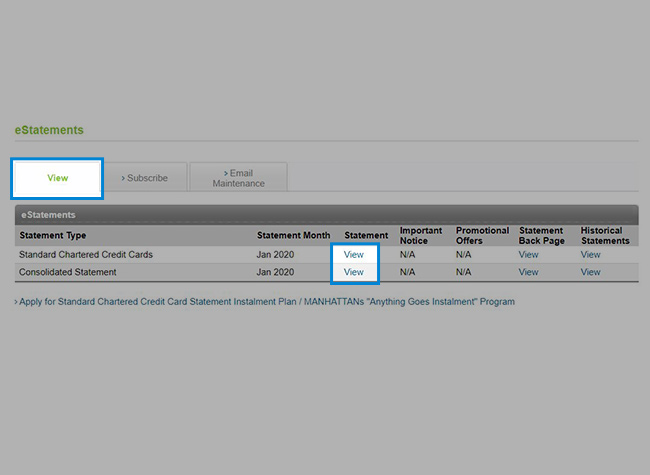

View eStatements on the go and save Paper Statement monthly fee

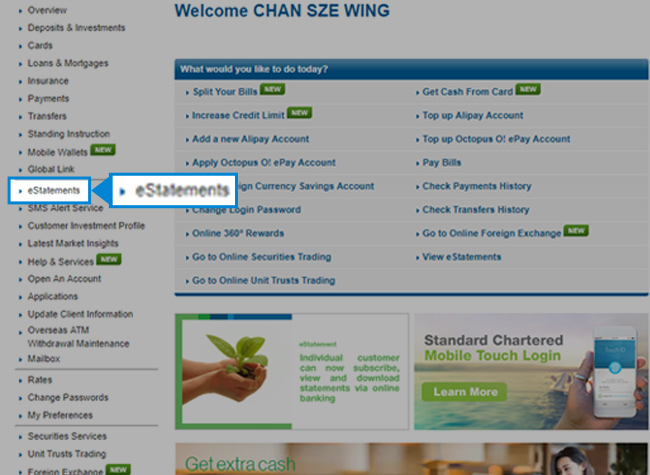

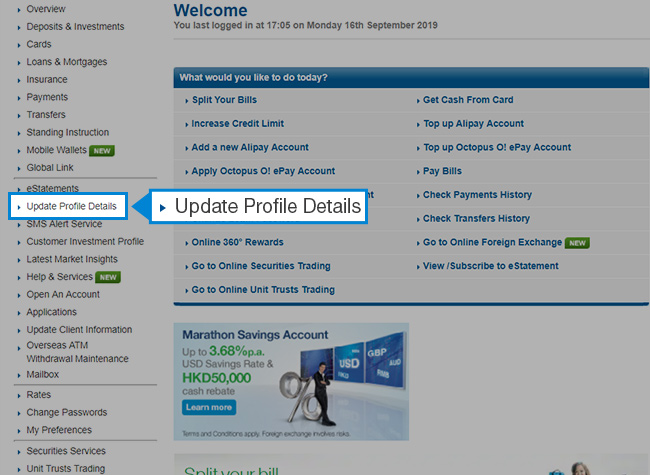

