View eStatements on the go and save Paper Statement monthly fee

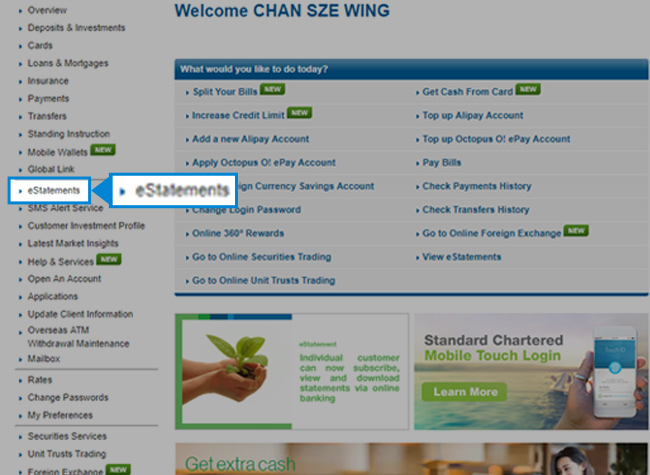

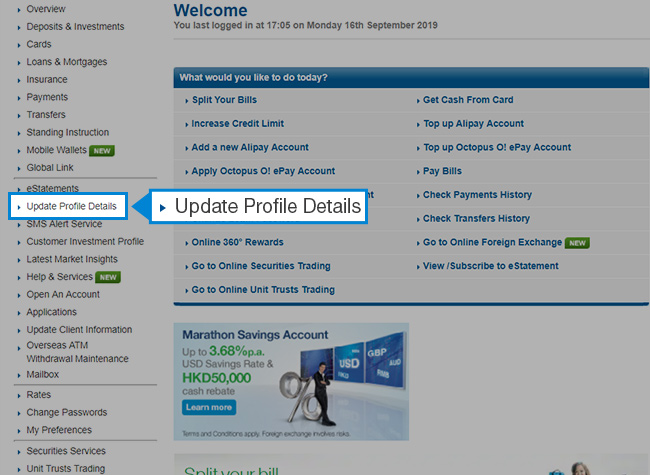

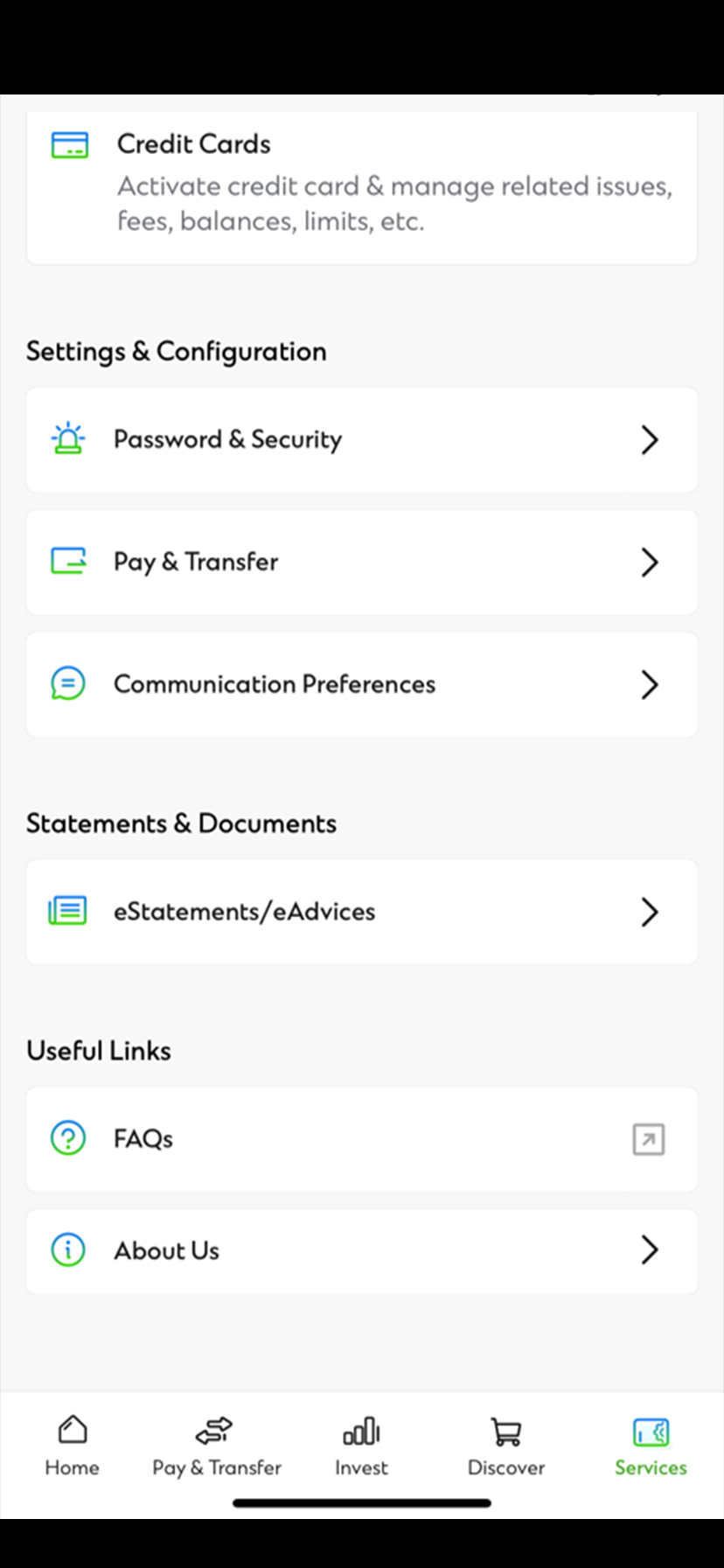

