Table of Contents

Short on time? Here’s what to expect from the article:

Take a deep dive into the world of unit trusts — how they work, the types available, and the reasons they’ve become a cornerstone of the discerning investor’s portfolio in Malaysia today. We also examine how they compare to other popular investment instruments, and how to choose the right unit trusts for your portfolio.

Unit trusts have steadily emerged as one of the preferred investment options for the discerning investor in recent years, investing in a diversified set of assets to balance growth with stability, with relatively lower levels of risk. Additionally, being professionally managed, they are also a compelling proposition for newer entrants looking to scale wealth without active intervention in the market.

And if you’re looking to invest in them, take a look at this guide on how they operate, the types available, and how they fit into your financial goals.

Invest smartly and diversely with unit trusts

Unit trusts pool money into a diversified portfolio, investing in diversified assets across sectors and geographies. These assets include equities, bonds, treasury bills, and other securities. Spreading risk across multiple instruments helps reduce concentrated risks and provides stable returns to investors.

The ‘units’ in unit trusts represent investors’ ownership (in part) of the underlying assets. Professional fund managers oversee these unit trusts and make decisions regarding whether to buy or sell securities under the fund based on their performance.

Are unit trusts in Malaysia suited for sophisticated investors?

Though unit trusts are associated with accessibility and simplicity, they also align well with more nuanced investment strategies.

Unit trusts support diversification

Unit trusts’ most enticing benefit is diversification, which mitigates concentrated risks from overexposure to any one single investment and helps balance capital appreciation with a stable income.

Unit trusts help build generational wealth

Unit trusts are medium- to long-term investment instruments and help wealth accumulation to last across generations. They can potentially provide for stable and inflation-beating returns, with a lower risk profile compared to equities. This allows one to fulfil long-term goals such as funding their children’s education, planning for their retirement, or preserving their wealth to pass it on to the next generation.

Unit trusts are professionally managed

Every unit trust has a fund manager who monitors the market, assesses the performance of the trust’s holdings, and makes adjustments as required. An independent trustee also oversees each trust to ensure compliance with regulatory standards.

Unit trusts offer high liquidity

Unit trusts offer investors easy access to their funds in case of unforeseen contingencies – whether accidents, illnesses, or home repairs. Most unit trusts allow for daily or weekly redemptions, allowing access to liquid funds with little to no delay.

This liquidity also allows investors to respond to market movements when required.

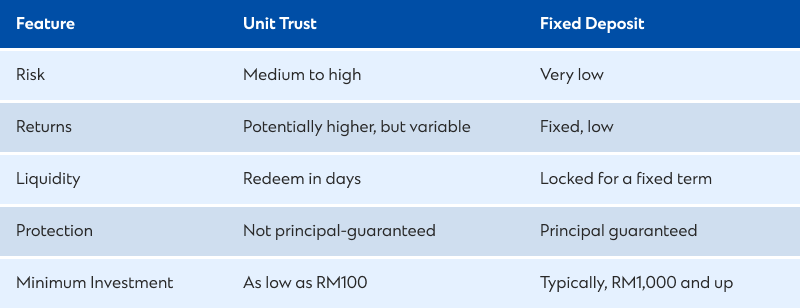

Unit trust vs fixed deposits

Fixed Deposits (or FDs) are low-risk savings products that guarantee a fixed return over a certain period and are ideal for investors seeking capital preservation. Unit trusts, on the other hand, are geared towards capital appreciation, with stable returns.

To help you understand the differences between the two, take a look at this table.

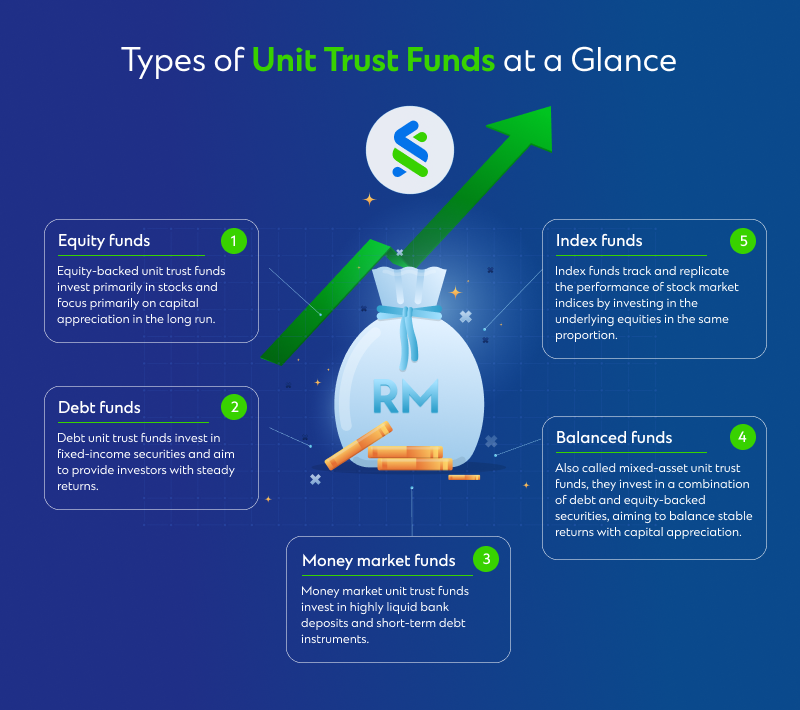

Types of unit trusts to enhance your portfolio

Here’s a quick look at the different types of unit trust funds you can consider investing in.

Equity funds

Predominantly invests in stocks and focuses on capital appreciation in the long run. Though returns are higher, they’re also susceptible to higher risk levels since their performance is dependent upon their underlying assets, and the broader market.

Bond funds

Invests in fixed-income securities such as government and corporate bonds. They are aimed at capital preservation with steady, albeit slightly lower returns.

Money market funds

Money market unit trust funds invest in highly liquid bank deposits and short-term debt instruments, including commercial papers and treasury bills. These are suited to those seeking higher liquidity levels in the short term.

Balanced funds

Balanced or mixed-asset unit trust funds invest in a combination of debt and equity instruments. They provide investors with a stable income alongside capital appreciation and are generally low-risk investments.

Navigating unit trust investments

If you’re new to unit trust investments, it offers a compelling proposition owing to their moderate risk profile and accessibility, with minimum investment thresholds as low as RM100. Choosing the right platform is key to making well informed decisions too.

A few key factors one must always take into consideration on their own are as follows:

- Historical performance

- The fund manager’s expertise

- Its fee, charges, and expenses

- The tax implications for redemption

- Its risk profile

If you’re looking to get started, check out Standard Chartered’s interactive fund library which gives you access to over 250 conventional, Islamic, local, and global unit trusts across eight currencies. In-depth research along with fund factsheets and comparisons enable you to choose funds aligned with your investment horizon, risk profile, as well as short- and long-term financial goals.

For more personalised recommendations, our priority clients can also leverage the same with MyRM as well.