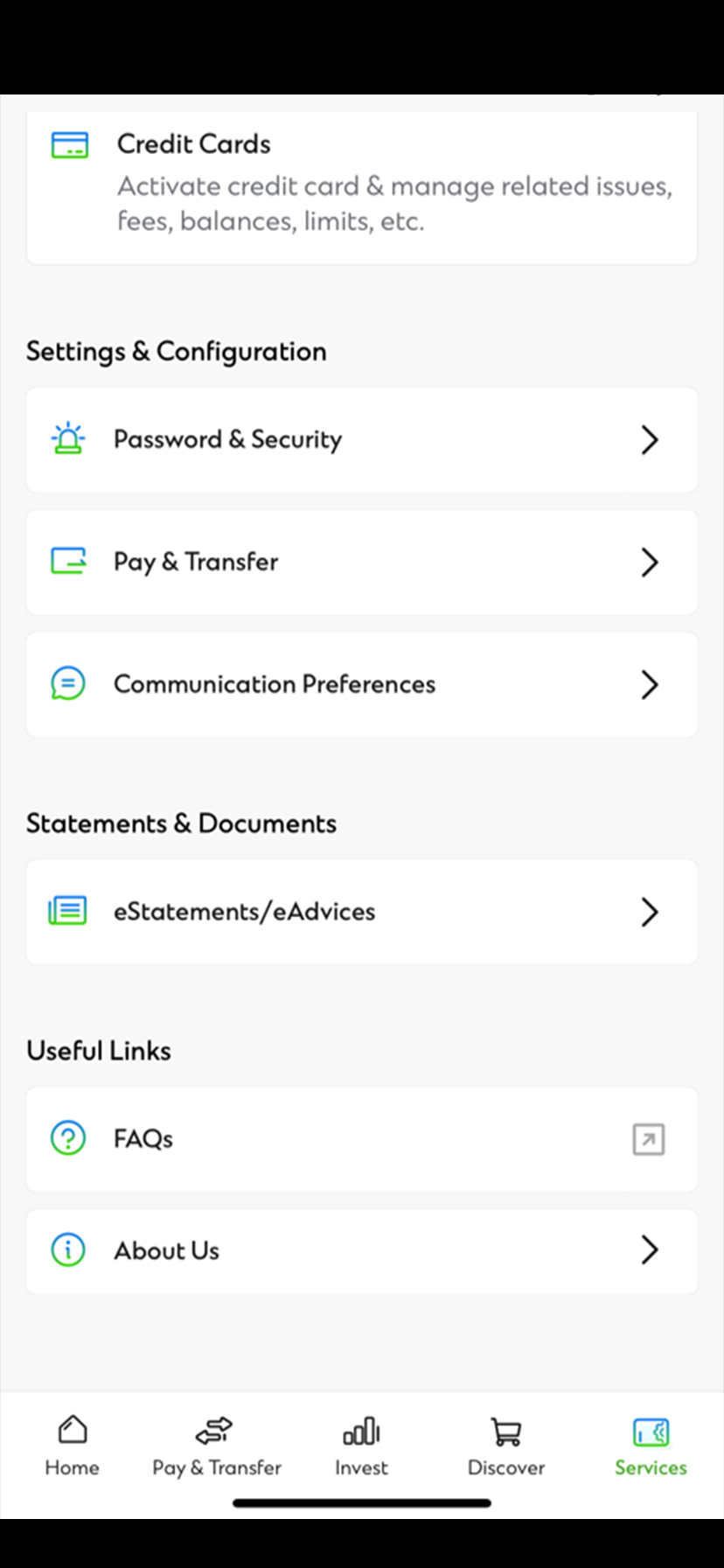

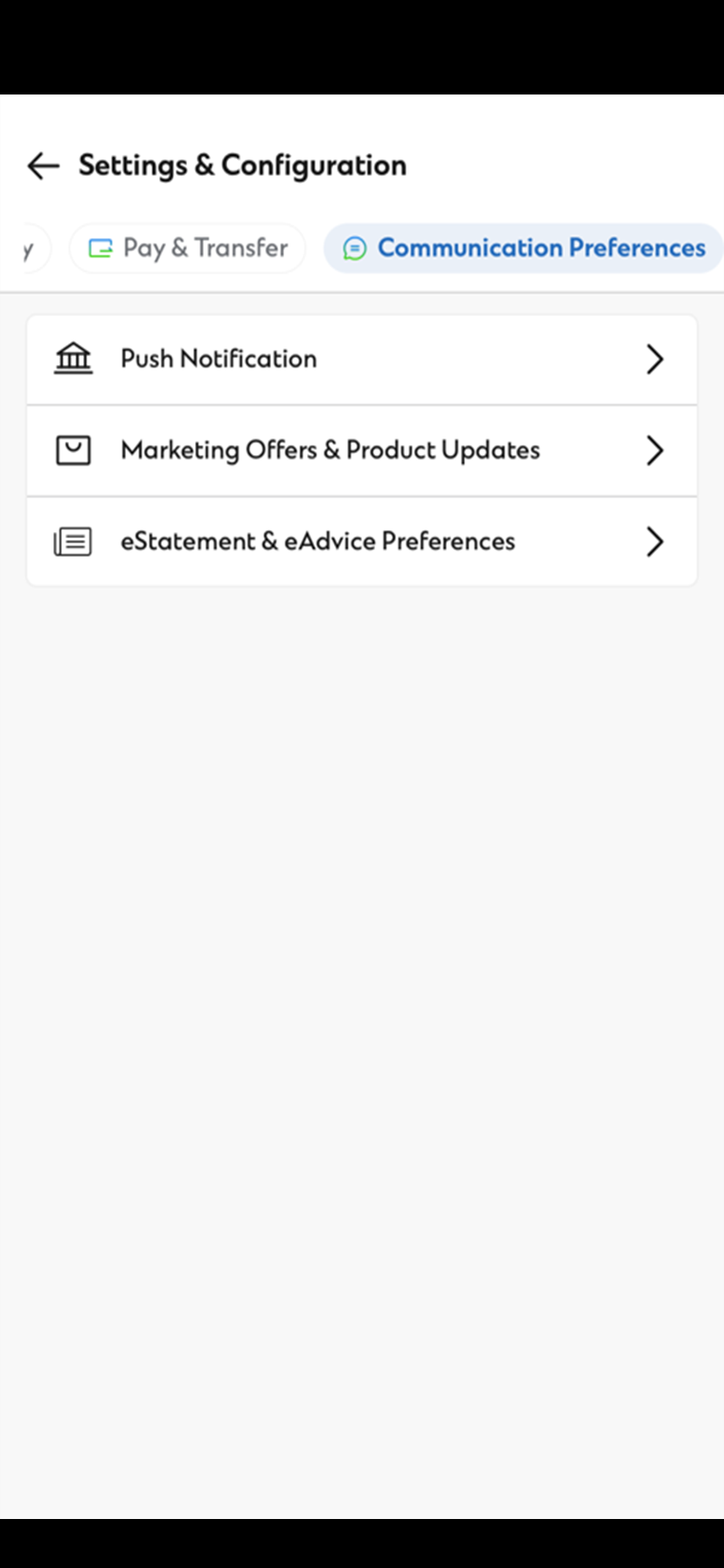

How to SubscribeStep 1

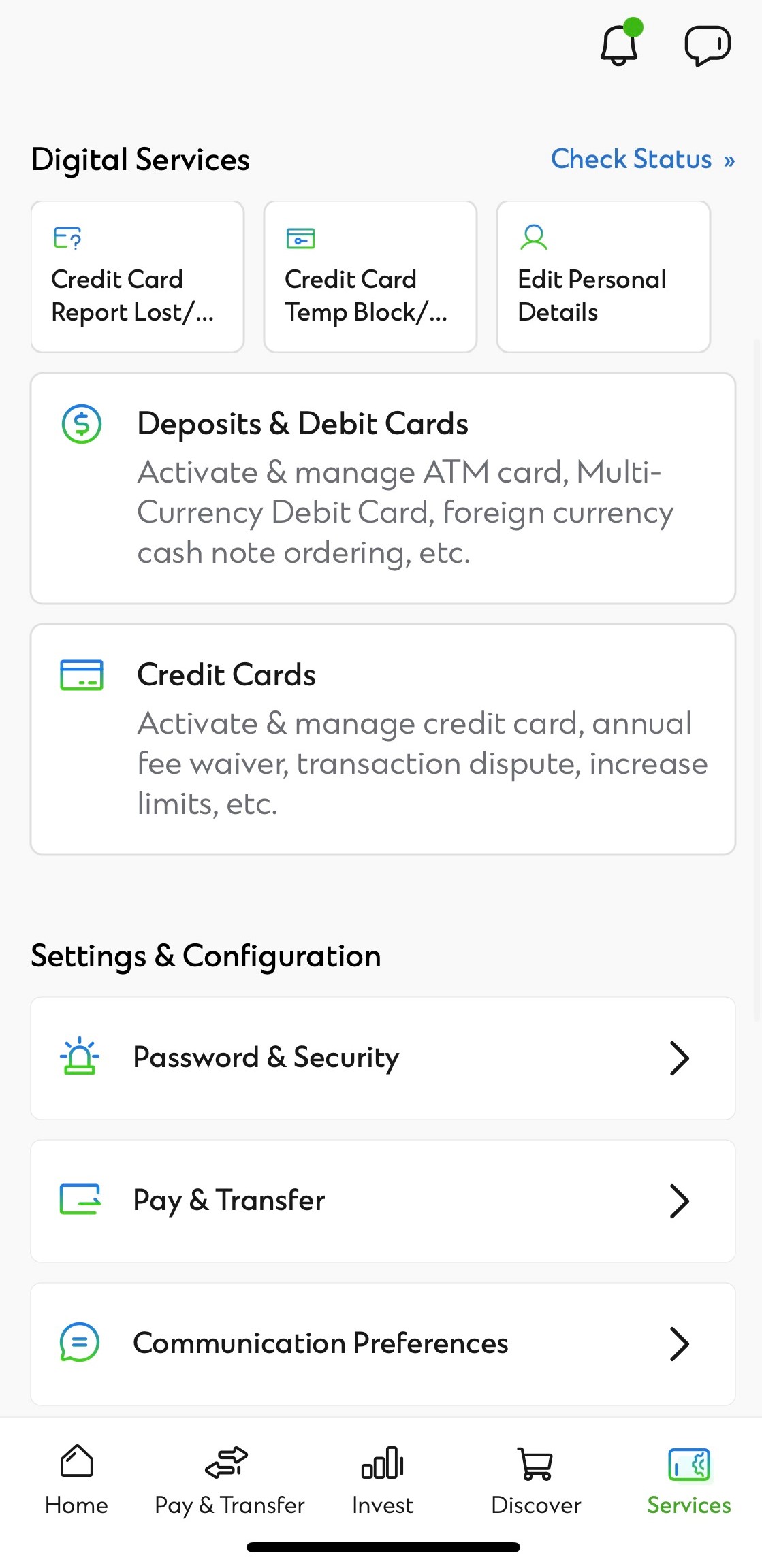

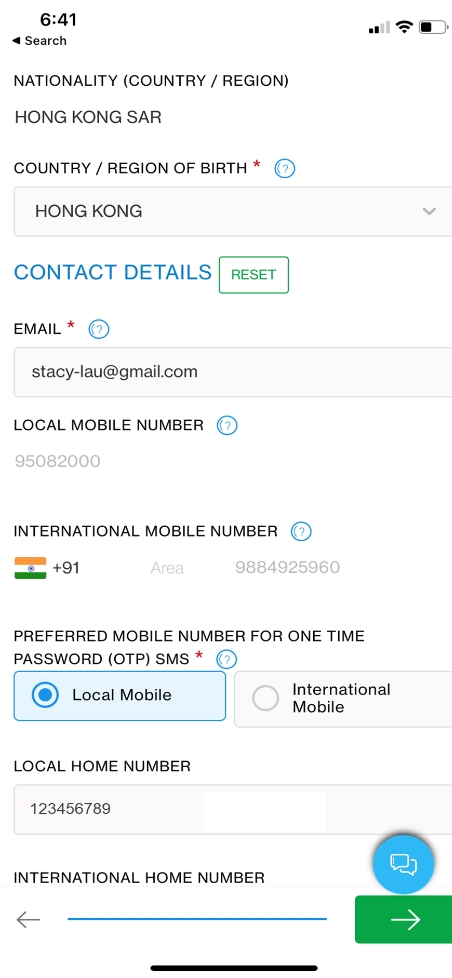