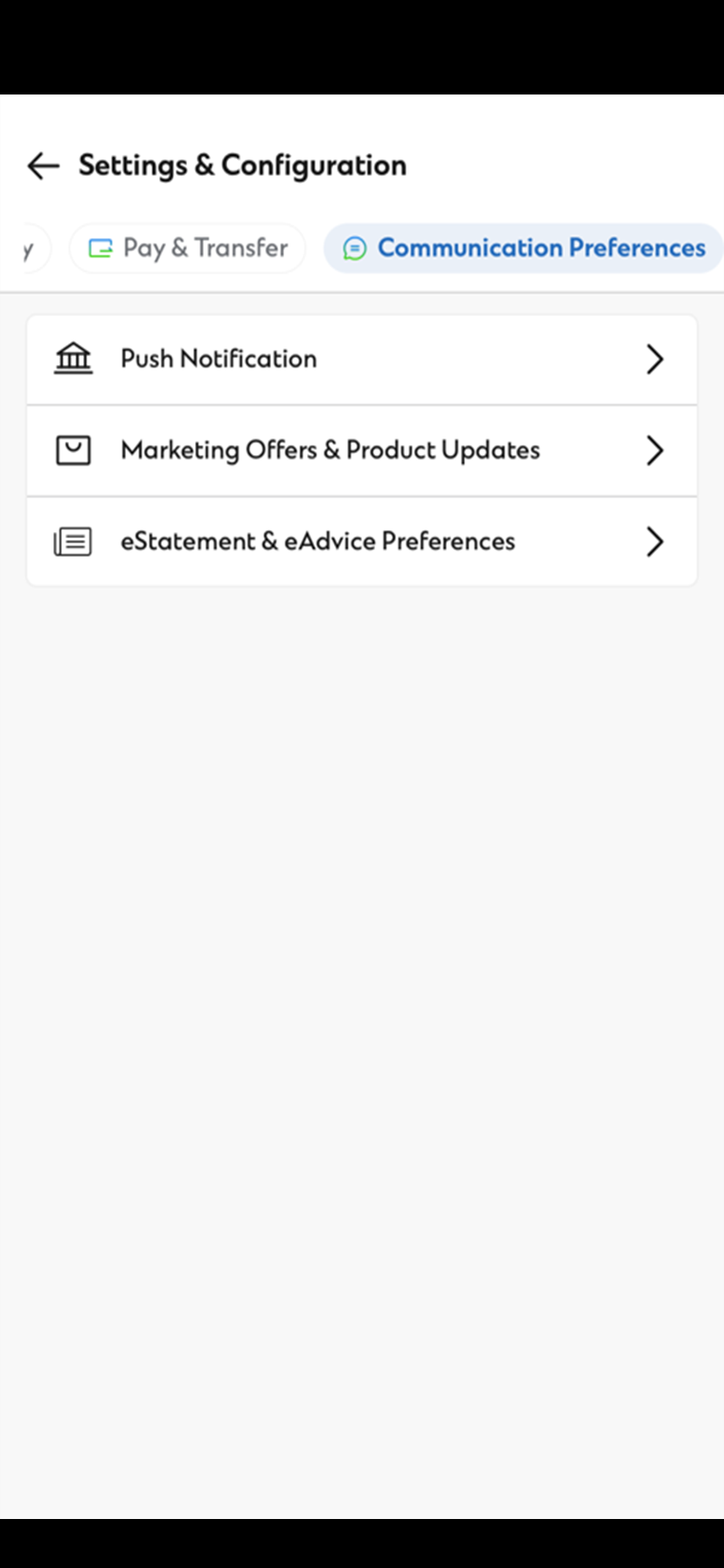

How to SubscribeStep 1

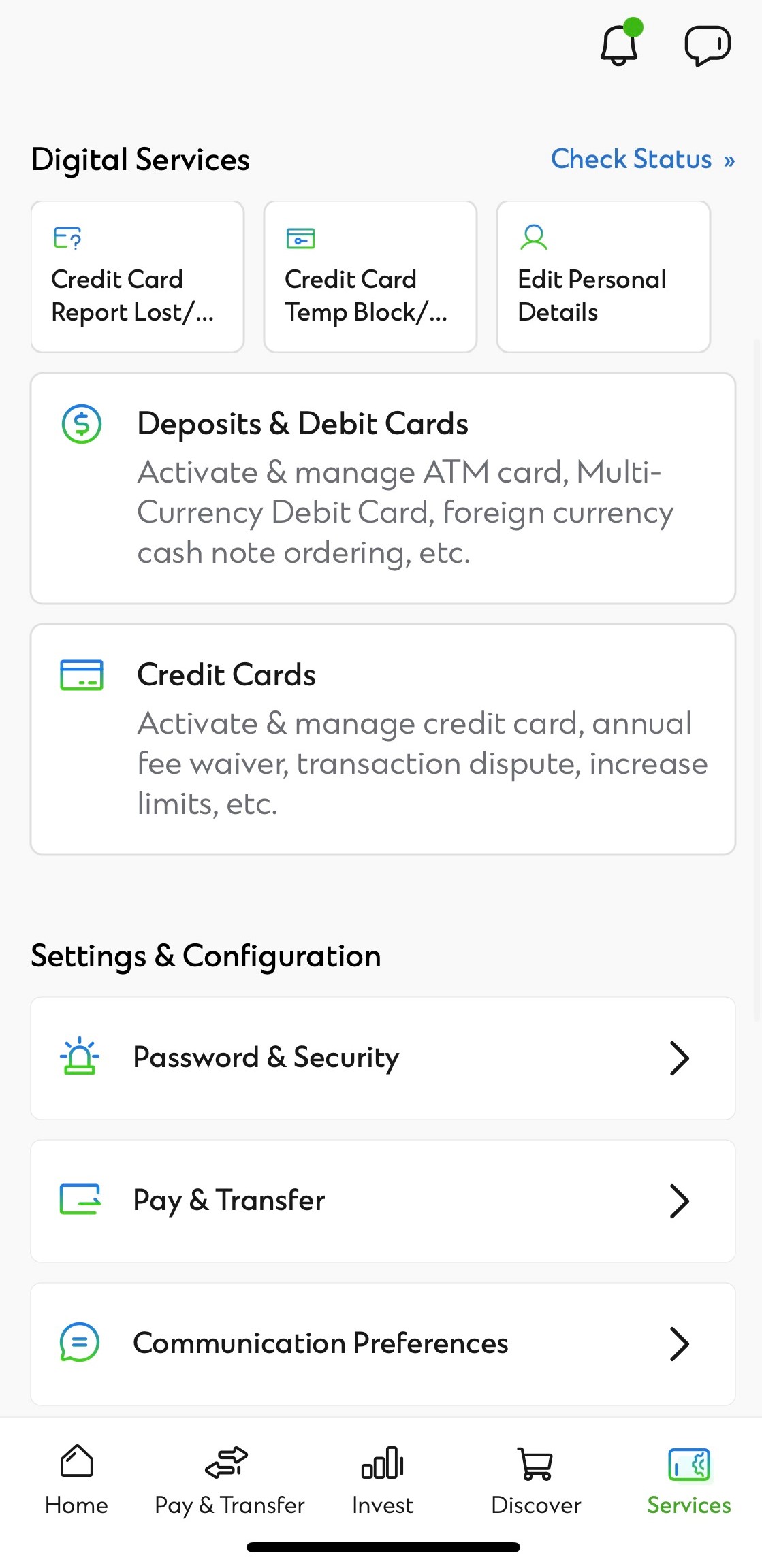

After login to SC Mobile, Open ‘Services’ on the bottom right corner. Tap ‘Communication Perferences’.

