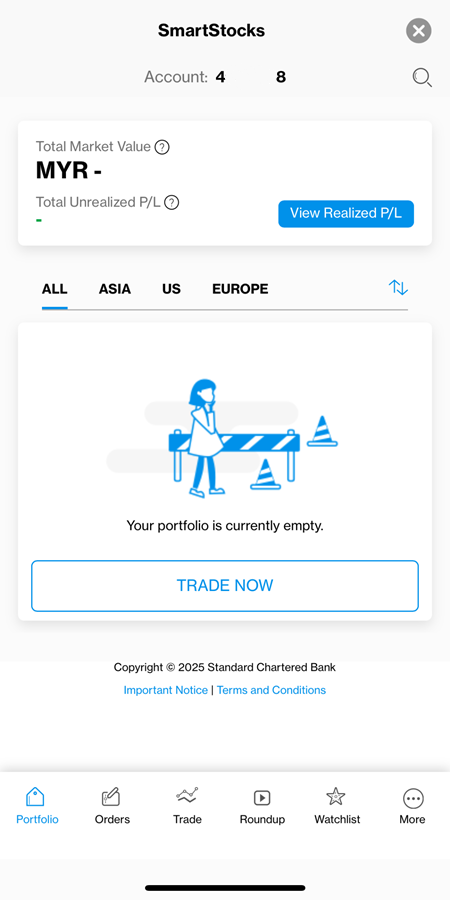

Convenience, at your fingertips

All your trading, banking and foreign exchange needs are conveniently met in one place to enable you to trade in foreign markets faster.

Why SmartStocks?

What sets our proprietary equity trading platform apart

Trade and invest smarter

Navigate global equity markets confidently, backed by in-depth market analyses and expert insights with StockReport+ on our award-winning online platform.

Secure

Sleep soundly by securing your money with Malaysia’s first bank.

Invest in global stocks

Global trading has never been easier, with all-in-one pricing for seamless transactions. Unlock opportunities across 12 exchanges in 7 markets today.

Convenience, at your fingertips

All your trading, banking and foreign exchange needs are conveniently met in one place to enable you to trade in foreign markets faster.