After login to SC Mobile, Open ‘Services’ on the bottom right corner. Tap ‘Communication Perferences’.

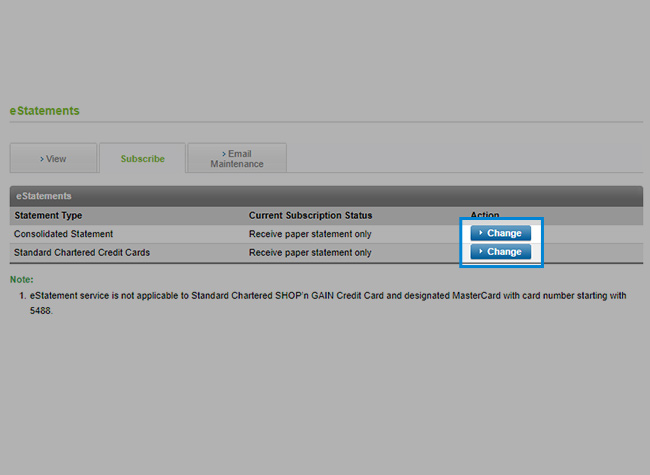

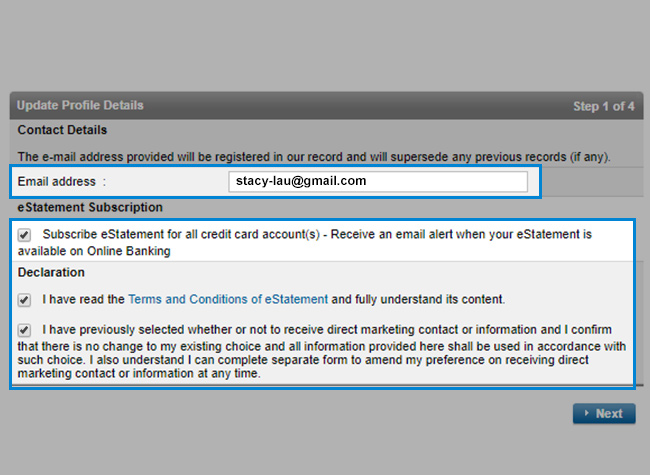

Step 2

Tap 'eStatement/ eAdvice preferences'