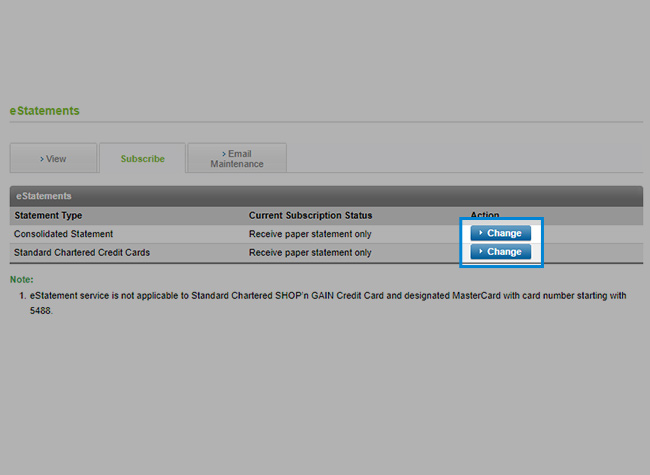

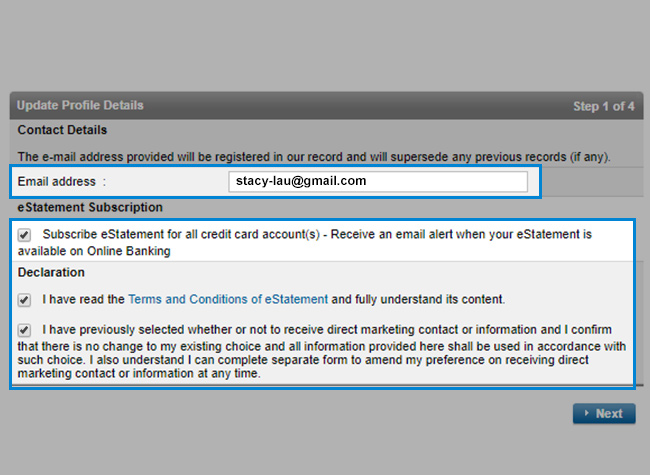

Step 2

Tap 'eStatement/ eAdvice preferences'

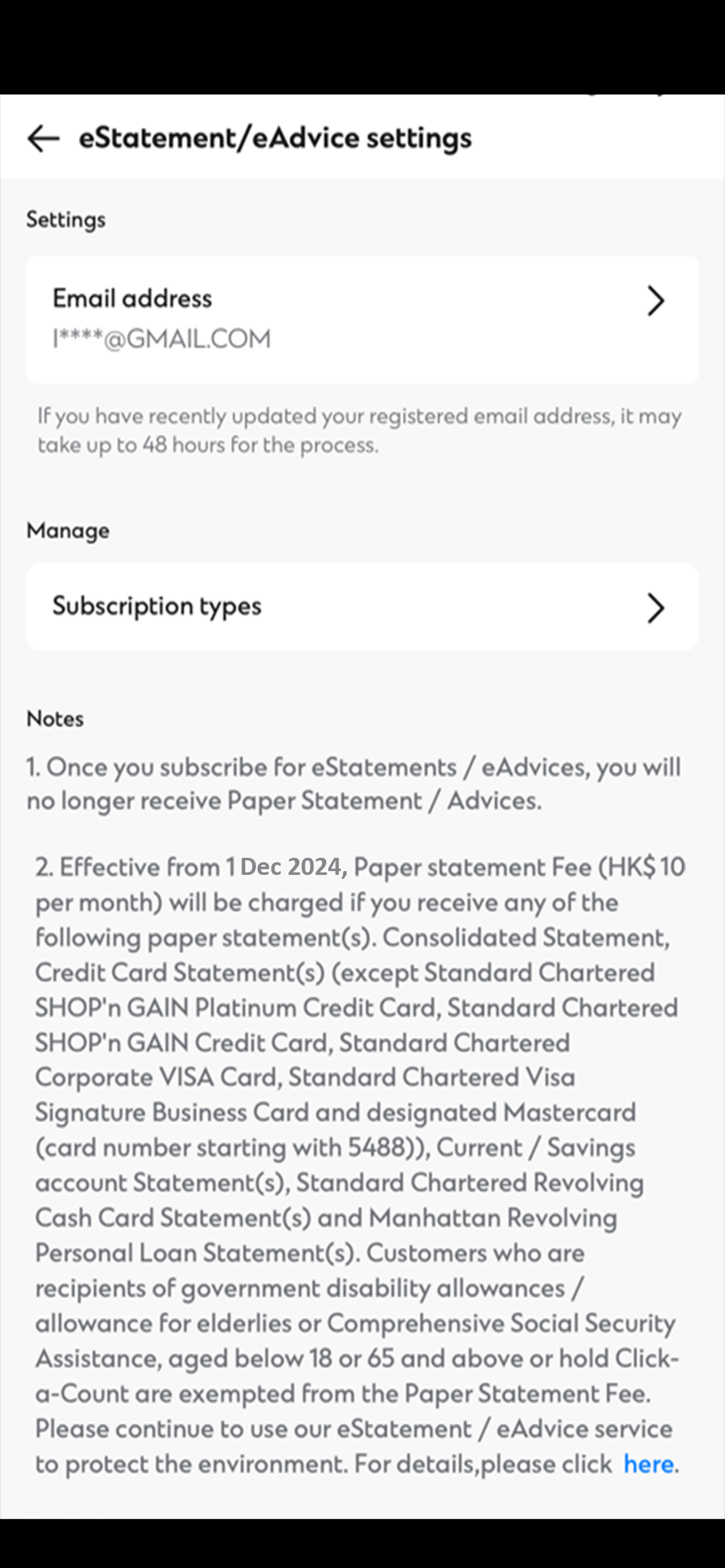

Step 3

Tap 'Subscription types'

