Table of Contents

- What are REITs and how do they work?

- REITs vs. direct property investment in Malaysia

- How to invest in REITs in Malaysia

- REIT dividends: Everything you need to know

- REITs as an investment strategy in Malaysia

- REITs vs. other investment avenues

- Risks and considerations

- Why Malaysian REITs deserve a place in your portfolio

Short on time? Here’s what to expect from the article:

This article offers a complete guide to investing in Malaysian Real Estate Investment Trusts (REITs) and aims to cover how they work, their advantages over direct property, and key risks. Readers will learn how REITs offer access to income-generating property with lower capital, greater liquidity and tax efficiency.

Malaysian Real Estate Investment Trusts (REITs) are fast becoming the preferred vehicle for investors seeking exposure to income-generating property—without the challenges of direct ownership. For those looking to invest in Malaysia’s property market with liquidity, diversification, and stable income, REITs offer a practical, tax-efficient route.

As of 2024, REITs in Malaysia collectively represent over RM40 billion in market capitalisation across sectors like retail, healthcare, industrial, hospitality, and offices. For investors, the case for REITs has never been stronger.

What are REITs and how do they work?

A REIT (real estate investment trust) is a publicly listed entity that owns or manages income-producing properties. Investors buy REIT units on Bursa Malaysia, similar to stocks, and receive rental income via dividends.

Introduced in 2005, REITs are regulated by the Securities Commission Malaysia. To maintain tax-exempt status, they must distribute at least 90% of their taxable income—making them ideal for income-focused investors seeking REIT dividends.

REITs vs. direct property investment in Malaysia

| Feature | Malaysian REITs | Direct Property Investment |

| Capital Required | Low; invest from RM1,000 onwards | High; includes down payment, legal fees, taxes |

| Liquidity | High; units traded on Bursa Malaysia | Low; sales may take months |

| Management | Passive; handled by professionals | Active; requires personal involvement |

| Return Profile | Steady income, moderate volatility | Higher upside potential but greater risk |

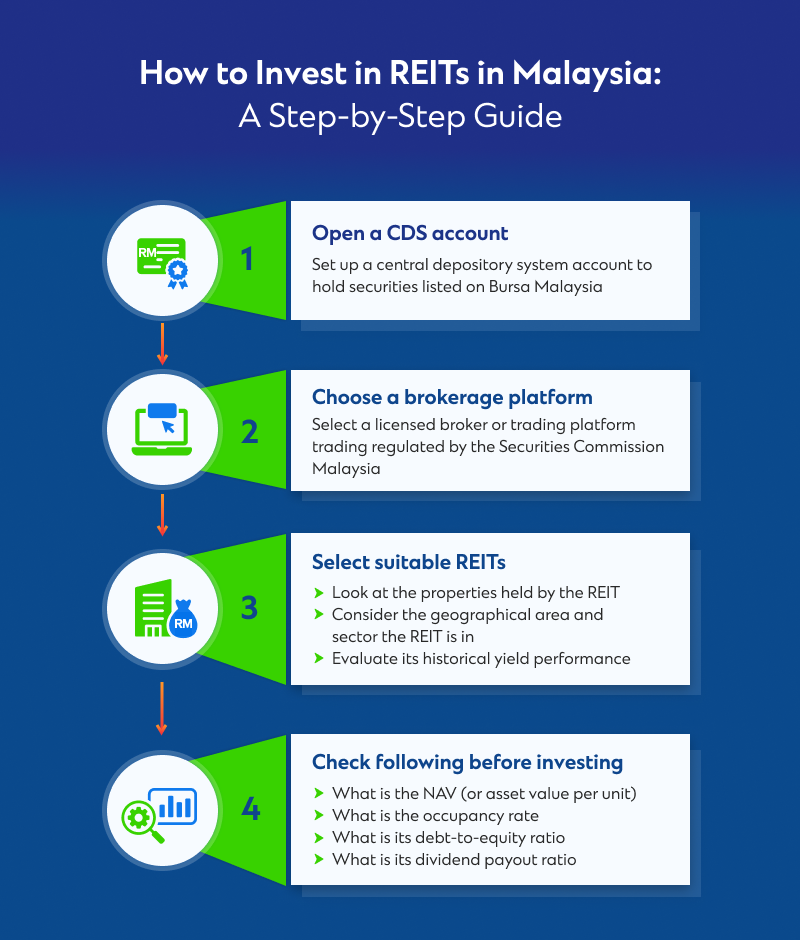

How to invest in REITs in Malaysia

Follow the steps below to start investing in REITs today:

Step 1: Open a CDS account through SmartStocks or Unit Trust

Step 2: Select suitable REITs, considering:

- Sector focus: Retail, industrial, healthcare

- Dividend yield: Ideally over 4.5% with consistent payouts

- Manager quality: Track record, tenant mix, acquisition strategy

Step 3: Evaluate key metrics:

- NAV per unit

- Occupancy rate

- Gearing ratio

- Dividend payout history

REIT dividends: Everything you need to know

How REITs generate and distribute income

REITs earn revenue through rental income and service charges. Their structure ensures regular distributions of income—making them attractive for both growth and income investors.

Factors influencing dividend yields

Dividend yields are influenced by:

- Occupancy rates: Higher rates equal steadier income

- Rental escalations: Built-in increases boost yields

- Asset quality: Prime locations attract stronger tenants

- Cost control: Lower operating costs enhance payouts

- Interest rates: Rising rates may impact REIT prices

REITs as an investment strategy in Malaysia

REITs have emerged as a pivotal instrument for investors aiming to gain exposure to Malaysia’s dynamic real estate market without the complexities of direct property ownership.

By investing in REITs, both local and foreign investors can access a diversified portfolio of income-generating properties, including commercial, retail, and industrial sectors.

Access to multiple property sectors

M-REITs span office towers, shopping centres, warehouses and logistic hubs, hotels, and hospitals. This diversification reduces risk and smooths income streams.

Inclusive for all investors

Foreign investors can enter Malaysia’s real estate market without direct ownership hurdles. Local investors gain access to premium assets usually out of financial reach.

Professional management and operational efficiency

Professional teams handle acquisitions, leasing, and compliance—removing the operational burden from investors.

High liquidity

Unlike direct property, REIT units can be bought or sold quickly on the stock exchange.

REITs vs. other investment avenues

| Investment Option | Risk Level | Liquidity | Entry Barriers | Tax Treatment | Return Potential |

| Fixed Deposits | Low | High | Very Low | Taxable Interest | 2–3% annually |

| Unit Trusts | Moderate | Moderate | Low | Taxable Dividends | 4–6% historically |

| Direct Property | Moderate–High | Low | High | Rental/Capital Gains | 5–8% net of costs |

| Equities | High | High | Moderate | Dividends/Capital Gains | Highly variable |

| Malaysian REITs | Moderate | High | Low | 10% Withholding | 4–6% dividend + growth |

As shown, REITs offer a balanced mix of liquidity, moderate risk, and tax-efficient returns, making them attractive for investors seeking property exposure without the traditional barriers of direct ownership.

Risks and considerations

Like all investments, REITs carry risks:

- Market fluctuations can affect unit prices

- Interest rate hikes may pressure valuations and payouts

- Regulatory changes could alter tax or ownership rules

- Managerial missteps can impact performance

- Review financials, tenant exposure, and debt levels regularly before investing.

Why Malaysian REITs deserve a place in your portfolio

Malaysian REITs offer a compelling avenue for investors to access diversified, professionally managed property portfolios with consistent income. Their low capital requirement, tax efficiency, and liquidity make them suitable for a wide range of portfolios—especially for HNW investors seeking passive income streams.

However, like all investments, REITs carry risks that must be carefully evaluated. Investors are encouraged to conduct comprehensive due diligence and consult licensed financial advisers to align REIT investments with broader financial goals.

If you’re considering adding REITs to your portfolio, explore our wide range of REIT-linked unit trust funds via the Standard Chartered Fund Library. You’ll find local and global opportunities suited to your financial goals. If you’re a Standard Chartered client with a Current or Savings account, login to SC Mobile to explore the REITs-related investments funds available.