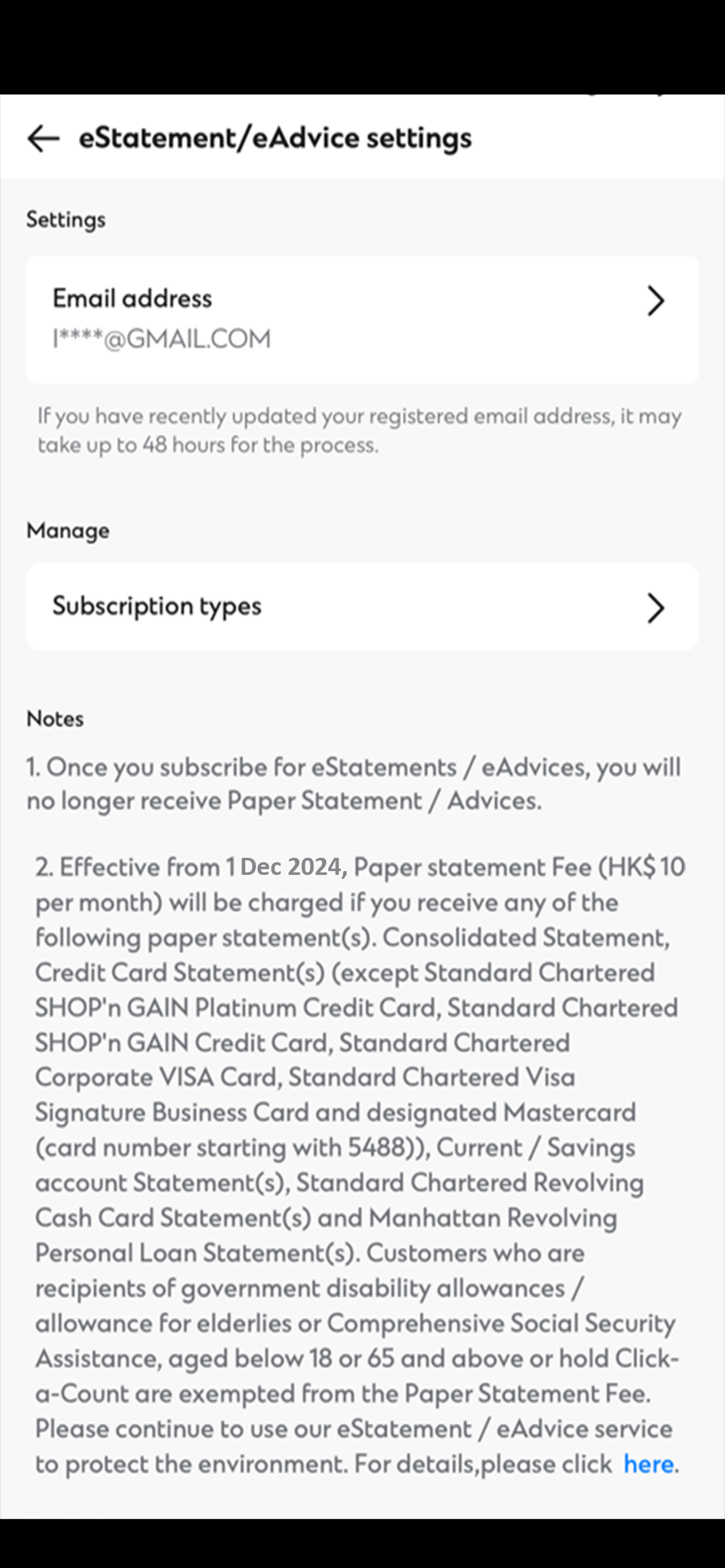

Step 3

Tap 'Subscription types'

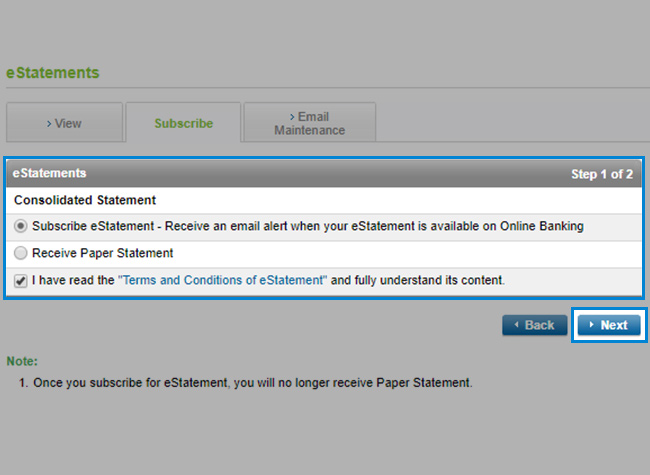

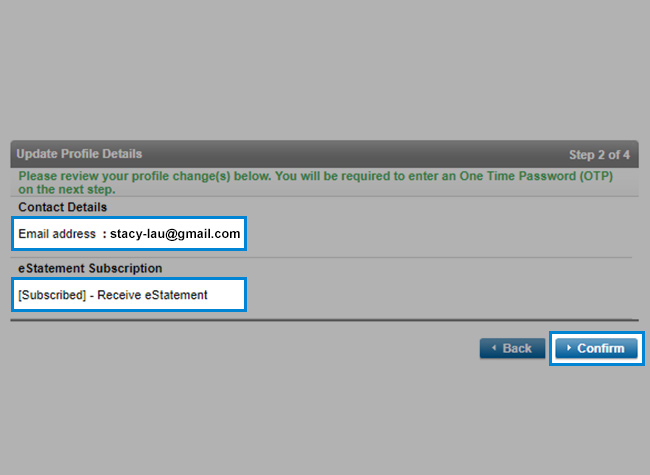

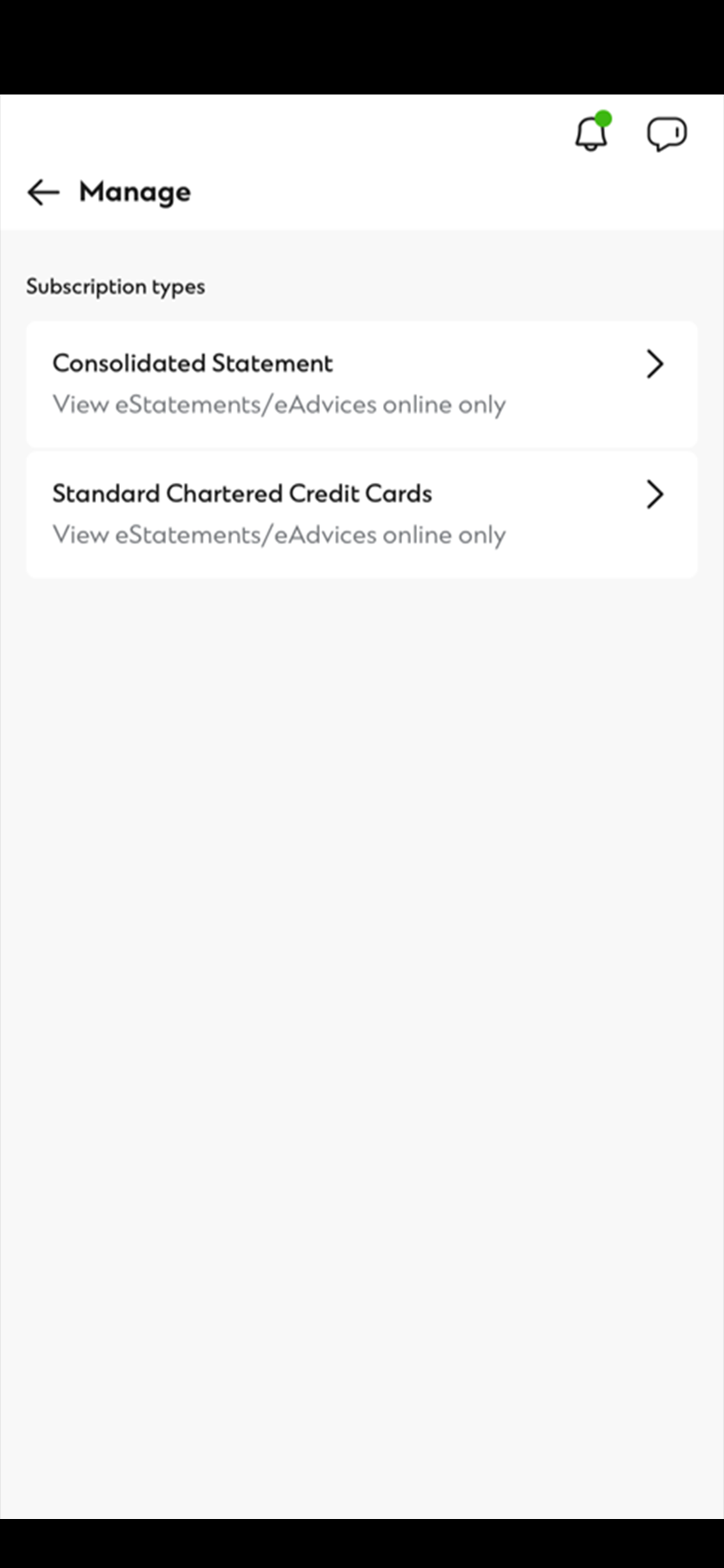

Step 4

Tap your desired statement to subscribe for eStatements.