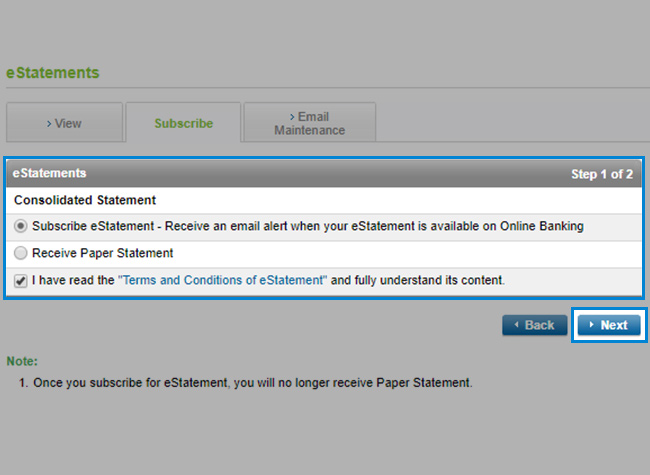

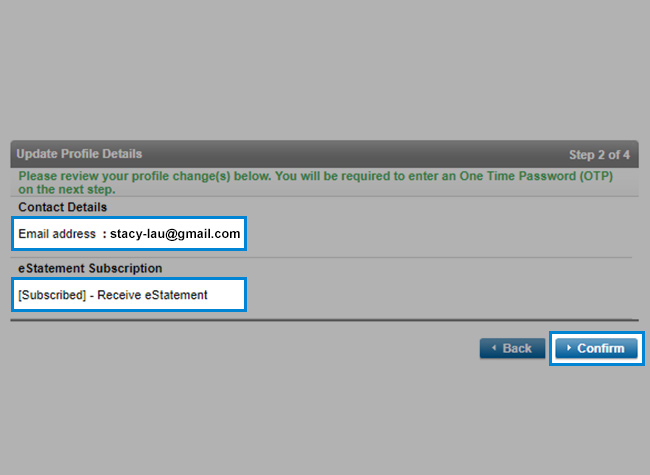

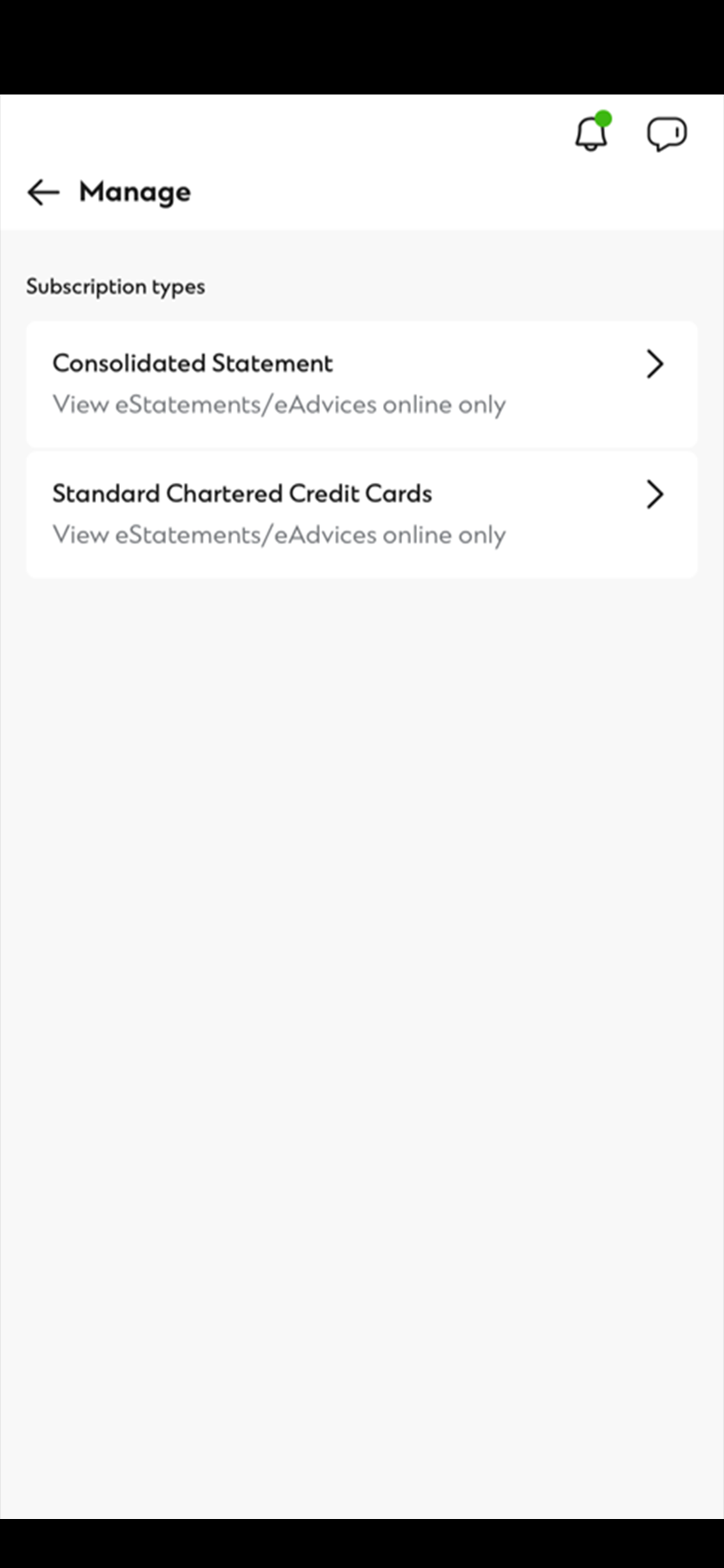

Step 4

Tap your desired statement to subscribe for eStatements.

