Table of Contents

- The evolving role of Sukuk in institutional-grade portfolios

- Structural innovation in Sukuk investment frameworks

- Strategic positioning of Sukuk in portfolio architecture

- Types of sukuk that suit bespoke portfolio objectives

- How to invest in sukuk in Malaysia: Access, instruments, and regulation

- Sukuk in Malaysia: Market depth and issuer sophistication

- Risk management and governance in high-value Islamic bond allocations

- Strategic outlook: Sukuk at the intersection of conviction and capital

Short on time? Here’s what to expect from the article:

This article explores advanced sukuk investment techniques tailored for high-net-worth portfolios, highlighting their role as ethical, asset-backed income instruments. It covers Malaysia’s leadership in sukuk issuance, evolving structures like ESG-linked and hybrid sukuk, and strategic integration within institutional portfolios. Designed for resilience, sukuk now combine Shariah compliance with sophisticated yield and governance frameworks suitable for modern wealth architecture.

The evolving role of Sukuk in institutional-grade portfolios

Sukuk, also known as Islamic bonds, are now embraced not just for Shariah compliance, but as strategic, asset‑linked alternatives designed to generate yield and preserve capital. High-net-worth-individuals (HNWIs), Islamic wealth managers, and sovereign funds are increasingly allocating to these instruments—recognising their portfolio-level benefits alongside their Shariah alignment.

Structural innovation in Sukuk investment frameworks

Beyond basic leasing (Ijarah), sophisticated structures support bespoke HNW strategies:

- Sukuk al‑Wakalah – delegated asset management

- Sukuk al‑Musyarakah – joint ventures with profit/loss sharing

- Sukuk al‑Istisna – tailored project financing

Hybrid and ESG-linked sukuk, multi-tranche issuances, and trust-structured mandates allow precision targeting of long‑duration income.

Strategic positioning of Sukuk in portfolio architecture

Sukuk offers risk diversification through low correlation to equities and conventional debt, an edge during rate hikes or market disruptions. They function as a credible income sleeve within liability-driven or multi-asset portfolios, delivering disciplined returns and regulatory transparency.

Types of sukuk that suit bespoke portfolio objectives

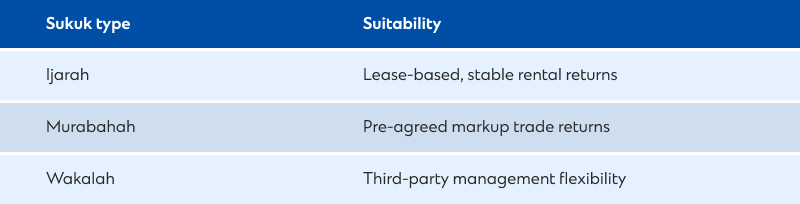

Each format offers different liquidity profiles, surplus distribution methods, and risk-return dynamics—making them suitable for large-ticket allocations or institutional wrappers.

Explore sukuk-focused funds available on SC Mobile or discover professionally managed Shariah-compliant strategies aligned with your portfolio objectives.

How to invest in sukuk in Malaysia: Access, instruments, and regulation

Malaysia is a global hub for sukuk issuance, supported by clear Shariah governance and strong regulation. HNWIs may access sukuk via:

- Licensed Islamic banks or brokers (direct issuance)

- Shariah-compliant sukuk funds, exchange-traded funds (ETFs), or discretionary mandates

- Private placements or syndicated deals for qualified investors

Currency choice and cross-border repatriation are key considerations for offshore clients.

Sukuk in Malaysia: Market depth and issuer sophistication

Malaysia dominates global sukuk issuance—estimated two-thirds of the global outstanding sukuk market. Instruments range from sovereign, quasi-sovereign, to corporate sukuk with strong participation from pension funds and central banks. Notably, Malaysia leads in environmental, social, governance (ESG) sukuk issuance, accounting for ~91% of active green/sustainable sukuk globally.

Risk management and governance in high-value Islamic bond allocations

HNW investors demand strong oversight:

- Shariah advisor’s credibility & consistent Shariah ruling issuance

- Transparency in asset ownership and surplus handling

- Issuer track record for maturity and liquidity management

In Malaysia, governance is anchored by local standards set by the Securities Commission Malaysia (SC) and Bank Negara Malaysia (BNM) through their respective Shariah advisory councils. These frameworks ensure Shariah compliance, investor protection, and market integrity. Where relevant, global standards such as those by Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and Islamic Financial Services Board (IFSB) may complement local regulations to support cross-border alignment and broader investor confidence.

Strategic outlook: Sukuk at the intersection of conviction and capital

Advanced sukuk structures have evolved into more than just compliant instruments—they now anchor sophisticated portfolios with clarity and conviction. Malaysia’s well-regulated sukuk landscape, paired with bespoke investment mandates, offers global investors an entry point into Shariah-aligned strategies built for resilience.

In today’s climate of shifting values and market complexity, sukuk deliver a rare balance: ethical alignment, transparent structure, and long-term income stability. For investors seeking more than performance alone, sukuk are not simply viable—they are increasingly essential.