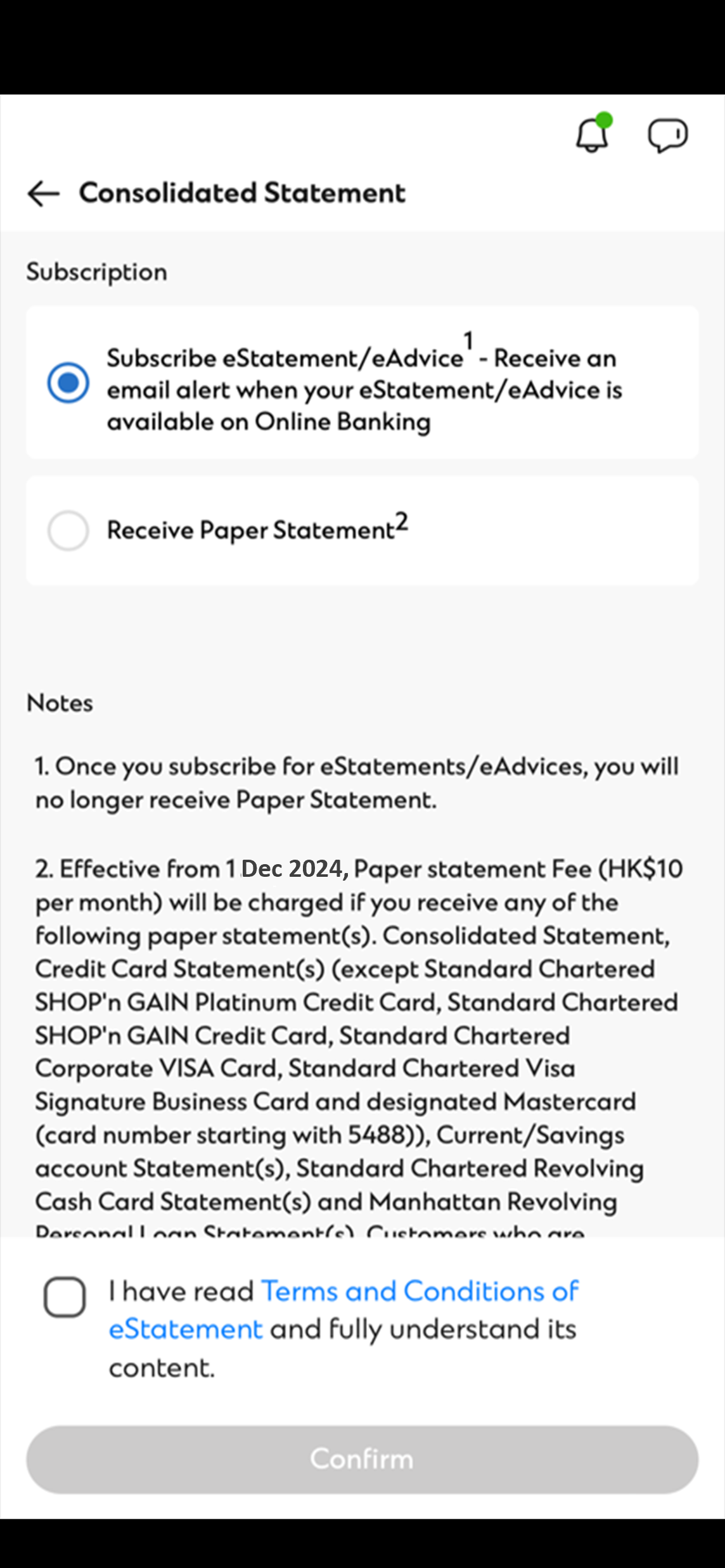

Step 5

Select the method of receival.