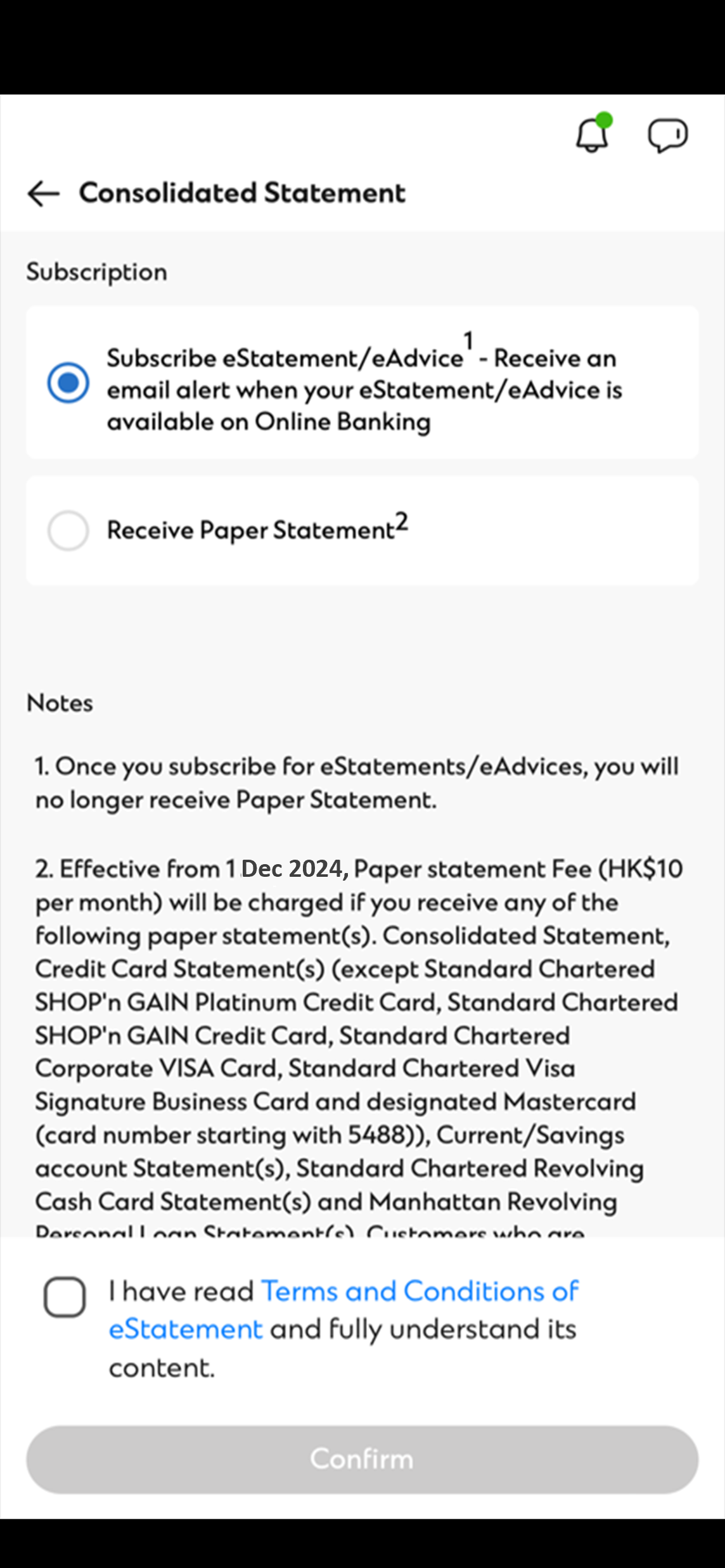

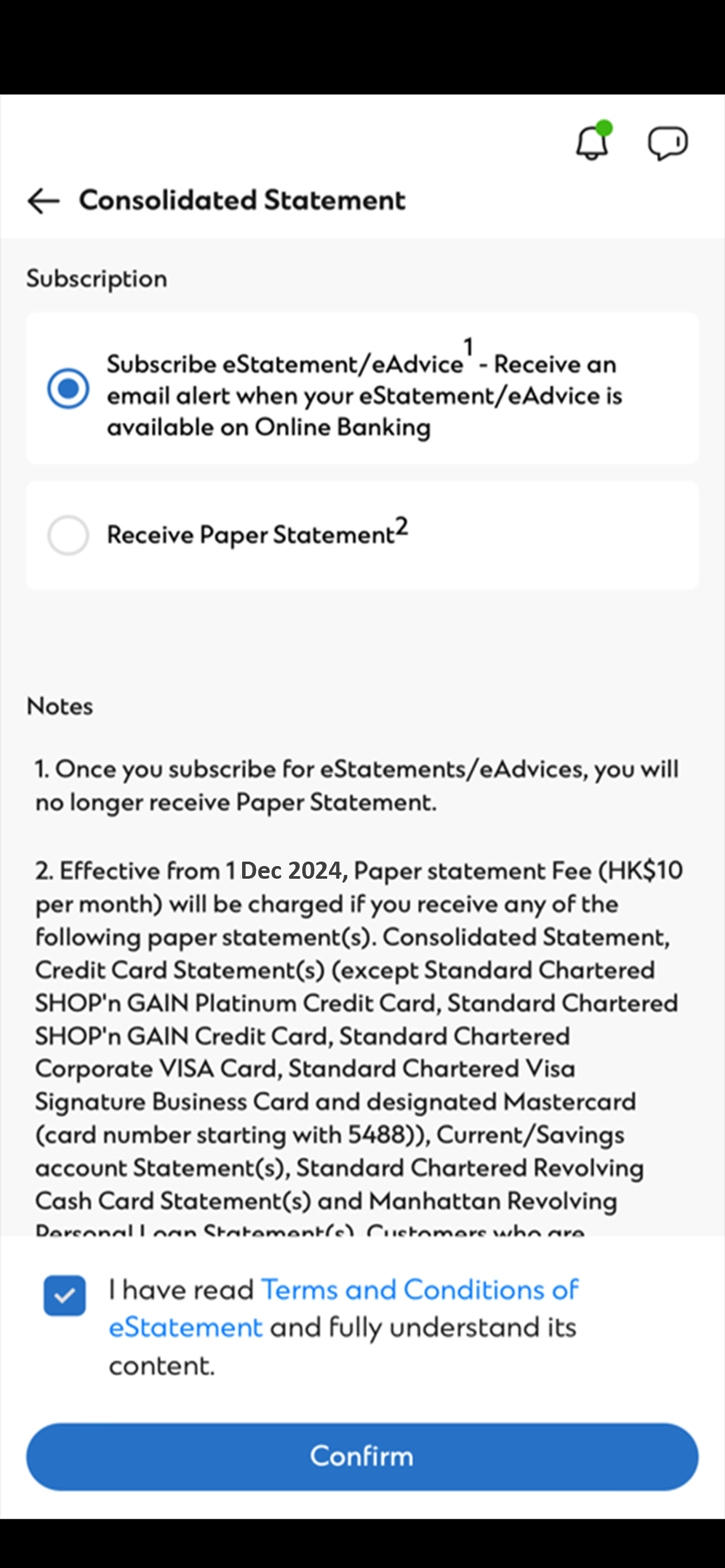

Step 5

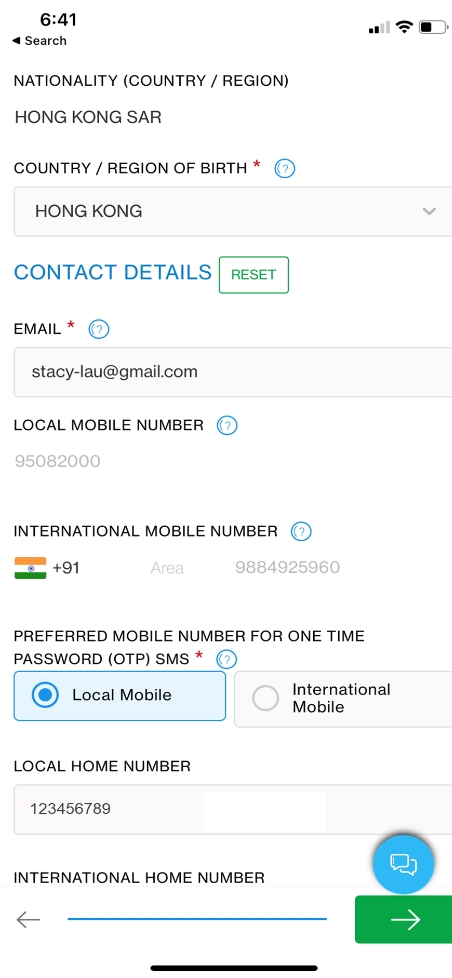

Select the method of receival.

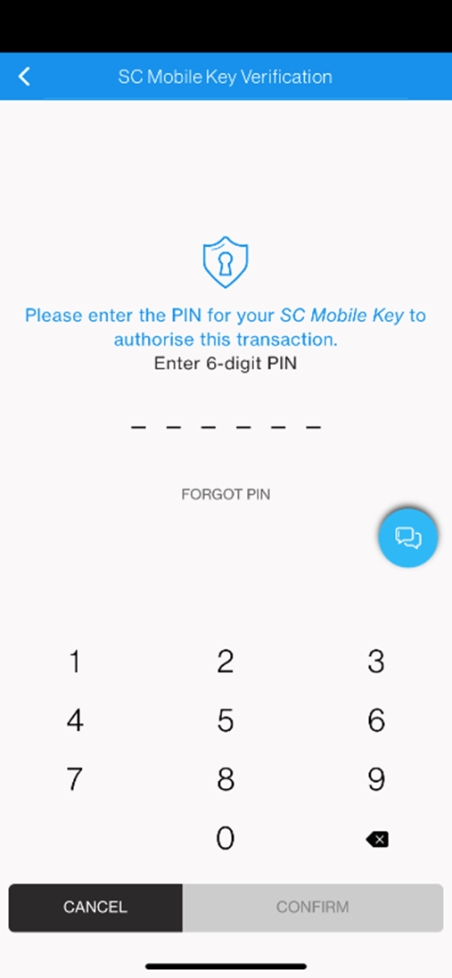

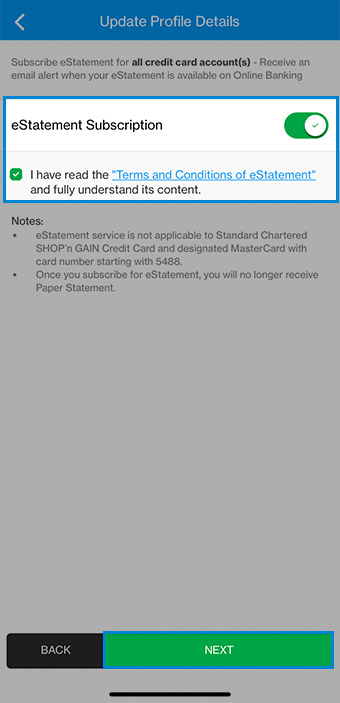

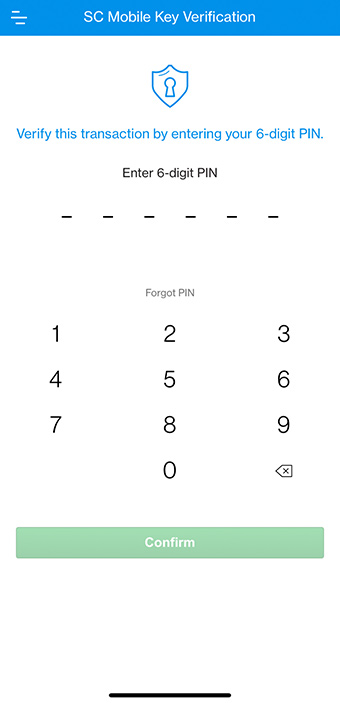

Step 6

Read and accept the Terms and Conditions. Then, click 'Confirm'.