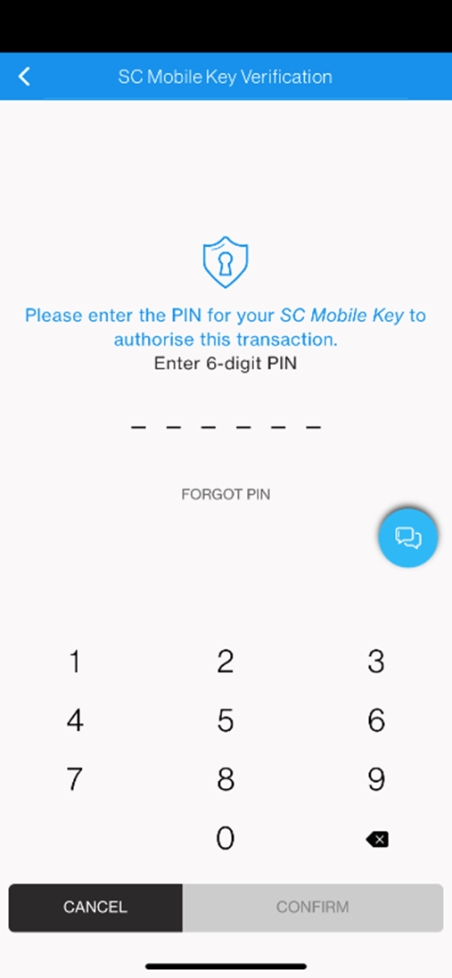

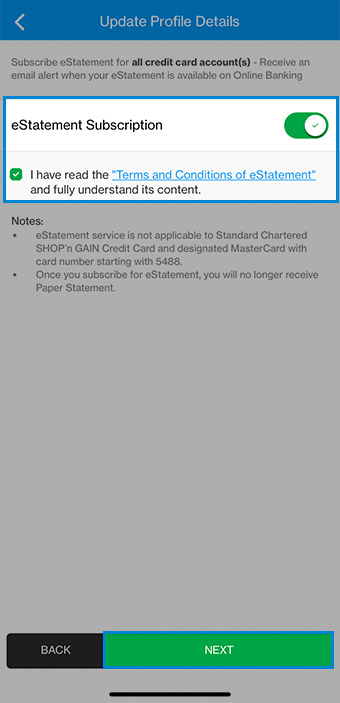

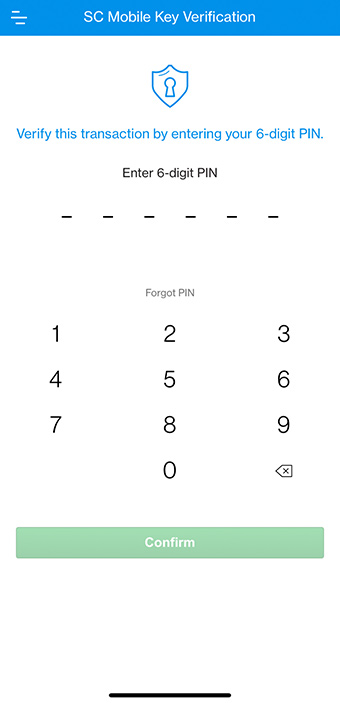

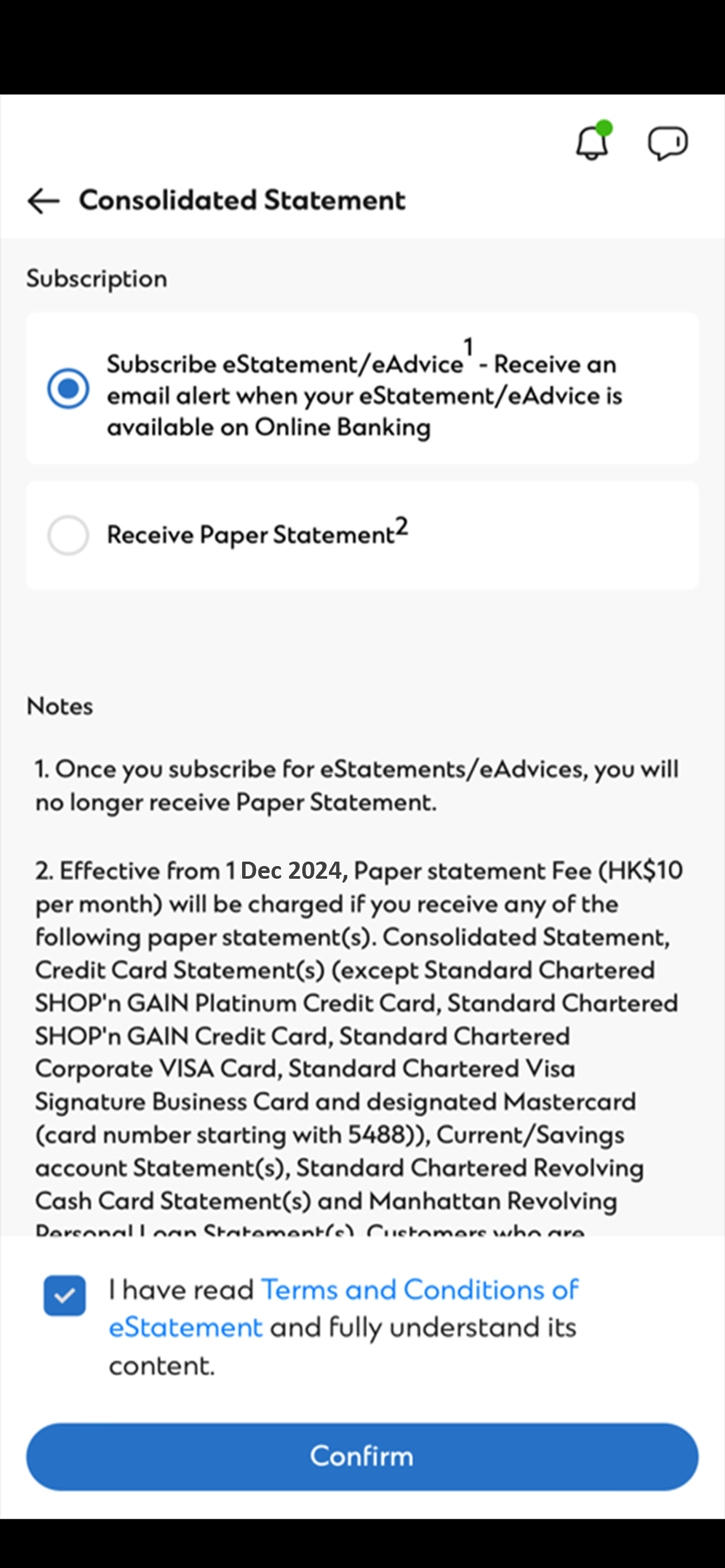

Step 6

Read and accept the Terms and Conditions. Then, click 'Confirm'.