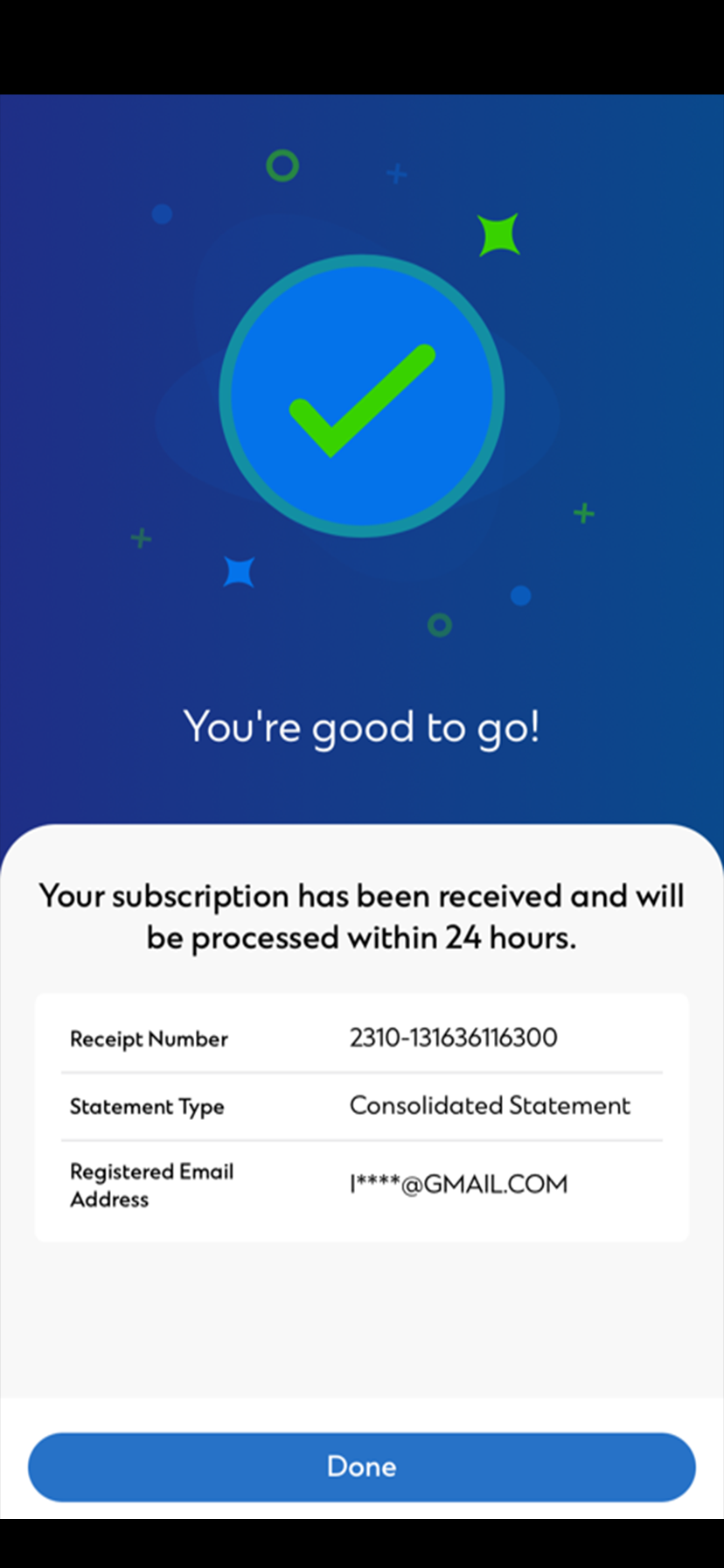

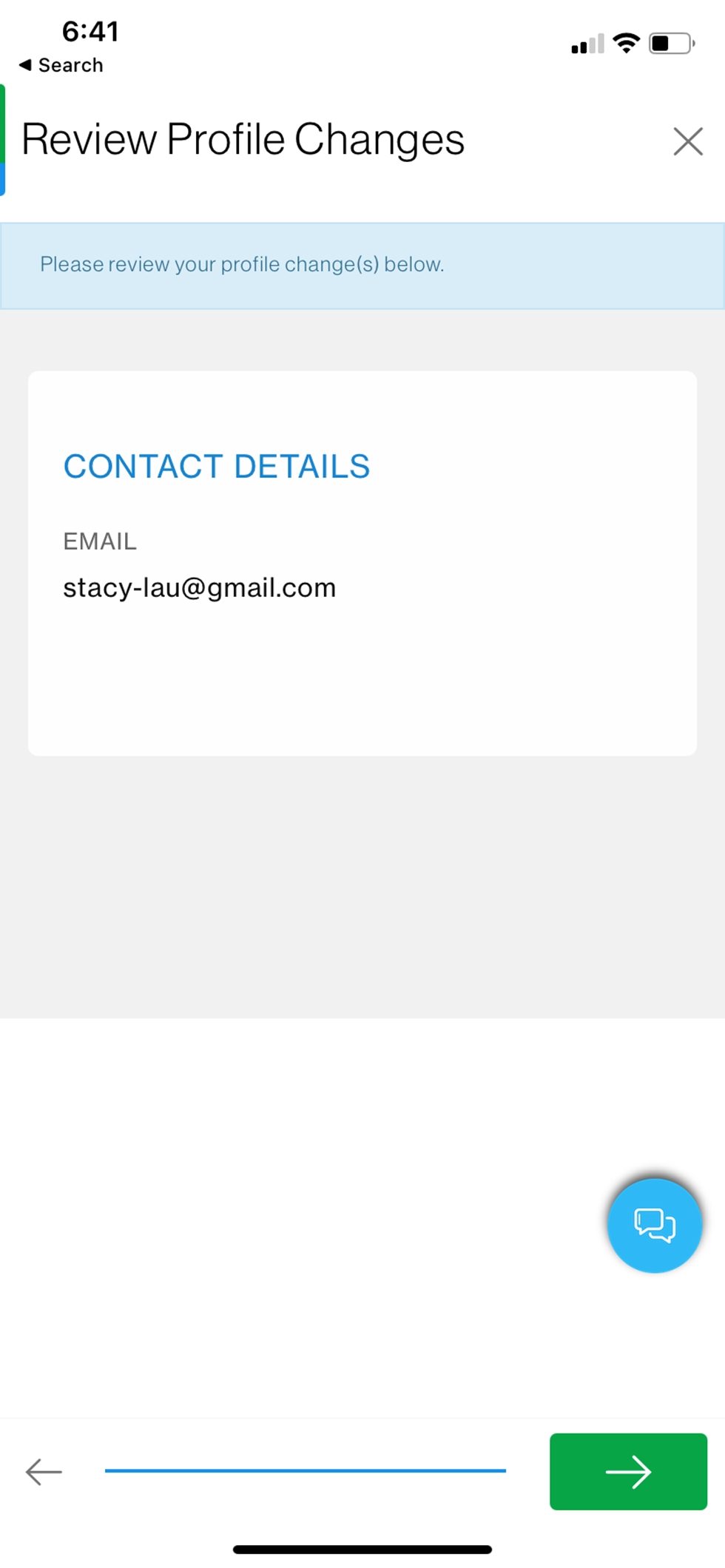

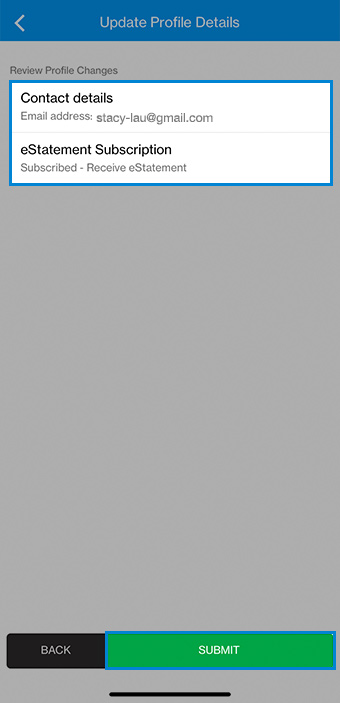

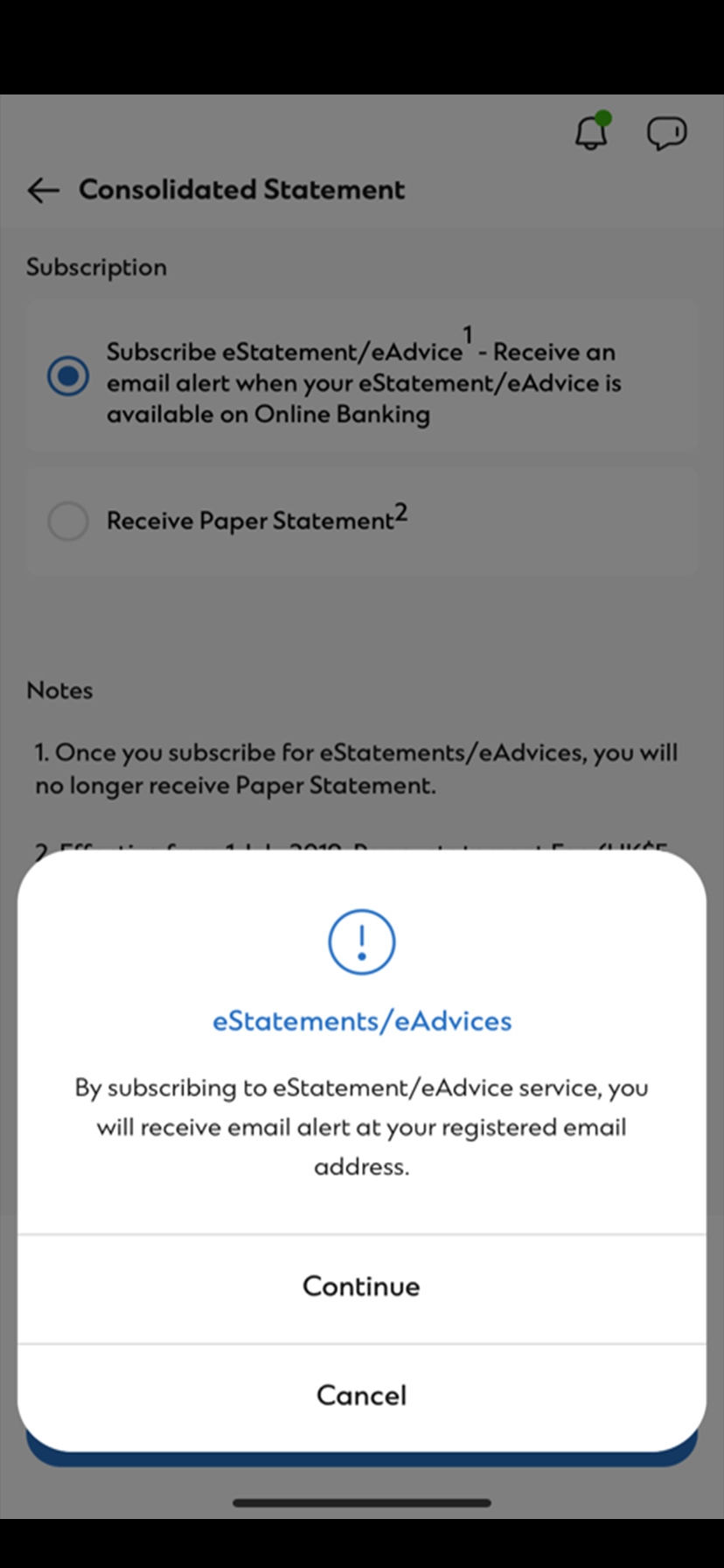

Step 7

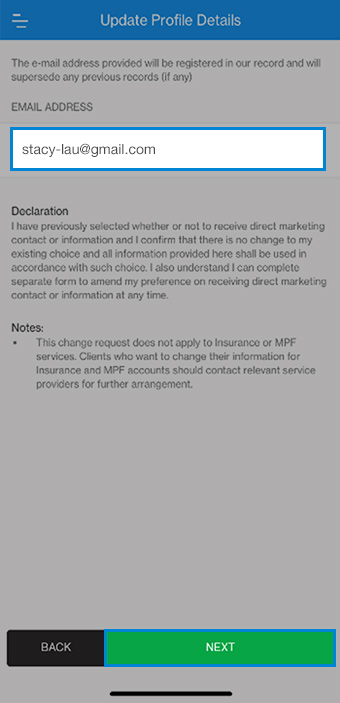

You will receive email alert at your registered email address. Click 'Continue'.

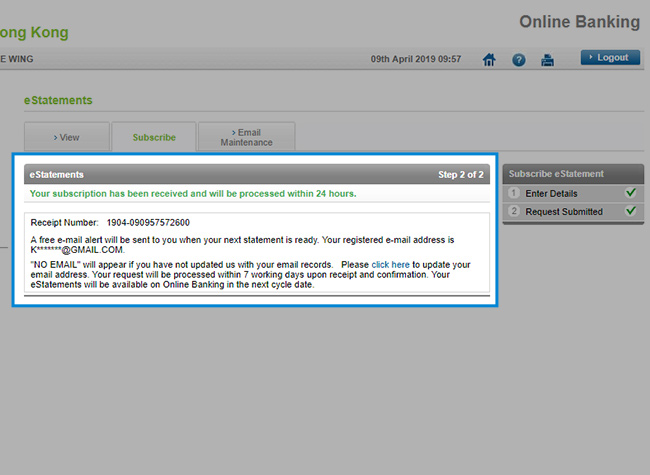

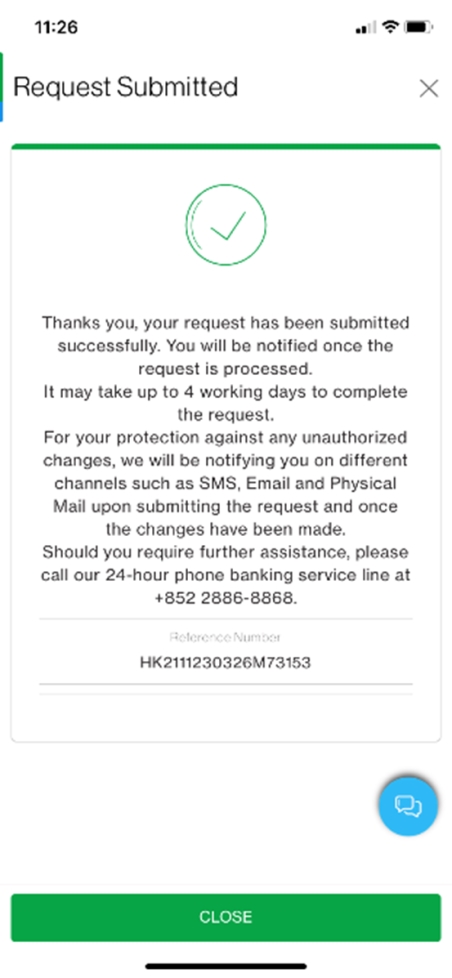

Step 8

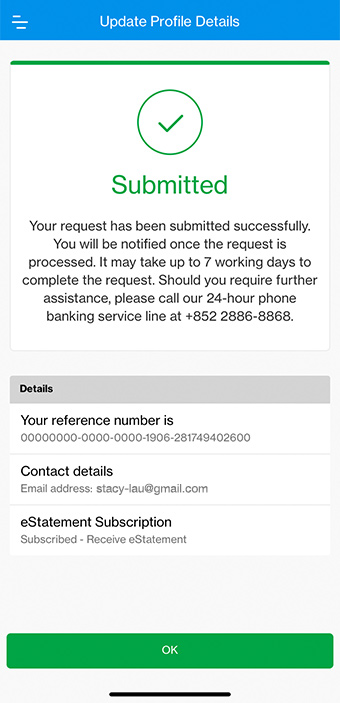

It's done. Your eStatements will be available in the next statement cycle.