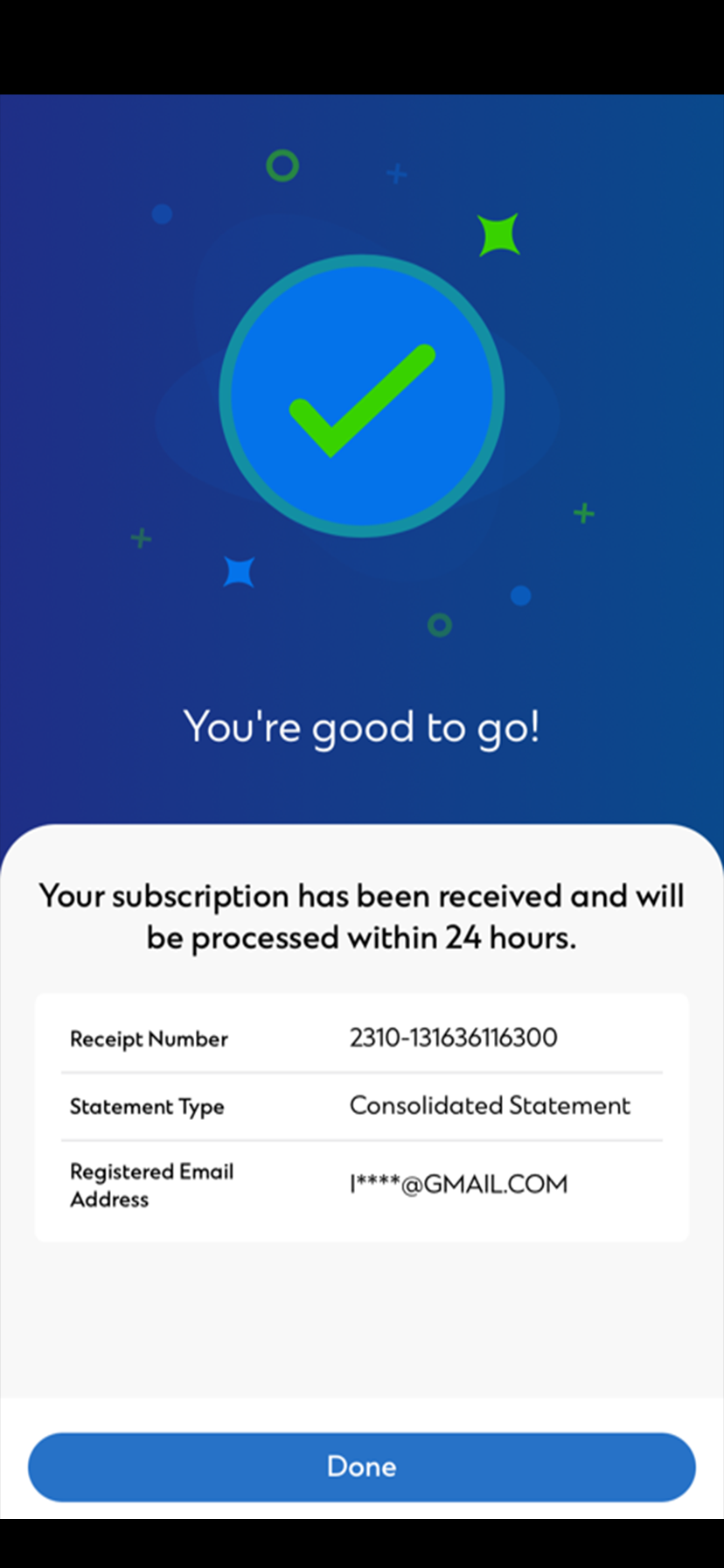

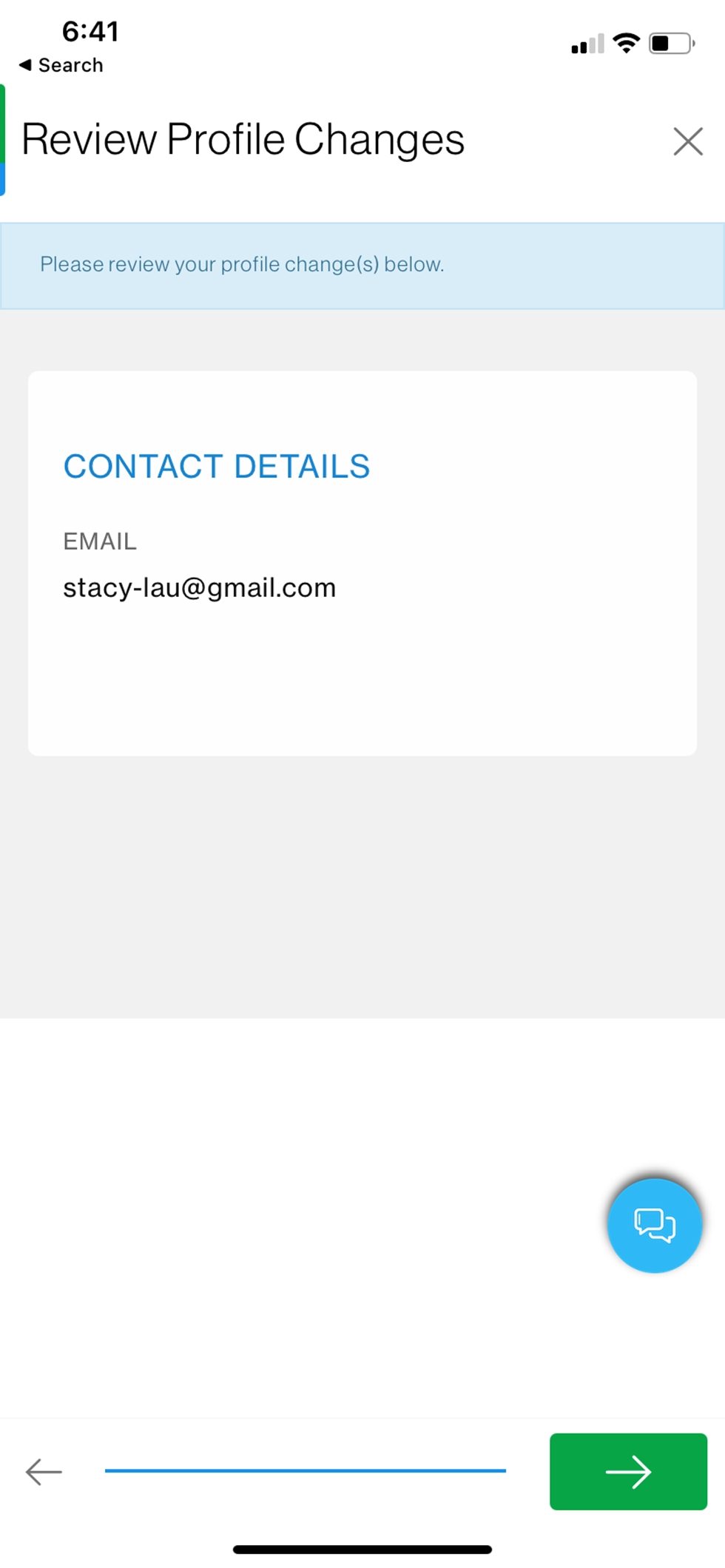

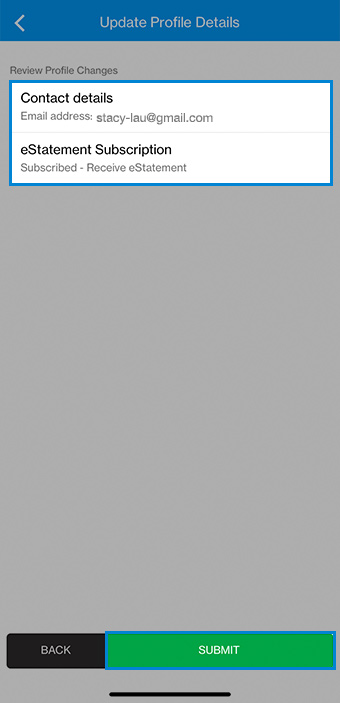

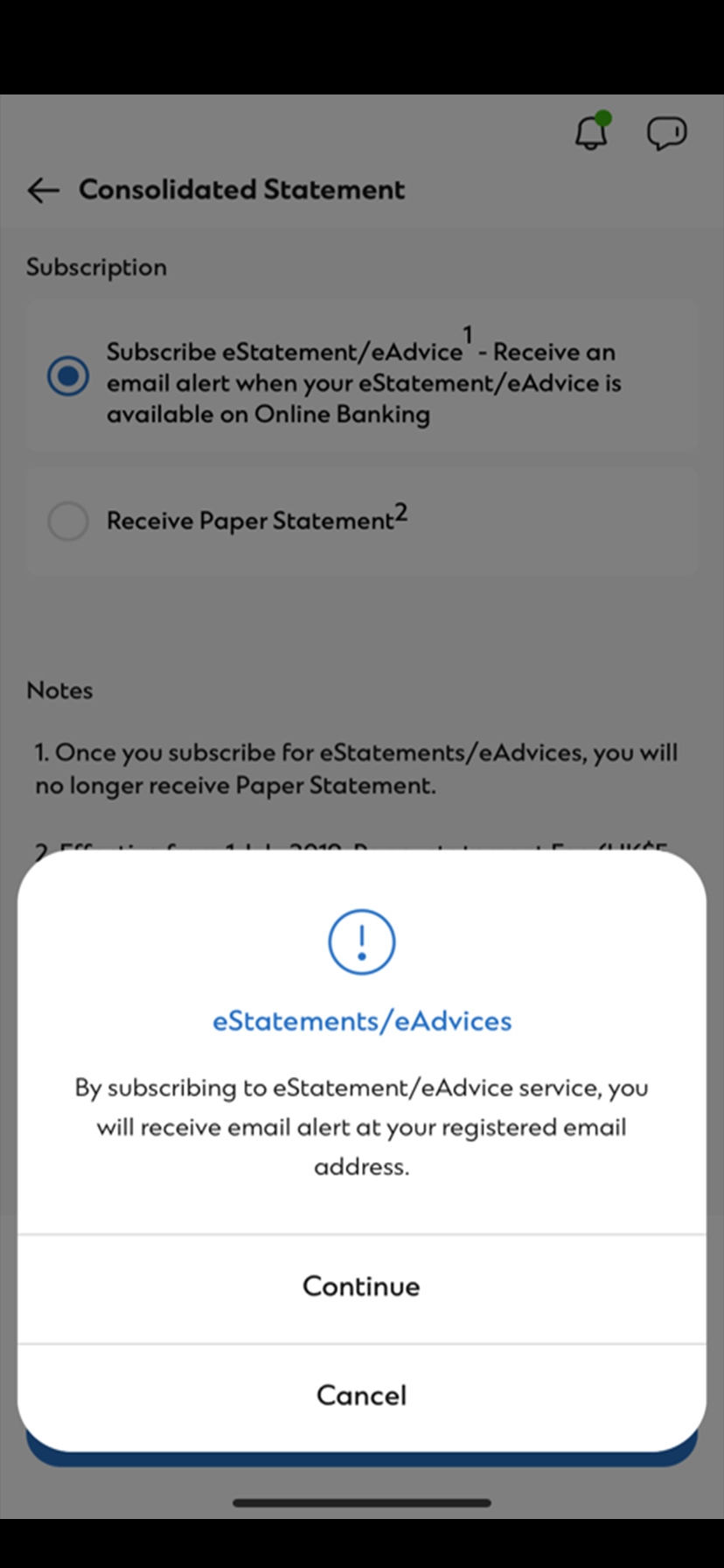

Step 7

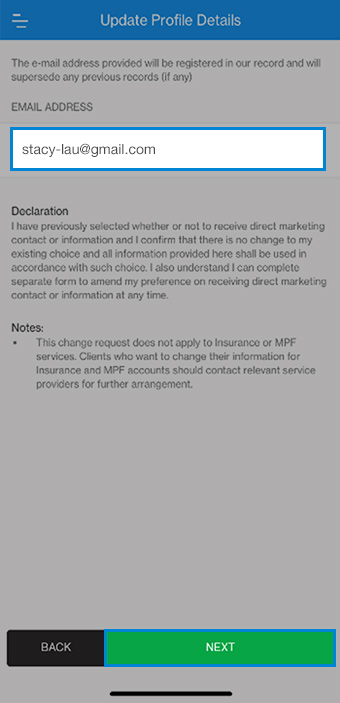

You will receive email alert at your registered email address. Click 'Continue'.

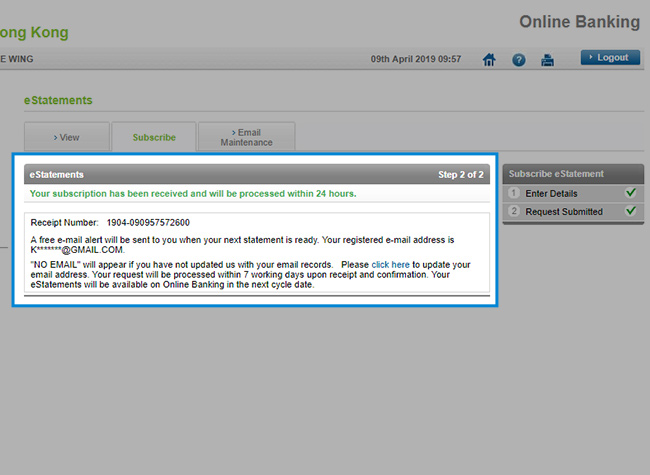

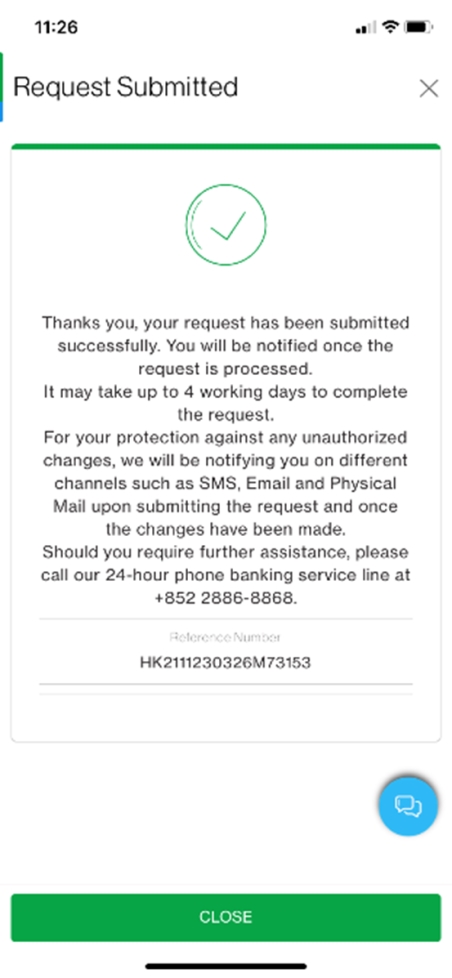

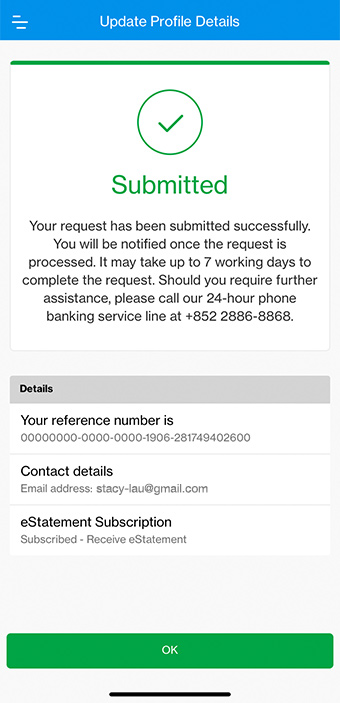

Step 8

It's done. Your eStatements will be available in the next statement cycle.